The State of AI

No Price Too High

Hi there,

This report’s a bit different than our usual ones. We are starting to cover macroeconomic news, given its increasing influence on stock performance. Let us know what you think at the end, either by voting on the poll or leaving a comment!

The Genius and the madness of people

In 1711, one of the earliest shell companies was formed - The South Sea Company.

It was marketed as a trading company with a monopoly on trade with Spanish South America.

But in reality, the trade routes were largely blocked by war. The company sent very few ships and made almost no profit from trade.

Behind the scenes, its real purpose was to take on British government debt and pay it off with the proceeds of a stock offering.

The strategy worked.

The demand for the company’s stock soared on expectations of strong profits, although none ever materialized.

In 1720, the bubble was at its peak.

Sir Isaac Newton, who was the Master of the Mint (chief officer responsible for coining money) at the time, had also invested £7,000 in the South Sea Co.

That’s $1.4M in today’s money.

The stock rose from £128 in January to £1,050 in June.

Wisely, he realized the exuberance of the market and sold his shares during the spring of 1720.

It turned out, however, that like many around him, even Newton couldn’t sit idle while everyone around him made vast profits.

He had reinvested in the stock near its high, and towards the end, lost upwards of £20,000! ($4.3 million today)

By September, the bubble had burst, and the stock was down to £200, off 80% of its high.

When asked about the direction of the market, he replied:

I can calculate the motion of the heavenly bodies, but not the madness of the people.

Then and Now

That brings us to today.

Today, we’re surrounded by AI - a technology built on the very calculus pioneered by Newton.

But, just as in 1711, reality is being overshadowed by mania.

The S&P 500 has hit 37 All-Time Highs this year alone, with AI stocks as the primary drivers.

Moreover, if you remove AI from the equation, the US GDP grew only 0.1% in H1 2025.

The final nail in the coffin is the valuation of AI companies.

Arguably, the biggest name in AI right now is ChatGPT, which is developed by OpenAI.

OpenAI was valued at $500B in its most recent funding round, despite generating just $4.3Bn in revenue during the first half of 2025. Their goal is to generate $13.5Bn in revenue in 2025.

For comparison, Google is currently valued at $3.8T - with $400Bn in annualized revenue.

Google generates OpenAI’s annual revenue goal roughly every 12 days.

Yet Google is valued at roughly 10x its sales, while OpenAI is valued at ~50x!

The market has already written a trillion-dollar check. Can AI actually cash it?

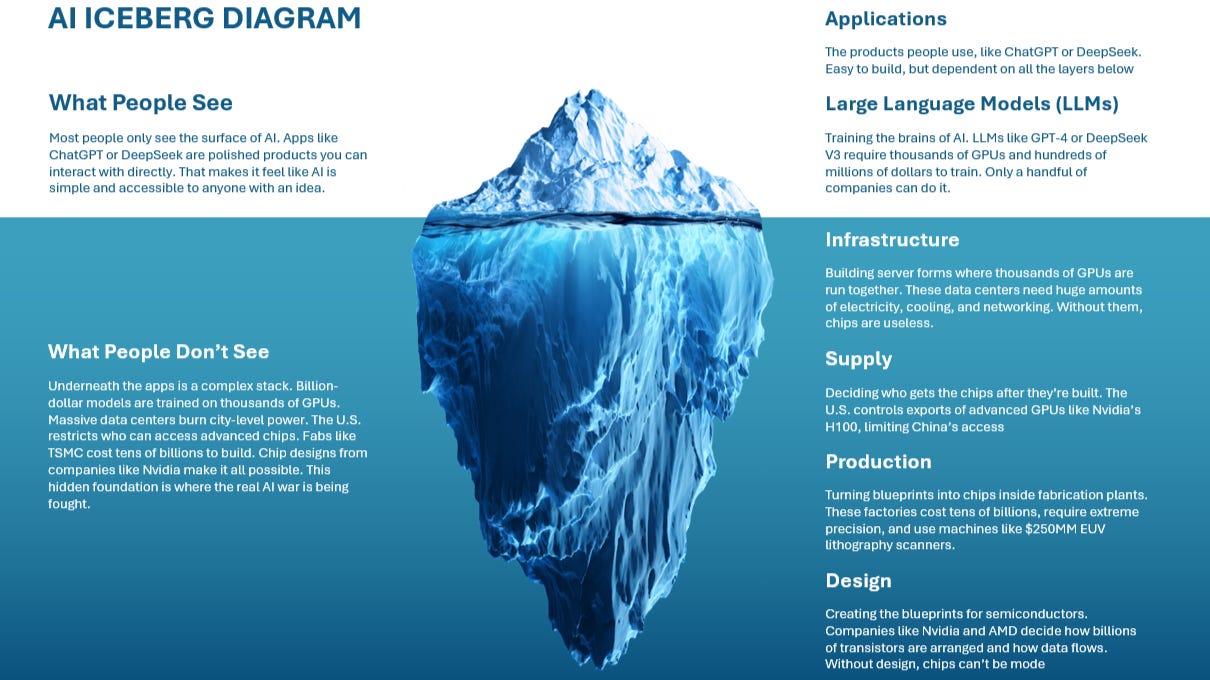

A View Behind the Curtain

Costs of running AI

The economic reality of AI is structurally different from the software businesses we are used to.

In the SaaS (Software as a Service) boom of the 2010s, companies enjoyed 85%+ gross margins because software is “write once, sell infinitely.”

AI breaks this rule. It introduces a physical cost to every digital interaction.

The most important one today is inference.

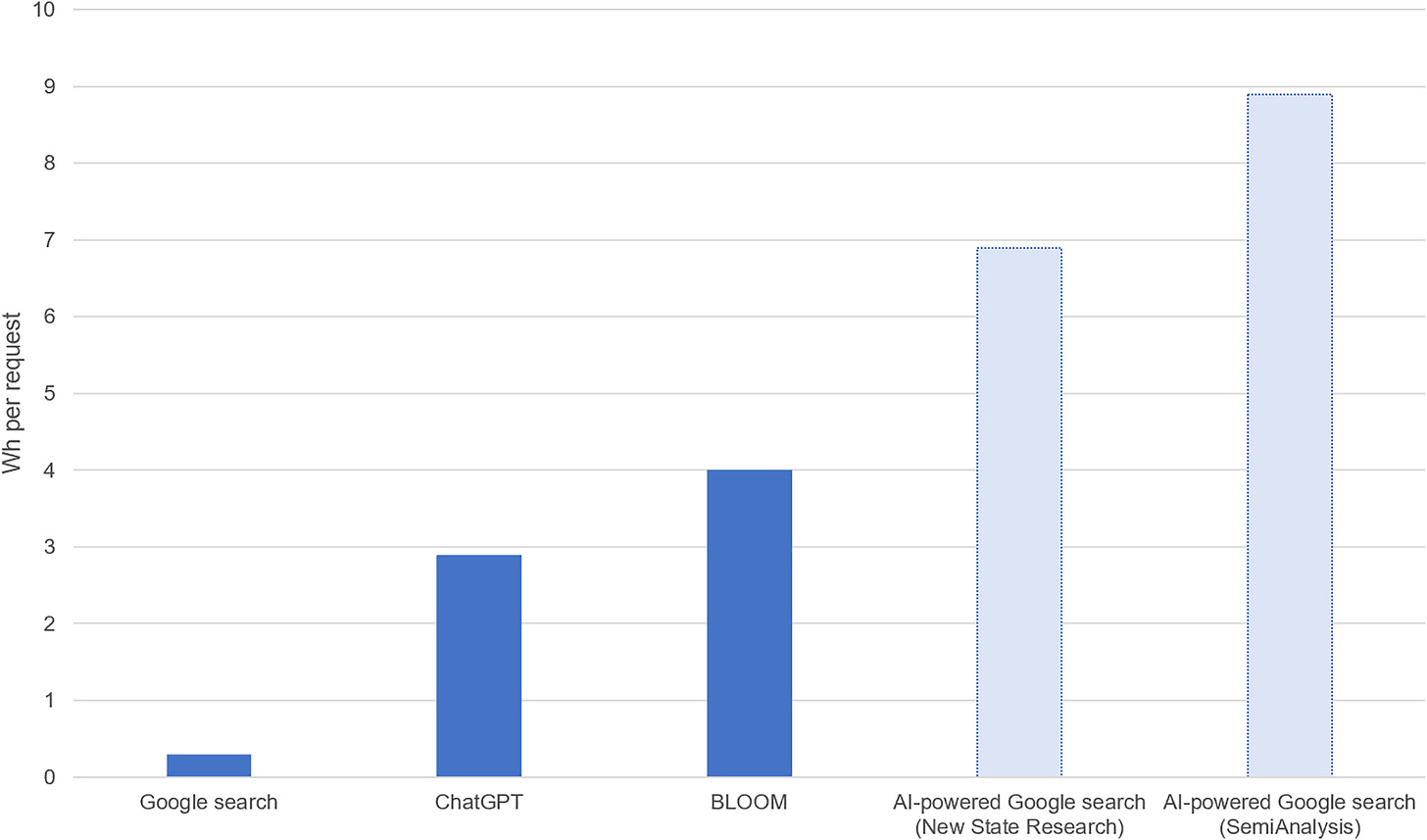

A single ChatGPT query consumes 10x -15x more energy than a traditional Google search:

While a Google search costs the company roughly $0.00003, a Generative AI response can cost upwards of $0.01 - $0.02. That’s a 500x jump in operating costs.

Then comes the training cost -