All that glitters

The Wild West of Staking, Terra-Luna & "Risk Free" Returns

Hello friends! Welcome to Market Sentiment. Join 16,863 other smart investors and traders by subscribing here:

If you are new here, you can check out my best articles here and follow me on Twitter too!

This issue of Market Sentiment is brought to you by… Masterworks

How Are Investing Gurus Preparing For The Bear Market?

Trick question. They already have.

Top investors have already secured their wealth in an unexpected safe-haven asset: fine art. As an asset class, art isn’t like GME or BTC. You won’t 10x your investment in 24 hours, but you probably won’t lose 90% of it either.

But as investment art checks all my boxes:

Inflation Resistant: art can help protect your wealth from inflation

Risk-adjusted performance: Nearly 0 correlation to equities according to Citi

Significant appreciation: contemporary art appreciated by 14% annually (95-21)

Inflation? Market Volatility? Recessions? This uncorrelated monster of an asset class spits in the face of all of them. Plus, investing in art is easier than ever. In the past, you could only buy shares of companies like APPL or TSLA, but with Masterworks, you can invest in shares of million-dollar paintings.

Plus they’ve compiled a metric ton of data, and pick quality works for you. Imagine you’ve got Warren Buffet picking stocks for you except they’re paintings.

In investing and also in life, it’s important to always remember this tenet. If someone is offering you something for nothing, you can be 100% sure that you’re being taken for a ride. Every time I asked someone to try and understand how they are getting a ‘risk-free’ return of 10% or more by staking their Crypto, I got a vague response like

Anchor pays 20%, because there is no middle man, that’s the power of DeFi!

Ryan from wantfi went on to classify this as the ‘Alchemy of DeFi’ that gets people to believe in magic internet money to which the traditional rules of finance just don’t apply, apparently, only because “there’s no middle man.”

Even the head of research at Terra went on to claim that

Anchor offers a principal-protected stablecoin savings product that accepts Terra deposits and pays a stable interest rate - Nicholas Platias (Head of Research - Terra)

As with all these schemes, it only works until it doesn't. I went back a month on the Wayback Machine to see what the Terra USD dashboard looked like before the crash. Notice anything strange? They had a deposit of $12 Billion on which they had to pay close to 20% APY while having only $2.8 Billion in borrowings at an 11% APR.

Now compare that with the interest rate spread across the world and you can being to see the problem. Nowhere in an established bank would you see the lending rate less than deposit interest rates. The difference between the borrowing rates and the deposit rates is how a bank is able to function.

While I am definitely simplifying the concept of staking a bit too much, given the $40 Billion crash of TerraUSD and Luna, it’s high time we understand what staking is, how the crash occurred, and finally, whether you should be staking on other established currencies like Ethereum, Tether, etc.

What is Staking?

To put it simply, staking is when you put your Crypto into an account, for which you will earn interest. It can be compared to putting money in a savings account that pays interest. But unlike traditional banks which make money by lending out the money you gave at a higher interest rate, staking in crypto is much more complicated.

In exchange for you staking your crypto (which helps in verifying the new blocks being added to that particular network), you are rewarded with additional native currency. i.e, if you stake 100 ETH, at the current rate, you will have 104.2 ETH (4.2% APY) at the end of the year. One thing to note here is that you cannot stake all Cryptos. Only cryptos supporting proof-of-stake technologies such as Ethereum 2.0, Solana, Cardano, etc can be staked whereas proof-of-work crypto such as Bitcoin, Dogecoin, etc cannot be staked.

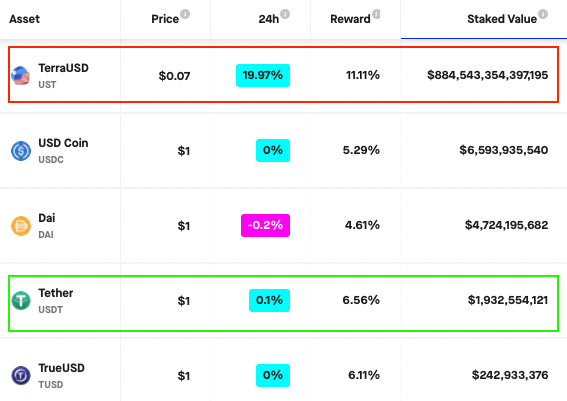

As you can see in the chart above, staking is a big industry. Currently, there are more than $56 Billion USD worth of coins staked in just the top 3 currencies that can be staked.

What went wrong with TerraUSD & Luna?

TerraUSD is a special kind of cryptocurrency - It's a stablecoin like Tether or USDC, which maintains a peg with another currency, like the US dollar. The working of TerraUSD is slightly more nuanced than other stablecoins, such as Tether which claims to be backed by bank reserves and loans that exceed the value in circulation. This is important because the whole purpose of a stablecoin is to provide stability, and everyone can be assured that they can convert their one stablecoin to $1 anytime they want to.

In the case of Terra, it was algorithmically connected to another cryptocurrency known as Luna. Both of them were tied to each other by an algorithm to maintain the value of TerraUSD, pegged to $11.

The problem with algorithmic stablecoins is that they have a high chance of failure2. It’s very hard to create an algorithm that can suitably handle all types of market swings. While we don’t have conclusive evidence yet, the most accepted explanation for the demise of TerraUSD and Luna is an unusually large withdrawal3.

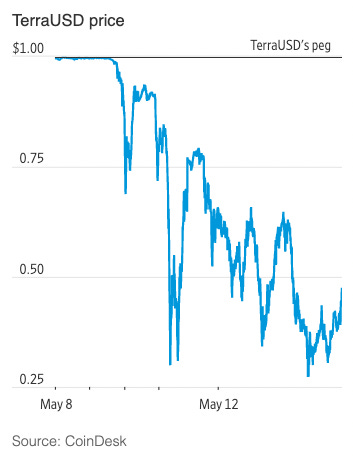

The best comparison would be that of a bank run. A $4 Billion withdrawal knocked TerraUSD value from $1 to 90 cents on May 9th. This sudden instability prompted other investors to sell their stakes as well. It created a cascading effect of more withdrawals and more selling, causing the crash.

In theory, this should have been stopped by the algorithm because when TerraUSD falls below $1, they can buy it at the depressed price and convert it to $1 in Luna. But this system only works if traders actually want Luna. When TerraUSD lost its peg, investors sold Luna also in a panic. It’s estimated that a total of $40 Billion was lost in the crash.

Should you Stake?

Given all that has happened, the million-dollar question is: where does it still make sense to stake your cryptos? Rather than going into the list of regular risks that you will face while staking your coin, what I want to cover is the differences in staking stablecoins vs other cryptocurrencies.

Staking cryptocurrencies

There are hundreds of cryptocurrencies that you can stake while earning a considerable reward. For e.g currently staking pancakeswap coin will net you a whopping 421% APY. Fundamentally, the math checks out as the key point here is that you will be getting your returns also in the same coin. If the coin appreciates in value during the period, your net APY would be higher, but on the other hand, if the coin goes to zero or drops in value, you will have to take that loss.

More established altcoins like Ethereum, Solana, Cardano, and Polkadot have a reward in the range of 4-6%, but the principle is essentially the same: The returns are paid in altcoins, which are volatile. Your return here is justified as you are holding a very volatile asset for a relatively long period of time and you end up getting paid in the same currency.

Staking Stablecoins

Unsurprisingly, the top staked stablecoin was TerraUSD which was offering up to 20% APY. The problem I have with staking stablecoins is that it’s technically offering a guaranteed return. In the case of Tether, they are currently offering 6.5% APY, and it’s pegged 1:1 to USD. So at the end of the year, if the peg is still holding, you are assured a 6.5% return in USD. This is much much higher than any bank is currently offering (The highest I could find for a savings account was a 1.02% APY).

A simple back-of-the-envelope calculation shows that at the current staked value and APY, Tether has to pay out 120M Tethers every year which is $120M if the stakers decide to withdraw. While we have no idea about how much Tether brings in Revenue, the only interesting info I could find was that Tether loaned $1 Billion to Celsius network for an interest rate of 5-6%. The obvious unanswered question here is: how is the company offering the same APY to both investors and lenders?

Adding to all of this, Tether has a long history of making sketchy financial decisions and has never allowed an independent audit firm to verify its claims.

Conclusion

Only when the tide goes out do you discover who has been swimming naked - Warren Buffet

The current bear market has definitely taken its first victim in TerraUSD & Luna. More importantly, it has shown chinks in the armor of the crypto world. Staking Crypto is definitely an interesting concept but it’s far from the magical risk-free returns that it claims to be. As for staking stable coins, I will stay as far away from them as possible until they

Until next week…

Disclaimer: I am not a financial advisor. Do not consider this as financial advice.

Footnotes

A list of previous algorithmic coins that failed - Iron, Neutrino, Basis cash (Created by Terra founder Kwon itself - talk about learning from your mistakes :P)

As Twitter user @dustintodd highlighted in one of the comments, “calling it an attack seems hyperbolic. Public markets have always had trading strategies that involve manipulating another trader’s position for gain. Markets are filled with adversaries, no strategy should assume that other participants will act in the best interest of others” - If your entire algo was created expecting fair play from others, it was never a good one to begin with.

If you enjoyed this piece, please do us the huge favor of simply liking and sharing it with one other person who you think would enjoy this article! Thank you.