Gold has now outperformed Warren Buffett

60:20:20 is the new 60:40

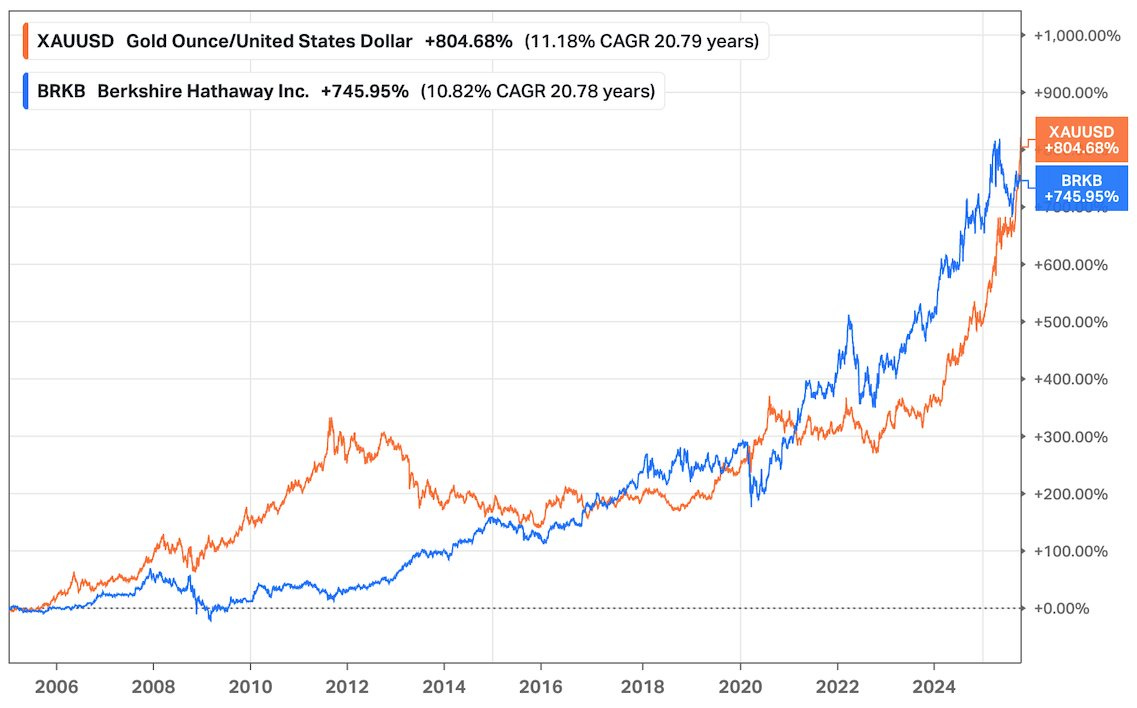

Here’s a stat that’s mind-bending.

Gold has now outperformed Berkshire Hathaway over both 10-year and 20-year horizons.

The performance has been so strong and so discomforting that the Chief Investment Officer of Morgan Stanley is now recommending a 60/20/20 portfolio instead of a 60/40 portfolio, where 20% of it is Gold instead of traditional bonds!

There was a time when the old-fashioned 60/40 portfolio worked perfectly fine. You could hedge your equity exposure with fixed income - say, short and long-duration US treasuries. Post 2022, this hedge no longer seems to work, as the equity beta of US treasuries has effectively turned zero.

Meanwhile, gold has been shining through - delivering positive returns during equity downturns, even though its beta is slightly positive.

State Street research points out that, “This suggests that while gold may not always move inversely to equities, it consistently preserves capital during periods of uncertainty, bolstered by its traditional role as a store of value amid inflation and geopolitical instability.”

Tomorrow, in one of our most in-depth reports, we dig into why gold is outperforming every other asset class and the optimal allocation to gold within your portfolio. We will cover

What’s driving the gold demand?

Performance of gold as an inflation hedge

The currency debasement trade

60/20/20 Portfolio (30-year backtest)

and much more…

The report will only be available to our paid subscribers.

As a special offer, we are giving 20% off our annual subscription if you subscribe within the next 24 hours.