Can Wallstreetbets beat the market?

I analyzed 20MM+ comments in 2021 to see if you should pay attention. Here are the results.

Welcome to the 133 investing enthusiasts who have joined us since Thursday! Join 11,554 smart investors and traders by subscribing here:

Like 4chan found a Bloomberg terminal

This is how they define themselves. Wallstreetbets is a community that has gained a following of 11MM+ members over the years. As much as it’s fun to follow their ups and downs and the laugh-out-loud memes that they post, the question in the back of everyone’s mind is: Is there really more to WSB than just the memes and jokes? Do they have real insights?

In this analysis, I try to use historical data about the conversations on WSB to see if there’s a method to the madness and chaos and GME hype: to see if we can beat the market by using the stock picks made on WSB. After all,

Data

Reddit’s PRAW API and Pushshift API were used to obtain the data for this analysis. There were more than 20 million comments and posts made on WSB in 2021. I have had a VM running for collecting the live data from all the financial subreddits since Dec’20.

The summary sheet containing the analysis will be shared at the end in a Google sheet but if you want access to the full historical data, you can get it from Pushshift API.

Analysis

Ahh, this is where it gets tricky. There are multiple ways to consider what constitutes a recommendation from WSB. Since there are millions of comments, it’s not realistic to invest in each and every recommendation made on the subreddit.

So what I have done to simplify this is to calculate the most popular tickers for each day [2]. Why I settled on this logic is because a stock from this list is what a person is most likely to see when he/she would randomly browse through the subreddit and the higher the number of mentions, the more the chances of investing in the said stock.

Considering the practical limitations, I kept the cut-off at the top 10 stocks. Once we have found the top 10 discussed stocks of that day, we invest in them at the market close. Then we calculate the returns generated by the stocks over the next

a. One Week

b. One Month

c. Till Date ( From the date of investment to Today)

The benchmark for comparison is SPY[3]. We will compare the returns against SPY to see if the most popular recommendations generated by the platform can beat returns by SPY during the same time period.

Results

Before we jump into the returns, here is a visualization of how the most popular stocks have changed over the last year in WSB.

In case the visualization is not loading in your mail, check it out here.

We would have made a grand total of 2,613 investments [4] in 2021 following this strategy. We would have lost money on more than 51% over the next week and more than 60% over the next month. But if you consider till date, we are slightly above 50%. If you compare this to SPY, its an extremely poor performance, as during the same period SPY would have given a positive return of 66% over one week, 76% over one month, and 100% Till Date (as SPY is trading at an all-time high now)

But, the stock market rewards predictions disproportionately [5]. Out of the 100 stocks you pick, even if you get 99 wrong but get one extremely unlikely event right your overall returns will still be extremely high (which is what WSB is aiming for - it’s definitely not for safe plays).

So, how has the average performance of WSB picks fared?

Would you look at that! WSB recommendations have hands down beaten SPY across all time periods. It gave a 2% overperformance over the period of one week and 2.2% over one month and a whopping 6% if you had held on to your stocks.

But keep in mind that your performance is skewed towards a few stocks which got featured repeatedly in the top 10 list.

GME has been in the top10 discussed stocks in 100% of the days and on average you would have gained 73% if you invested in it every day. Both AMC and TSLA are close followers with both of them giving substantial returns. Among the other ones who have made the list repeatedly, only BB, CLOV, and WISH on average have lost money [6].

Now that our main question is out of the way, we can really do a deep dive into the data and see some interesting patterns.

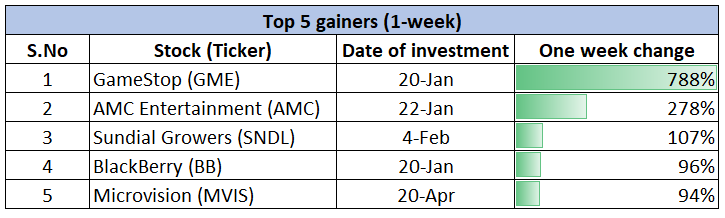

Unsurprisingly, Gamestop and AMC are at the top of the pile with GME returning an insane 788% in one week. Even if you remove GME and AMC (due to the unlikely scenario of a short-squeeze), the other 3 stocks would have doubled your investment in one week.

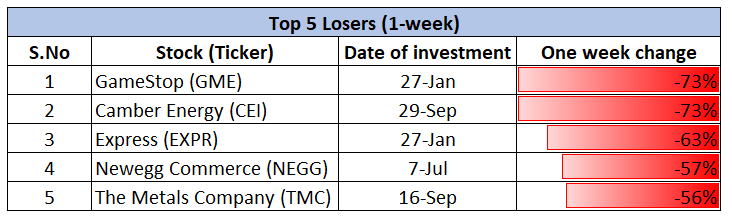

For every winner, there are bound to be losers. If you bought into GME at the top of the rally, you would have lost 73% of your investment in the next week. All the other companies on the list had a brief jump in popularity but folks who invested in that ended up holding the bag.

But what if you did not want to invest in 10 stocks every day. What if you only wanted to invest in the top stock of the day (ie, the one creating the most discussion)? Would you have beaten the market?

Unsurprisingly, you would have beaten the market by a wide margin. This is mainly due to the insane returns generated by GME, AMC, TSLA, etc. which came to the top of the list. You are just being rewarded for the high amount of risks you are taking by putting all your investment into a few stocks [7].

Now let’s hear from our sponsor of the week who can truly save you the money you need to experiment with these strategies…

SPONSORED BY TRUEBILL

It’s time to join the money management movement.

Are you searching for a tool to simplify your finances? If you answered yes, Truebill should be at the top of your “need to try” app list.

Truebill is the all-in-one personal finance app that empowers you to take back control of your financial life—helping you save more, spend less, and enjoy the feeling of financial freedom.

From a single dashboard on your phone, Truebill can:

• Track your income and expenses

• Manage and cancel subscriptions

• Lower monthly bills

• Create custom budgets

• Set up an automatic savings account

• Track your credit score

Truebill has over 2 million members and over the past 5 years, we’ve saved them over $100 million dollars. Thousands of 5-star reviews can’t be wrong, so check out all the Truebill app has to offer to help you take back control of your finances. Download Truebill on the iOS and Google Play stores today or sign up online!

Limitations

There are some limitations to this analysis which you should be aware of

As explained in footnote-1 there are 8-12 days of missing data - though this is not going to affect the results in any significant way as it’s lesser than 5% of the total days in the analysis.

This analysis does not consider Options which is a big part of what WSB is made of. The returns from options can be wildly different from what we are observing in the case of buying stocks

We have just considered the last year of data where it was predominantly a bull market and meme stocks have made insane rallies. The results might be different if we expand our time horizon.

Finally, the above analysis only considers the chatter and not the sentiment about the stock. I would invest no matter if people are saying positive or negative things about the company. My hypothesis is that we would be able to generate more alpha if we can distinguish the sentiment in comments. A part-2 of this analysis incorporating sentiment is in the works — stay tuned!

Conclusion

Before starting the analysis, I fully expected to end it with

The real returns were the friends we made and the fun we had along the way!

I was expecting that the chatter in WSB would be a lagging follower of the stock price rally and the people who invest in them would end up holding the bag.

But I was pleasantly surprised to see that on average the stock that made it to the trending list beat SPY in returns, that too across different time periods.

Either it’s due to the self-fulfilling prophecy of stock price rallies leading to more chatter that will lead to more investments that will cause the stock to rally even more. Or it might just be that WSB is the place where we can successfully leverage the Wisdom of crowds.

Whatever the case may be, you truly would need nerves of steel to keep holding on to a stock that rallies 700% in one week only to drop 70% in value next week and then finish net positive by the end of the year. For that, you are rewarded with market-beating returns!

If you liked reading this issue, you will love

How to consistently make returns from the Crypto market!

Should you follow insider transactions while investing?

Until next week…

Footnotes

[1] During the GME rally in January, the traffic was so high that the VM failed. I have used Pushshift to fill in the details wherever possible, but keep in mind that there are 7-8 days of missing data from 28th Jan to 8th Feb and 4 days of missing data in April 2nd week.

[2] To find the most popular tickers I used a base of around 9,000 stock tickers that I got from IEX cloud. The program would flag if any of these tickers were present in a comment or post. This is by far the most data-intensive exercise I have done. if you hypothetically consider the loop as a cross join, we processed more than 200 Billion rows to find the most popular tickers.

[3] If SPY was in the top 10 tickers, we would invest in that as well. I feel that this would slightly reduce our risk profile.

[4] It’s lesser than the expected 2,900 investments as there are some days in between where we had data loss (footnote 1) and also some stocks got delisted or underwent mergers (eg. Aphira) due to which we could not get the financial data from Yahoo Finance.

[5] Take the classic example of Keith Gill (aka DFV). He at one point had a $50MM return using a 50K call option. Even if he had another 99 50K call options in other stocks which expired worthless, just this one right pick would have made him a net profit of $45MM. This phenomenon is known as black swan farming.

[6] This is very surprising given the amount of risk we are taking investing in meme stocks. Also, in my mind, you cannot complain about the skew towards a few stocks as it’s bound to happen. Even in the case of S&P500, a vast majority of returns is driven by a few tech stocks.

[7] The Beta of this portfolio would be through the roof and you beating the market is more probable as we are in a rally. Remember, what Beta giveth, Beta can take it away just as easily.

If you found this insightful, please help us by Re-tweeting this article

How would you rate this week’s newsletter?

What is your take on wallstreetbets? Let me know by leaving a comment.

BRAVO!

This is really good! Am I missing the data sheet? i would love to take a look at it.