Game of skill?

Exploring the world of day-trading

Join 41,000+ smart investors and traders by subscribing here:

During my MBA days, I had a course on Poker. It was about leveraging the skills of Poker in real-world business scenarios, but as expected we just sat around the class playing Poker 90% of the time.

I had a slightly sinister motive for selecting the course as well. I was so convinced that the game was just based on pure luck, and that no real skill was involved, that anyone could win a Poker tournament.

Given that I’m a Chess enthusiast, my argument was simple - compare the list of world Chess champions and world Poker champions. Over the last decade, not even once did the same person win the World Series of Poker twice in a row whereas in the Chess world we could see two people dominating the championship.

Why am I discussing Poker when the article is about Day-trading? I feel that there are some parallels between both these fields.

We have all seen the memes that technical analysis and day-trading are like Astrology for men. And, there are articles after articles that diss on day-trading with valid reasoning. Finally, there are the ‘Day-Trading Gurus’ who will help you make insane gains if you just buy their course.

So in this week’s analysis, let’s use data to break down these arguments and see if Day Trading is a viable investment strategy!

First, the bad news

Since none of the famous trading platforms in the U.S (Fidelity, Robinhood, E-Trade, etc.) give out data about individual investor performance, we would have to leverage existing research done by other analysts/institutions. We will cover results from the top 3-4 studies on the topic but the overwhelming conclusion from these studies is that

It’s very very hard to make a consistent profit out of day-trading.

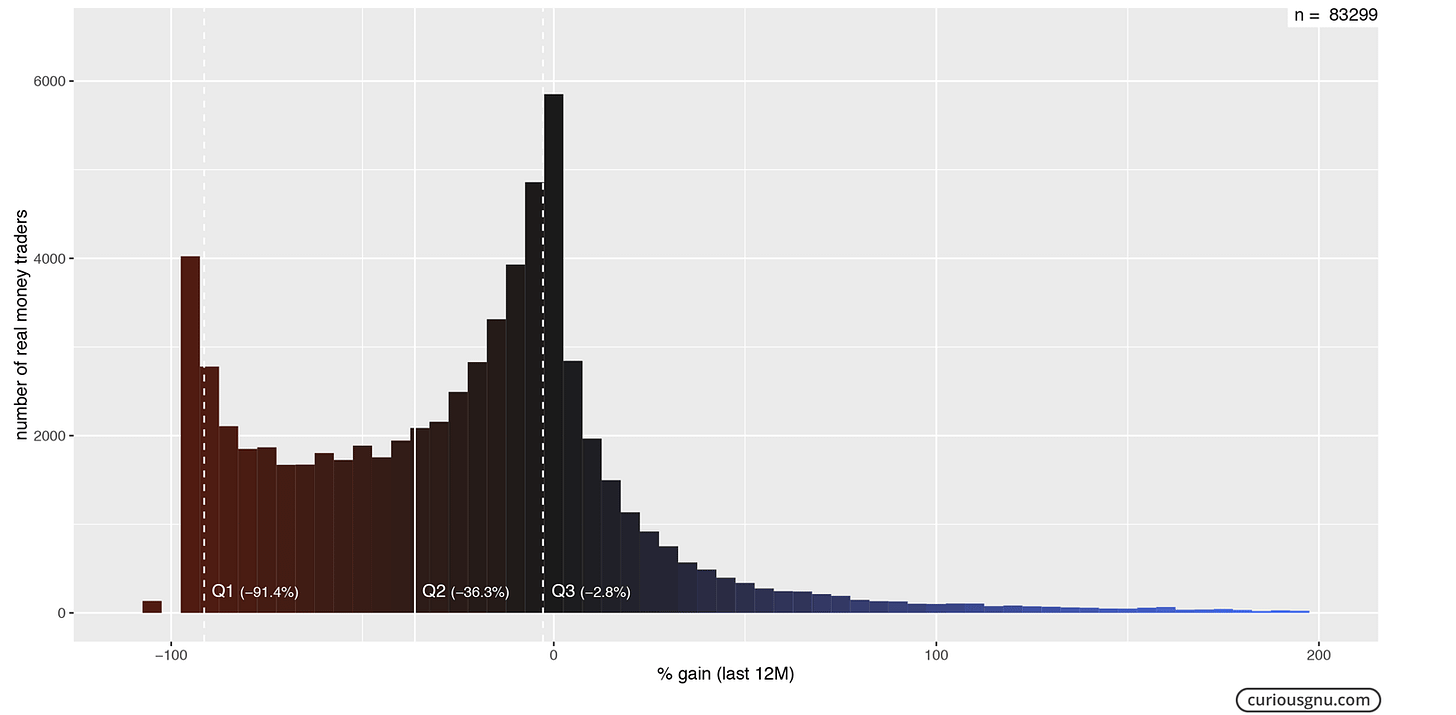

Alex (an analyst) scraped all the public data available from the eToro trading platform in 2016 and benchmarked the performance of more than 83,000 traders over the past year who had made more than 3 trades. The results were not pretty.

The following histogram shows the average gains of each trader over the past twelve months. In the end, 79.5% of them lost real money. The median 12-month returns were -36.3%.

The results were stunning. Only 1 in 5 people who tried day-trading even broke even and 50% of the traders lost more than 36% of their invested capital (That too in a predominantly bull market!)

A 2010 study conducted by faculty at the University of California at Davis indicated a mere 1.6% of traders were profitable net of fees. Similar results were observed in the Brazilian market as well with a 2019 study titled ‘Day Trading for a Living?’ claiming that

97% of all individuals who persisted for more than 300 days lost money. Only 1.1% earned more than the Brazilian minimum wage and only 0.5% earned more than the initial salary of a bank teller — all with great risk.

One of the most insightful observations also came from the same study which showcased that individuals who traded for more days lost more money. Ideally, if day-trading was a learnable skill, then we should see more experience leading to more profit. Here we are observing exactly the opposite trend - i.e, there is no evidence of learning!

Probable causes of why day-trading is extremely difficult

We can keep on listing study after study which showcases similar results. But we need to take a look at the fundamental mechanism to internalize why things go wrong. I think day-trading is tough mainly due to:

a. Overconfidence: Individual traders typically make emotional trades and see an edge where there is none. We tend to be super confident about our investments which leads us to make riskier investments, further contributing to these losing statistics.

b. Initial Capital: Unless you are starting off with a really large initial capital, it’s difficult to make a significant amount of money which will make you want to make riskier trades. For example, a 2% profit on a $10k investment is only $200 whereas the same investment with a $1 Million capital is $20K.

c. Stock selection: Individual traders focus mainly on attention-grabbing stocks. A report from Robinhood showed that 35% of the trading activity was just focused on 10 stocks. After all, how much edge can you possibly have in really popular stocks, especially against hedge funds and algo-traders who do this for a living?!

A silver lining?

It’s easy to end here stating that Day Trading does not work and most end up losing money. But the fact is that there is that minuscule percentage of traders who absolutely make a killing in the market consistently.

I had done an entire article on the Medallion Fund, arguably the greatest hedge fund of all time. Since its creation, the fund has only lost money in a single year (1989). For the next 30 years continuously, there was not even a single year where their returns dropped below 20%. Even at the peak of the 2008 financial crisis, the fund had made an 82% gain net of fees!

These returns were generated using a model that held 1000s of short-term positions in the market. (Unlike Buffet, who held stocks for decades!). Even though we can consider Medallion to be an outlier, there are many others who have performed exceptionally well using short-term strategies.

Remember my disdain about Poker in the beginning? Well, turns out I was wrong. The more you play, the more you start seeing trends and patterns in the game that you never realized. You start adjusting your bet amount to read into how strong your opponent’s hand is. And you start seeing that more experienced and patient players coming on top time after time.

Is it 100% foolproof? Absolutely not! You might get an amazing hand but your opponent might have an even better hand. That’s just how the game is. I feel the same is true for day trading. You might have bad bets on some days, but if you stick it out long enough and learn the game by putting in the effort, you are bound to come out on top.

Otherwise, how do you explain Daniel Negreanu, who has won the World Series of Poker 6 times with career earnings of more than $42 Million, or Jim Simons who beat the market 28 out of the 30 years starting from 1990? Nobody can be that lucky!

After all, it’s not only about the cards that you are dealt - It’s also how you play them. Stay tuned for next week’s post that’s going to go deep into this topic, something every investor and trader needs to know: How do you decide how much to stake on an investment?

Until next week…

Join us on Twitter

Disclaimer: I am not a financial advisor. Do not consider this as financial advice. To be perfectly clear, I still think a vast majority of us would just be better off just investing into a total market index fund instead of trying to beat the market by day trading. But for those few who are willing to put in the effort or allocate wisely, it might just be rewarding!

More interesting reads

Mr. Money Mustache: This is a fantastic witty blog by Pete Adeney who retired at 30 by making some smart financial decisions. His “Work is better when you don’t need the money” is something I related very much to! Here is an excellent video where he explains how and why he did it.

Visualize Value: Just two words - Stunning Creativity - This is one of my favorite Twitter accounts that breaks complicated topics into simple black and white visualizations.

If you enjoyed this piece, please do us the HUGE favor of simply liking it and sharing it with one other person who you think would enjoy this article! Thank you.

If it takes time to learn how to trade profitably, those initial losses would probably counteract later gains in such a way that even an experienced, successful trader would have been better off sticking with SPY from the start.

A way around this would be for rookies to keep 90% of their portfolio in an index fund and play around with 10% silly money.

If after a decade or so the proto-trader reckons he's ready for the big time, he might increase the amount of funds he plays with. If he finds the results disappointing (more likely), the losses will be limited and he will have painlessly learned his lesson.

I think most people trade or pick stocks just to prove to themselves or to finance Twitter bros how clever they are. I credit all my success with money to admitting that I'm an idiot.

I've been bench trading for several months, with your sentiment tracking tool as one of my inputs, and I'm averaging a little under 1% per day over S&P 500 on ≤24-hour trades and about 1.5% on 24-48 hour trades. Compound that over 252 or 126 trades per year and the results are tremendous.

It's not straightforward, mind you: I track (currently - always expanding) four different buy/sell timing strategies and eight selection strategies, and have created an analytics platform to test them and optimize. Preliminary testing of optimizations in progress suggests I can increase those 1- or 2-day returns by a further 0.5% - 1%.

There may be opportunities to improve your sentiment tracker, which would further increase its predictive power. My suggestions, if not already implemented:

• Weight your sources according to the reputation of the poster, ex. Reddit Karma, Twitter followers, etc.

• Weight your sources according to the positivity of the response to the post, ex. Reddit upvotes, Twitter likes, Twitter retweets, etc. I suggest some combination of the total positivity and the positivity ratio (ex. likes per follower).

• Create a weighting factor that correlates sentiment with stock price movement. This will reduce the influence of the meme stocks and the stocks users "can't let go of". My inferences are that: 1. users who invested in meme stocks can't accept their sunk costs and move on, so they keep discussing - with undue optimism - their poor investments; 2. stocks with high beta values were frequent "winners" during the extreme bull market of the past two years, and users may have difficulty letting go of these stocks in the (probable) upcoming bear market.

Thank you for your sentiment tracker and your newsletter! Excellent resources and I look forward to where they can go in the future.