Betting against the $

Six portfolio tools to hedge against the dollar debasement

Market Sentiment delivers data-backed, actionable insights for long-term investors. Join 51,000 other investors to make sure you don’t miss our next briefing.

Last month, the U.S. Govt collected $371 billion. Pretty cool until you see what it spent — $687 billion. We added $316 billion to the national debt in just one month!

The funny thing about national debt is that it won’t matter until it does — Then it will matter more than anything else. While everyone was focused on the stock market rout following the Liberation Day tariffs, something more alarming happened that most investors missed.

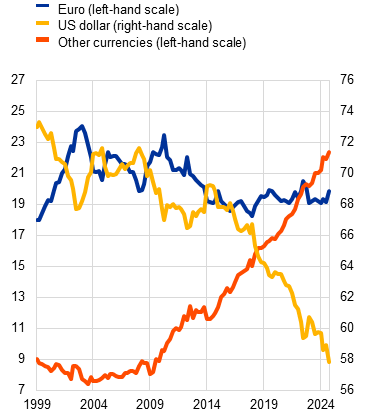

For the first time in recent history, the value of the dollar dropped simultaneously with the market.

This is unprecedented — In times of market turmoil, the dollar tends to appreciate as investors seek safety and shift funds away from equities. This trend occurred during both the 2008 financial crisis and the 2020 pandemic crash.

But what happened in April is a sign that something is brewing in the financial markets. Investors are no longer just shifting between U.S. assets; they are actively seeking alternatives outside the country.

What changed now?

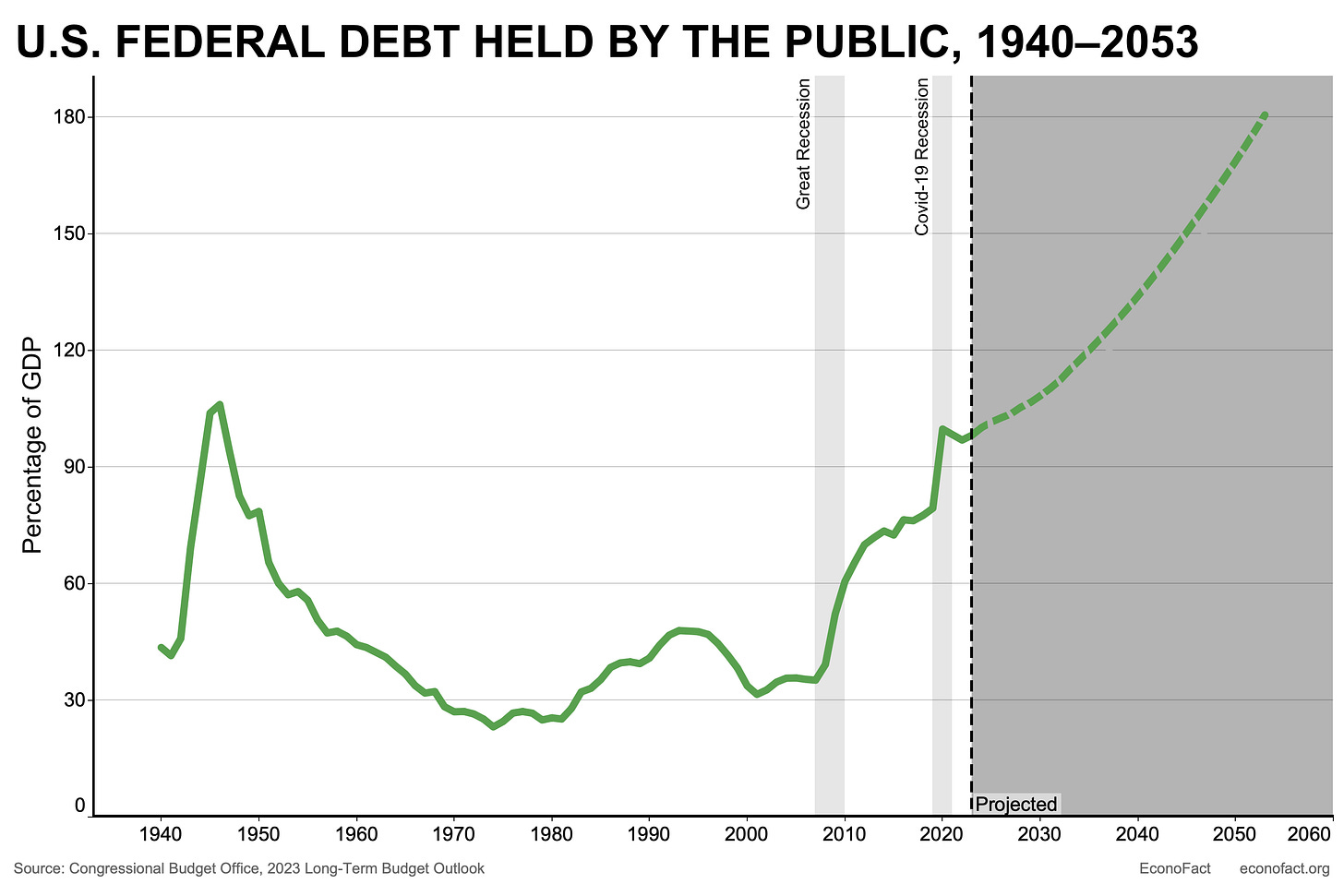

The answer lies in the ever-increasing national debt. We are now at World War 2 levels of debt — At least back then, there was a good reason to go into debt. Citing the growing debt, Moody's downgraded the US government's credit rating in May. According to their calculations, interest payments in the US are on a path to consume 30% of the federal government's revenue by 2035, compared with 9% in 2021.

While Ray Dalio keeps arguing that the U.S. Govt will go broke, the simple fact is that the U.S. can’t ever default on its debt (unless Congress decides to). The U.S. Dollar is the reserve currency, and all the debt is also denominated in $. So we can always print more to pay back our debts.

But, there are no free lunches — Uncontrolled spending always leads to inflation, loss of confidence, and the currency losing its purchasing power. Take a look at what happened with Argentina.

With the Big Beautiful Bill expected to add another $3 trillion to the national debt over the next decade, the Government does not seem willing to make the hard choice of being fiscally conservative. The issue is so severe that Elon and Trump had a falling out over it, with Elon tweeting, “Bankrupting America is not ok.”

If inflation and the Dollar losing its value are inevitable, having an equity-only portfolio will be a losing proposition. During the inflationary period of the 1970s, although the market rose 17%, inflation-adjusted, the S&P 500 was down 50%.

For what it's worth, betting against the $ is not exactly an original idea — Based on a Goldman Sachs client survey, the majority of survey respondents expect the U.S. dollar to weaken.

With that, let’s dig into six portfolio tools to hedge against the dollar debasement: