Smart Beta

The cherry on top of index investing?

Welcome to the 601 investing enthusiasts who have joined us since last Sunday! Join 19,038 smart investors and traders by subscribing here:

If you are new here, you can check out my best articles here and follow me on Twitter too!

A low-cost index fund is the most sensible equity investment for the great majority of investors.

From Warren Buffett in my YouTube feed to innumerable studies over the years, all results seem to point to the same conclusion: You can’t beat Index investing in the long run.

But of late, there has also been a lot of talk in the market about Smart Beta funds. The premise is that a market-cap-weighted fund offers diversified exposure to the market, but in the bargain, you also lose the gains that you could be making by focusing on specific factors that drive stock returns. Smart Beta funds propose to capture these factors. The billion-dollar question is: Do Smart Beta funds work and should you invest in them? Let’s dive in!

What is Smart Beta?

Smart Beta funds gained popularity because they went against the established wisdom. It all started when the Efficient Market Hypothesis that had held sway in the 1960s was challenged. The hypothesis stated that all information was priced into the market and it was not possible to find a consistent edge that beat the market. But as researchers discovered, there were portfolios that were consistently beating the market while seemingly taking no extra risk - proving the hypothesis wrong!

Eugene Fama and Kenneth French researched this and developed their “Five Factor Model” which explained this anomaly. Apart from market diversification, there were other factors that gave a premium. By designing your portfolio to focus on these extra factors, you could theoretically perform better than the market index by getting exposure to systematic risk! These factors were:

Market Beta - The sensitivity of the portfolio compared to the movement of the market as a whole

Value - Stocks with low P/E ratio beat ones with high P/E ratio

Size - Small stocks beat Big ones (based on market cap)

Quality - Companies with high profitability did better

Investment patterns - Companies that invested conservatively in asset growth did better

This paper launched the creation of hundreds of “Factor ETFs” and “Smart Beta ETFs”1 which tracked one or more of these factors, sometimes bringing custom factors into the mix. Unlike actively managed mutual funds, the rules for designing the portfolio of these funds would be set in advance, and could not be adjusted at the whim of the managers.

But while the theory is academically sound, the implementation is tricky. How would you track these factors in practice? How would you know you were doing it right? You would have to trust the ETF managers on their word: Or you could look at the data instead.

Data

For this analysis, we will be looking at how Smart Beta ETFs have done historically compared to the S&P 500. The list of Smart Beta ETFs has been collected from Vettafi, which is an ETF database. As the site’s data is proprietary, I am not sharing the raw data here, but you can check it out for yourself by creating a free account.

On top of this list, I am applying two filters:

A fund size of at least $100 Million

A track record of 20 years or more2

After applying these filters, we are left with 19 ETFs that serve as our sample set. The prices were tracked from 15 May 2002 to 15 May 2022 (so that it captures some significant market corrections as well).

Results

Comparing returns of Smart Beta ETFs with the S&P 500 over the last 20 years, this is what we get:

The average return over 20 years for the smart beta ETFs is 489.47% - This beats the S&P 500 by 41.26%! Not just that, 73% of the ETFs in the list beat the S&P 500 - If you had picked an ETF from the list randomly, you would have beaten the market almost 3 out of 4 times. The best-performing fund has a return of 624.36%.

But the returns at this point in time alone do not tell the whole story. How has the yearly performance of the ETFs compared to the S&P 500?

In the last 20 years, the average returns of the Smart Beta ETFs have been higher than that of the S&P 500 in only 8 out of 19 years. The performance of the ETFs seems to be highly correlated with the market, and it seems to outperform the market during bull runs. But the problem is that it also underperforms the market during corrections (for example, during the dot-com crash, the 2007-08 correction, and the 2020 COVID lockdown).

During a period of negative returns, the market has never done worse than Smart Beta. Shielding against market volatility or hedging during bad times is definitely not their strong point.

Long term returns

The outlook is better when we plot the 10-year rolling returns of the ETFs against the S&P 500 - after all ETFs are supposed to be for the long term, right? (In the figure below 2012 indicates returns from 2002-2012, and so on)

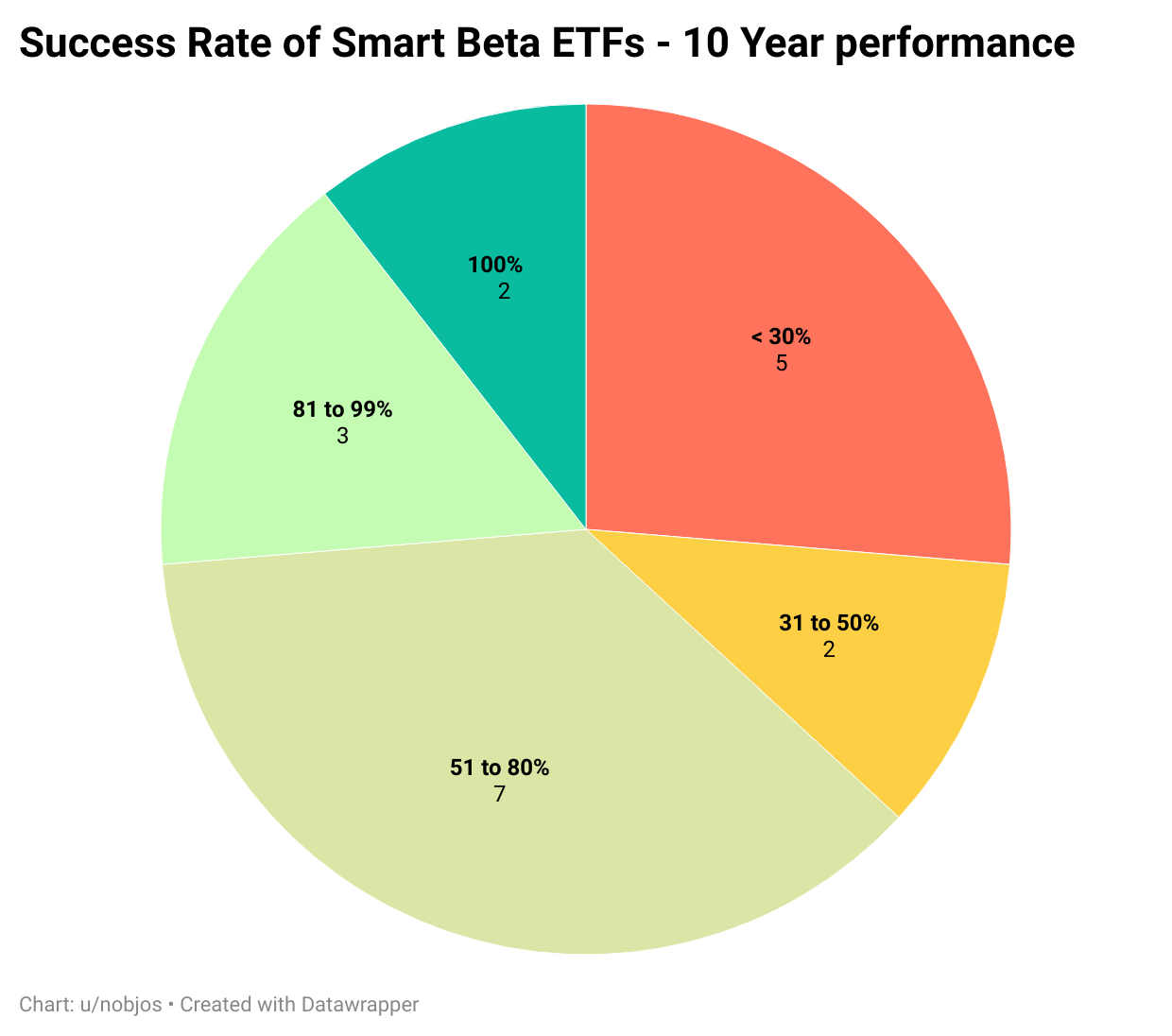

Now there is a marked difference! In 8 out of 11 of the previous 10-year windows, Smart Beta has beaten the market. The concern is that it underperformed the market in the last 3 years. We can get a closer look at this by seeing the success rate of the ETFs - I define success rate as the percentage of 10-year windows in which a particular ETF has beaten the market.

While 7 ETFs out of 19 have shown a success rate of 50% or lesser, 12 of the ETFs have a success rate of more than 50%. In fact, 2 of the ETFs have a success rate of 100%, having always beaten the market over a 10-year period since 2002! (The two ETFs are IWF and IUSG, both growth ETFs). The problem is that none of us have a crystal ball, and picking such ETFs is a hard problem. The most we can do is make an educated guess.

So, should you try to pick a winning ETF? We had earlier seen that the 20-year return for even the worst-performing Smart Beta ETF in this sample is 331%. Historically speaking, the chance of losing your money over a 10-year period is quite less. Since 12 out of the 19 ETFs have a success rate greater than 50%, investing a small portion of your portfolio in a Smart Beta ETF has a reasonable chance of beating the S&P 500 with limited downside to your portfolio.

Limitations

While Smart Beta ETFs on aggregate seem to have done well with time, it is worth pointing out that there are a few funds in the list which had a success rate of below 10%, and one even had a 0% success rate - There was no year or 10-year window in which this fund beat the S&P 500, and these are funds which have existed for 20 years or more!

Factor investing is backed by academic research, but when it comes down to implementation, funds might be introducing a mix of factors and their own rules, which are neither tested by research nor time. For example, Momentum and Growth are contentious themes that are considered factors by some and gimmicks by others.3

Conclusion

Smart Beta ETFs have been around for a while now, and investors are divided over their effectiveness. The data tells a different story, however. Smart Beta ETFs have higher average returns, the potential to beat the S&P500 by a large margin, and limited downside. On the other hand, they are highly correlated with the market and cannot hedge against downturns.

If you are looking to get exposure to specific drivers of returns and diversify a part of your portfolio, Smart Beta ETFs are a good option. Remember to always study the historical returns and vet the ETFs before investing in them - It’s no guarantee of future returns, but it’s a practical way to weed out short-lived candidates!

Until next week…

Vettafi alone lists 950 ETFs in the Smart Beta category. Etf.com states that there are more than 1000 Smart Beta ETFs with more than $1590 billion under management. Smart Beta might be a new way to do investing, but there is a high probability that it’s also a buzzword that sells well.

To account for survivorship bias. Only funds that do well privately are made available to the public while many die out, so short-term performance is not sufficient to judge the fund.

To learn more about the theory behind factors and how to identify a good factor, check out this excellent video by Ben Felix.

Had never heard of Smart Beta's! Love what you do keep up the good work.

I love your content. Every time I read your newsletter I am learning something new. By far one of my most favourite newsletters! Keep doing what you do ❤️