A primer on Inflation, how it affects stock prices, and what it means for your investments?

Should you be concerned about the current jump in inflation?

The current jump in US consumer prices has understandably spooked investors. The current CPI numbers stand at 4.2 percent which is the highest it has been since Sep 2008. (the increase was almost 4x of what was expected)

While it is definitely a questionable way to showcase the annual inflation rates like how they have done here, the current sudden rise in inflation can have serious long-term effects. To understand how increasing inflation can have detrimental effects on the market as a whole and the stock prices, first, we have to understand the basics of inflation.

What is inflation: To put it simply, inflation can be considered as the rise in the price of goods and services which in turn reduces the purchasing power of each unit of currency. As prices of products inflate, each unit of money is increasingly less valuable. Zimbabwe is an extreme example (they had to print banknotes of 100 Billion) of what happens when a country does not control its inflation and goes into hyperinflation. A sudden rise in inflation can have an insidious effect to the economy: The raw material prices increase; consumers can purchase fewer goods and revenue and profits of companies decline until a new equilibrium is reached.

Is it a serious concern among investors?

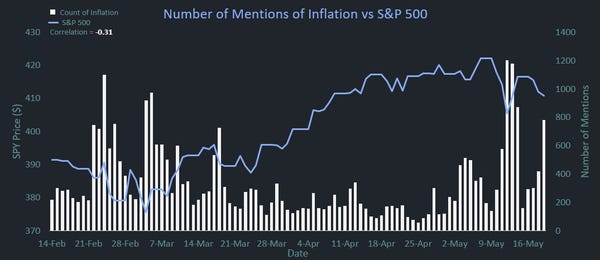

I analyze mentions and sentiment of various stocks to identify trending ones. I used the same data I collected to see the number of mentions of inflations and how it trends with S&P500. As expected, mentions of inflations have a negative correlation with how the market performs and we can see that it has exploded over the past few days.

How does inflation affect stock price?

The relationship between inflation and stock prices is not straightforward and no single rule applies. In the long run, shares can act as a hedge against inflation. i.e, the companies had enough time to adapt to the inflation in input prices and adjust their own prices, thereby increasing revenues and passing down the cost to consumers.

But let’s be real here. None of us are interested in the long term and want to know the short-term impacts on stock prices. In general, stock prices have an inverse correlation (as can be observed from the chart above) – i.e, as inflation rises, stock prices fall. This can be attributed to multiple factors such as falling short-term revenue and profits, general economic slowdown, and a prospect of lowered real returns. But the single most important factor to consider for short-term stock price swings in interest rates.

Interest Rates

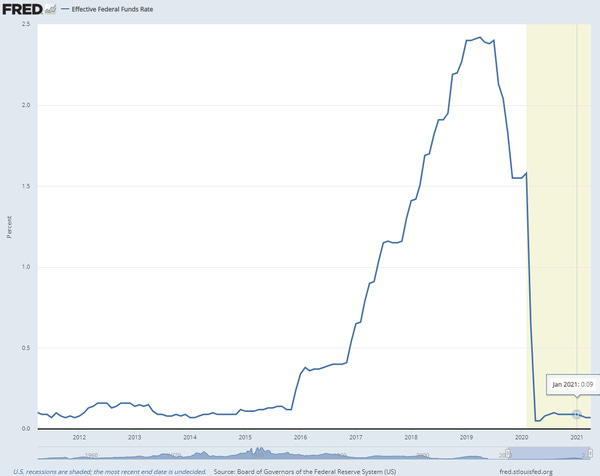

The U.S federal reserve interest rates have been near zero from the time pandemic hit the country. This caused the market to be on a massive bull run over the past year as there are no attractive alternative investments that can generate a respectable return. This along with the massive Covid economic relief bills channeled a massive amount into equities (bonds with almost no interest were not an attractive investment anymore)

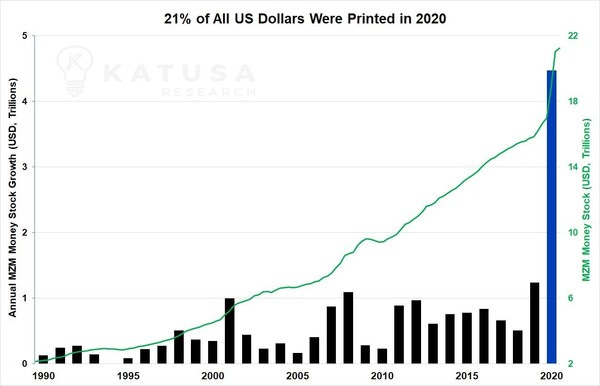

”Money printer go brrr” was not just a meme. 1/5th of all US currency in circulation was printed in the last year. Out of this, only a small portion went into the actual paychecks that people received and a vast majority was used for keeping companies afloat. While the Fed still hasn’t announced any concrete plans for an interest rate increase, it certainly is on cards if the inflation continues unabated.

What does it mean for my portfolio?

Historical research indicates that during high inflation periods growth stocks drop in price. This is predominantly because the valuation of the company is based on future expected cash flows and the increasing inflation rates will reduce the current value of the company thereby adversely impacting the share price.

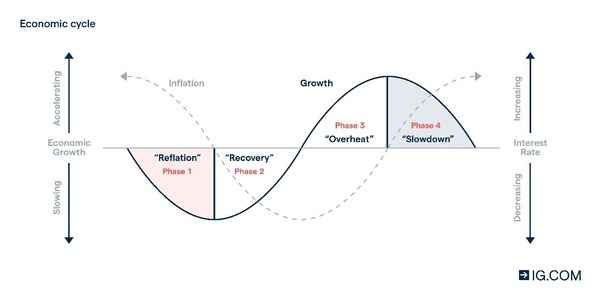

Depending on where you believe our current economic cycle is, we have multiple options. If you think that the market is still in a recovery phase, you can still continue to invest in Growth stocks but if you believe that the market is overheated and inflation would be the final trigger for a slowdown then Value stocks, Commodities, and Real estate investment trusts can act as a good hedge against inflationary market changes.

Conclusion

The short-term plays based on inflation entirely depends upon whether you believe the Fed’s explanation that the current jump is transitionary in nature and will settle down or that the rising prices of consumer goods will finally force the Fed to increase their interest rates leading to the end of bull run over the last one year. Whatever the case may be, we are in for some wild swings when the next inflation report comes out.

If you found this insightful and know someone else who would benefit from this, please share it with them! Thank you for reading!

Disclaimer: I am not a financial advisor.