Beyond the Copper Wall

The Inevitability of Light

This one is a bit technical, and we had a lot of fun writing this. Hope you enjoy!

Just two weeks after we published our deep dive into energy being the best AI trade, the portfolio is already up 5.2% outperforming the S&P 500, with Fluence Energy up 55%, Oklo up 20%, and NuScale Power up 14%.

While energy is a second-order impact of AI, we found a third-order impact while building our energy portfolio. As far as we can tell, we are the first to cover this trade in depth. This portfolio is taking a bet on one of the most profound hardware transformations occurring in computing right now.

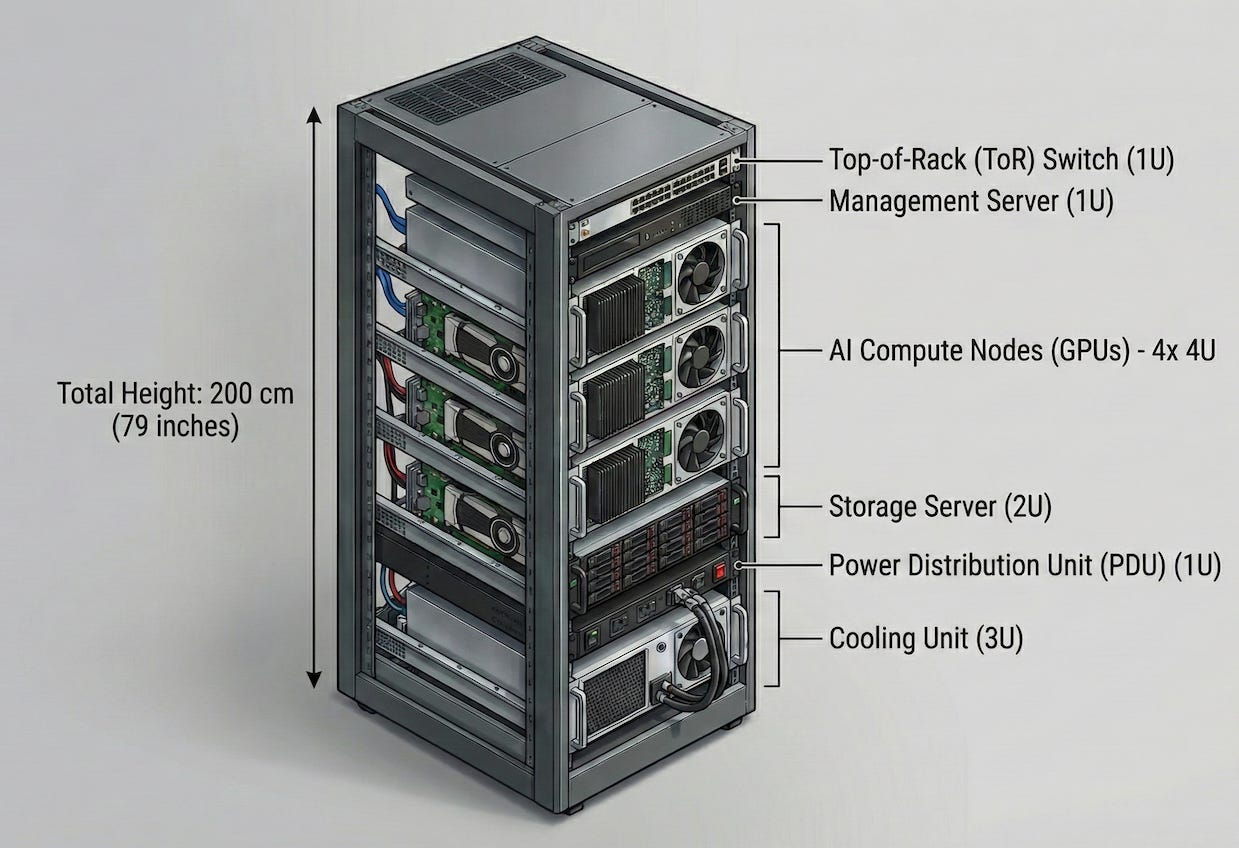

But before we jump in, we have to understand how an AI data center rack works.

To put it simply, the storage server stores massive amounts of data that feed the AI compute nodes, where all calculations are performed. The power and cooling units are self-explanatory.

Our focus here is on the Top-of-Rack (ToR) Switch.

The ToR switch manages data traffic between the storage server and the AI compute nodes, as well as between server racks in a data center. With AI companies planning 1 GW data centers, even with the best AI training GPUs, each data center will have more than 10,000 of these server racks.

That’s why communication between and within these racks is crucial to maintaining efficiency and scaling effectively, which brings us to the Copper Wall.

Market Sentiment delivers data-backed, actionable insights for long-term investors. Join 62,000 other investors to make sure you don’t miss our next briefing.

Copper Wall

The Copper Wall is the physical limit beyond which copper cables cannot transmit data fast enough over a given distance. As the signal frequency increases (to push more data), the current density tends to concentrate near the surface rather than flow uniformly across the cross-section. This reduces the effective conductive area of the wire, leading to higher resistance and signal loss.

In the early 2010s, a standard passive copper cable could reliably transmit 10 Gbps up to 7 meters. But with exploding data density and AI workflows, we have now increased the speed to 112 Gbps, where traditional copper cables can only transmit up to 2 meters.

The upcoming generation of servers will operate at 224 Gbps, at which point the reach of passive copper cables drops to less than 1 meter. This 1-meter limit is the “Copper Wall.” A standard data center rack is roughly 2 meters tall (as highlighted in the pic). If a switch at the top of the rack cannot reliably send a signal to a server at the bottom of the rack using passive copper, the traditional architecture fails.

To scale AI clusters from thousands to hundreds of thousands of GPUs, the industry has no choice but to adopt optical interconnects for short-reach applications that were previously the exclusive domain of cheap, passive copper.

Instead of using a copper wire to send data, an optical interconnect converts electrical signals into pulses of light and sends them through a fiber-optic cable, allowing it to carry massive amounts of data without loss or distance limitations.

Why now?

This once again comes back to AI.

The massive training and inference load requirements mean that GPUs are improving at a breakneck pace. For example, to properly utilize Nvidia’s latest Blackwell cluster, the switches must support 800 Gbps ports, which requires the underlying silicon to support 224 Gbps speed. The next generation of Nvidia’s chips is expected to double this speed!

But as with any transition, it will not be a step change but a gradual replacement of existing components. Here’s how we think it will play out over the next 3-4 years:

2025 - 2026 | At current speeds of 224 Gbps, passive copper cables are limited to <1 meter. The simple solution here is Active Electrical Cables (AECs), which use a chip to boost the signal halfway along the cable, extending the reach back to 2-3 meters.

2027 - 2028 | As we move to 1.6 Terabit speeds, even the AECs become too thick and inefficient. The only solution is to use Linear Drive Optics (LPO), which uses the GPU itself to handle the signal processing.

2029 onwards | The final step would be Co-Packaged Optics (CPO), in which the signal is converted to an optical signal directly on the chip. It achieves near-perfect transmission with almost zero electrical resistance losses, but it requires a complete redesign of server manufacturing.

The bigger players have already started making moves to prepare for this shift. Just five days back, Marvell Technology MRVL 0.00%↑ announced the acquisition of Celestial AI for $3.25 billion. Celestial AI is at the forefront of developing optical interconnect platforms. Even Nvidia is there, trying to fuse compute with NVLink, NVSwitch, and networking silicon to keep traffic inside its walled garden.

Companies like Corning Inc. GLW 0.00%↑ , best known for its Gorilla Glass used in iPhones, are gaining momentum in optical communications as AI computing is exploding. Analysts expect a 39% YoY growth for Corning’s Optical Communication segment, which provides high-speed fiber connectivity in AI data centers.

Building an Optics Portfolio

While traditional mega caps, such as Nvidia, Broadcom, Intel, etc., have some exposure here, the best way to capture upside will be to build a basket of optics companies that will drive this change over the next 5 years.

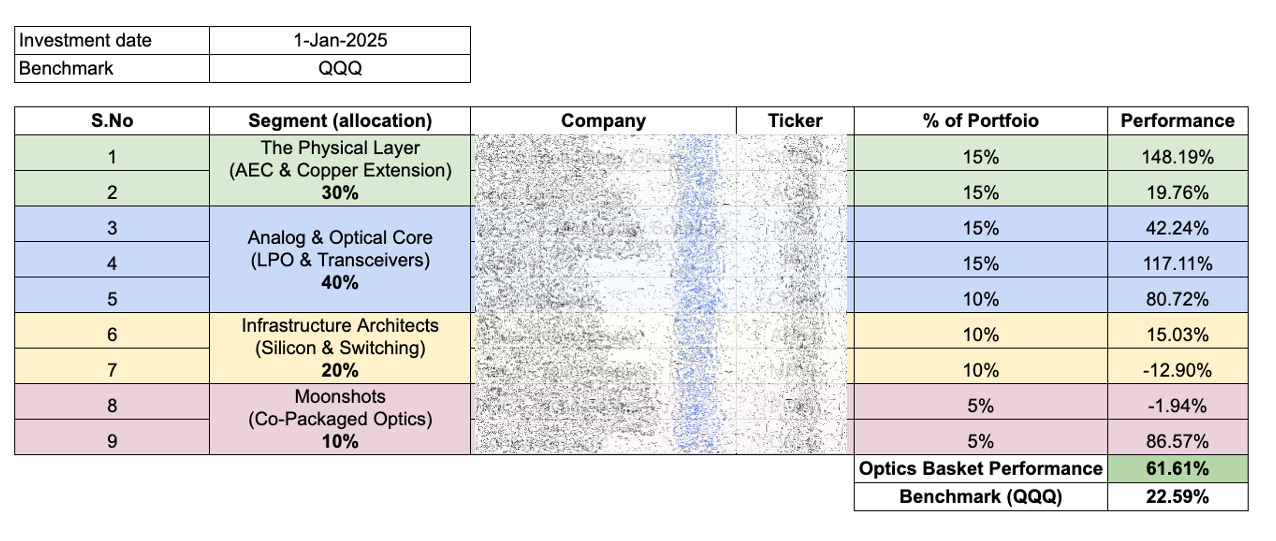

The portfolio we have built is based on a balance of near-term revenue reliability and long-term moonshot potential. We have bucketed it into four segments, with no single position exceeding 20% of the portfolio allocation.

A simple backtest validates our thesis: YTD, the Optics portfolio would have returned 3x that of the QQQ, with only 2 of the 9 picks dropping in value.

We will start by focusing on Active Electrical Cables companies, which are experiencing a massive demand surge, followed by taking informed bets on companies with exposure to Linear Drive Optics (LPO) and Co-Packaged Optics (CPO).