50 Year Mortgages

30 > 50?

The greatest shortcoming of the human race is our inability to understand the exponential function — Albert Bartlett

In the late 1980s and 90s, Japan offered 100-year ‘multi-generational’ housing mortgages. The idea was to pass on homes like ancestral property from grandparents to grandchildren - along with the mortgage, of course. By stretching loan payments over a century, this financial innovation was intended to increase affordability for homebuyers.

Did it?

Well, no. A 1995 study found that 100-year mortgages did little to increase home affordability or reduce monthly payments. Instead, they became an ‘estate planning tool’ deployed by the affluent Japanese to reduce inheritance taxes. In 1990, the Japanese asset market bubble burst, marking the onset of the Lost Decade - a prolonged period of economic stagnation. Once asset prices collapsed, people suddenly owed far more on their mortgages than their homes were worth. Borrowers were left drowning in negative equity.

The New York Times reported about a Tokyo-based bureaucrat who bought a four-room apartment in the suburb for $400,000 during the bubble. By 2005 (nearly two decades later), the apartment’s value had fallen to $200,000 while he still owed the bank $300,000.

Fast forward to today, policymakers in the United States are weighing on a 50-year mortgage.

Last week, President Trump floated this idea, in contrast to the 30-year mortgages championed by Franklin D Roosevelt after the Great Depression of 1929. Even 30-year mortgages are a unique feature of the US economy, with their secondary market (for mortgage-backed securities) a major reason for their existence.

So does a 50-year mortgage really make a house more affordable?

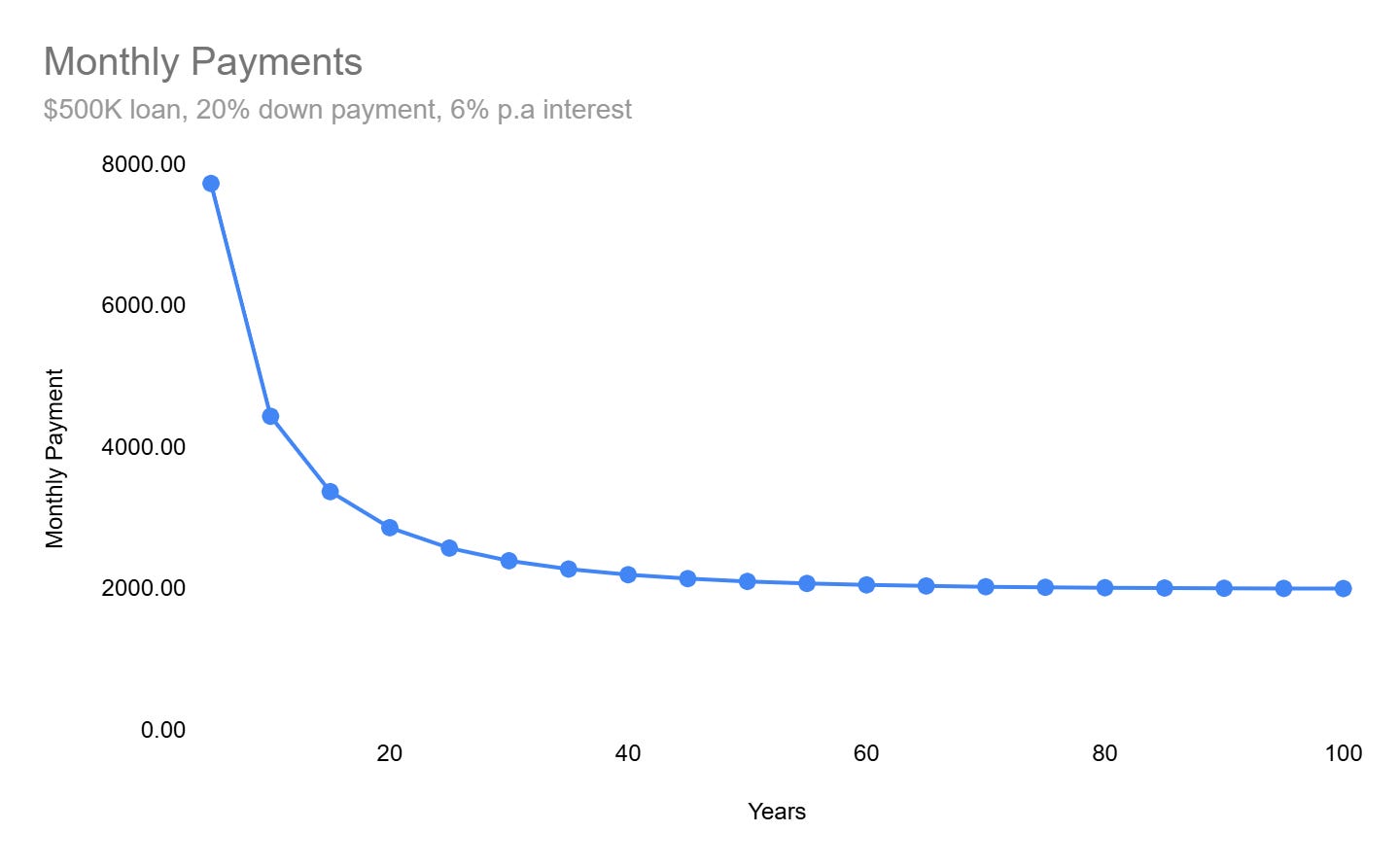

It’s quite intuitive that the longer you stretch the loan payment, the smaller the monthly payments you make. But you also increase your interest burden — the lender is taking on duration risk by lending to you for a longer period. And at some point, the interest burden outweighs the payment reduction due to a longer horizon - at which point it stops being ‘more affordable’ than the smaller tenure loan.

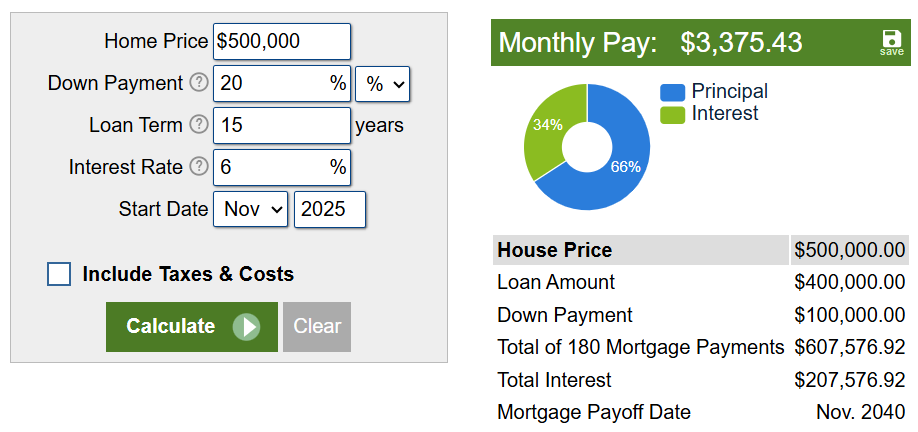

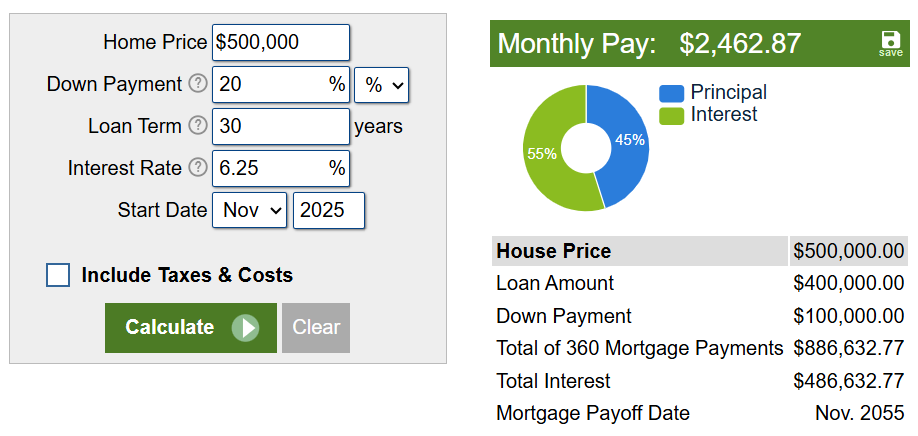

Let’s put things in perspective. Suppose you take out a mortgage for a $500,000 mortgage with 20% down payment. Assume the interest rate per annum on the 15-year tenure is 6%, and that on the 30-year tenure is 6.25%.1

You can stretch your loan payments across -

15 years — in which case you will make monthly payments of $3,375 (with 34% of the total amount you pay being the interest component)

$500K mortgage with 20% down-payment, 15 years. Source: Mortgage calculator Or 30 years, in which case you will make monthly payments of $2,462 (with 55% of the total amount you pay being the interest component)

$500K mortgage with 20% down-payment, 30 years. Source: Mortgage calculator

When you go from a 15-year mortgage to a 30-year mortgage, affordability increases by 34%.

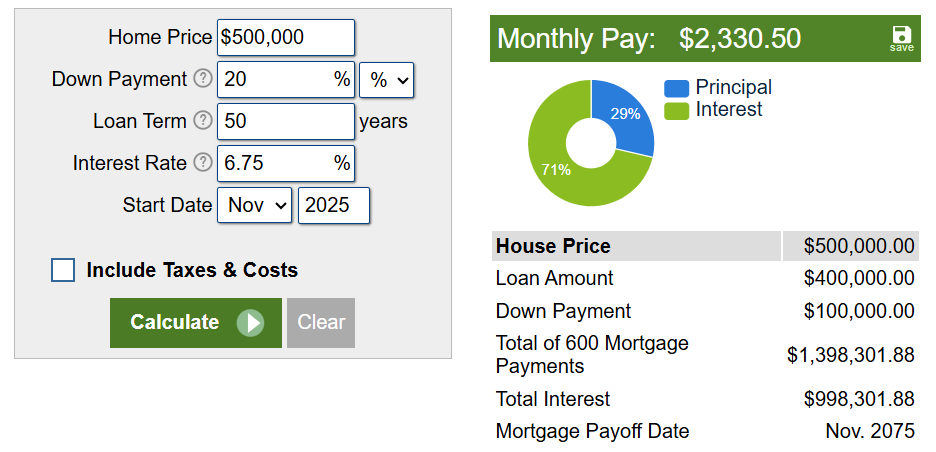

Extending the same argument to a 50-year loan (assuming it carries a 6.75% p.a. interest2) — it should make the house even more affordable to buyers who were previously priced out of the market, right?

If you go with the 30-year option instead of the 15-year option, you save $912 per year in monthly installments (for 15 years). And if you choose a 50-year mortgage over a 30-year mortgage, you save about $132 every month.

Market Sentiment delivers data-backed, actionable insights for long-term investors. Join 60,000 other investors to make sure you don’t miss our next briefing.

While the $912 savings switching from 15 to 30 may compound and grow large enough to cover the total interest difference between these tenures, the $132 savings compounded when you go from 30 to 50 don’t grow enough to cover the $517K total interest differential between these tenures.

In fact, beyond a threshold (which appears to be around 40 years), there is only a marginal reduction in the monthly installments. After that, you may stretch the loan over a century if you like, but it won’t make it any more affordable.

While going from a 15-year mortgage to a 30-year mortgage substantially improves affordability, going from a 30-year mortgage to a 50-year mortgage does not.

Why does the 50-year tenure stop being any more affordable than the 30-year tenure? And can we invest the difference in the monthly payments into the market to make up for the interest differential?