Welcome to the 156 investing enthusiasts who have joined us since last Sunday. Join 22,107 smart investors and traders by subscribing here. It’s totally free :)

Check out our - Best Articles | Twitter | Reddit | Discord

“Only those who do not wish to see can be deceived” - Dianna Hardy

To the surprise of no one, the Bureau of Economic Analysis reported on Thursday that the U.S GDP fell by 0.9% in the second quarter. While we all saw this coming, now that it’s here, the implications are far-reaching. 10 out of the last 10 times the US economy shrank for two consecutive quarters, the US economy was declared to be in a recession.

In case you are wondering, no, two consecutive contractions of GDP won’t mean that we are officially in a recession. The recession call is made by an independent committee inside the National Bureau of Economic Research (NBER) where they have defined a recession as

A significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. Waiting for the NBER is pointless as they usually wait more than six months after the downturn starts to make their announcement. Finally, as if this was not complicated enough, there is the political optics of the country being in a recession as it’s close to a mid-term election and the White House will do everything within its power not to classify the current downturn as a recession.

Given the confusing picture right now, it’s important to understand what’s going well in the economy, what we should be worried about, and finally how all of this will impact the stock market. Before we jump into it, let me know your take -

The Good News

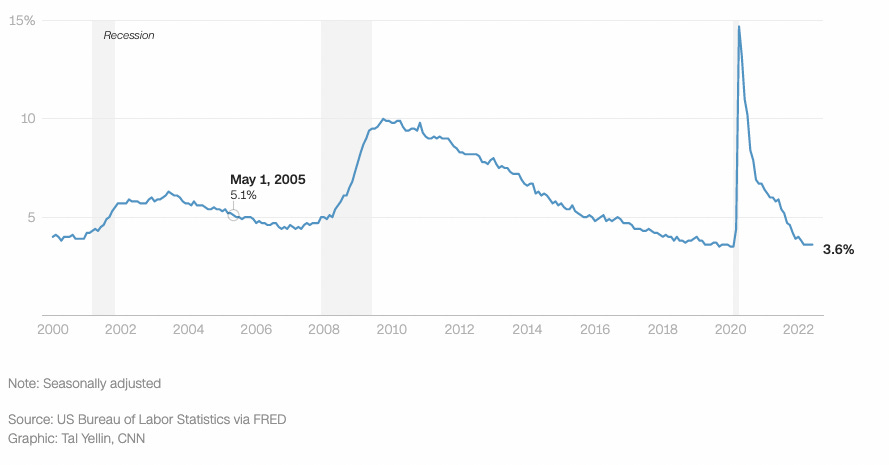

Usually, recession periods are associated with increased job cuts and unemployment. But, thankfully, unemployment is now the lowest it has been over the last 5 decades! 98% of the jobs that were lost due to the pandemic have been recovered and the U.S economy added an impressive 2.2 million jobs since January. It was so good that the U.S now has 2 job openings for every person who is unemployed.

Even though the job market is slightly slowing down, people, in general, are still confident. Check out the results of a poll run by Graham Stephan recently on his Twitter - Nearly 80% of responders are not concerned about losing their jobs.

Building upon the low unemployment rate, consumer spending also saw an increase of 1.1% in Jun. This is good news as consumer spending forms the largest part of the U.S economy.

According to a recent report released by American Express, Q2’22 had a massive jump in travel and entertainment spending. There is an argument that the increased spending is due to the rising inflation, but there is a small chance that we might be able to get out of the current fix by just spending more.

Sadly, this is all we have for the good news. Every day more and more reports pop up showing the

Cracks in the Economy.

Inflation and Interest Rate Hikes

Inflation has jumped to 9.1%, the highest it has been since 1981. While there are a lot of theories about why inflation is running rampant, it’s no surprise that money is tight in many US households. Consequentially, Americans saved just 5.4% of disposable personal income, down from 12.4% year-over-year.

To combat the rising inflation, the Fed has been issuing massive rate hikes which will make borrowing money more expensive. The interest rates have risen from near zero to 2.5 % in just four months. This is the fastest tightening of monetary policy since former Fed Chair Paul Volcker battled double-digit inflation in the 1980s. A higher interest rate will lead to lesser business expansion, more expensive car loans & mortgages, and an overall tightening of the economy.

Yield Curve Inversion

I did an entire article on Yield Curve inversion a few months back. A yield curve is just a chart showing how interest rates on various U.S. government bonds compare. Usually, investors expect to get paid more for long-term bonds than short-term bonds since the uncertainty of locking up your money for a longer period is higher.

Ideally, the yield rates are supposed to be in increasing order like it was in Apr 2021. Now the 2-year yield rate is more than the 10-year one and almost equal to the 30-year yield rate. Why this is concerning is that an inversion has preceded every U.S. recession for the past half-century.

Every U.S. recession in the past 60 years was preceded by a negative term spread, that is, an inverted yield curve. Furthermore, a negative term spread was always followed by an economic slowdown and, except for one time, by a recession. - FRBSF

Consumer Sentiment

Even though consumers are spending more, the overall sentiment is down. The U.S consumer confidence is now the lowest it has been since Feb’21. Most of this can be attributed to inflation. After all, rising inflation is something that will be apparent in our everyday purchases such as gas and food and almost everyone feels the pinch.

The weakening of sentiment will cause the consumers to cut back on their discretionary spending just when the economy is struggling for momentum. This can lead to a self-fulfilling prophecy where if enough people believe that the economy is going into recession, they will take actions that reflect this thought such as reduced spending, lesser travel, etc. leading to an actual recession.

Well, that’s a lot of bad news. The only silver lining that I can see here is the strong job situation but I don’t think that alone is going to get us out of this fix. Companies sooner or later will start their layoffs as rate hikes force a conservative policy and falling consumer sentiment reduces the demand.

We are starting to see this with poor quarterly earnings reports with Microsoft, Google, Meta, etc. all falling short of analyst estimates. This brings us to our question of how the stock market has generally performed during recessions and what the optimal way to invest your money is.

Stock Market & Recessions

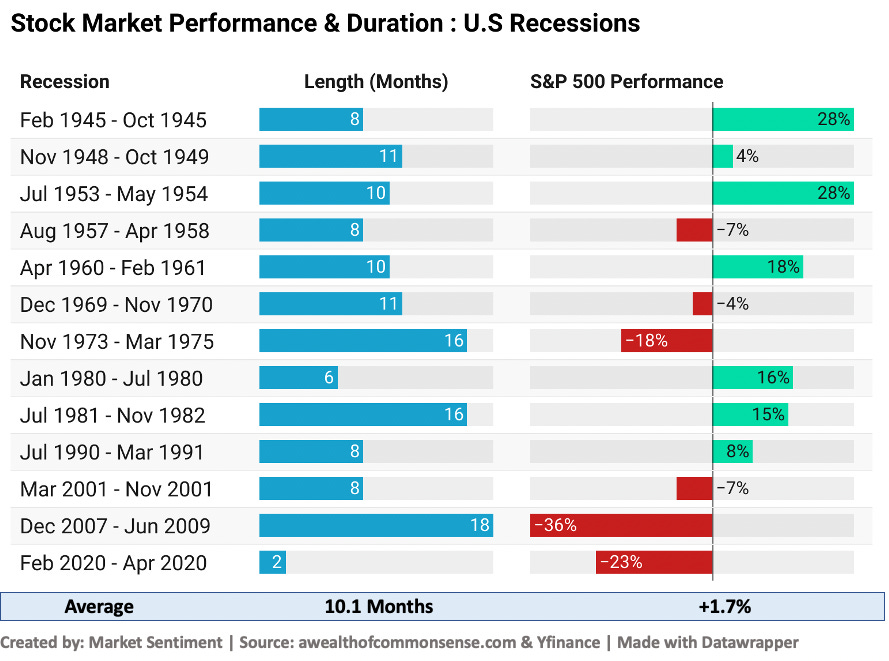

Though recessions have a scary reputation, since 1945, recessions have lasted an average of 11 months with a 2.3% average decline in GDP. No recession has lasted more than 18 months in the past 70 years.

Let’s take a look at all the recessions after WW2. Ben Carlson from “A Wealth of Commonsense” has written a couple of articles that dive much deeper into these questions, and I’m leveraging that data for this analysis.

As can be seen, in the past 13 years, recessions caused the market to lose value only half of the time, and on average you would still have come out ahead, with an overall return of 1.7%. This means that recession or not, investing in the stock market was still one of the best bets available.

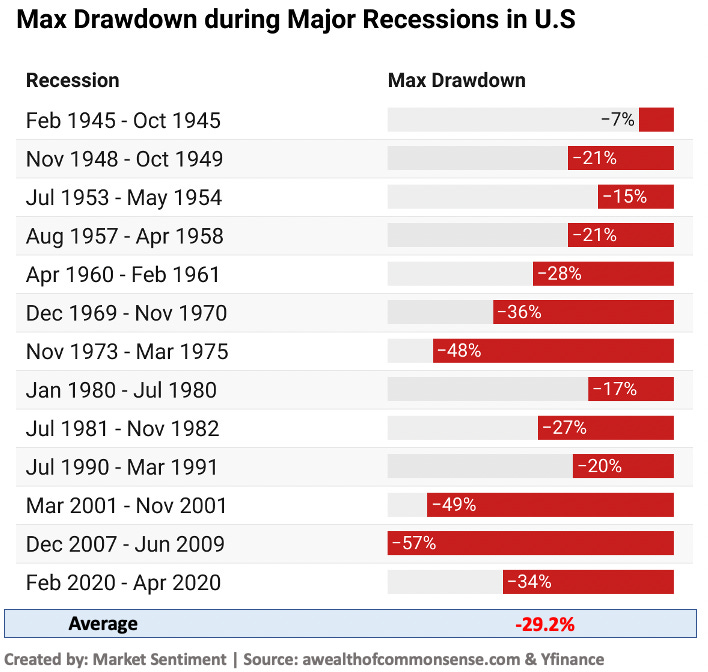

But hindsight 20/20 - Just because the average performance during a recession was positive, doesn’t mean that the market didn’t go through a brutal drawdown that would have played havoc on emotions. As you can see below, on average, the S&P 500 had drawdowns close to 30% during these recessions.

The maximum drawdown was in 2007-09 with a drawdown of 57%. Imagine seeing more than half of your portfolio lose value! In our current situation, the S&P 500 is down 14% and QQQ is down 21%. We might have some more pain coming our way before the bottom is reached.

Even those with nerves of steel would find it hard to not panic sell. But say you did hold on. Then what?

After the recession

This is the most striking insight. After the end of the recession, in just one year, you would have made money in 85% of the cases. And after 3 years, you would have been in the green in 100% of the cases!

The rationale behind this is simple - The recession is a time of little hope and bleak prospects, but as investors start hearing news of the economy reopening and businesses growing once more, the optimism alone is sufficient to drive the market upwards. The economy can remain sluggish in the aftermath of a recession but the stock market may still be rocketing higher in anticipation of relative improvements.

This shows the importance of staying invested.

Given that it was a lot of information to process in a short period of time, you might have the “now what” question in your mind. According to me and as shown by the backtests, the best way forward is pretty straightforward.

Stay employed - Current market conditions and the strong job market should make it simple to stay employed (ideally in a company or industry that can survive a recession without serious problems) and have a consistent stream of income so that you don’t have to dip into your savings/investments.

Stay Invested (Buy the dip, if you can) - It’s very hard seeing your portfolio bleeding every day but right now would be one of the worst times to liquidate or shift your portfolio allocation away from equity. If you do have the capital available, consider adding to your existing positions as it’s bound to give you great returns during the eventual bounce back.

Be fearful when others are greedy, and greedy when others are fearful - Warren Buffet

That’s it for this week’s deep dive - Let me know what your take in the comment section below

If you enjoyed this piece, please do me the huge favor of simply liking and sharing it with one other person who you think would enjoy this article! Thank you.

Disclaimer: I am not a financial advisor. Please do your own research before investing.

As per usual, great piece of information, thanks for sharing and giving knowledge that lets my nerves keep calm('ish) :)

Muy buen artículo.. Uno de los mejores que nos has regalado en los últimos tiempos.. Felicitaciones y muchas gracias.. Un saludo desde Argentina.