The Rekindling of a Recession

Buy Now Pay Later

In the 1840s, a fever swept across the United States.

It wasn’t gold; it was canals.

At the time, Pennsylvania was the Silicon Valley of the world.

The state had embarked on a feverish building spree, constructing a massive network of canals and railways to compete with New York’s Erie Canal.

To fund this “bridge to the future,” the state borrowed aggressively, convinced that the tolls and future growth would easily cover the debt.

It was the ultimate “Buy Now, Build Later” scheme.

The state was borrowing to sustain an image of progress while the underlying math turned toxic.

The economy grew until it stuttered.

On February 1, 1842, Pennsylvania defaulted on its interest payments. The “wealthy” state was effectively broke.

The fallout was swift and brutal: credit markets slammed shut, the state was forced to halt all infrastructure projects mid-construction, and the reputation of American credit was so thoroughly trashed that even the U.S. Federal Government was later rejected for loans by European bankers.

Today, BNPL has made a return.

The only difference is that people are financing burrito bowls and the weekly grocery haul.

But the psychological trap is identical -

We are spending a future that hasn’t happened yet to survive a present we can’t afford.

What is Buy Now Pay Later?

“Buy Now, Pay Later” (BNPL) was originally sold as a savvy tool for the tech-forward shopper, a way to snag a new pair of Nikes without the credit card interest.

The model is simple: split any purchase into four interest-free payments over six weeks.

However, in late 2025, the mask of “convenience” has slipped.

BNPL has morphed into a literal bridge to the next paycheck.

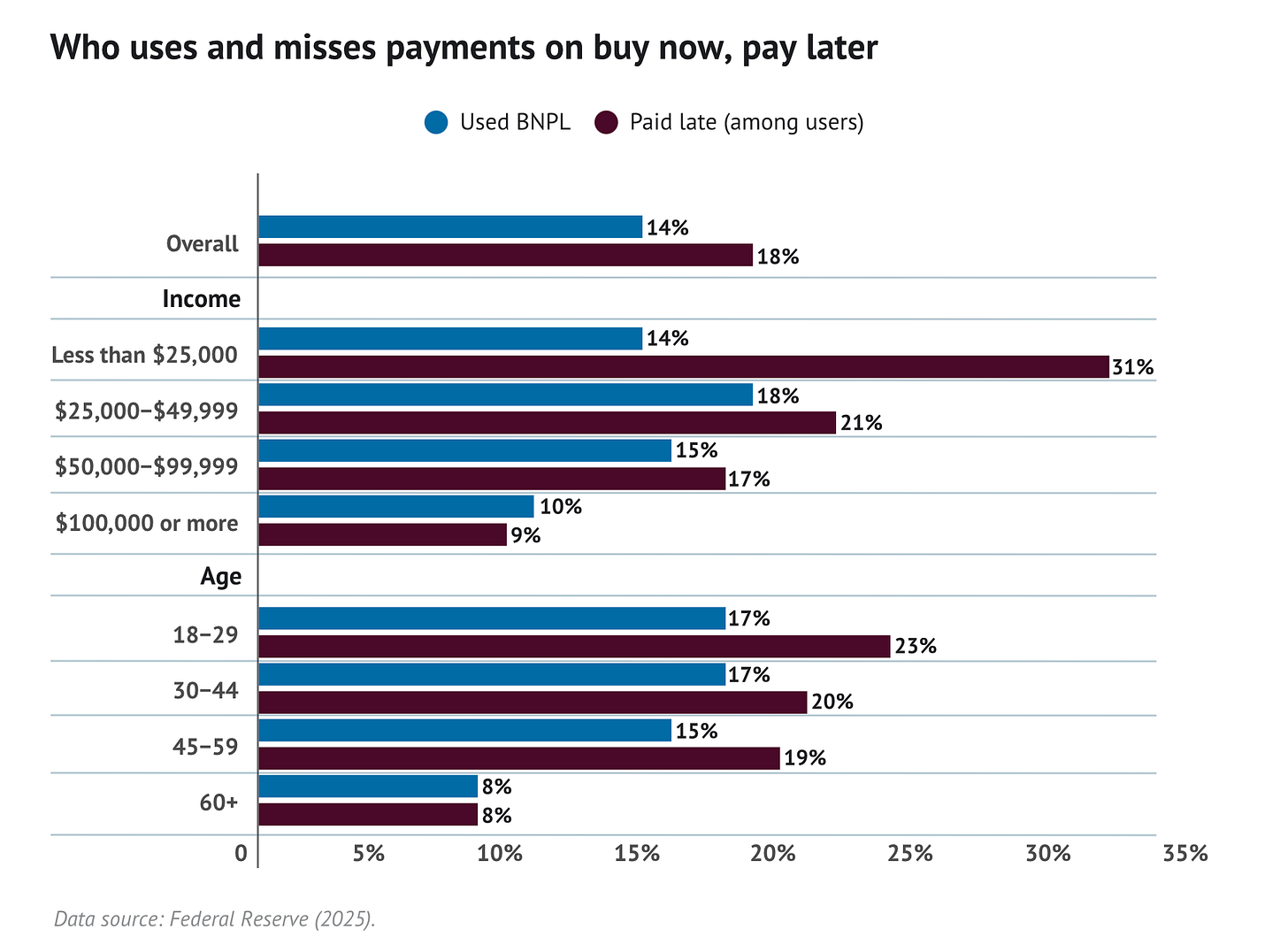

Almost 15% of Americans have used these services, with the highest usage among those who have the most to lose.

64% of Gen Z are now “split-paying” their lives, and the frequency is increasing: 11% of respondents report using these services at least six times!

Moreover, over 1 in 4 Americans report regretting using buy now, pay later (BNPL) after realizing the actual amount they owed (the debt trap).

Nearly 60% admit they’ve used BNPL to finance a purchase they couldn’t otherwise afford, and around 50% of young consumers prefer buy now, pay later over credit cards.

Additionally, according to Federal Reserve data, the share of BNPL users making late payments is rising. Nearly one-quarter of BNPL users (24%) have made a late payment.

The next logical question is, how much are Americans really spending on BNPL?

According to a January 2025 Consumer Financial Protection Bureau report, the average transaction amount for a BNPL loan was $142 in 2022, the most recent year for which data was available.

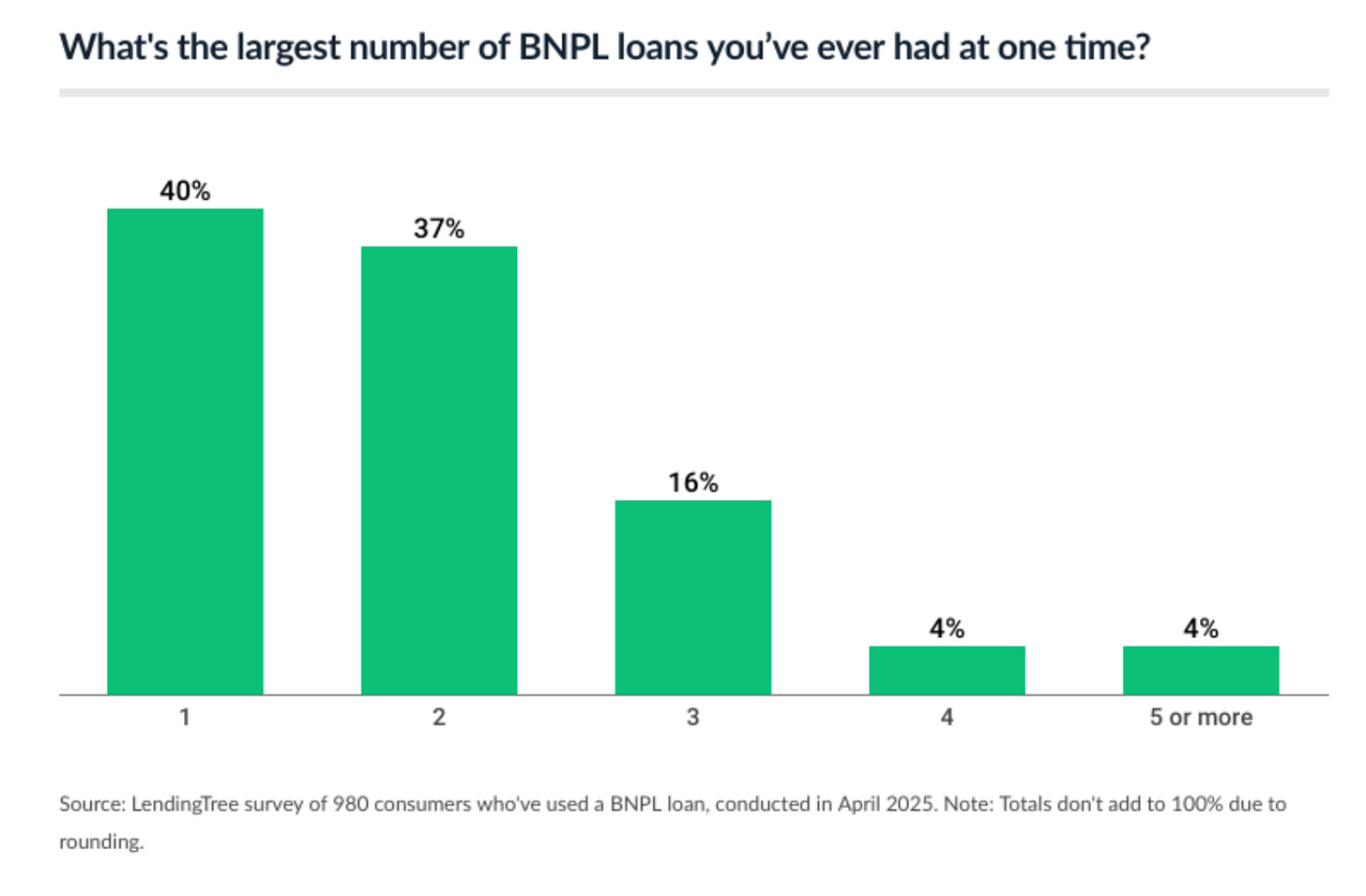

This may sound less on the surface. But when you look deeper, you realize that most BNPL users don’t just stop at one loan.

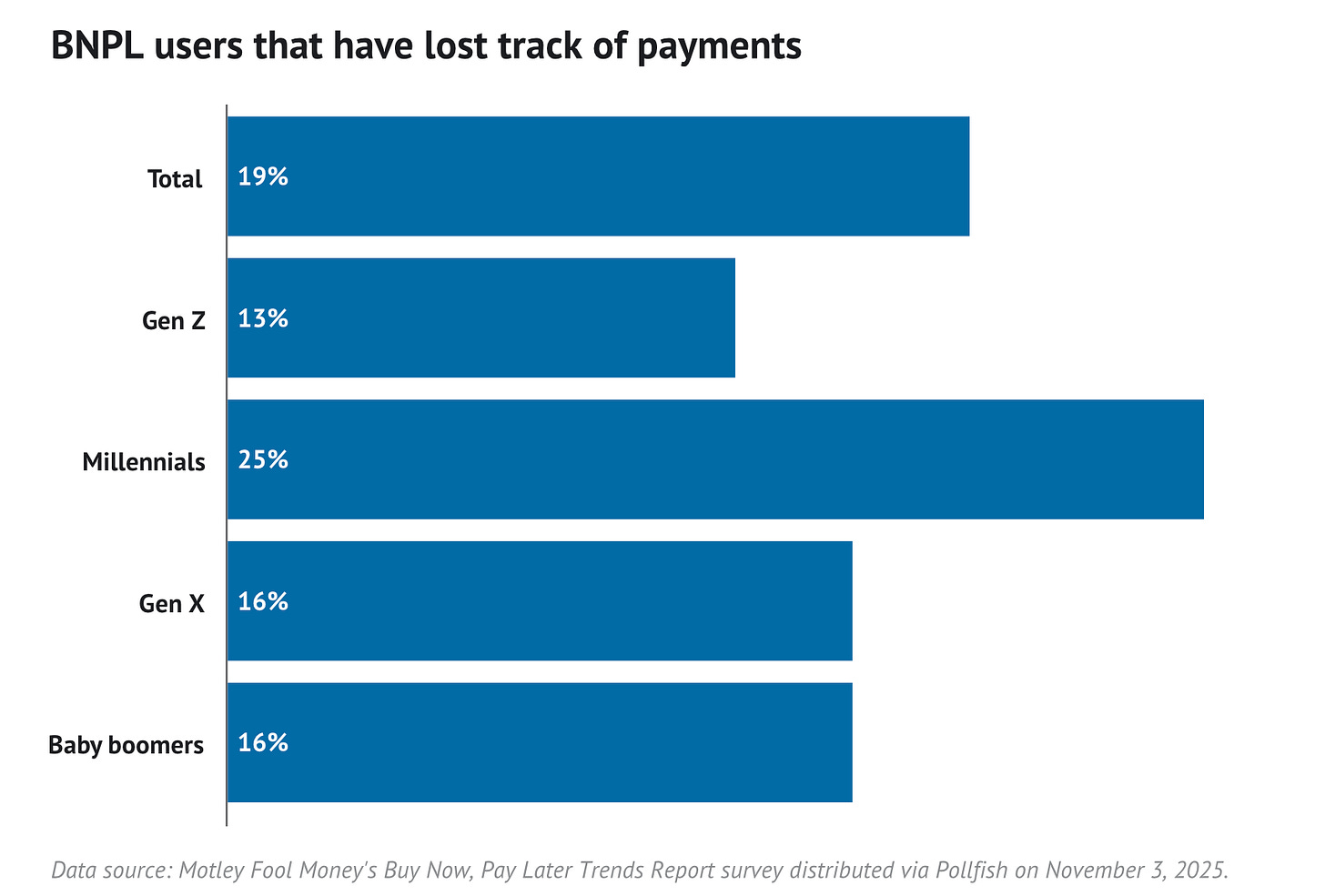

What’s more, is that 19% of BNPL users have lost track of their payments.

Millennials were the most likely to do so (25%), while Gen Z, despite having the highest late-payment rate, were least likely (13%).

This is very concerning, since it’s the equivalent of taking one loan to pay off another loan, without any lenders checking your eligibility prior.

It doesn’t take a lot to estimate where this sort of “convenience” practiced by the majority leads.

Why the Spigot is Opening

Why the surge? It isn’t a sudden love for apps.

It is a desperate response to an economy where the “bottom line” is hurting.

The Paycheck Bridge: 33% of users now explicitly state they use BNPL as a bridge to their next paycheck, up from 27% two years ago.

The Utility Crunch: As the costs of heating, electricity, and water continue to climb, households are redirecting cash to the “must-pays,” leaving a hole in the “daily-pays.”

The Grocery Shift: Perhaps most alarming, 25% of borrowers now use BNPL for groceries (up from 14% last year).

We are seeing an institutionalization of this “debt-for-food” lifestyle.

The recent partnership between DoorDash and Klarna allows consumers to finance a single meal over four installments.

When you are paying for a pizza over the course of six weeks, you aren’t “shopping” as much as you’re subsidizing a deficit.

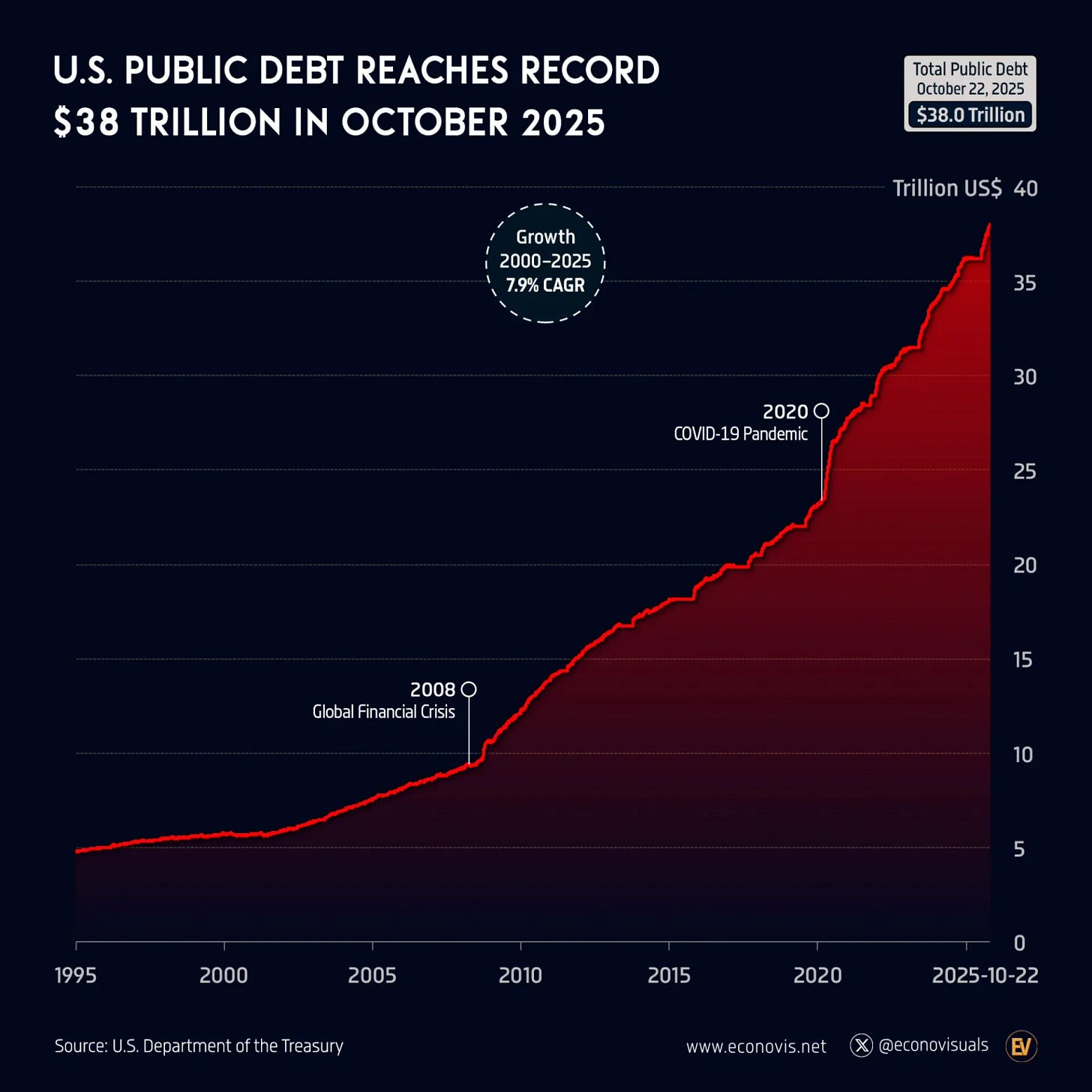

The economy looks healthy at a 3-4% GDP growth rate, but that growth is being fueled by a ghost in the machine.

We are building a financial house of cards, and the wind is starting to pick up.

The “Shadow Debt” Trap

The real danger isn’t just the debt, but more the invisibility.

BNPL is what economists call Shadow Debt.