60/20/20 Portfolio

Were Gold bugs right all along?

While the market is having a great year, with the S&P 500 up 15% and QQQ up 20% YTD, a significant shift is happening right in front of us.

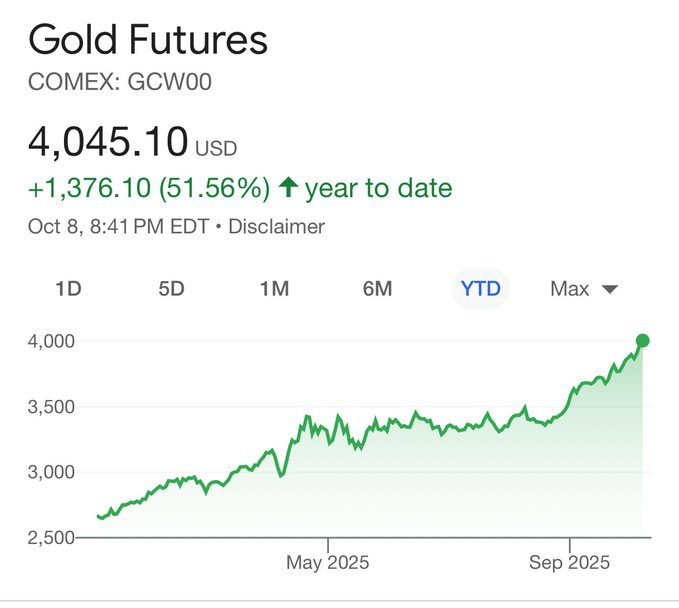

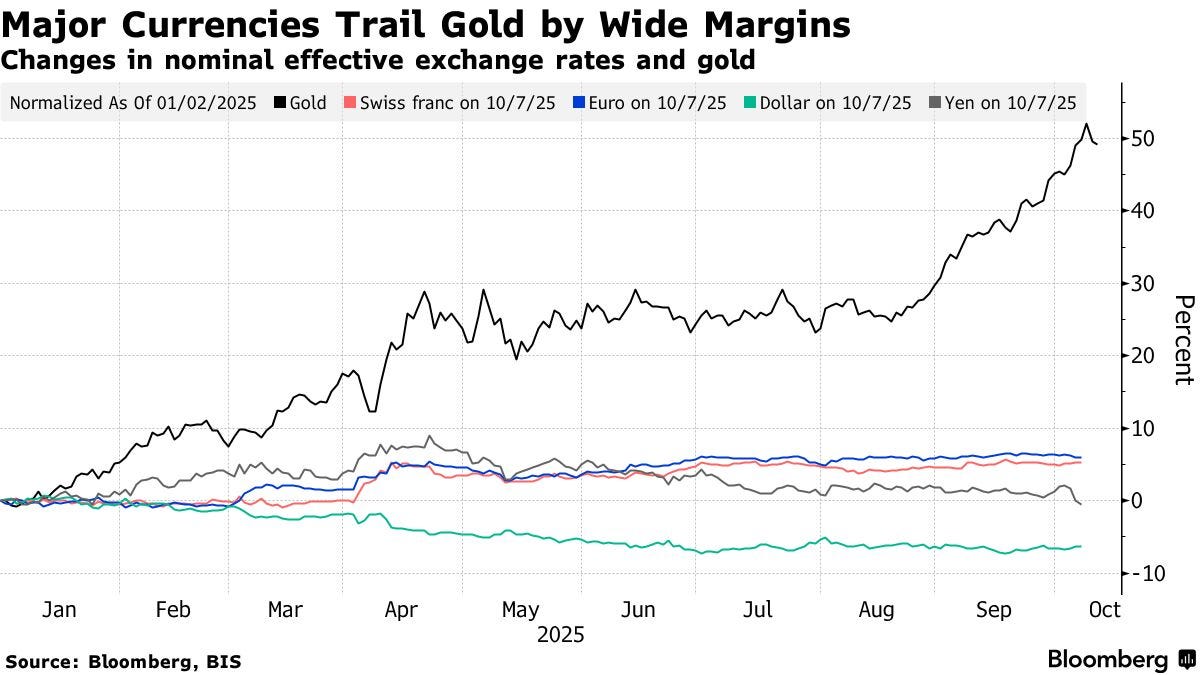

Gold is now up 51% YTD against the dollar.

This is not an aberration as well. If you go back longer, the results are even worse.

Denominate U.S. stocks in gold rather than dollars, and they’ve been in decline since the dot-com bubble burst 25 years ago.

Yes… Read that again! While the total stock market has gone up considerably since the dot-com bubble, if you benchmark its performance against Gold, the market has been falling ever since the start of the millennium.

Here’s one last stat that’s mind-bending.

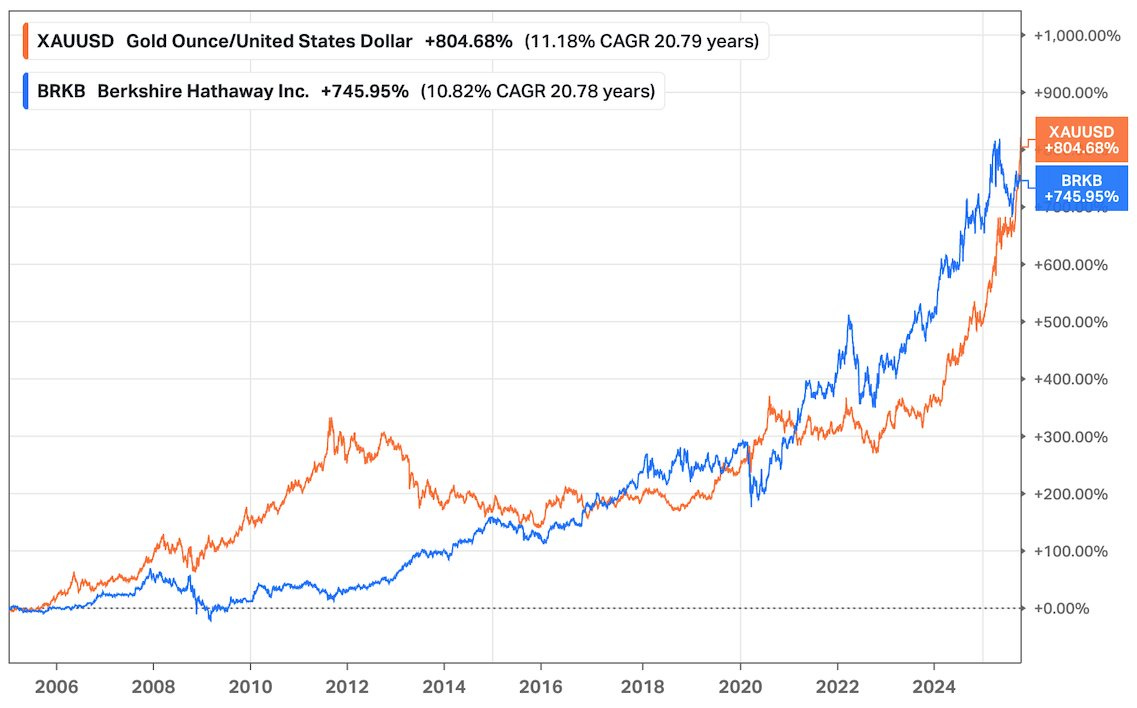

Gold has now outperformed Berkshire Hathaway over both 10-year and 20-year horizons.

Ray Dalio says it’s like the early 1970s again (remember stagflation!), and investors should allocate as much as 15% of their portfolios to gold.

And he’s not alone.

The performance has been so strong and so discomforting that the Chief Investment Officer of Morgan Stanley is now recommending a 60/20/20 portfolio instead of a 60/40 portfolio, where 20% of it is Gold instead of traditional bonds!

Let’s dig into why everyone’s suddenly recommending gold, how it fits in your portfolio, and why a literal piece of rock is outperforming one of the greatest investors ever!

Market Sentiment delivers data-backed, actionable insights for long-term investors. Join 57,000 other investors to make sure you don’t miss our next briefing.

What’s driving the demand:

1. Central Bank Gold Purchases

In 2024 alone, central banks scooped up 1,045 metric tons of the precious metal, marking the third straight year of 1,000+ ton purchases. This wave of central bank accumulation is historic in scale: global official gold reserves have risen to levels last seen in the Bretton Woods era, and in 2024, gold became the second-largest reserve asset worldwide (by market value) after the U.S. dollar.

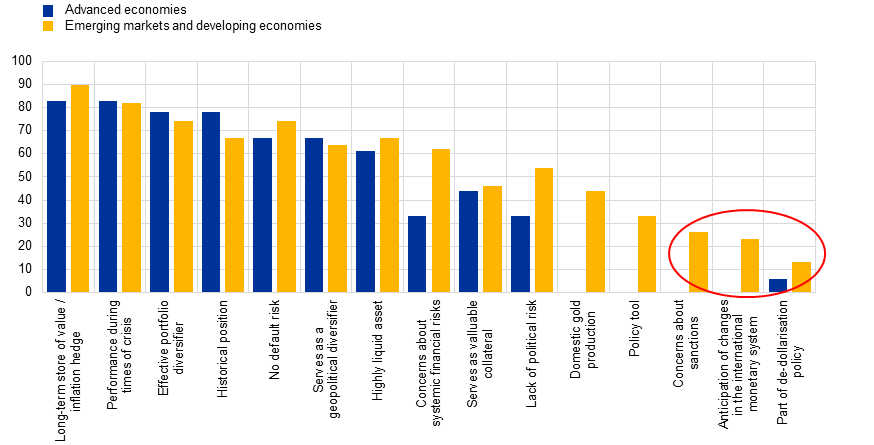

As to why Central Banks are accumulating gold at an all-time high, it’s because they expect gold to perform during crises, act as a long-term store of value, and finally hedge against currency default risk. This is also the central banks’ way of diversifying away from the US dollar - as the US grapples with its own economic problems (high deficits, slower growth, mercurial policy).

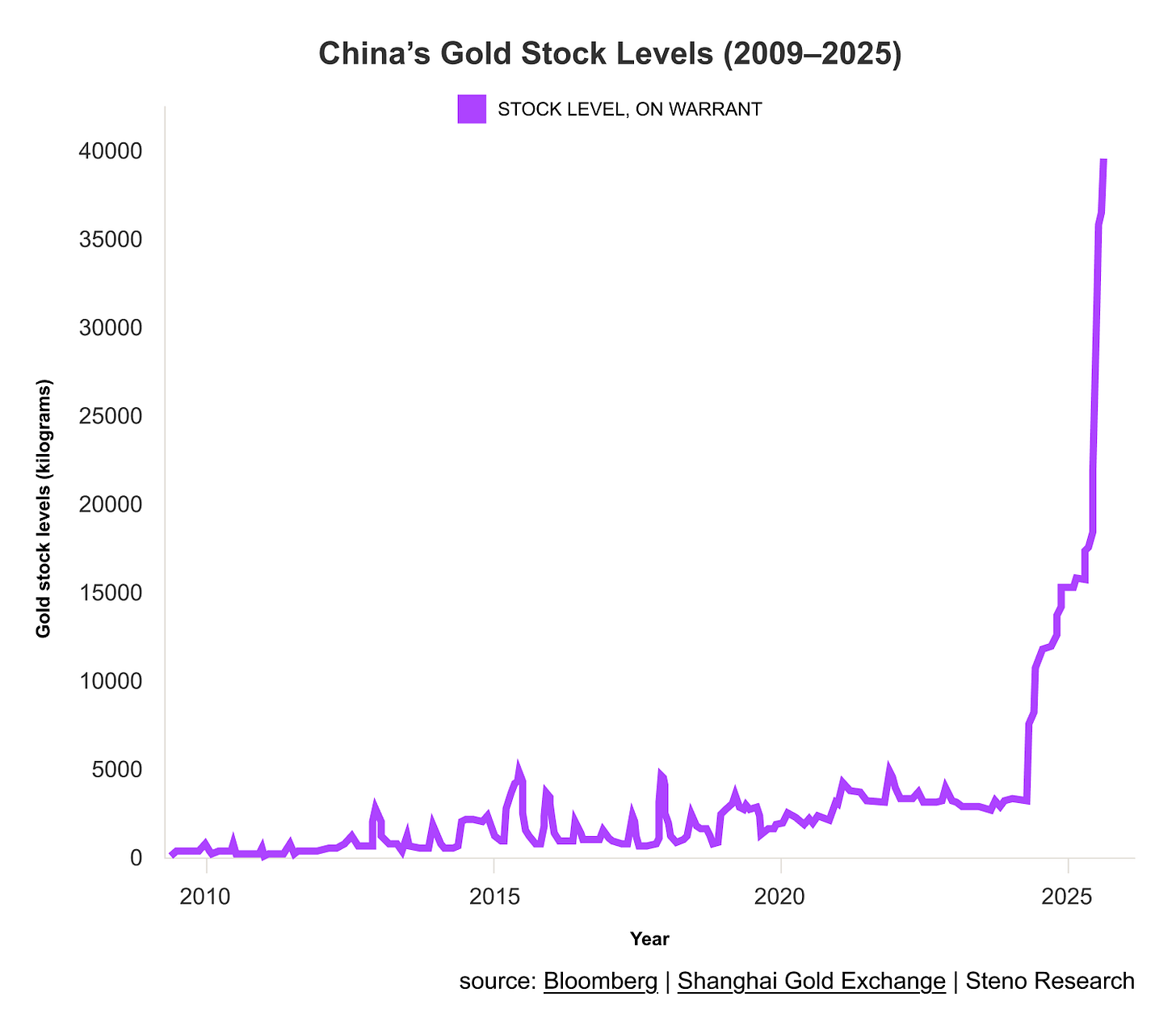

The astute among you would have noticed that the trend accelerated after 2022: This is in part driven by the U.S. and its allies freezing Russia’s foreign-exchange reserves after the Ukraine invasion, prompting reserve managers to seek more “sanctions-resistant” assets like gold.

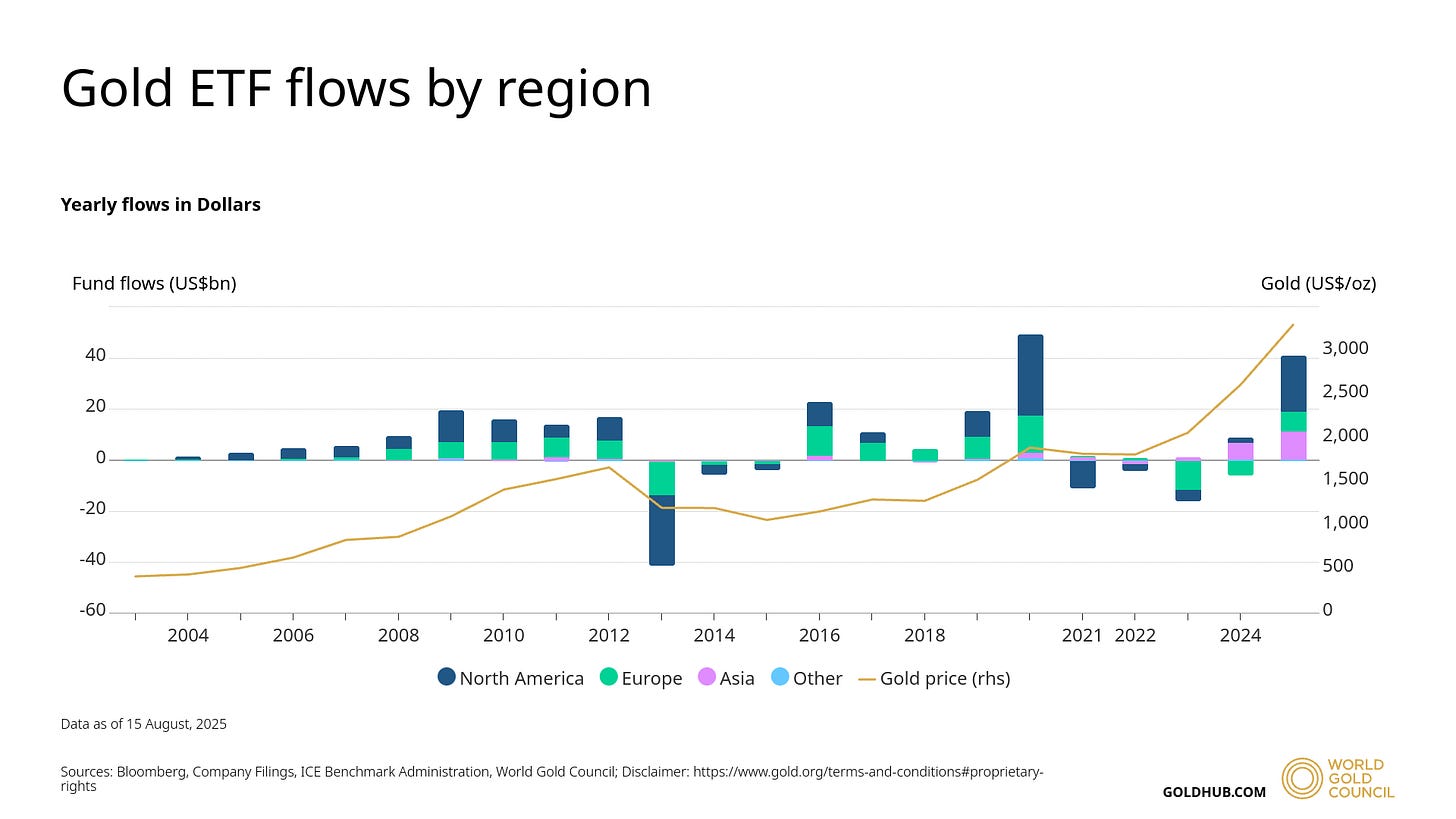

2. Investor demand

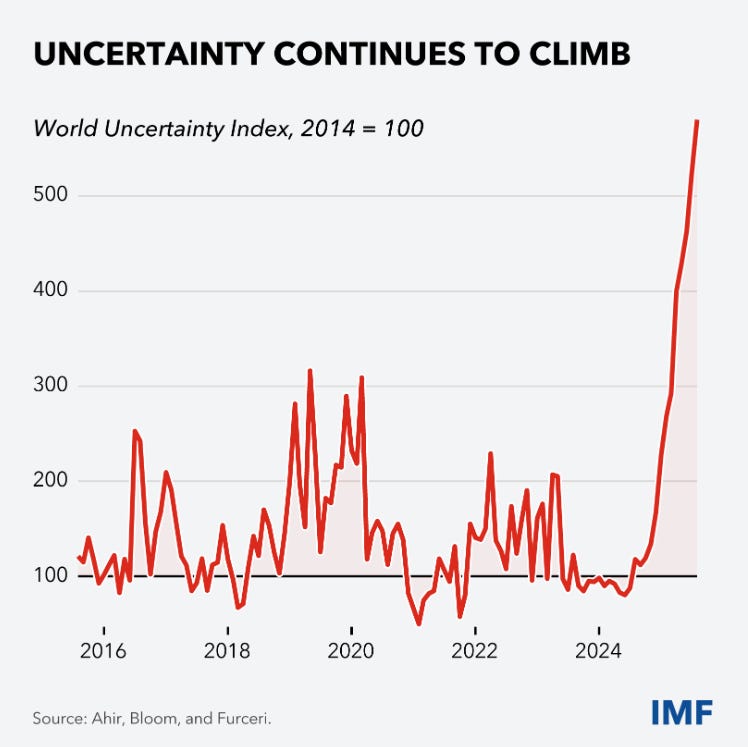

Nobody likes uncertainty, especially in markets.

But uncertainty has become the new normal - especially after 2020, when the global economy has been met with one crisis after the other.

If you look at the following chart, gold demand has been steady during both risk-on and risk-off periods, but the biggest uptick is seen in 2020 (Covid period) and now in 2025, when there’s uncertainty about economic growth, the threat of a trade war looms large, and geopolitical risk shrouds the markets. The most efficient way to hedge against uncertainty is to buy the one asset you know will always stand the test of time.

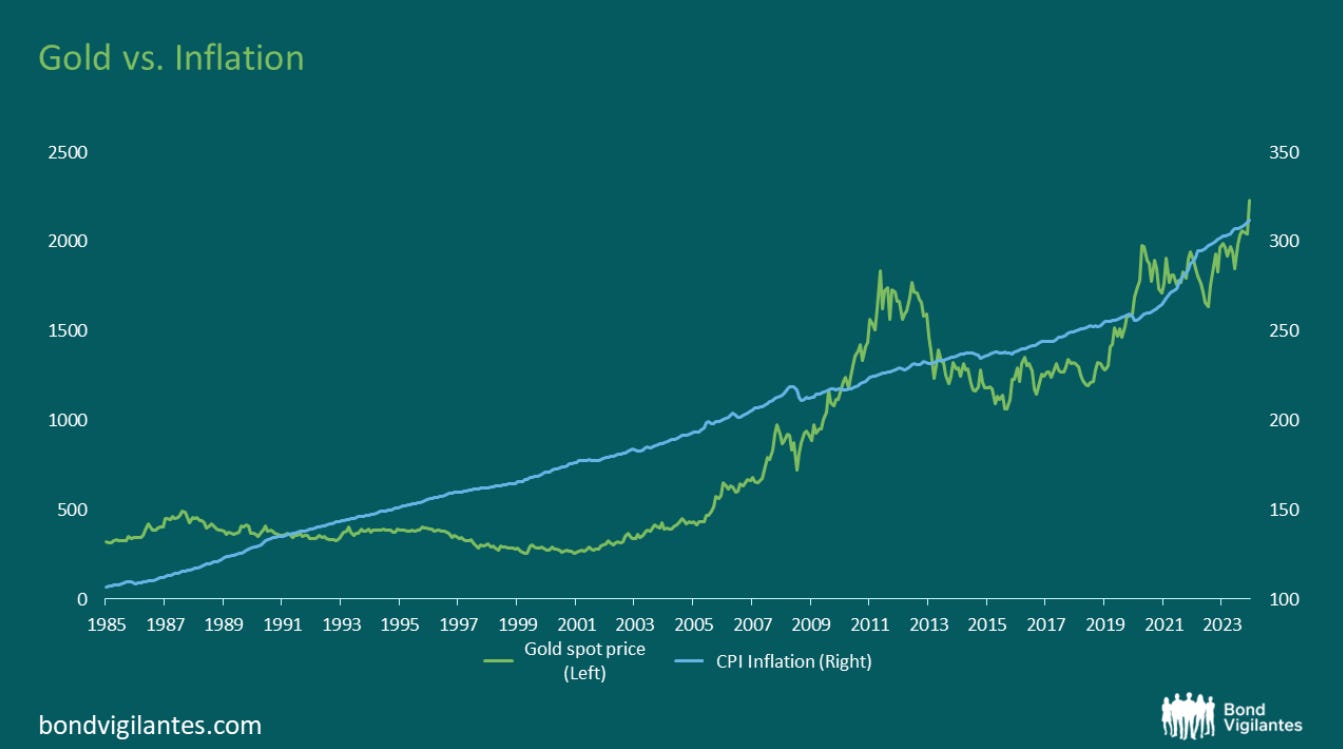

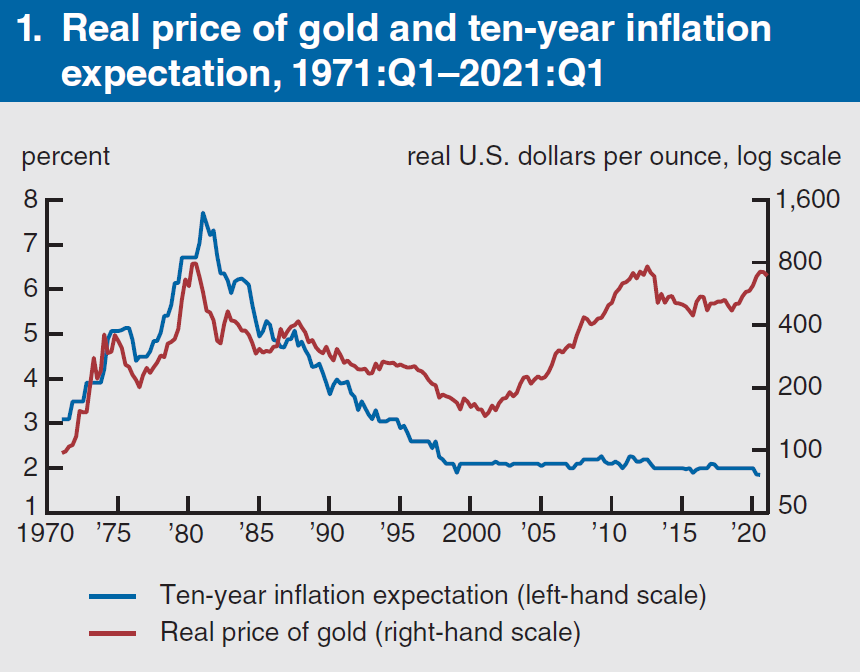

3. Inflation Hedge

As opposed to fiat currency, gold is inherently fixed in supply. The supply of gold is inelastic, with the mining production adding only 1-2% annually to the total above-ground stock.

As Joe Weisenthal quotes in this speech,

One of the striking things about gold is just how incredibly hard it is to attain (and hold onto once you have it) and the different things you have to master to get gold.

To get gold, you

— Have to be good at warfare

— Be able to marshall an extensive human workforce to mine it

— Mastery of global supply and logistics routes

— Be able to command guards who will watch your gold, and not steal it

— Have the technical know-how to get gold out of the ground, which is expensive and

cumbersome. And so on…Gold, then, is a very specific proof of work. If you can get gold, you’ve proven that you have the ability to run a state or some state-like entity.

Gold is a well-burnished inflation hedge — High inflation episodes or high inflation expectations have coincided with higher gold prices.

4. Currency Debasement

If you look at the US dollar, it has slid 11% in the first half of 2025 - clocking its biggest decline in 50 years. Other major currencies - the Swiss franc, Euro, and Yen - are also lagging behind.

High deficit spending by governments leading to currency debasement is now driving this ‘debasement trade’ wherein investors pull away from sovereign debt and currencies. On the other side of the trade is gold (among other precious metals), which continues its rally.

All of this brings us to:

60/20/20 Portfolio

What if you replaced 20% of your bonds with gold? Here’s what the last 30 years of data tell us: