Party’s Over

How the planned rate hikes are going to affect the stock market!

Welcome to the 1,576 investing enthusiasts who have joined us since last Sunday! Join 18,439 smart investors and traders by subscribing here:

If you are new here, you can check out my best articles here and follow me on Twitter too!

This issue of Market Sentiment is brought to you by… Rows

A balanced portfolio is your best defense against a bear market. And a reliable tool to track your investments will increase your chances of success.

Rows is the spreadsheet for investors like you:

Easily build personalized investment tools.

Connect to 40+ platforms like Stripe, Google Analytics, Twitter, Salesforce, and LinkedIn.

Instantly add data on stocks, crypto, and more.

Automatically refresh to keep up to date with stock and crypto markets.

Send Slack alerts or emails when your portfolio goes below your sell target. All without code.

Jumpstart with their Investment Portfolio Tracker to monitor your stocks and cryptos. Try one of their 50+ templates. Or build your custom tools from the scratch.

Ready to jump on a better spreadsheet?

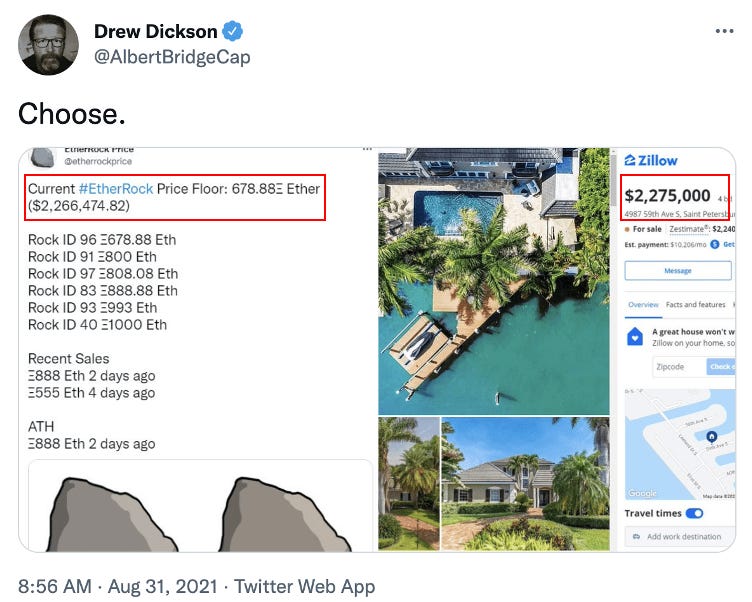

At the peak of the 2021 “everything rally”, I saw this stunning tweet from Drew Dickson that compared the price of EtherRock (an NFT) to that of an actual waterfront property in Florida.

While you can argue that I don’t completely ‘get’ the NFT ecosystem, something has to be terribly wrong when literally the image of a rock has the same value as a full-fledged house. (>$2MM FFS)

But with the Fed finally getting serious about raising the interest rates, it looks like the everything rally has come to an end. Since the beginning of the year, Bitcoin is down 40%, Nasdaq is down 23% and even S&P 500 is down more than 13%. And for those who are curious, that NFT rock is now down 73% while the house has held its value and is estimated to be worth slightly more than $2.2M.

While we covered the importance of buying the dip in one of our previous articles, it’s important to understand what caused the current sell-off, how growth stocks and startups are going to have a tough time going forward, and finally how it might be time for value stocks to shine!

What caused the Everything Sell-Off

The current drop in the market is being termed the “everything sell-off”. It mainly started with inflation going out of control forcing the Fed to increase its interest rates. Add to this the uncertainty about the ongoing Russia-Ukraine war, and we had the perfect condition for the 2021 rally to come to an end.

Inflation

At one point, the price rise was so fast that inflation hit a 40-year high at a whopping 8.5%! The availability of interest-free capital and stimulus checks pumped so much money into the economy that the total Monetary Base (supply of liquid money) went up 52% in 2020.

The supply chain constraints caused by COVID and the Russia-Ukraine war added to this to create the perfect condition for accelerated inflation. While some inflation is definitely good for the economy, the current rates are so high that the Fed is desperately trying to bring it down as soon as possible with its planned…

Interest Rate Hikes

The Fed uses the interest rates as a control pedal to grow the economy or put brakes on it if it gets super-heated. The idea here is simple. If the borrowing costs become very cheap, it becomes very easy for businesses and consumers to borrow money → either for business expansion or personal needs, thereby pushing more money into the economy and getting it out of recession. This is why the rate was virtually zero from 2008 to 2015 and from Mar’20 to Jan’22.

But now, given the high inflation, the Fed has no choice but to increase the interest rates. We saw a 25 basis point rate hike in March, a 50 basis point rate hike in May (the highest in 22 years), and several more rate hikes planned throughout the rest of the year. Higher interest rates imply that Bonds & T-Bills will have higher returns, mortgages cost more to borrow and businesses have to pay a higher overhead. All of these lead to less money that can go into the stock market causing the current dip.

Fading growth story

Compounding the above issues, the “grow at any cost” phase is coming to an end. More and more VCs and investors are asking founders to focus more on profitability rather than growth. The famous startup accelerator Y-Combinator went as far as warning startup founders to plan for the worst for the next 1-2 years.

The capital inflow into the Venture Capital space has also seen a sudden decline after peaking in the last quarter of 2021. If it drops back to the pre-pandemic levels, we could see a lot more layoffs as well as shrinking valuations in the startup space.

What’s even more concerning is that according to a recent survey by Bank of America, the global growth optimism has hit a record low (even lower than the 2008 financial crisis). This is clearly reflected in the performance of growth stocks this year. It has been an absolute bloodbath in the growth stocks area with companies such as Peloton, Zillow, Paypal, and Zoom losing more than 70% of their market value in just one year. Even the crypto market is performing better when compared to growth stocks!

What Now?

We had covered the impact of the Federal Reserve rate on the stock market during the first rate hike in Feb ’22. As we can see below, the stock market has returned an average of 9% CAGR during periods of rate increase. While it cannot be compared to the periods where the rates were held close to 0% (23.6% CAGR growth), the market still returned well above what you would have got investing in bonds and T-bills. So sticking with your Dollar Cost Averaging method is bound to give you great results.

Growth vs Value

One final thing that we can backtest is how growth and value stocks have performed during the previous rate hikes. While the data is thin (Growth & Value ETF data is available only from 2000 onwards), we can see that during the 1% to 5% rate hike from Jun’04 to Aug’06, Value stocks outperformed Growth stocks. Value stocks also gave almost the same return as growth stocks when the rates were held at 5% while having much less volatility.

As expected, growth stocks shine during periods of low-interest rates. When the interest rates were held close to 0% after the 2007 recession as well as the COVID-19 crisis, growth stocks outperformed value stocks by a considerable margin.

Price is what you pay, value is what you get - Warren Buffet

The prices of some great tech companies such as Google, Apple, etc. have undergone a significant correction during the recent dip. While these are arguably great companies with a solid economic moat, as we found out from our analysis, their performance during high-interest periods has been lackluster.

Given the current market conditions and economic outlook, it does look like there is going to be a lot more volatility in the market. If the Fed goes ahead with its planned rate hikes, we can expect to see a lot more drops in the growth stocks and flight of capital from the equity markets.

But then, it just might be time for Warren Buffet and his value stocks to finally shine again!

Until next week….

Disclaimer: I am not a financial advisor. Do not consider this as financial advice.

If you enjoyed this piece, please do us the huge favor of simply liking and sharing it with one other person who you think would enjoy this article! Thank you.

can rising interest rates backfire the Fed as mere rates don't rein in supply-side constraints

You even created this table that shows that market is growing during rate hikes. Yet all the other content is contradicting the table, including the title "party is over". This is hilarious. How the market at -20% only turns even data analysts to irrational state.