Private Credit Goes Retail

Too big to ignore

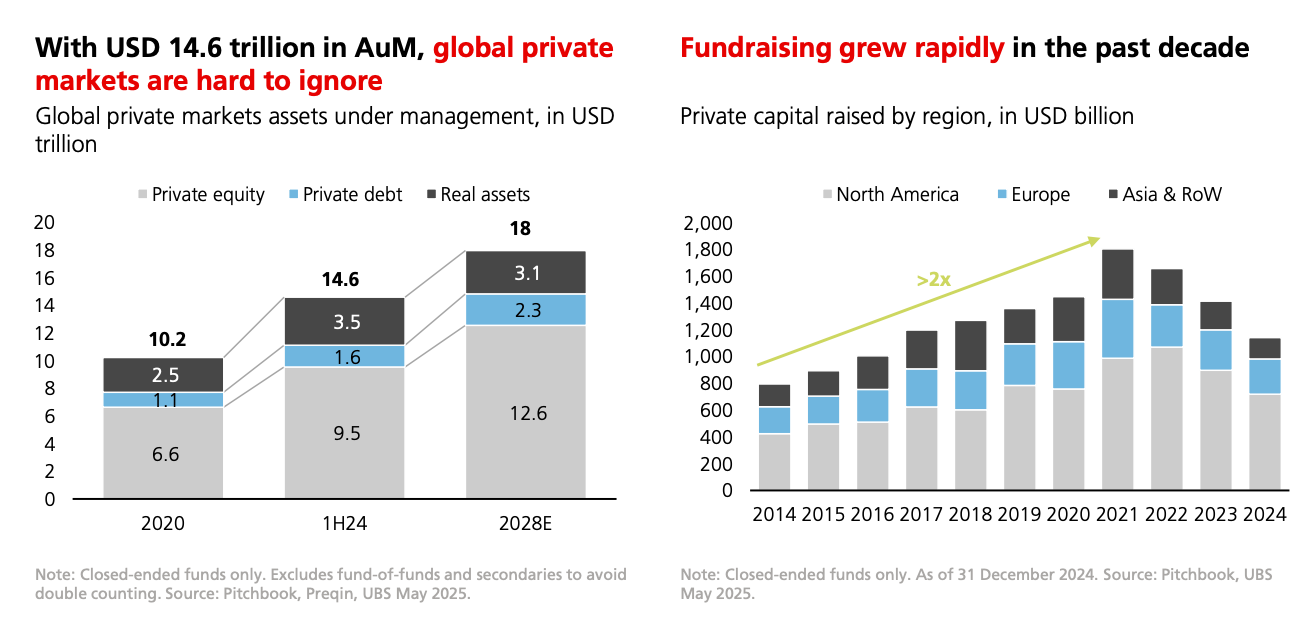

The first private market transaction is believed to have happened in Amsterdam in the 1600s when the Dutch East India Company raised money privately to fund its voyage to the Far East. Four centuries later, the assets under management in private markets have swelled to $14 trillion - offering investors potential for higher returns compared to public markets.

Within this expanding private markets universe, the private credit market has ballooned from about $100 billion AUM in 2010 to $2.2 trillion today. Private credit funds returned an average of 6.9% globally in 2024, according to MSCI data, surpassing private equity returns. The Virtus Private Credit ETF has delivered a 5-year return of 12.68% since its inception, against the -0.51% 5-year returns offered by the Vanguard Total Bond Market ETF (which is the largest bond ETF in terms of AUM).

Market Sentiment delivers data-backed, actionable insights for long-term investors. Join 57,000 other investors to make sure you don’t miss our next briefing.

So what exactly is this asset class that’s drawing so much attention?

Private credit refers to credit extended privately, that is, outside the purview of the traditional banking system. It is essentially non-bank credit extended by specialised investment vehicles (“funds”) to small or medium-sized non-financial firms. Unlike bonds traded on exchanges, these loans are often negotiated directly between lenders and borrowers, offering customized terms like interest rates and covenants. But this tailored structure also limits liquidity: These loans can’t be easily traded and valuations are infrequent, meaning investors often need to hold them for longer periods.

Private credit can be bracketed into 4 types broadly -

Direct Lending — Loans provided directly to mid-sized companies, often secured and floating-rate, bypassing traditional banks.

Mezzanine Debt — Subordinated debt that sits between senior loans and equity, offering higher returns in exchange for greater risk.

Distressed Debt — Investments in the debt of companies facing financial trouble, with the aim of profiting from a turnaround or restructuring.

Special Situations — Opportunistic financing for companies undergoing events like mergers, spin-offs, or recapitalizations, where flexible capital is needed.

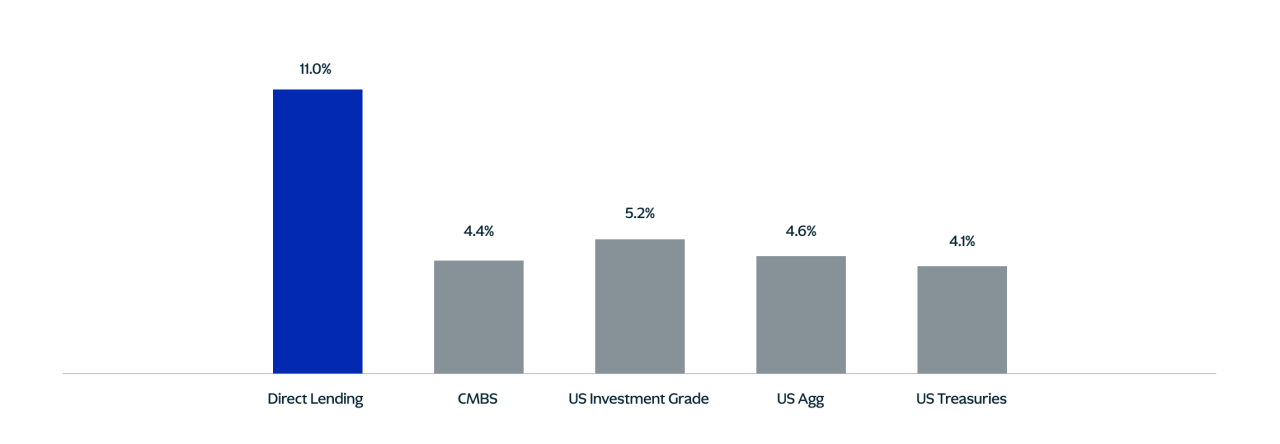

So how exactly does private credit fit into your portfolio? Think of it like a fixed-income strategy asset except it’s typically higher yielding because of the ‘illiquidity premium’ - a yield spread above the publicly traded bonds. Since private credit (or any ‘private’ investments) are not very easily tradable on the public markets, investors are compensated for taking them on.

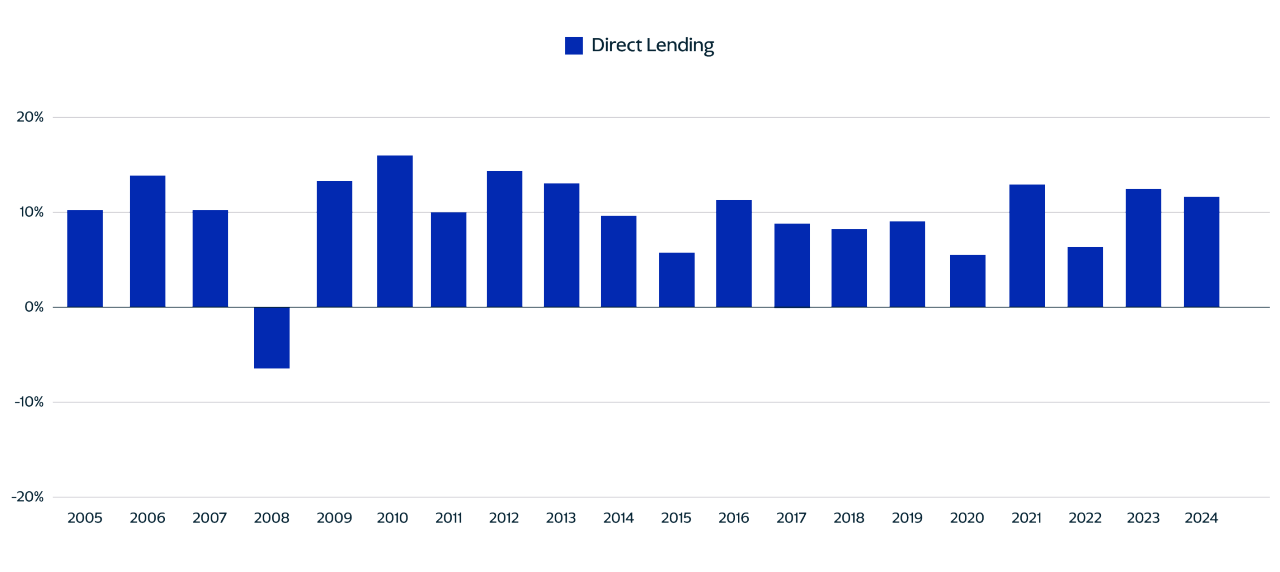

And the asset class has delivered strong absolute return across various market environments.

How does private credit fit into your portfolio?

Over the last decade, the share of AUM held by retail investors rose from less than 1% in 2010 to 13%, or $280 billion. Retail investor entry into this asset class was facilitated through business development companies (BDCs). A BDC is a close-end fund that helps to move capital from investors to small and medium businesses that could use some credit. This gives the investors access to a diversified pool of private credit assets.

So how does private credit fit into your overall portfolio?

Recently, private credit-themed ETFs have emerged, opening the floodgates to this asset class to retail investors. Here’s everything you need to know about them and how they have performed: