Lindy Effect in Investing

2025 update

We are publishing this without a paywall.

Here’s the most counterintuitive investing insight we found this year:

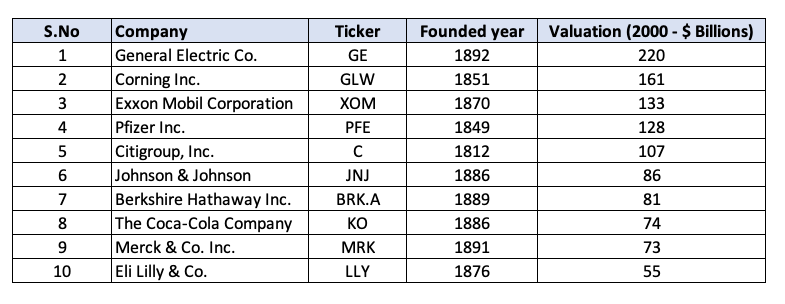

We created a Lindy portfolio in 2023, a basket of companies that were more than 100 years old as of 2000. The list included famous names such as General Electric (founded 1892), Pfizer (founded 1849), Johnson & Johnson (founded 1886), and many other household names.

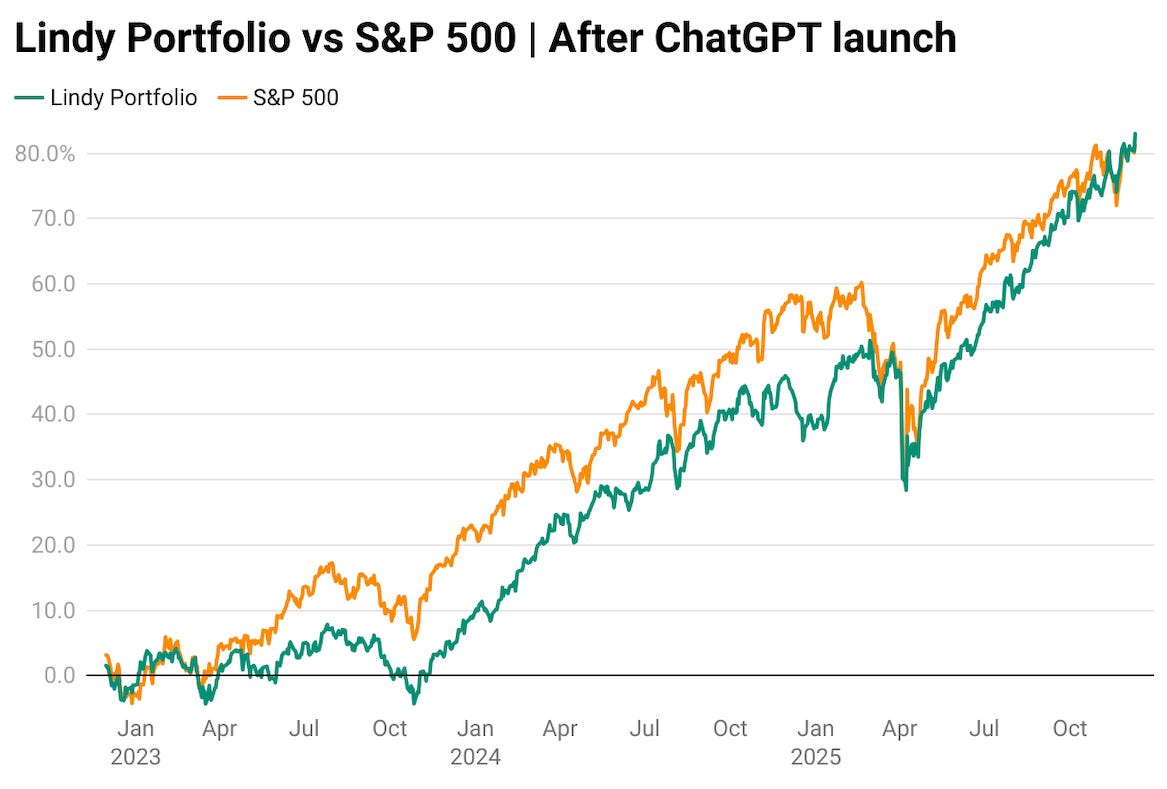

ChatGPT was launched on 30th November 2022, which kick-started the AI wave and catalyzed the staggering performance of the “Magnificent 7”. How do you think a portfolio that was created 25 years ago, which only included companies that were older than 100 years, would perform in the age of AI?

Better than you expect!

From December 2022 to December 2025, the Lindy portfolio returned 83% compared to 81% of the S&P 500 — while having lower volatility!

Market Sentiment delivers data-backed, actionable insights for long-term investors. Join 62,000 other investors to make sure you don’t miss our next briefing.

Nassim Taleb, in his 2012 book Antifragile, expanded on an interesting idea known as the Lindy Effect — If something has been around for a long time, then the probability that it will stick around for longer is higher.

This partially explains why people still read Shakespeare and Socrates but forget the bestsellers from the last decade.

If a book has been in print for forty years, I can expect it to be in print for another forty years. But, and that is the main difference, if it survives another decade, then it will be expected to be in print another fifty years.

“This, simply, as a rule, tells you why things that have been around for a long time are not “aging” like persons, but “aging” in reverse. Every year that passes without extinction doubles the additional life expectancy. This is an indicator of some robustness. The robustness of an item is proportional to its life!

For the perishable, every additional day in its life translates into a shorter additional life expectancy. For the nonperishable, every additional day may imply a longer life expectancy. — Nassim Taleb

Half of all companies fail within five years, and 80% in the first 20 years. However, some companies become outliers and survive for hundreds of years. So, in theory, the Lindy Effect applies to companies.

Take Coca-Cola, for example — The company was founded in 1892 and survived the Great Depression, two World Wars, and the 1980s Cola wars, just to name a few. Not only did the company survive all this, but it has also thrived and increased its dividends for the past 61 consecutive years. Based on the Lindy Effect, Coca-Cola has a greater likelihood of surviving to the next century than Google.

If you are a value investor, this is an important but often overlooked factor. Ultimately, the company valuation is based on the present value of future cash flow. The problem with the current valuation technique is that we always project that the company will survive in perpetuity.

This is why it becomes so hard to value companies in their growth stage. A classic example is that during the dot-com bubble, economist Burton Malkiel pointed out that at Cisco’s implied growth rate (Cisco was only 15 years old at that time), it would become larger than the entire U.S. economy within 20 years.

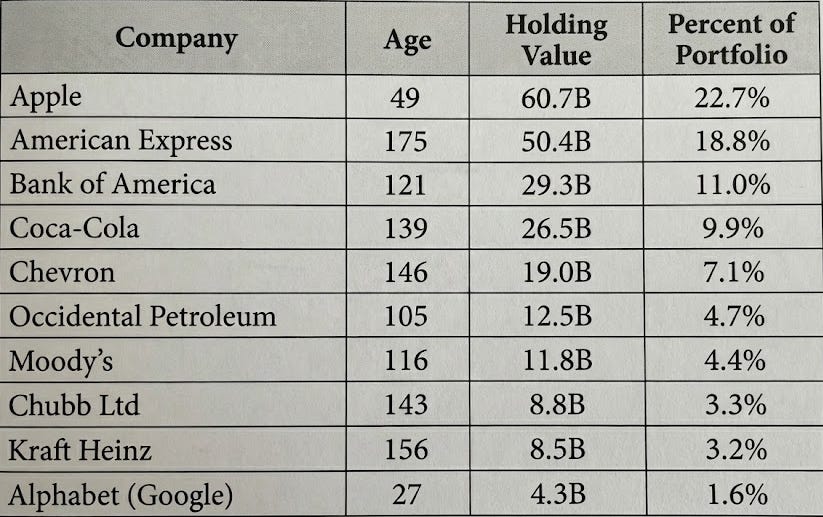

But once a company has matured, it will have an established brand, a loyal customer base, and a strong market position, making it easier to assign a fair value to the company. Buffett understands this intuitively, and it’s one of the key reasons why he only invests in established companies — The average age of the top 10 holdings of Berkshire is 117 years, with eight companies older than 100 years!

Performance of Lindy stocks

Survival is only half the story.

What we are particularly interested in is how legacy companies have performed over the long run. On the one hand, older firms will have better structures, more efficient processes, higher productivity, and an easier time attracting new talent. But, on the downside, older firms will have a negative base effect (they tend to be larger), lower sales growth, and tend to move slowly.

To test this, we are using an excellent dataset compiled by Boris Marhanovic, which consolidates all publicly traded companies in the U.S. that are more than 100 years old. There were 485 companies on the list, and after some data cleaning, we are left with 73 target companies that we can consider as Lindy stocks.

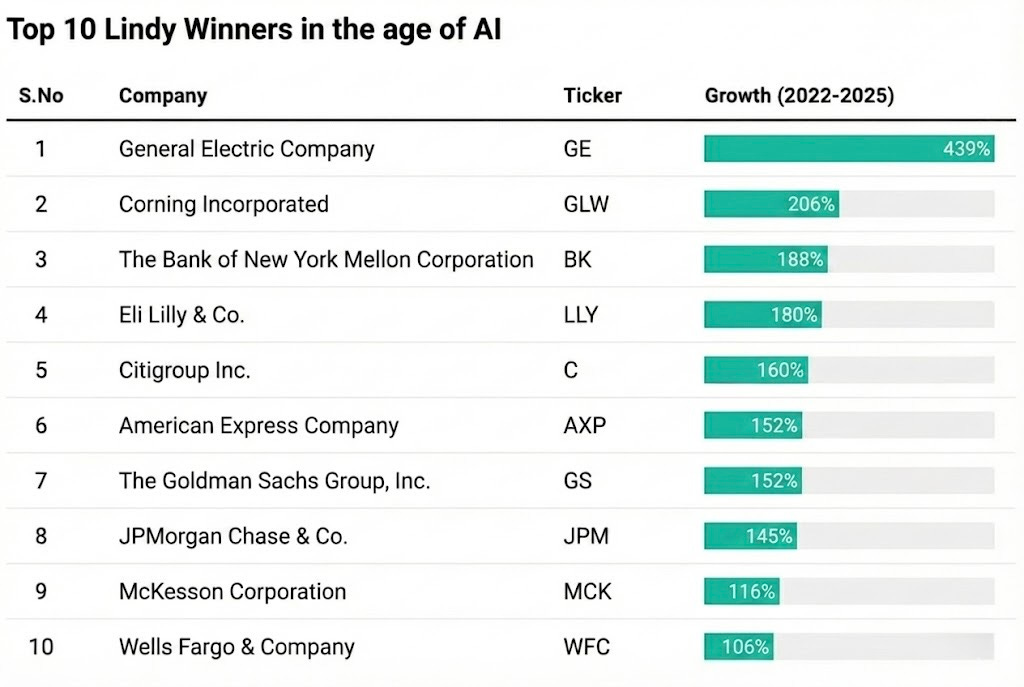

To give you a flavor of the type of companies that we are investing in, below are the top 10 companies from our list of Lindy stocks.

How did these companies perform over the long term?

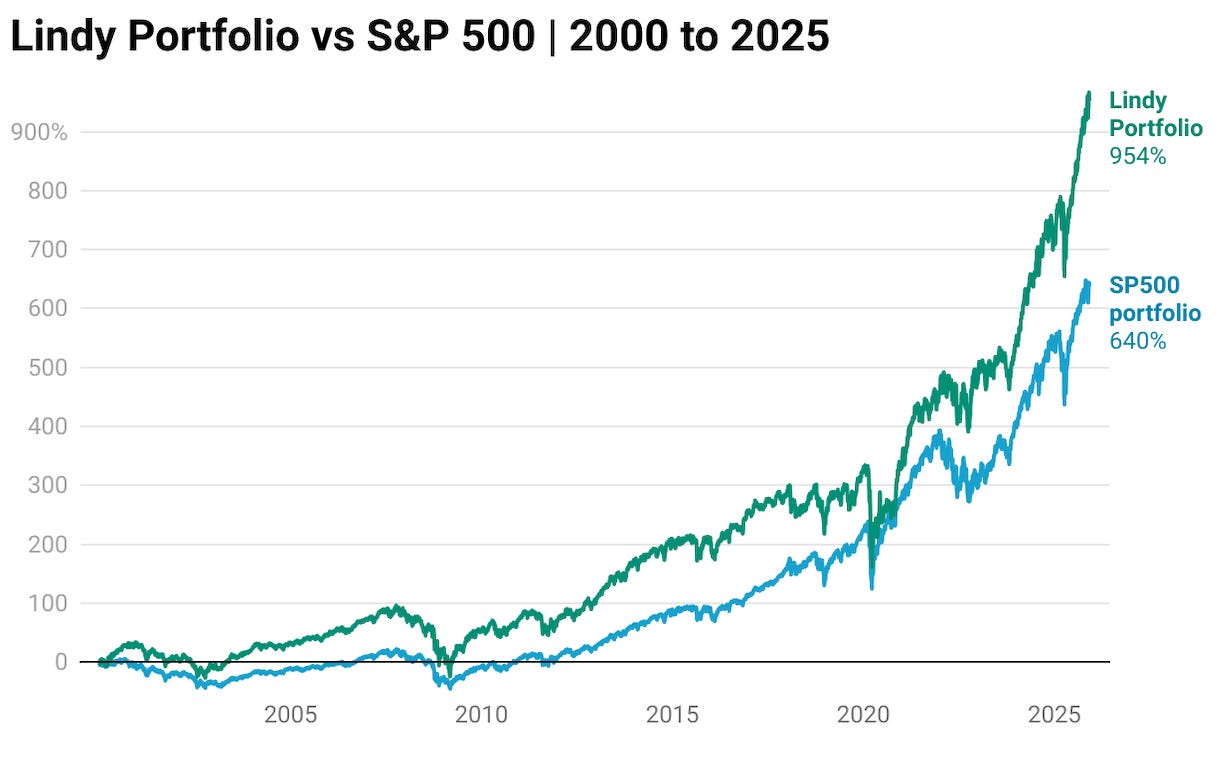

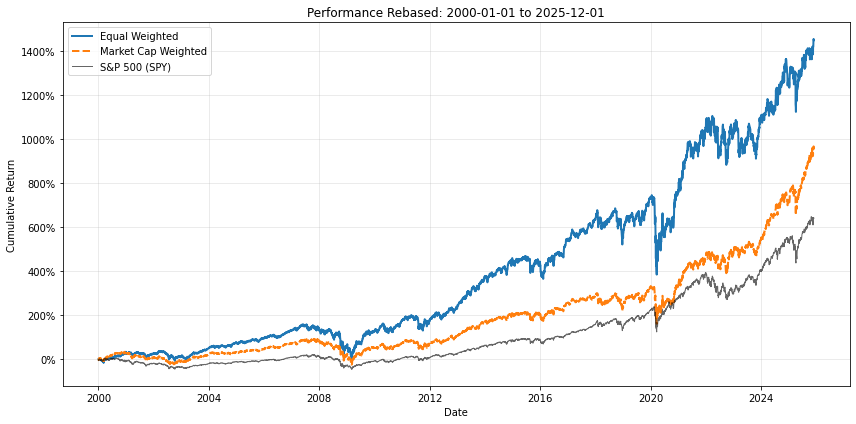

$100 invested in Lindy stocks1 would have grown into $1,054 (954% return) compared to only $740 (640% return) if you had invested in the S&P 500. The cherry on top was that this outperformance was achieved with comparable portfolio volatility (20.5%) and max drawdown (61%) to that of the S&P 500.

As we highlighted at the outset, the portfolio created 25 years ago continues to outperform in the age of AI. This is incredible considering that none of the Mag-7 companies are in our portfolio.

Endurance of Lindy stocks

Ultimately, we would argue that more than outperformance, the endurance and downside protection of these companies are incredible. Of the 73 companies we invested in 25 years ago, 72 are still trading in the market, and the only company that was acquired (Marathon Oil) delivered a 19x return to its investors.

Regarding downside protection, only six companies lost investors’ money over the long run, of which only one we will consider “bankrupt.”

Anyways, here are a few limitations that you should be aware of before trying to replicate this [Portfolio raw data and holdings are shared at the end of the sheet]

Our portfolio is not rebalanced annually, nor is it updated every year (with the new companies that make it into the 100-year list)

The analysis is prone to survivorship bias: because we started with companies that were surviving as of 2017, there may be other 100-year-old companies that died between 2000 and 2017.

We believe a few, less objective quality checks, like the industry tailwind, management competence, etc., could have improved our returns considerably more.

Time is the friend of the wonderful company, the enemy of the mediocre. — Warren Buffett

It is often said that time is the best filter for quality, and the only way a company can survive more than a century is to be a wonderful company. Jeff Bezos was once asked how Amazon became so successful, and his response gives us an insight into what it takes to build companies that last for generations.

I very frequently get the question: ‘What’s going to change in the next 10 years?’ And that is a very interesting question; it’s a very common one.

I almost never get the question: ‘What’s not going to change in the next 10 years?

‘ And I submit to you that that second question is actually the more important of the two -- because you can build a business strategy around the things that are stable in time. In our retail business, we know that customers want low prices, and I know that’s going to be true 10 years from now. They want fast delivery; they want vast selection.

It’s impossible to imagine a future 10 years from now where a customer comes up and says, ‘Jeff I love Amazon; I just wish the prices were a little higher,’ [or] ‘I love Amazon; I just wish you’d deliver a little more slowly.’

Impossible. And so the effort we put into those things, spinning those things up, we know the energy we put into it today will still be paying off dividends for our customers 10 years from now.

When you have something that you know is true, even over the long term, you can afford to put a lot of energy into it.

Finally, if you consider that our lives and the world around us are changing fast, we will leave you with this remarkable passage by Nassim Taleb.

“Tonight I will be meeting friends in a restaurant (tavernas have existed for at least twenty-five centuries). I will be walking there wearing shoes hardly different from those worn fifty-three hundred years ago by the mummified man discovered in a glacier in the Austrian Alps.

At the restaurant, I will be using silverware, a Mesopotamian technology, which qualifies as a “killer application” given what it allows me to do to the leg of lamb, such as tear it apart while sparing my fingers from burns. I will be drinking wine, a liquid that has been in use for at least six millennia.

The wine will be poured into glasses, an innovation claimed by my Lebanese compatriots to come from their Phoenician ancestors, and if you disagree about the source, we can say that glass objects have been sold by them as trinkets for at least twenty-nine hundred years. After the main course, I will have a somewhat younger technology, artisanal cheese, paying higher prices for those that have not changed in their preparation for several centuries.”

Market Sentiment is now fully reader-supported. A lot of work goes into these articles, and if you enjoyed this piece, please hit the like button and consider upgrading your subscription to access all issues.

Data

List of public companies that are more than 100 years old — Here

Lindy portfolio with stock data — Here

That’s it for now. If you are here, please “♡ Like” this piece. It helps us massively!

This work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research

Informative & interesting .. wonder what effect ai and tech innovation will have on the rationale over next decade

D'abord surpris au début de lecture puis convaincu par les arguments. Vraiment surprenant! Bravo