Principles for a Successful Retirement

Ronald Read was born in rural Vermont. After serving in World War 2, Read returned to his hometown and worked as a gas station attendant for about 25 years. He then retired for one year before taking up a part-time job as a janitor at J.C. Penney. His life was unremarkable by all traditional metrics.

Only when he died in 2014 did he make it into international headlines. Unknown to even his closest friends and family, Read had amassed a fortune of $8 million by living frugally and investing in blue chip dividend-producing stocks in industries he knew intimately. Read focused on companies that paid generous dividends, and avoided technology companies that he did not understand. Read reportedly made his first investment in his 30s and held on to them for the next 60 years allowing compounding to do its magic.

Of the $8 million he amassed, he left $6 million of his fortune to his local library and hospital and the remaining to his family. Unfortunately, most of us will not (and arguably should not) have the extreme frugality or the long time horizon of Ronald.

In his book Die with Zero, Bill Perkins argues for the exact opposite approach. Perkins emphasizes the importance of starting to invest in life experiences as soon as possible, advocating for a life rich in adventures and memories rather than just financial wealth. He advocates that “money has no value once you're gone” and we should all aim to die with Zero.

Given this contrasting approach to retirement and the fact that more Americans are turning 65 this year than any prior time in history, let’s dig into some core principles for a successful retirement.

Longevity

The single most important factor affecting your retirement is your life expectancy. The latest research from the Social Security Administration shows that if you are a non-smoker in excellent health, you must plan for at least 30 years in retirement.

If you are a couple that plans to retire at 65, there is a 46% chance that one of you will live to 95. Another observation was that even though 68% of the workers planned to retire at 65+, only 31% managed to do so. A majority of the workers had to retire early due to either a health problem or company downsizing.

This means that if you end up retiring at 55, your portfolio must last for 40 years.

Portfolio Checkpoints & Savings Rate

If you break it down, there are 3 factors that you should be aware of about your retirement portfolio:

Income replacement rate

Current retirement savings

Savings rate

Income replacement rate

This refers to the percentage of your pre-retirement earnings that you will need to maintain your standard of living once you retire. The higher your pre-retirement income, the lower the income replacement rate. A household that makes $30K pre-retirement has no leeway and needs 98% of that income after retirement. But if you make $300K, you only need 72% of that to maintain the same standard of living.

Current retirement savings

If you plan to retire at 65 and spend 35 years in retirement, the below chart is a quick way to know if you are on track to hit your retirement goals (check the intersection of your age and household income). For example, if you are 40 years old with a $175K household income, you should have $500K saved for your retirement by now.

Savings Rate

Finally, not all is lost if you don’t have a nest egg now. The thumb rule is that the higher your income, the higher should be your savings rate. The following table shows what percentage of your income you must save to have the same standard of living after retirement (assuming your current retirement portfolio is zero).

Building from the example above, if you are 40 years old with a $175K household income and zero retirement savings, you should start saving 26% of your household income every year.

Safe Withdrawal Rate

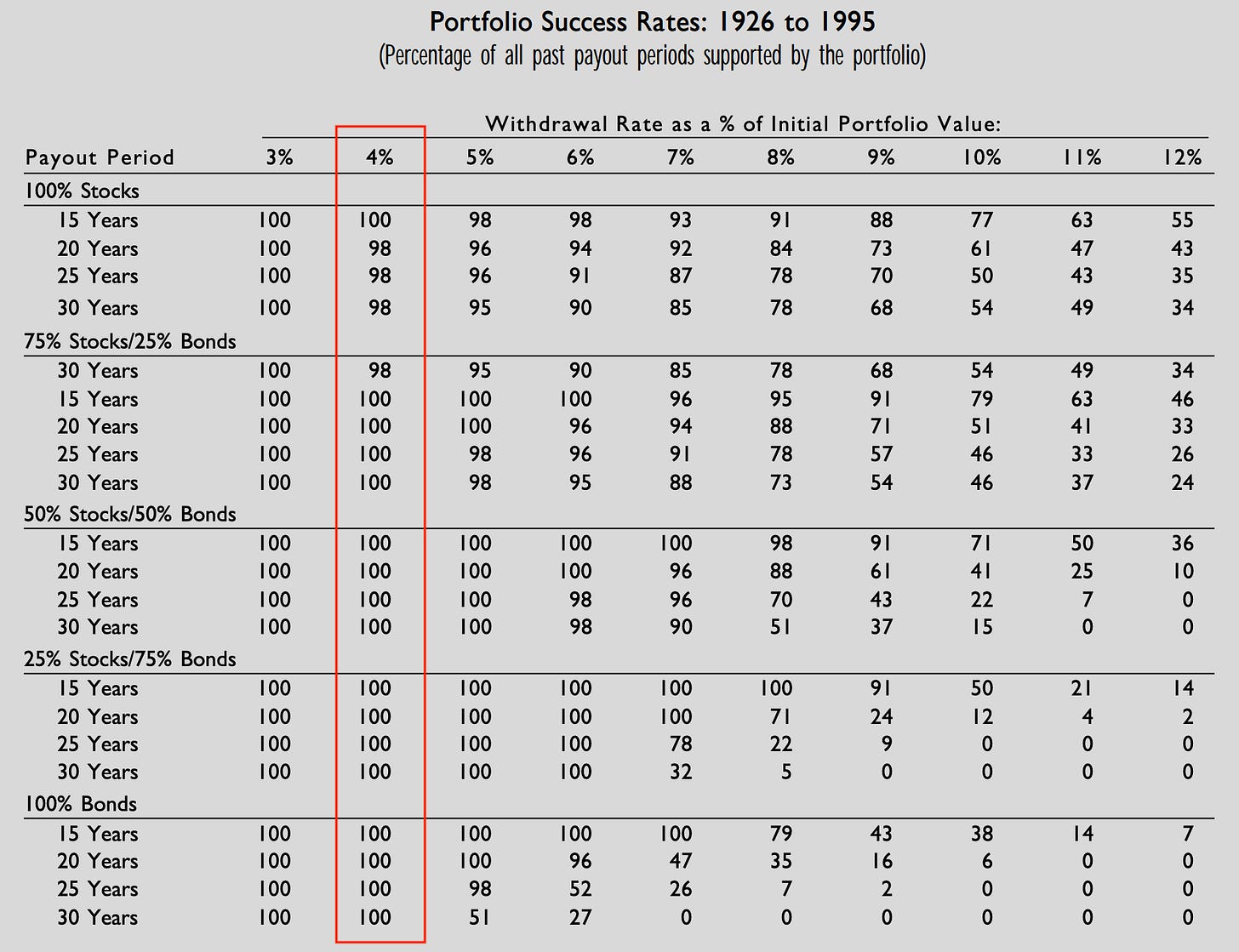

The famous 4% rule for a safe withdrawal rate came from the 1998 Trinity study. Published in 1998 by three professors from Trinity University, the study aimed to determine safe withdrawal rates from retirement portfolios over various time periods.

The 4% rule emerged as a guideline suggesting that retirees could withdraw 4% of their portfolio's value in the first year of retirement and adjust that amount for inflation in subsequent years, with a reasonable expectation that their savings would last for at least 30 years.

Example of the 4% rule — If you have a $1 million portfolio at the start of your retirement, in the first year you can withdraw $40,000 (4% of $1M). For each subsequent year, you can adjust the amount for inflation. If the inflation is 2%, next year you will withdraw $40,800 and so on…

But the study is 30 years old and the average life expectancy has gone up considerably during this time. Add to this the fact that popular financial influencers like Dave Ramsey are recommending an 8% withdrawal rate and 22% of millennials are planning for early retirement using the 4% rule, what exactly is the safe withdrawal rate now? And how would it affect your asset allocation strategies?

Let’s dig in: