Should you max out your 401k?

To do, or not to do, that is the question

Our friend Nick recently kicked off a storm on Twitter with the following hot take:

Unsurprisingly, the Tweet garnered more than a million views, and responses varied from this is the worst financial advice ever to older investors agreeing to the mistake they made by maxing out their 401k.

In the world of personal finance, few pieces of advice are as sacrosanct as max out your 401(k). You must have heard this everywhere, from that random TikTok influencer to probably your financial advisor. At the same time, Nick is the COO of Ritholtz Wealth Management and a published author and is not someone who will write something so provocative without doing a thorough analysis.

So, is Nick right? Are we blindly following outdated advice at the expense of our financial flexibility? Or is maxing out your 401(k) still the cornerstone of a solid retirement strategy?

A quick look 401(k)

A 401(k) is an employer-sponsored retirement savings plan that offers tax advantages to incentivize long-term saving. The key distinction lies between traditional and Roth 401(k)s, primarily in their tax treatment. The important thing to understand is that if your income tax rate remains the same in working years and retirement, there is no difference between traditional 401(k) and Roth 401(k).

To understand this better, let’s take the example of a 30-year-old making $100K and making an annual contribution of $10K to the traditional 401(k).

Assumptions — Combined tax rate: 29%, Investment return: 7%, Time horizon: 30 years

Traditional 401(k):

Annual contribution: $10K

Account value at age 60: $1.01M

Taxes on withdrawal (assuming a 29% tax rate): $293K

Net retirement value: $717K

Roth 401(k):

Annual contribution: $7.1K (because Roth 401(k) is an after-tax investment. If you kept $10K to invest in it, you will have to pay $2.9K as tax that year)

Account value at age 60: $717K

Taxes on withdrawal: $0

Net retirement value: $717K

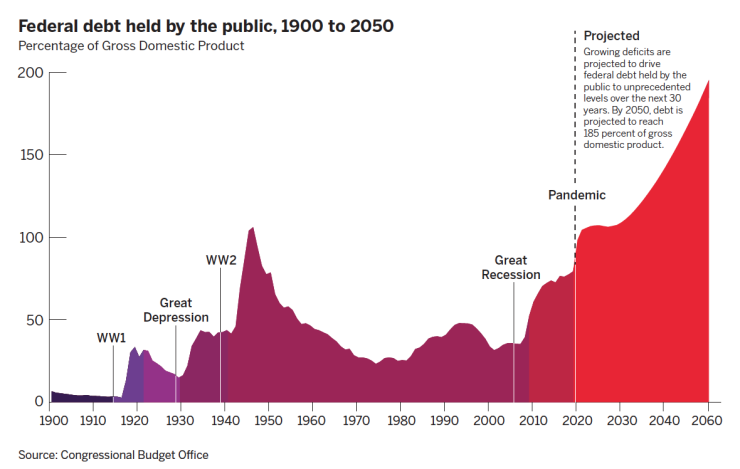

The benefit of Roth 401(k) is that you don’t have to worry about future tax rates. Our assumption that the future tax rate will remain is a big one. In our poll, 87% of you expected U.S. taxes to increase over the next few decades.

Not to be “that guy”, but this intuitively makes sense when you look at the ever-growing national debt. According to the Congressional Budget Office, interest payment on the debt is projected to surpass both Medicare and Social Security by 2049. The only way the Govt. can maintain or lower the current personal tax rate is to have an explosion in productivity or an exponential rise in corporate earnings.