Doomsayers: Have Tesla critics ever got it right?

Analyzing how predictions about Tesla's imminent collapse have turned out over the last decade!

Welcome to the 1,717 investing enthusiasts who have joined us since last Thursday! Join 11,422 smart investors and traders by subscribing here:

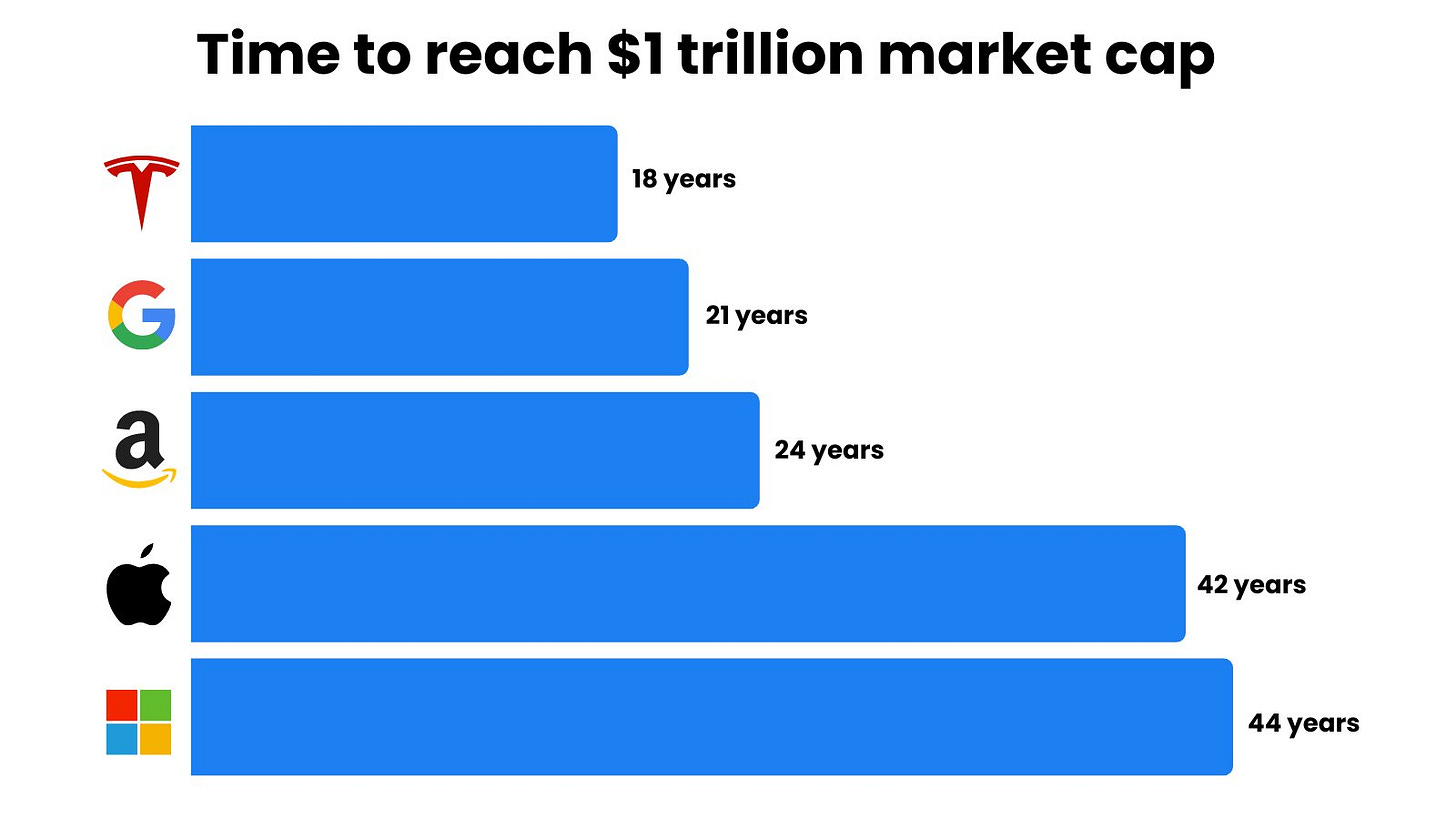

Tesla rallied more than 12% on Monday after it struck a deal with Hertz for 100,000 vehicles. This has also made them the fastest company to breach the $1 Trillion mark in valuation. It’s staggering given that Tesla makes up less than 1% of global car sales but now is worth more than the combined market cap of the world’s nine largest car-makers.

But what is more interesting is that every time Tesla has had a rally, there were always analysts and financial news articles stating that the company was overvalued and predicting an imminent correction. So in this week’s analysis, let’s go back in time and see how those predictions have turned out!

Analysis

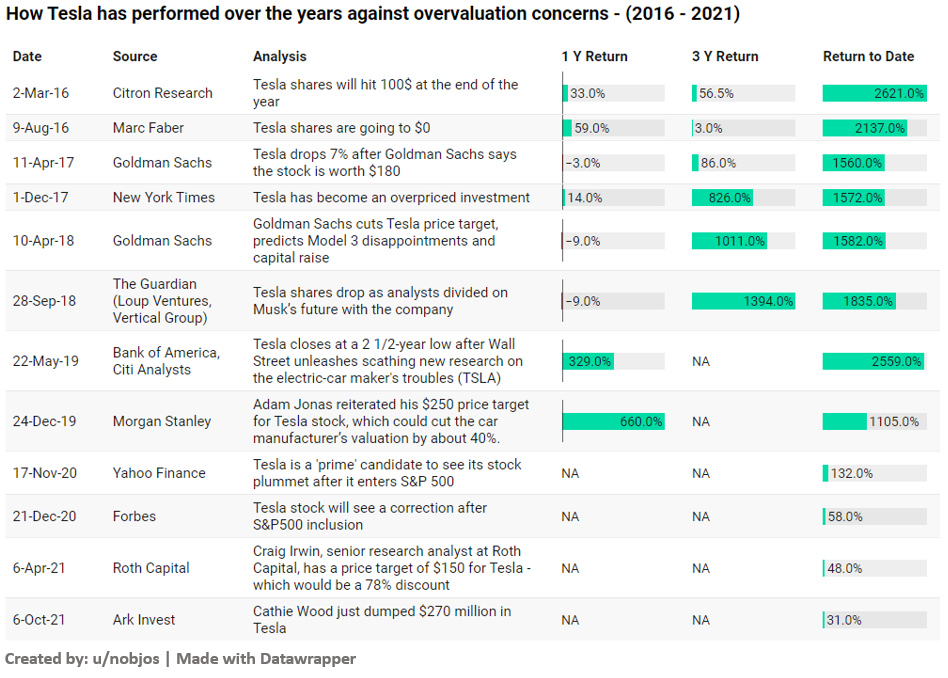

Various news articles spanning over the last decade (Tesla IPO’d in 2010) were obtained from Google News [1]. I flagged the exact date on which the article came out and then analyzed the performance of the stock over the

a. Next One-year

b. Next Three-years

c. Till date

Results

What the experts said

Ahh… Our story begins way back in 2010 when Tesla was listed on NASDAQ at a price of $17.00 per share[2]. Experts immediately jumped on the company stating that Tesla won’t be able to produce the Model S in time to beat their competition [3] and told CNN that Tesla has no unique selling point.

IHS Global Insight (an economic forecasting organization) went so far as to say that “Tesla is not a car company and they have no expertise in automaking” and that they are not all that bullish on Tesla as a business case. Tesla has since returned more than 200x the invested amount.

MarketWatch and Forbes followed suit in 2012-13 recommending that you should not invest in Tesla as it’s significantly overvalued due to a multitude of reasons with MarketWatch even comparing Tesla to Groupon.

Elon Musk on Tesla

What is really interesting is that Elon Musk himself has stated multiple times publically that Tesla stock is overvalued. In 2013, he told reporters that

“The stock price that we have is more than we have any right to deserve”

and he followed this up in 2014 saying that investors often get “carried away” with their investment in Tesla. The stock is up 2000% from the day he made the statement. I think it’s the first time in history where a stock did this well after the CEO of the company stated that the company is overvalued.

In 2015, both Bank of America and Morgan Stanley analysts had a negative outlook on the stock, with BoA predicting an imminent collapse and Morgan Stanley cutting their price target for the stock. Both of these had a short-term impact on the stock with Tesla shares losing ~10% over the next year. Even if you had made an investment on the exact day BoA predicted Tesla collapse, you would have made a 20x return on your investment to date.

That was at the time when Tesla was having teething troubles. But after Tesla has established itself, how have the predictions performed over the last 5 years? Let’s find out.

The last five years - Proving critics wrong?

Famous investor and fund manager Marc Faber said in 2016 that

What they produce can be produced by Mercedes, BMW, Toyota, Nissan. Anybody in the world can make it eventually, at a much lower cost and probably much more efficiently — I think Tesla is a company that is likely to go to zero eventually [stock price] (emphasis mine)

In the same year, a short-seller report from Citron Research concluded that Tesla's share price was going to hit $100 by the end of the year. Tesla ended up gaining 33% in the next year and has a return to date of more than 2600%.

Similar trends continued in 2017-18 with Goldman Sachs, NY Times, and Guardian all taking a bearish position on the stock. In 2019, Merrill Lynch and Citi analysis issued critical reports on Tesla exploring the underlying demand concerns, free-cash-flow worries, and leaked internal mail. All of them including Morgan Stanley issued an underperform rating for the stock. In the next year, Tesla would end up gaining 660%.

Coming over to recent history, there were a lot of reports [Forbes, Yahoo Finance, etc.] which predicted a correction after Tesla was added to the S&P 500. Adding to this, the famous investor Micheal Burry in May’21 revealed a short position of more than half a billion dollars against Tesla [4]. Even Cathie Wood (who has a price target of $3K for Tesla), recently went on a selling spree by selling more than $370MM stake in Tesla [5]. Even with this bearish outlook, Tesla ended up gaining 42% in 2021.

Before summing it all up, let’s hear from our sponsor for this week: Titan.

SPONSORED BY TITAN

Bringing world-class investment management to everyone.

Titan. Where some of the world’s best analysts manage your money for you.

Are you researching and buying stocks yourself, hoping to build long-term wealth faster without a middleman? Well, the odds that you’ll beat the market going it alone are very slim.

While some brands want you to believe that investing is a simple game, easily played, the reality is that successful long-term investing requires diligence, rigor, and precision -- not simple DIY investing.

That’s where Titan comes in: our team of award-winning investment analysts actively manages your portfolio while giving you a transparent view of how your money is invested through our intuitive mobile app. You’ll see exactly how your money is handled through videos and daily updates. Start compounding your wealth with as low as $100 in investment.

· Titan manages your investments so that you don't have to.

· You can earn up to $6,000 if you roll over a retirement account to Titan by Halloween

· They have over 35,000 clients with nearly $750M in AUM and are backed by some of Silicon Valley’s biggest investors

Conclusion

At the end of the day, you can love or hate Elon Musk, but he has undeniably created massive wealth for his shareholders and changed the way we think about electric cars. Why have so many experts been wrong so many times about Tesla?

Tesla was the first of its kind so there was no benchmark to compare against, and it overhauled the entire supply chain rather than just making cars [7]. At the same time, this uncertainty and euphoria led to a lot of speculation and fraud ("*cough* Nikola Motors *cough*").

Tesla had unconventional management.

The changing narrative about climate change might have given undue advantages to companies like Tesla in form of EV tax credits.

At the same time, you have to keep in mind that the investors in Tesla have taken extreme risks [6] for which they were well rewarded. Tesla is still very volatile and is currently trading at an insanely high PE ratio of 336.

Even though this article suffers from hindsight bias, it showcases that ‘experts’ in the field can be completely wrong in predicting the future. In the case of Tesla, everyone from stock analysts, short-seller research firms, automobile experts, and even Elon Musk himself was wrong about Tesla’s stock price.

I will end this with this gem from The Wolf of Wall Street.

If you liked reading about how the experts got it wrong, you might enjoy my other posts:

Do analyst recommendations beat the market?

Should you follow Michael Burry’s predictions?

Until next week….

Footnotes

[1] Google News has a nifty feature where it allows you to search for news in specific time periods. Also, Google News seems to capture almost all the major publications other than the historical archives.

[2] Fun fact: Tesla stock has given more than 20,000% return in the last 10 years. Now that would have been an IPO to buy into. (Check out our post on whether you can make money from IPOs)

[3] Model S was then compared to Nissan Lead and GM’s Chevy Volt which they stated would be cheaper and with a much better range.

[4] As of Oct’21, Burry has stated he has closed all short positions on Tesla. Whether Burry scored a profit on the trade is unclear as even though the stock experienced a significant rally in 2021, it did experience a 40% decline from its record high.

[5] To be clear, Cathie Wood selling shares of Tesla is not a really bearish outlook. It’s just that she might have found higher return investments or a need to diversify her overall portfolio.

[6] Tesla was on the brink of going bankrupt multiple times and its heavy reliance on Elon Musk with his unconventional PR moves and gambles makes it a very volatile and risky investment. (What happens if he leaves?)

[7] Here is a fun read by waitbutwhy on why and how Tesla is such a big deal.

[8] There was this interesting comment on one of the threads on Hertz buying 100K Teslas which I felt was very insightful.

I wasn’t sold on an EV until I test-drove a Tesla. I placed an order the same day. My speculation is that this Hertz order will be huge for Tesla beyond the revenue from the order itself in that it can introduce tens of thousands of customers a week to Tesla cars, which may help drive sales. Furthermore, 100,000 extra EVs on the road driven mostly by tourists renting cars may encourage more destination chargers, more charging infrastructure, etc. in areas where these cars are being rented.

If you found this insightful, please help us by Re-tweeting this article tagging @elonmusk.

Let’s get him to see this and find out what he has to say!

How would you rate this week’s newsletter?

What is your take on Tesla’s future? Let me know by leaving a comment.

I love your newsletter more than my ex.