Does index inclusion positively affect stock price?

I analyzed 300+ stocks that were added to S&P500 over the past 3 decades. Here are the results!

There is a lot of publicity generated when a company is added to the S&P 500 or Russell Indices. The company usually gets a bump in stock price following the announcement and there is a significant increase in retail interest for the stock.

The underlying principle for this is that institutional investors which track these indices would have to buy into the stock and that this would cause a considerable bump in the stock price.

At the same time, there are some contradictory opinions regarding this expected jump in price. Some people believe that there would be profit booking following the index inclusion which would actually tank the stock price.

What I wanted to analyze was

Whether the stock price rise following index inclusion or would the profit booking cause to stock price to fall?

This in turn would allow us to create the best strategy for trading using index inclusion news.

Data: The data for index inclusion time was surprisingly difficult to obtain. This list from Wikipedia was the only source where I could find when each stock was added to S&P 500. Data from official sources are split by years and only the latest years’ data is provided on the website.

All the data and my analysis are shared as a Google sheet at the end.

Analysis:

One of the major limitations of S&P500 index inclusions is that there is no set time delay between the date of announcement of inclusion and the actual inclusion [1]. As detailed in this post, it can vary from 1 day to 10 days with the average being 6 days.

To incorporate this complexity also into the analysis, we will calculate the returns of the stock (keeping the date of inclusion as the benchmark)

a. 1-week leading up to the index inclusion

b. 1-week following the index inclusion

c. 1-month following the index inclusion

Results:

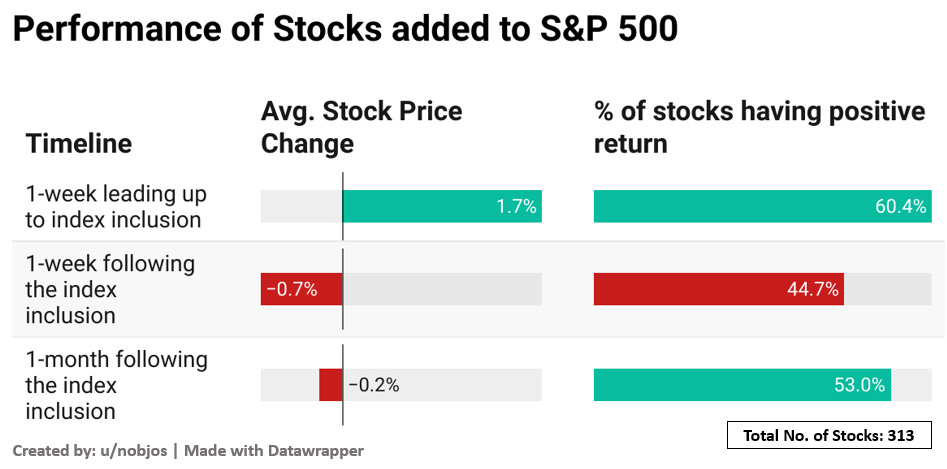

As expected, on average the stocks made positive returns only during the week leading up to the index inclusion. Out of the 313 stocks analyzed, more than 60% had positive returns with an average return of 1.7%.

After the stock had been added to the index, the returns on average were negative. There is a consistent drop in the stock price in the following weeks after the index addition. On average, the stocks lost 0.7% in the week after the index inclusion. One probable reason for this would be profit booking where investors pull out after the run-up leading to the index addition.

We can further deep dive into the mechanics of index addition to understand the best possible plays. For this, we will take case studies of some popular stocks that were added to the index.

Domino’s Pizza ($DPZ)

The inclusion of Dominos into S&P500 was announced on 6th May 2020 and the date of inclusion was on 12th May 2020. As we can observe from the graph, all the indices which track S&P 500 had to buy Domino’s stock before the market open on 12th May due to which there is almost an 11x jump in traded volume and a 2% gain in stock price. In this case, the stock continued its upward trend for one more day before dipping.

Tesla Inc ($TSLA)

Tesla was the largest company to be added to S&P 500 at more than $500 Billion valuation. The inclusion of Tesla into S&P500 was announced on 16th Nov 2020 and the date of inclusion was on 21st Dec 2020. As we can see from the graph, there was a nice bump in traded volume as well as stock price following the announcement.

Since the company was added into the index in one step before the 21st Dec open, all the funds had to buy the stock on 18th Dec (19 & 20 were weekends). There was a 6% jump in stock price and almost 4x normal traded volume on that day. We can also see the profit booking following the index addition where the stock briefly dipped before continuing on its rally.

Conclusion:

The analysis does prove that stock prices positively react to index inclusion. But this is only applicable till the stock is added to the index. As we saw earlier, stocks rise 1 week leading to the inclusion and then falls due to profit booking.

So, the best strategy to trade based on index addition is to buy the stock as soon as the news breaks and hold it till the day of inclusion.

Google Sheet containing the data and my analysis: here

Footnotes

[1] If you are a diligent investor, you can analyze the quarterly earnings report and understand whether the company is now in a position to be added to the index. But then again, the final decision of whether a stock will be added to the index will be based on the index committee

As always, please note that I am not a financial advisor. Hope you enjoyed this week’s analysis. If you found this insightful, please share it with your friends and family :)

WhatsApp | Facebook | Twitter | Reddit