There are two types of people in this world.

Think back to your Thanksgiving lunch or a family wedding. The uncle who loves the sound of their voice (we all have one) says exactly this; right before they break down the wide world by slicing it into two.

In their book The Millionaire Next Door, Dr. Thomas and Dr. Williams use the same approach. There are two types of people — “Prodigious Accumulators of Wealth” (PAWs) and “Under Accumulators of Wealth” (UAWs).

The former? They’re frugal and invest religiously. Taking a leaf out of Mr. Buffett’s playbook, they still drive a Caddy. The latter? Make big money fast, spend it faster. Most likely to be spotted in a Lamborghini with the top down. Williams and Thomas go on to give us tips about becoming a PAW, and not UAW.

But like the uncle, the book too, falls short on nuance — most millionaires become millionaires by investing judiciously, not just through income.

Where the book falls short, our review of reports on the Vanguard, KKR, and Bank of America steps up. These reports break down the portfolio composition of the 1%

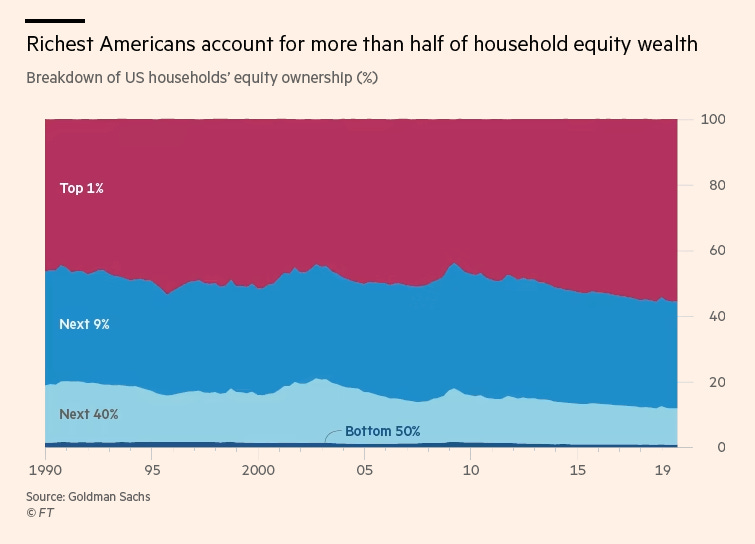

Stocks, stocks, and (some more) stocks. Largely, this sums up the portfolio composition of the richest 1% Americans. They own more stock than the rest, put together.

Now, that the where is answered, let’s figure out the how.

Vanguard set its sights on Americans with a median account balance of $1 million; while KKR focused on folks with over $30 million in assets (Ultra High Net Worth aka UHNW).

Here’s what they found:

Affluent retail investors (median balance of $1 million)

Long-term risk orientation — With more than 3/5th of their money in equities, the typical household just traded 8% of its assets.

Home Bias - The U.S. stock market makes up about half of the global market. Yet, 82% of their money stayed within U.S. borders.

Active funds are still popular — This one is a head-scratcher. Despite contrary evidence to the effectiveness of fund managers, 83% of investors had some exposure to active funds.

Diversification counts — Investors who have exposure to individual securities are well diversified and only have an average allocation of 5% to individual securities.

Don’t panic, don’t sell — During the 2020 Covid crisis, only 1% of affluent households completely abandoned equities, and on average, the equity allocation dropped only 3% (from 64% to 61%)

UHNW (balance more than $30 million)

Alternate allocation - Compared to the affluent retail investors, UHNW are cut from a different cloth. Only 29% have investment in equities (compared to 64% for the affluent), while a whopping 46% allocation to alternatives (private equity and hedge funds).

Capital conservation > Appreciation — UHNWs prefer lower volatility to affluent retail investors. On average their portfolio volatility was only ~7% when compared to the 15% volatility of the S&P 500.

Copy-pasting either strategy is not gonna get you closer to your goal. Each has its ups and downs. To find it out, let’s dive in

The 1%

The irony in finance is that windfalls make great headlines, but such occurrences are rare. The probability of you winning the lottery or signing a multi-million contract is lower than one in four thousand. Contrast this with the latest census, and there is a