The Great AI Round Tipping

6 strategies to hedge against the AI bubble

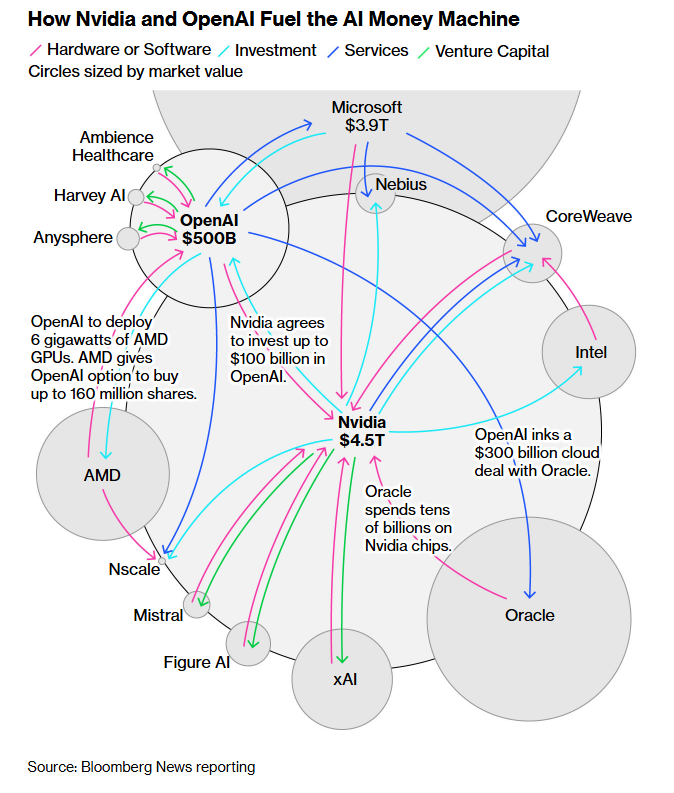

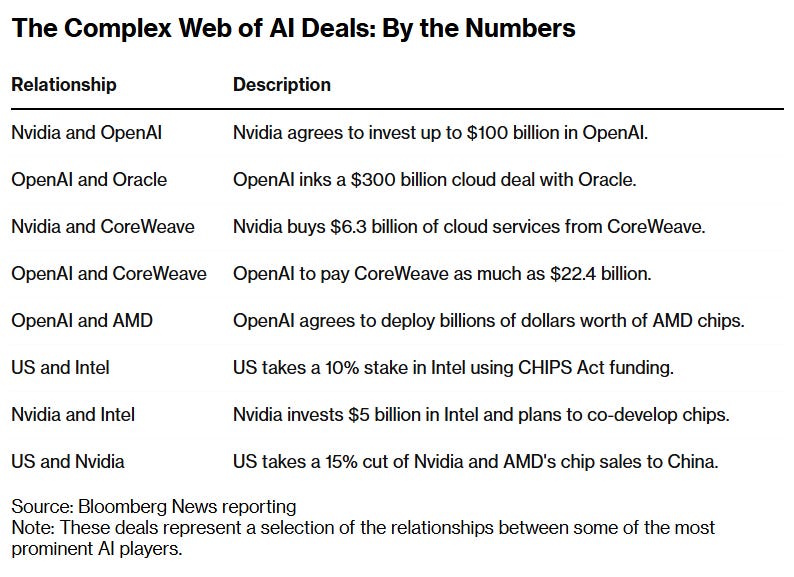

A lot of money is flowing back and forth in AI right now. NVIDIA plans to invest $100 billion in OpenAI. OpenAI is purchasing computing power from Oracle in a $300 billion deal. Oracle plans to spend $40 billion on NVIDIA’s high-performance chips to fire up OpenAI’s data centers. NVIDIA owns a $3 billion stake in Coreweave, which provides infrastructure to OpenAI.

As Goldman Sachs analyst James Schneider points out in a research note,

NVIDIA’s investments flow out as funding, returns are realised via GPU sales, therefore inflating the reported growth.

Equity investment from a supplier resembles a twisted form of vendor financing, prevalent during the 2000 tech bubble era. This has sparked concerns of an AI bubble, given the circular nature of this deal.

But that’s not the only AI deal that looks circular.

AMD-OpenAI signed a deal as part of which OpenAI committed to purchasing 6 gigawatts worth of AMD’s chips in return for warrants for up to 160 million AMD shares, roughly 10% of the chip company. The chips OpenAI is committing to buy are the MI450 chips, which won’t ship until 2026. Basically, AMD is giving away 10% equity to its customer (OpenAI) to buy its products. As crazy as it sounds, AMD’s stock rose 24% on the announcement of the deal.

Then there’s the $300 billion deal between OpenAI and Oracle, which left many questions in its wake. OpenAI’s current annual revenue is around $12 billion, and this deal commits it to spend $60 billion in CapEx annually. And it doesn’t stop at that. Oracle and OpenAI are also working with SoftBank to pay $500 billion for setting up Stargate data centers.

And Oracle’s financials aren’t exactly stellar either. Compared to Microsoft, Amazon, and Meta, it has a much greater debt load, outstripping its cash flows. Yet the deal sent Oracle’s stock soaring 43% in a single day when it was announced. CTO Larry Ellison, who holds a 41% stake in the company, got $100 billion richer in a single day.

Whether or not AI is a bubble will only be clear after/if it pops. But you want to make sure you’re not the one left without a chair when the music stops.

The question then is - how do you really navigate a bubble?

If you invest in individual stocks, one option is to trade these companies. Due to the sky-high PEs of most of these companies, they are susceptible to wild swings, which you can profit from — just like how we did at Rebound Capital

In our AMD deep-dive, our hypothesis for investing in the company was that, given constant comparisons to Nvidia, the stock is undervalued and that most investors are overlooking the performance gains from their latest GPU chips. This thesis proved true after the OpenAI x AMD deal. But we then sold the stock, locking in a 62% gain as the valuation had run way ahead of the business fundamentals, and avoided the following risks.

It could fail to materialize if the AI investment cycle weakens in 2026.

If Nvidia lowers the prices of its GPUs, AMD’s GPU profitability could be affected.

If AMD is unable to develop that many GPUs by 2026. They lack experience building and managing such large clusters (let alone in such a short time).

ASML was more interesting as the industry was in a cyclical downturn and the stock had taken a significant hit due to tariffs and China restrictions. Once again, our thesis was that the cyclical downturn was almost over and the China impact was already priced in. Over the next 4 months, ASML rebounded 26% (we continue to hold due to the Memory Supercycle).

But if you are more of an index and chill type of investor, here is what you can do: