Buffett isn’t the only great investor. You just don’t know the others — yet

Tomorrow at 11:00 am ET, Market Sentiment will publish The Alpha 20, a database of the 20 highest-performing active managers. It’s the product of hundreds of hours of research combing through 6,000+ mutual funds across the past three decades to uncover managers who have consistently beaten the market for decades.

We started with a simple question:

How can we ensure that Market Sentiment readers are aware of the best-performing active managers who have beaten the market?

Case in point: While everyone knows about Buffett and Berkshire, virtually no one knows about Larry Puliga. Puliga launched the T. Rowe Bluechip fund in 1993, and by the time he retired in 2021, he had grown the fund to $102 billion in AUM.

While the longevity in itself is very impressive (large growth funds have a 70% failure rate over a 20-year period), what is stunning is that he managed to beat the S&P 500 over 28 years. Puliga’s stock picking was so good that he beat Buffett in the last 20 years running up to his retirement.

Yet, after Puliga’s retirement in 2021, the fund has struggled to maintain its performance. After all, a great fund is only as good as its manager.

While index funds are all the rage now, nearly half of all assets under management are still with active managers. If your portfolio is equity-heavy, chances are you have significant exposure to active management.

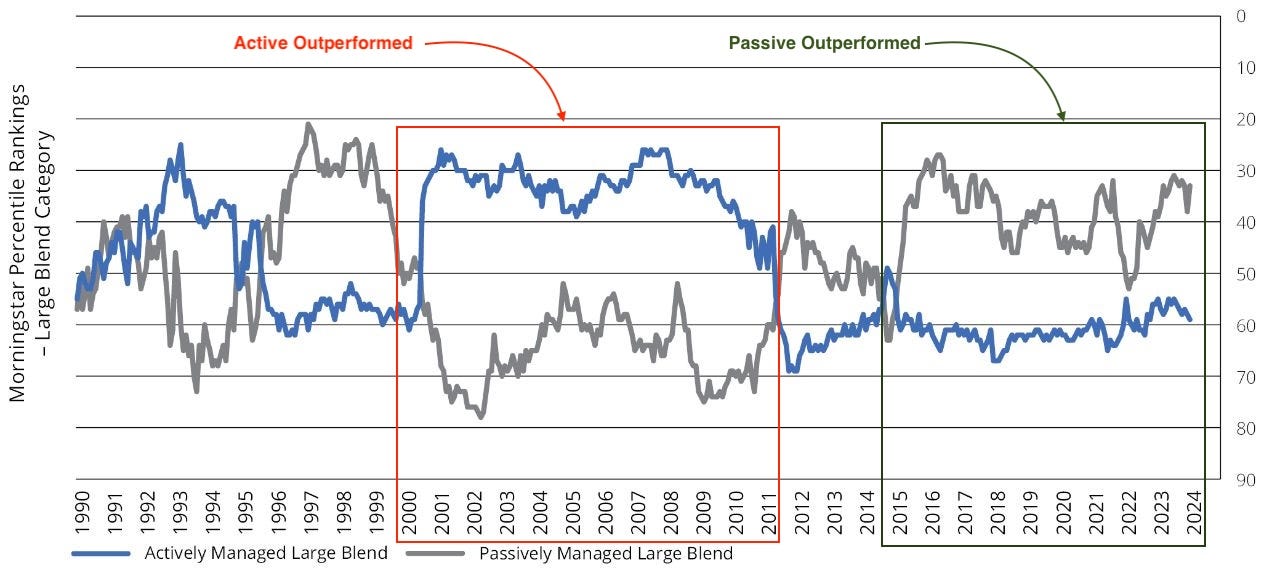

While passive has outperformed active funds for eight consecutive years leading up to 2022, if you look at the past 35 years’ data, it’s almost an equal split (Active 17 times, Passive 18 times).

Active managers tend to perform better during periods of corrections and market stress, while passive strategies excel when business is as usual.

We are in anything but a 'business as usual' situation.

That brings us back to The Alpha 20 — a curated list of 20 active managers who have consistently outperformed the market for decades. It includes a diverse range of strategies, from micro-cap investors to those who have beaten the benchmark by investing in the largest companies in the index.

This 4,000-word report is exclusively available to our paid subscribers. In addition to this, you will continue to receive four to six in-depth analyses every month and can be part of our exclusive community.

As a special pre-launch offer, we are giving 20% off our annual subscription ($180 => $144) if you subscribe before the launch (24 hours to go).

If you have even $10K invested in active funds, the alpha generated by The Alpha 20 managers should easily cover the cost of your subscription — many times over. At just $144 per year, this is one of the highest ROI investments you can make

See you tomorrow :)