The CapEx Boom

Spending $400 billion to make $50 billion

In the late 1990s, a specific type of madness gripped the telecommunications industry.

The nascent internet was growing, and a statistic began circulating in boardrooms and investor pitches. A statistic that became gospel: “Internet traffic was doubling every three months.”

If you believed that curve, no amount of infrastructure you could build would ever be enough. The future belonged to whoever owned the pipes.

Triggered by this collective belief, a massive capital-intensive race began.

Companies like Global Crossing, WorldCom, and Qwest raised billions of dollars (much of it in debt) to lay down fiber optic cables around the planet.

They were laying hundreds of strands across the floor of the Atlantic and Pacific, drilling through mountains, and trenching alongside every major highway.

The spending was astronomical for the physical right-of-way to the future.

Investors cheered the CapEx.

Every dollar spent digging a trench was seen as a dollar creating future monopolistic value.

The stock prices soared based not on current profits, but on the sheer scale of their construction projects.

Then, around 2000, the music stopped.

The reality dawned that while internet traffic was growing fast, it wasn’t growing that fast. The “doubling every three months” metric was a myth.

Suddenly, the world realized it was awash in bandwidth.

There was so much redundant fiber in the ground that “dark fiber” (infrastructure sitting unused) became the industry standard.

Prices for data transmission collapsed by nearly 90%.

Global Crossing filed for what was then one of the largest bankruptcies in history.

Investors lost billions, leaving behind a technologically impressive, but financially disastrous, web connecting a demand that hadn’t arrived yet.

The Silicon Trap

Today, in late 2025, we are seeing a new, equally expensive race to lay the foundation of a different future.

But instead of glass cables under the ocean, we are pouring billions into silicon.

And the numbers make the telecom bubble look insignificant.

To understand the magnitude of what is happening right now, we first need to understand the reality of Capital Expenditure (CapEx).

CapEx is not just “spending money.”

In the tech world, it is the process of turning liquid cash into illiquid concrete, steel, and silicon.

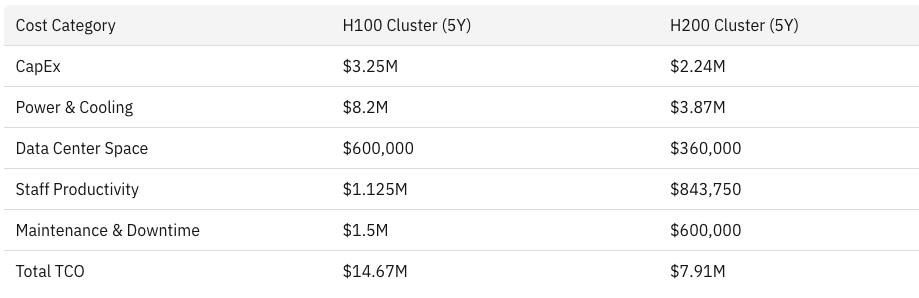

When a company buys Nvidia’s H100 or Blackwell series GPU, that money is effectively gone.

It is locked into an asset that starts losing value the moment it is plugged in.

Historically, software companies hated CapEx.

The beauty of software was that you could write code once and sell it a million times with zero marginal cost.

But AI has broken that model.

AI is not software; it is industrial manufacturing. It requires factories (data centers) and raw materials (electricity and compute).

This shift has introduced a terrifying new variable to Big Tech balance sheets: The Depreciation Cliff.

When Google spends $10 billion on chips, it doesn’t expense it all at once.

They spread that cost over the “useful life” of the asset, typically 4 to 6 years for accounting purposes.

But here is the catch: in the AI arms race, the technology is advancing so rapidly that a chip purchased in 2023 is effectively obsolete by 2025.

Companies are depreciating these assets over six years on paper, but the assets are becoming useless in two years.

This creates a “profit air pocket” waiting in the future: a massive write-down of hundreds of billions of dollars in infrastructure that is still being paid for but is no longer competitive.

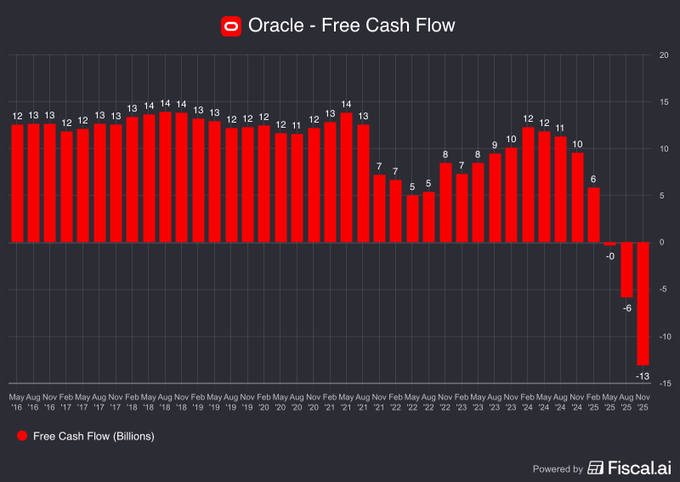

Oracle, for example, was a reliable cash-generating machine for the past decade, reliably generating $12-14 billion in free cash flow every year.

Then the mania hit.

Oracle decided to build the infrastructure that OpenAI couldn’t afford to build itself.

To achieve this, Oracle raised its CapEx forecast by $15 billion (to a total of $50 billion!) in a single year to build massive superclusters.

This is the price of admission in 2025.

The State of the Mania

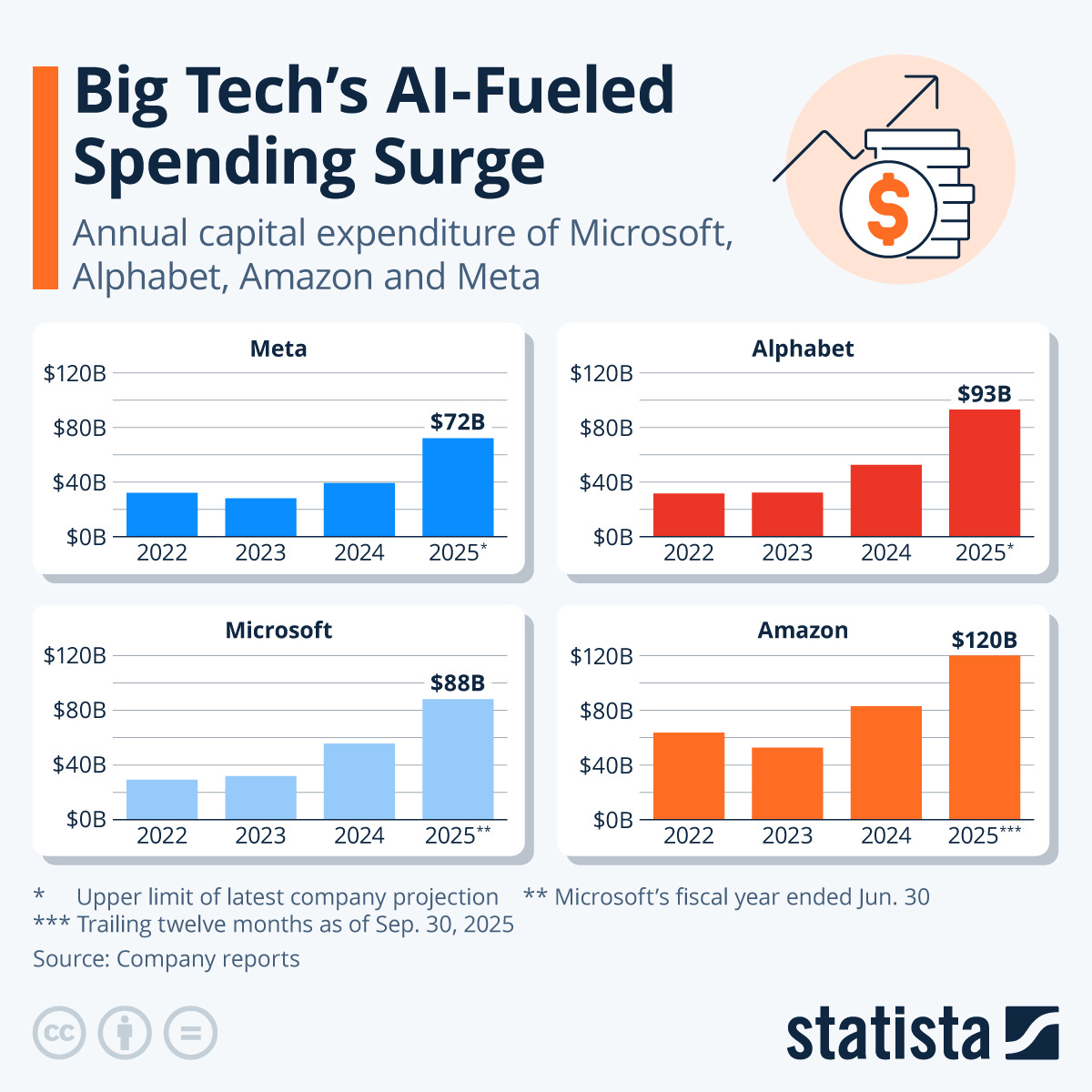

As we close out 2025, the spending has detached from reality.

In 2024, the “Hyperscalers” (Amazon, Google, Microsoft, Meta) spent roughly $250 billion on CapEx. This year, that number has ballooned to nearly $400 billion.

To put that in perspective:

Amazon alone is projecting ~$120 billion in spending.

Google is nearing $93 billion.

Microsoft and Meta are close to $88 billion and $72 billion, respectively.

The cumulative CapEx of these four companies since 2000 has just passed $1 trillion, with nearly half of that spent in the last 24 months.

Why? The revenue isn’t there yet. The entire AI software market generates roughly $50-60 billion in annual revenue.

The industry is effectively spending $400 billion a year to chase a $50 billion prize. To understand this better, read:

This is the Prisoner’s Dilemma of CapEx.

None of these CEOs is stupid.

They know the math doesn’t work in the short term. But they are locked in a game where the only rational move is irrational spending.

If Google spends $100 billion and AI is a bust, they lose money.

But if they don’t spend and AI becomes the future operating system of the world, they cease to exist. They are not spending to make a profit now, but to stay alive tomorrow.

Why This “Bubble” is Different

If the SaaS bubble bursts, it wipes out venture capitalists.

If the AI bubble bursts, something similar to the dot-com bubble happens, where only a handful of companies survive.

But if the AI CapEx bubble bursts, it poses a systemic risk to the pillars of the modern economy.

The S&P 500’s three-year, $30 trillion bull run has largely been driven by the world’s biggest tech companies like Google, Meta, and Microsoft.

Additionally, firms benefiting from spending on AI infrastructure, Nvidia and Broadcom Inc., and electricity providers such as Constellation Energy Corp., also drew huge gains from the AI momentum.

If they stop rising, the equity indexes will follow.

The danger lies in the concentration of risk, specifically surrounding OpenAI.