Time for Bonds

How bonds can fit into your portfolio

Market Sentiment delivers data-backed, actionable insights for long-term investors. Join 57,000 other investors to make sure you don’t miss our next briefing.

The Federal Reserve meets again next week, and the stakes for rate cuts are high.

At its last meeting, the Fed kept rates steady at 4.25% to 4.50% for the fifth consecutive time. That didn’t come as a surprise. However, the tone shifted noticeably at the Jackson Hole symposium, where policymakers leaned toward the likelihood of rate cuts, signaling they could begin as early as September.

Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance. — Fed Chair Jerome Powell

This raises an important question: why is the Fed now considering easing policy?

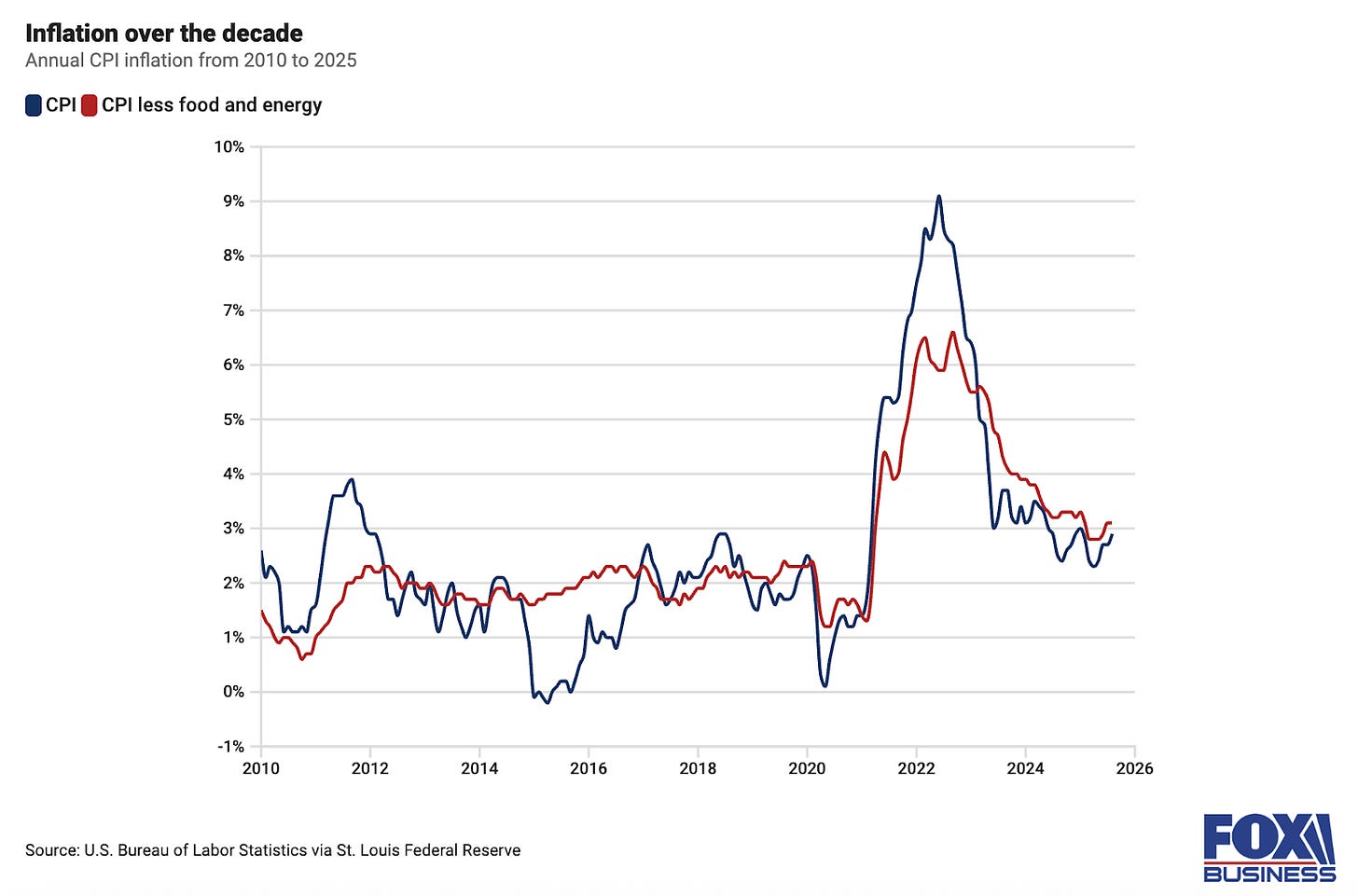

If you focus just on inflation, it’s hard to see why the Fed would ease. After dropping sharply from its 2022 highs, price growth has started to creep up again. In August 2025, U.S. inflation was at 2.9%, slightly up from 2.7% in July and still above the Fed’s 2% target. Core inflation, which excludes food and energy, was at 3.1%. That’s below its peak but still high enough to indicate that price pressures remain.

But inflation doesn’t tell the whole story. It’s the signs of weakness elsewhere in the economy that make the case for rate cuts.

Growth appears fragile. The economy grew by only 1.4% in the first half of the year. The first quarter even shrank by 0.5% before rebounding with 3.3% growth in the second. Despite this recovery, momentum still feels uneven.

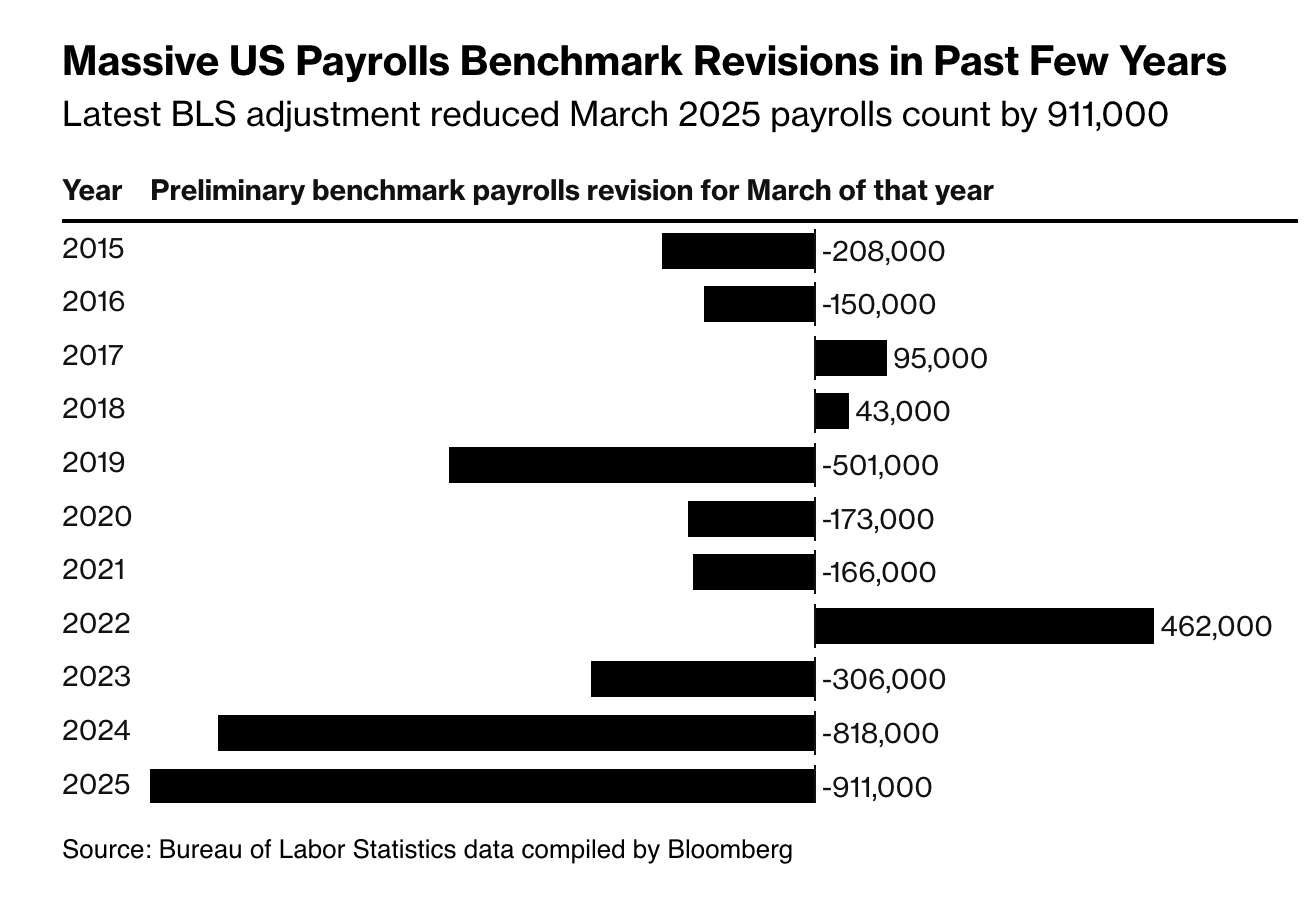

The labor market is also showing warning signs. In August, the economy added just 22,000 jobs. Annual revisions revealed that from April 2024 to March 2025, the U.S. actually created 911,000 fewer jobs than initially reported. With unemployment at 4.3%, its highest since 2021, it’s clear the job market is losing momentum.

All these factors point towards rate cuts. Traders are factoring in a 100% chance of a September cut, and institutions like Bank of America predict at least two cuts before the year ends, with more possible in 2026.

If rate cuts are all but certain, how should we as investors position ourselves?

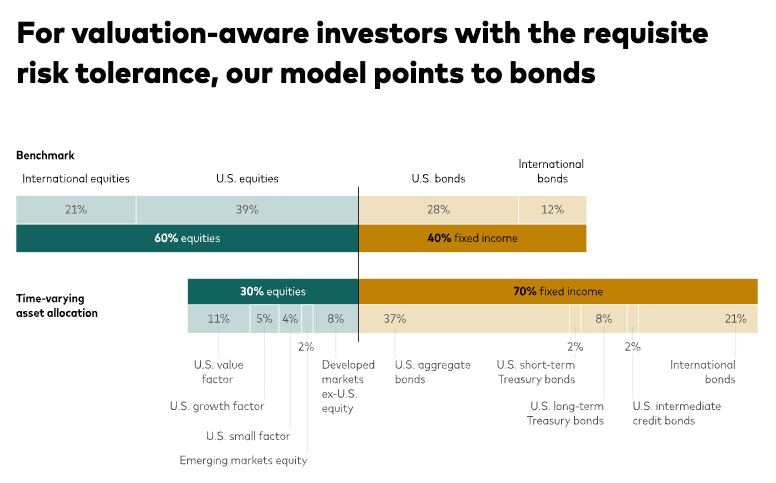

The answer might lie in Bonds. Research from Vanguard now recommends a portfolio with about 70% in bonds and 30% in stocks.

The U.S. equity market continues to trade well above the top end of its fair-value range. The ongoing strength in equities reinforces Vanguard's case that bonds are attractive relative to US stocks, which we anticipate will offer returns below their long-term historical averages over the next decade — Vangaurd Asset Management.

Over the next decade, Vanguard expects annual U.S. stock returns of 3.3% to 5.3%, compared to 4.0% to 5.0% for bonds. In other words, the current situation favors fixed income.

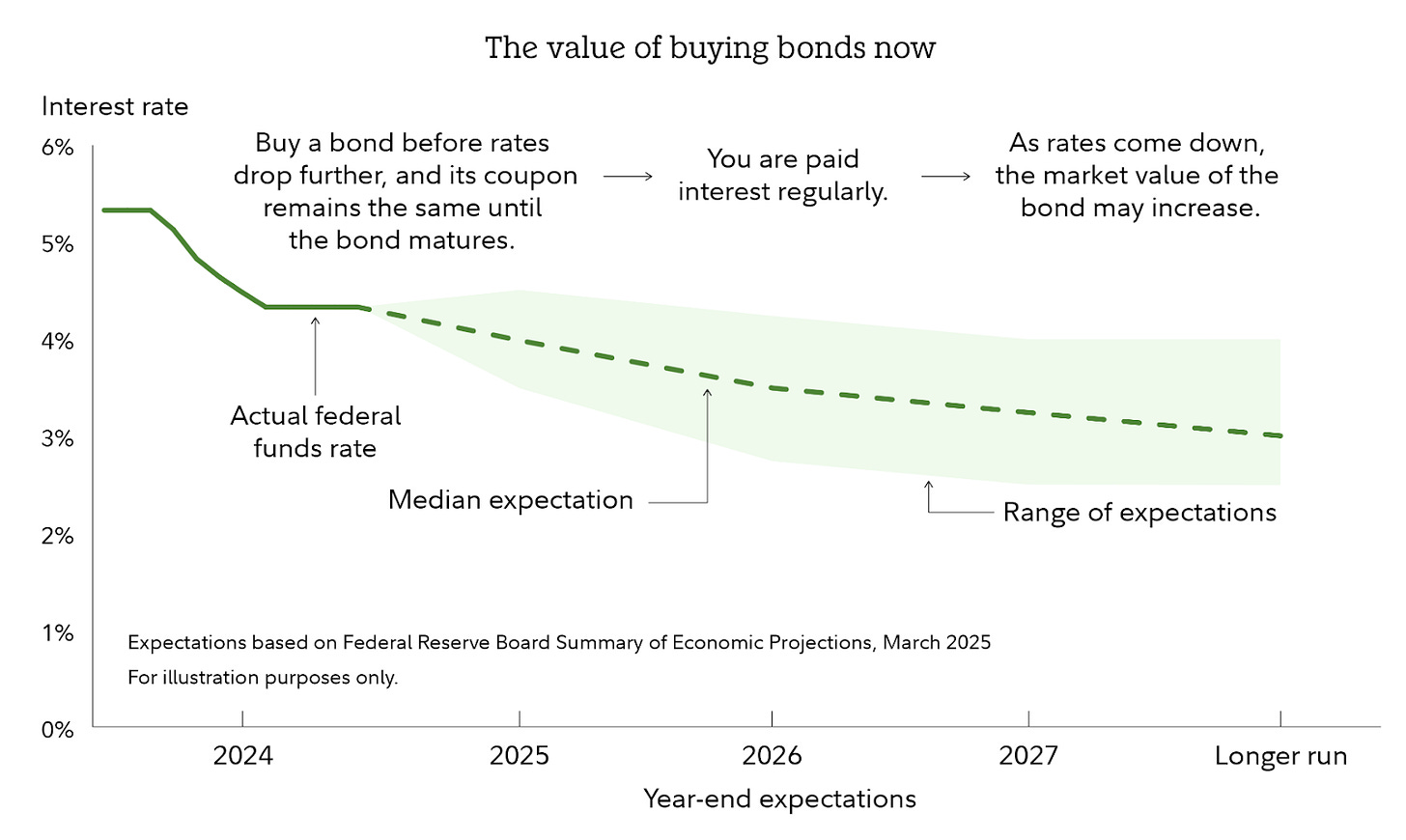

The reasoning is simple: when interest rates fall, bond yields typically decrease, which raises the prices of existing bonds. This means investors can gain not just from stable interest income but also from potential capital gains.

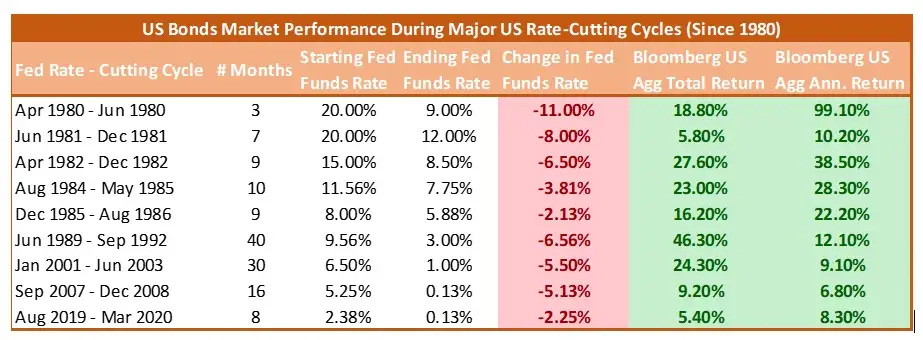

Over the last four decades, bonds have delivered impressive performance during Federal Reserve rate-cutting cycles.

Taken together, these factors show that bonds once again offer real income and an asymmetric upside. Nominal Treasury yields remain attractive at ~4.3% and high-quality corporate bonds hover ~5% yields — offering a straightforward way to fund retirement income needs with far less equity risk. If the Fed begins cutting (as the consensus expects), duration should do the heavy lifting.

Given all this, it would be the perfect time to get a deep dive into the bond market. Here’s everything you need to know about bonds:

What are bonds, and how do they work?

Open market bond pricing – how do interest rates affect bond prices?

Short-term vs Long-term bonds

Investing in bonds – Individual bonds vs Bond ETFs

Benefits of bonds in your portfolio and historical performance

Best fixed-income opportunities for 2025

Risks of bond investing

Bonds 101

Bonds are a way in which a company or government can borrow the money it needs to fund its projects. When you buy a bond, the issuer agrees to pay you a specific rate of interest over the life of the bond and repay the face value of the bond when it reaches maturity.

Let’s take the example of you buying a $100, 10-year bond with a 10% coupon rate:

On the day of purchase, you have to give $100 to the issuing organization. Over the next 10 years, the bond issuer will give you $10 every year as the coupon payment, and at the end of 10 years, you receive the initial $100 you used to purchase the bond. Bonds are called fixed-income investments because you are assured of that $10 payment every year (usually paid semi-annually) unless the issuer goes bankrupt.

Bonds are less risky than stocks due to their place in the order of priority in the corporate capital structure. In the event of a company filing for bankruptcy, bondholders (senior debt) are the first in line to get repaid.

A typical example was Lehman Brothers’ bankruptcy, where the bondholders received up to 40% of their investment back, whereas equity holders went to zero.

Bond pricing and interest rates

It’s difficult for a retail investor to buy bonds directly from a company. Mostly, bonds are bought and sold on the secondary market after they are issued. A bond’s price reflects the value of the income that it provides through coupon payments.

Practically, bond prices are quoted as a percent of the bond’s face value, and you can easily determine if a bond is trading for a discount or a premium to the par.

When interest rates fall, older bonds that were issued at higher interest rates become more valuable since they have higher coupons compared to the new bonds. Investors holding the older bond can charge a premium while selling the bond in the secondary market. On the other hand, if the interest rates rise, as we saw in 2022, the old bonds become less valuable as new bonds are being issued at higher coupon rates, and older bonds would trade at a discount.

Short-term vs long-term bonds

In general, there are 3 types of bonds:

Short-term — Mature in less than 2 years

Intermediate-term — Mature in 2 to 10 years

Long-term — Mature in over 10 years

As a rule of thumb, the longer your maturity period, the higher the annual yield. The simple logic here is that it’s riskier for you to buy a longer-term bond (the future is uncertain because of all the unknowns, good and bad, that could happen over years of time) and you are rewarded proportionally for taking the larger risk.

For example, you would get a significantly lower interest rate if you are investing for 1 year vs 20 years, as it’s generally riskier to stash away your money for a longer time period. As Nick showed in his excellent analysis, as maturity goes up, inflation-adjusted return also goes up.

Individual bonds vs bond ETFs

Certain investors like buying individual bonds from a broker and holding them to maturity, whereas others get bond exposure through bond mutual funds or ETFs. There are pros and cons to each approach, and it comes down to your personal investment goals, time horizon, and risk tolerance.

Individual bonds are great if you have considerable assets that can offset the slightly higher trading fee, want the comfort of getting a fixed amount semi-annually, and have a predictable market value at maturity, barring a default from the company. The downside of individual bonds is that you will usually incur a higher trading fee, the initial capital outlay is higher, and they make it much harder to diversify your portfolio.

If you are not a sophisticated investor, sticking to a bond fund is your best bet. Though you have to pay a management fee (aka expense ratio), the minimums are lower to invest, easier to diversify, and mathematically give the same return as holding an individual bond. Considering the fact that the expense ratio is only 0.04% for Vanguard's corporate bond ETFs, it’s not a big price to pay for the convenience and diversification.

One of the best bond ETFs is the Vanguard Total Bond Market ETF. It has an expense ratio of only 0.03% and is currently yielding 4.19%. The fund is a good mix of U.S. Govt treasuries, investment-grade corporate bonds, and mortgage-backed securities.

Impact of bonds on your portfolio

Given the attractive valuation, consistent income, and low volatility bonds offer, it might look like an attractive option to add to your portfolio. But before doing that let’s take a look at the typical bond portfolios, how adding them to your portfolio will affect its performance, and how they have performed during previous crises.

After all, bonds are considered to be one of the best defensive asset classes.

Here’s a 20% discount on our annual subscription if you subscribe in the next few hours