Coinbase & Index Inclusion Effect

What 25 years of data say about post-announcement rallies

Market Sentiment delivers data-backed, actionable insights for long-term investors. Join 49,000 other investors to make sure you don’t miss our next briefing.

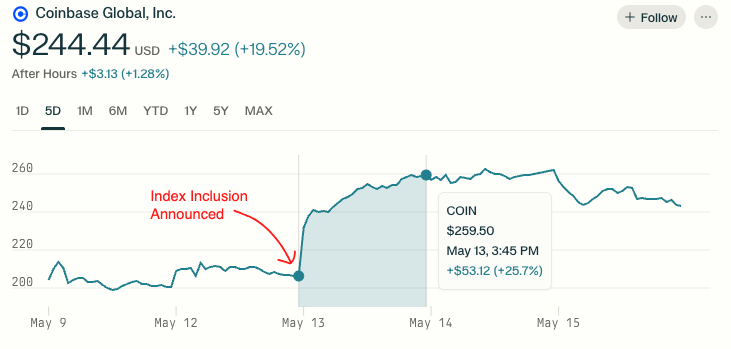

After the market closed on Tuesday, S&P Global announced that Coinbase would be added to the S&P 500 index. Although the change is set to take effect before trading begins on Monday, May 19, Coinbase shares surged 25% the following day.

Once added, Coinbase will become the first and only crypto-focused company in the S&P 500. The surge in buying interest reflects both the credibility that comes with index inclusion and, more importantly, the anticipated inflows from ETFs and index funds that track the index.

Bernstein estimates that Coinbase could see up to $16 billion in inflows, as both passive and active managers benchmarked to the S&P 500 take positions in the stock.

Investors are betting that this influx of capital will drive the stock price higher. But does this actually play out? Do companies added to the index continue to outperform?