Tail Risk Hedging

A practical guide to tail-risk hedging

Market Sentiment delivers data-backed, actionable insights for long-term investors. Join 55,000 other investors to make sure you don’t miss our next briefing.

One of my favorite financial strategies was executed by Mark Spitznagel in 2020.

The strategy is tail-risk hedging.

Simply put, Mark’s fund, Universa Investments, buys short-term options contracts that protect against a sudden market crash. These contracts involve highly convex and out-of-the-money options, which only yield a payoff in the event of a major crash.

So every day, Mark loses a bit of money doing this. But once in a while (historically every 5 to 10 years), a black swan appears and Mark makes an enormous amount of money, enough to cover all the losses and some more.

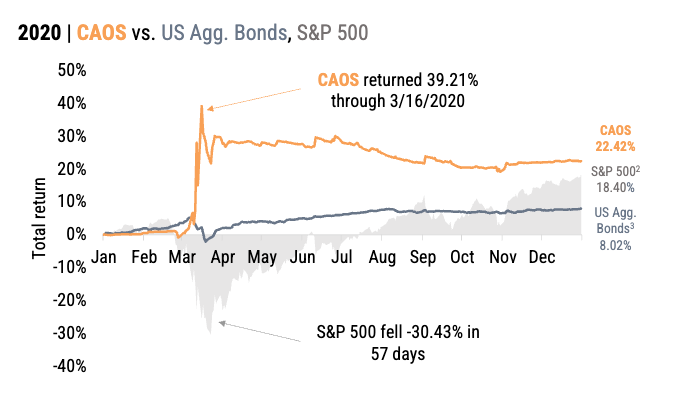

How much money? When the S&P 500 cratered 30% in the immediate aftermath of the 2020 global pandemic, Universa’s flagship “Black Swan Protection Protocol” fund earned a staggering 3,612%.

The fund's performance barely matched that of the S&P 500 from 2008 to 2019. But after the 2020 crash, the average annual return of the fund was 76%!

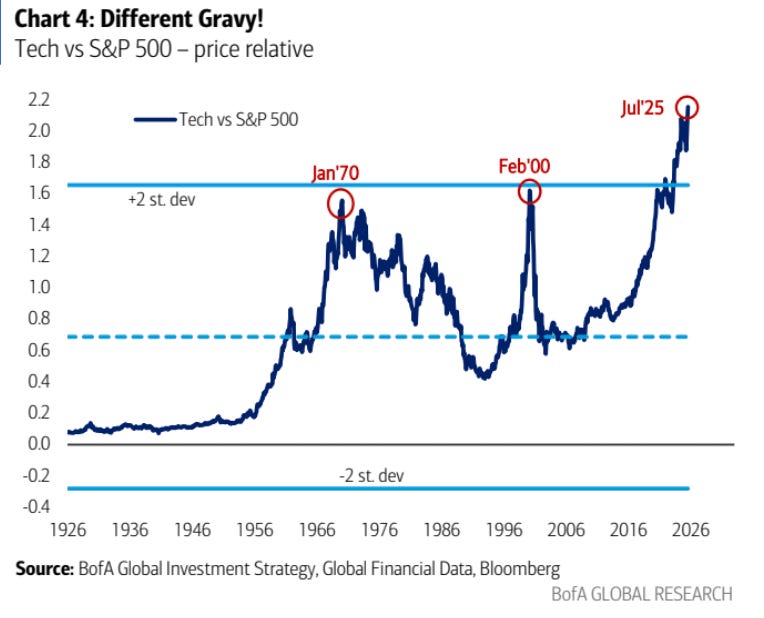

While not to be “that guy”, it’s hard to argue that the current market run-up and stock valuations are normal. Here are some signs that have us worried.

US technology stocks relative to the S&P 500 reached 2.2x in July, the highest level ever recorded. (higher than the dot-com bubble and two standard deviations away from the historical average)

We are currently investing 5% of the U.S. GDP into AI spending (source: KKR)

Meta is offering up to a billion $ (yeah, with a B) packages to poach AI talent from other companies. (And people are rejecting it!)

While no one can be certain about how AI will unfold, it makes sense to hedge against a scenario like the dot-com crash.

Tail Risk Hedging

The strategy, in theory, is very simple. You buy Put Options (the right to sell the index at a specified price) well below the current market price. In typical environments, market volatility is very low, and buying short-dated puts that are significantly out of the money is relatively inexpensive.

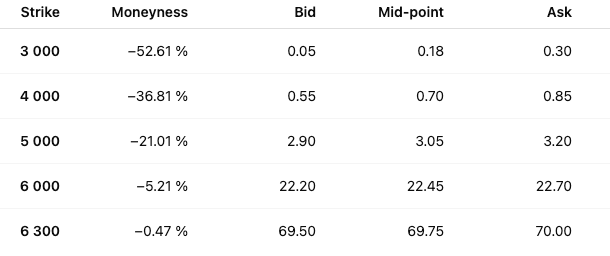

For example, if you are buying a $SPX put today with the end of August as expiration, the following are the bid and ask for varying strike prices.

As you can see, to hedge against a 5% drop, you would need to pay ~7.5 times more than if you were hedging against a 20% drop (refer to the Bids). The massive difference in premium is because, based on historical data, a 20% drop would be much rarer than a 5% drop within a month.

To give you an example of how Mark Spitznagel made those incredible returns, if you buy $1K worth of 3,000-strike puts and say the index ends up falling 60% in August (which has never happened before), you would walk away with a cool $2.6 million.

A warning — since you are betting on an extremely unlikely event to happen, most of the time, it won't occur, making your Puts worthless.

But, once in a while, something so crazy happens (Pandemic, 9/11, 2008 crisis, Liberation Day, etc.) that your Puts become incredibly valuable, offsetting all your previous losses. (In the case of Universa, they started in 2008 and had to wait 13 years for the next crisis to unfold)

Implementing Tail Risk Hedging in your portfolio

Not all of us are accredited investors with access to Mark’s hedge fund. Here are some relatively easy methods to implement this in your portfolio:

Before proceeding, the first step is to understand the level of protection you are seeking. For example, our analysis assumes:

$100K in a 60/40 portfolio

Protect against a 25% drop in the S&P 500 over the next 1-2 years

This is not a one-size-fits-all approach; you will need to redo the calculations based on your risk tolerance and the required level of protection.

Self-Managed LEAP Puts and Put Spreads

Here’s how it would work out for our portfolio. We will use XSP (Mini-SPX) Index Options to achieve this, as we only need to hedge against a $60,000 equity portfolio. ^XSP spot is now trading at ~630.

Contract: XSP 17-Jun-2027 470 put (25% OTM vs ~630 spot)

Entry: (Bid 12.91 + Ask 13.61)/2 ≈ 13.26

Cost (cash outlay): 13.26 × $100 = $1,326

So you would have to spend $1.3K (~2.1% of our equity portfolio) to hedge against a 25% drop.

Now let’s see what happens if the S&P drops by 40%.

Unhedged:

Equities: $60,000 × (1 − 0.40) = $36,000

Bonds: $40,000 (assuming no change)

End value: $76,000 → −24.0%

Hedged with 1 × XSP 470 put:

Equities: $36,000

Bonds: $40,000

Put payoff: $9,200 (593% return)

End value: $85,200 → −14.8%

The hedge improves our outcome and reduces the overall portfolio drawdown from 24% to 14%. On the other hand, if the markets continue to rise, your LEAP will expire worthless, which will drag down the overall portfolio performance by ~1.3%.

You can use Put Spreads to reduce the overall cost of your hedge (For example, buy a 2-year SPY put ~20% below the current level and sell a 2-year put at ~40% below the current level).

The premium received from the lower strike sale offsets part of the cost of the higher strike put. But by doing this, the hedge’s payoff is capped, and you are adding additional complexity to your portfolio.

Tail-Risk ETFs

If you don’t want the complexity associated with managing the option trades, some ETFs provide the same diversification at decent expense ratios.

Our two favorites are

1. Cambria Tail Risk ETF (TAIL)

TAIL is an actively-managed tail hedge fund that invests ~80% in intermediate-term U.S. Treasuries and about 20% in a laddered portfolio of out-of-the-money (OTM) S&P 500 put options. The fund dynamically adjusts put exposure, buying more when volatility is low and fewer when volatility is high to control costs. They charge a reasonable expense ratio of 0.59%.

But the long-term performance has been abysmal, even considering that insurance has a persistent cost. The cumulative return since its inception in 2017 is -44%!

Other than 2020 when the markets had a sudden drop, TAIL has consistently lost money. Even in 2022, when markets crashed, TAIL could not generate a good return, as bonds also crashed that year. Another consideration is that TAIL buys fewer puts when volatility is high; its hedge can be less effective in a subsequent decline that begins from an already elevated VIX regime.

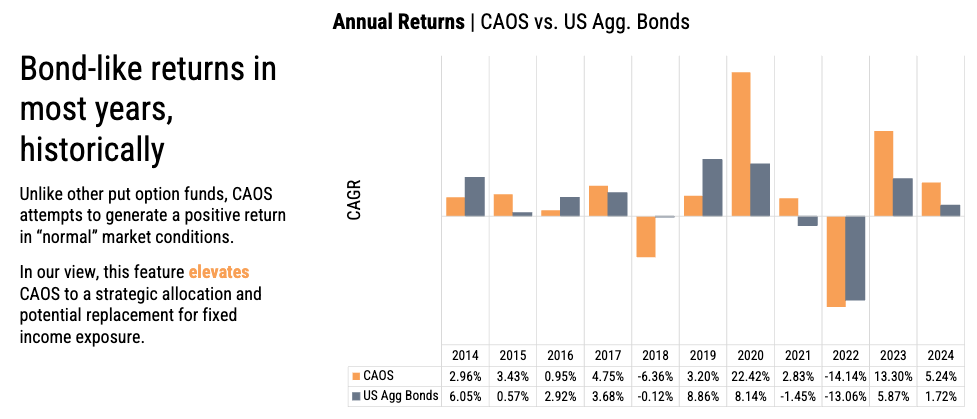

2. CAOS Tail Risk ETF

The fund is designed to generate asymmetric returns during rapid market crashes and modest positive returns in normal market conditions. CAOS maintains a strategic allocation to protective long puts on the S&P 500 (for tail hedge) plus some long put spreads on the S&P (which provide limited upside participation in mild rallies).

Basically, they are running a put-spread collar: long deep OTM puts for crash insurance, and long nearer-the-money put spreads to capture some market moves. Unlike the previous fund, CAOS has managed to perform comparable to bonds over the long run.

While maintaining the downside protection.

The major downside of choosing the ETF option is that you would need to allocate a substantial portion of your portfolio to these ETFs to see a noticeable impact.

This means that in addition to the insurance cost of hedging the position, you will also have to pay a % to the fund manager.

A small, persistent allocation to tail protection can lower max drawdowns, reduce behavioral mistakes, and improve the geometric return of a long-only portfolio — especially in the current market conditions. Not everyone needs to swing for a Universa-style home run.

Ultimately, if your investment horizon is high (10+ years), just sticking to equities is the best bet for long-term wealth creation. If you need your funds in the next 5 years or are planning your retirement soon, a tail risk strategy can help prevent nasty surprises.

Any chance you are considering a deep-dive on this? Alternately, maybe point to some good reads on the subject? :)