Rivian - Is this the right time to buy?

My take on Rivian's $100 Billion IPO

Welcome to the 129 investing enthusiasts who have joined us since last Sunday! Join 11,400 smart investors and traders by subscribing here:

Electric vehicle maker Rivian became the second-largest IPO in US history on Wednesday by raising an estimated $12 Billion. It’s the 12th largest listing ever for an IPO. The shares made a 37% listing gain and the stock has rallied since the listing and is now trading at ~$145 ($125 Billion valuation) which makes it more valuable than both Ford and General Motors.

It’s easy to dismiss Rivian’s performance as yet another stock that is caught up in the current EV hype train led by Tesla. But in this week’s analysis, let’s deep dive into the history of Rivian, what made them so successful, is the current valuation justified and finally, whether it’s the right time to invest in the company [1].

The Company

Rivian started way back in 2009 and before pivoting to trucks and SUVs, Rivian was also following the Tesla model with its first car intended to be a sports car.

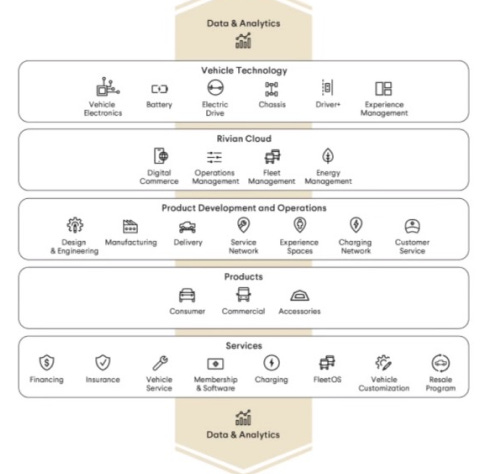

It was only in Dec’17 that the company announced its shift to an electric five-passenger pickup truck and an electric seven-passenger SUV. The company aims to have a vertically integrated structure with a vast majority of R&D occurring in-house.

The idea is to not only sell the vehicles but upsell and also create recurring revenues from each sale. Rivan expects to make a whopping $67,900 per customer over ten years in additional revenue from products and services.

Products

Rivian’s product line is very straightforward as of now. They have two products (R1T and R1S) that are aimed at the general public and they are also in a partnership with Amazon to create custom delivery vehicles.

The reviews for the pickup truck R1T have been nothing short of phenomenal (that too from hardcore enthusiasts).

R1T is unlike any pickup we've ever driven—part truck, part sport sedan, and 100 percent amazing - Motortrend

Rivian's R1T is not just the first battery-powered light-duty pickup, it's also just a really good truck - CNET

But not all reviews have been positive:

Even if the R1T does prove rugged and reliable, I have yet to see any evidence that the core of America’s truck-loving customers will be taken by its altruistic promise - Bloomberg

No matter the reviews, at least we can rest easy knowing that the company has a working and driving product, unlike Nikola which just filmed a truck rolling down a hill to satisfy its investors.

Adding to the arguably great product, Rivian is building its own charging network which is expected to offer more than 3,500 fast chargers exclusively to Rivian owners (planned by 2023). Living up to the name (‘Adventure Network’) - the company is expected to offer these chargers even in remote and off-road destinations thereby catering to their more off-trail customers.

Investors & Partnerships

Even more than the product, I would argue that Rivian’s management has been exceptional in choosing the right investors in the company. Rivian has raised more than $11 Billion till the IPO which has been led by marquee investors such as Blackstone, BlackRock, Amazon, Ford, etc.

They have been using the raised money to build most of their research and production technology in-house which they can monetize down the line by licensing their products to other companies. The funding has accelerated since they have shown the prototype, which makes sense as it needs enormous investment to build an automobile at scale.

One of the biggest drivers for the current valuation is the deal with Amazon where Amazon agreed to purchase 100,000 delivery vehicles from Rivian by the end of 2025 with the pilot starting as soon as the end of 2021. This is the single largest order for EV delivery vehicles ever!

But you should keep in mind that big investors and partnerships might not correlate directly with how good the underlying business is. In the case of Nikola, the company had partnerships running with Bosch, BP, Anheuser-Busch, etc. while lying about having a working prototype/technology.

Valuation

The company is currently valued at $125 Billion which is a hard swallow for most investors. One important thing to note is that it does not make sense to use legacy automakers’ valuation to evaluate EV startups such as Rivian as it does not have steady earnings.

What we can do is to compare the stock with its peers (Tesla and Lucid) on projected revenue multiple. In the current valuation,

Lucid is trading 27x projected 2022 revenue, 10.8x projected 2023 revenue, and 4.3x projected 2025 revenue

Tesla is trading at 16x estimated 2022 revenue and 13x estimated 2023 revenue

Even if we estimate their production to be 50,000 vehicles per year at an avg price of $70k per vehicle (both at higher ends), Rivian is trading at 35x of estimated 2023 revenue. For the current valuation of $125 Billion to be comparable to that of Tesla, the company has to roughly deliver ~130k vehicles in 2023 and ~400k vehicles in 2025.

Granted that a lot of things can change in the next ten years - Rivan can partner up with another big player, introduce new and lower-priced models, or effectively scale their production much better than analyst’s estimates, but at the end of the day, they have some lofty production challenges to overcome.

This brings us to..

Delivery goals & Challenges

Rivian says it will produce 20,000 to 40,000 vehicles in 2021, its first full year of production — New York Times (July 2019)

The actual production numbers for 2021 is ~200 vehicles till now and even after the S-1 amendment, Rivian is expecting to deliver only 1,025 vehicles by the end of this year. This is a far cry from the promised 20-40K vehicles.

Even though the pandemic was the major driver behind the delivery delays, it shows that everything has to go right for Rivian to achieve its proposed production plan by 2025.

Rivian currently has 55,000 preorders for its non-van EVs and 100,000 preorders from Amazon for its delivery vans (while not directly comparable, Ford’s F-150 lightning has 160,000 preorders). The problem with considering pre-orders for valuation purposes is that pre-orders are far from money in the bank.

The pre-orders for Rivian Vehicles are cancelable and fully refundable. Adding to this we have to keep in mind that Amazon has the ability to modify its number of orders. I brought this up as extended delays in delivery might change the minds of customers who might opt for an option that is more easily available.

Conclusion

Without a doubt, Rivian is a fantastic company. It’s the brainchild of RJ Scaringe who had a singular vision of creating a car company. They also put money where their mouth is by contributing 1% of equity into high-impact climate initiatives. I don’t think even if they wanted to, they could have chosen a better time to IPO [5].

Even if you are sold on the company’s vision and its ability to successfully ramp up its production targets, at the current valuation, even a perfect execution up to 2025 would still make the company a premium compared to the already hyped Tesla stock.

If you are still interested in buying and holding the stock for the long term, as we saw in my analysis last week, waiting a week or even a month won’t substantially change your returns at the same time allowing the stock price to settle.

Until next week…

Footnotes

[1] Disclaimer: This is not investment advice. I am not a registered investment adviser. Please do your own research before investing.

[2] Some of the ideas in the article are taken from this article from Not Boring. It’s a fantasic piece and goes into much more depth about the product and company (a bit too bullish for me though).

[3] Well, the valuation comparison of Rivian I made last week seems relatively outdated now given the insane rally.

[4] I have no positions in Rivian stock

[5] The media and retail attention for EV are at an all-time high and Tesla stock is up 148% and Lucid stock is up 362% in the last year.