Bear Market Strategy

What works and what doesn't

Welcome to the 426 investing enthusiasts who have joined us since last Sunday. Join 21,951 smart investors and traders by subscribing here. It’s totally free :)

Check out our - Best Articles | Twitter | Reddit | Discord

This week’s issue is brought to you by… me.

Hi folks, it’s been a year since I started this newsletter and your support has been incredible. I have some exciting plans to create additional content with deeper research and analysis. But I need your help to understand which insights would be most useful to you… I’ve put together a very short survey (promise!) for this. Do let me know what you think.

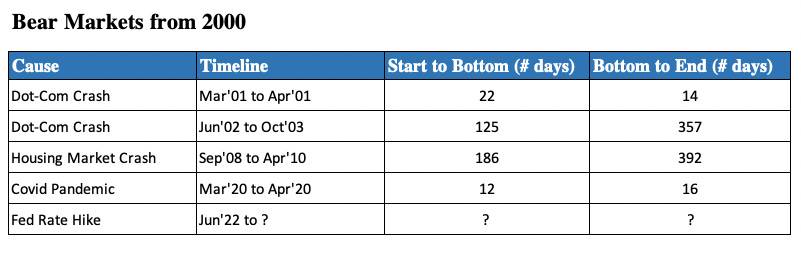

Bear markets are stressful times. It’s not easy to see your portfolio plummet in value. But there’s something even worse - the uncertainty about when things will be alright. It’s one thing to say that “the market is cyclical”, and “booms and busts are part of the game”, but sometimes you can’t even say for sure that a bear market is over. Here’s a breakdown of how bear markets have unfolded in the recent past. There is no clear pattern as to how long they can last.

Sometimes, bear markets can follow in quick succession - for example, consider the dead cat bounce rally that happened in April 2001. Just as investors thought the market was recovering, it proved to be a false alarm that was followed by a crash and an even longer bear market.

Of course, “buy the dip” is sensible advice - The market eventually has to recover right? But there’s another factor that we have to take into account. Not all people have the same life situation or investment goals.

Different approaches

Every investor’s time horizon is different. Investors nearing retirement or those with short-term goals would be looking to minimize their losses as the market crashes. As the market can take anywhere from two months to two years to recover, preserving capital is their first priority.

On the other hand, investors with a longer time horizon who know that a bear market must eventually end would be looking for ways to beat the market, and taking on extra risk would not be as much of a concern.

In this analysis, I’ll be trying to answer both these questions:

For investors with short-term goals, which sectors are worse affected than the S&P500 and see a higher drawdown? What should they avoid?

For investors with long-term goals, which sectors and assets provide higher rewards in exchange for higher risk?

First, let’s make sure we’re on the same page before we begin.

The baseline

The S&P500 is the benchmark for this analysis.

A bear market begins when there is at least a 20% decline in the S&P500 from a recent high and persists for at least a month. In the same way, a bear market ends when it crosses the 20% mark again and persists for at least a month. (This is to avoid considering short-term fluctuations as bear markets).

The S&P500 had an average drawdown of 39%. If an asset has a greater drawdown than this, short-term investors should probably avoid it.

In these timeframes, the S&P500’s returns will be nearly 0. If another asset has positive returns in the same period, it’s a good investment, and negative returns make it a bad long-term investment.

Let’s look at each of these in turn.

Minimize the downside

Sure, markets always recover. But is it wise to continue investing in sectors of the market that you know will be disproportionately affected? Some types of stocks do worse in bear markets in general without presenting a higher potential for gain.

When the market declines by 38%, sectors like Semiconductors, Industrial ETFs, and Financial stocks decline by an equal or greater amount - but they do not have greater returns to show for it at the end of the bear market.

Avoiding these sectors during a bear market could limit your losses.1 This is probably because the last few bear markets have overlapped with recessions, and highly capital-intensive sectors like the Financial and Industrial sectors might have been disproportionately affected.2

Safety - at a price

So, if you want to preserve your capital in the short term, where should you park your money? Stocks like consumer staples, healthcare, and utilities are attractive during the bear market and pundits claim that they are the safest alternatives. And sure enough, their drawdowns reflect the same.

The drawdowns of utilities, healthcare, and consumer staples are far lower compared to the S&P500 - Investing in these at the beginning of a bear market could conserve your capital in the short term. But it also comes at a price - you forgo the opportunity for long-term returns. Investors rush to these stocks considering them safe havens in times of turbulence, but when the market reverses from the bottom, these stocks drop in value when other sectors start gaining. (Almost all the stocks above have negative returns from the market bottom!)

This is also a good time to talk about Gold and Real Estate - especially because they are considered insurance for bad times. There’s some truth to that, but it’s tricky.

Gold is the only asset that has an inverse drawdown. When the market drops, its value rises by 4.4%! It also has a positive return if you had bought into it right at the beginning… But as the market reverses, gold is the asset that has the steepest drop in value - 22%. So buy early, but don’t keep buying.

Real estate has a slightly negative return in a bear market, but it also has a much lower drawdown than the market (by about 13%). Also, real estate ETFs have 16.5% extra returns compared to the S&P500 from the market bottom! Unlike gold, real estate is both a hedge and something that you could keep buying.

Now that we’ve looked at the “safe” options, let’s look at some high-risk, high-reward assets.

Maximizing the upside

Of course, if you’ve read your Warren Buffett, you know that bear markets are not just times of decline, but great opportunities to buy cheap when others are fearful. After limiting your losses, if you look at which investments have performed the best during a bear market, these are the results:

Tech is a high-risk, high-reward bet in bear markets. The QQQ ETF and the tech-heavy Nasdaq have seen massive drawdowns when the market takes a hit, but they have bounced back by more than 12% than the S&P500 on average! Tech ETFs have given a premium of around 6% over the S&P5003. When the market hits the bottom and starts to recover, these sectors provide the best opportunity for investing.

Consumer discretionary goods and Vanguard’s Mid-cap ETF VO have also performed well, though VO has been around for only a short time.4 Also, as discussed in the previous section, Real estate ETFs have high returns from the market bottom. But their overall returns in bear markets are slightly negative.

There’s a catch here. The difference in gains from the bear market bottom seems lucrative, but calling the bottom correctly is easier said than done! Investing in these sectors or index funds is not a magic formula or an alternative to investing in the S&P500. Rather, it’s just a guideline: When you think the bear market is coming to an end, getting additional exposure to these sectors in addition to the market can boost your returns.

Buying the dip is still the best strategy for long-term investors with a large time horizon. Just sticking to your plan and continuing to invest in the S&P500 will give you great returns - You can check out my detailed analysis below:

At the same time, if you are wondering whether getting exposure to certain sectors will add value to your portfolio, the answer is yes. Some sectors have a clear long-term advantage in a bear market, while you can resort to other assets to trade long-term returns for safety in the short-term. Use this information wisely to design a portfolio that matches your risk profile!

All data used in the analysis can be accessed here.

If you enjoyed this piece, please do me the huge favor of simply liking and sharing it with one other person who you think would enjoy this article! Thank you.

Disclaimer: I am not a financial advisor. Please do your own research before investing.

Footnotes

Another curious case is that of REITs - They had a huge drawdown in the previous bear market and did not recover enough to beat the market. But REIT ETFs have been around only for a short time, so the data is not enough to come to a good conclusion.

Interestingly, the returns of all these sectors from the bear market bottom to the bear market end are higher than that of the S&P500 (check full analysis). I would still not recommend buying them because these returns are valid only if you can time the bottom exactly - Easier said than done.

The price of these sectoral ETFs is being measured when the S&P500 hits the bottom, not at the minimum point of each ETF - There is a possibility that they might drop further. But that would mean that the potential returns when the bear market ends are higher, making regular investments more rewarding.

Growth ETFs, Small-cap ETFs, and Telecom ETFs had ambiguous results, and they have not been around for long enough to justify results. I have omitted them from the results.

The best return in a bear market selloff come from identifying stocks, not sectors, that completely overshoot. This means drawing up a list of potential buys and the prices you consider them to be attractive and wait until they come to you. The bottoms in bear markets are often V’s so you need to pay attention and not get caught up in the sentiment. For all indices note that the stocks that were the darlings of the previous bull market are not the ones that are going to be stellar in the future. The only safe place in a bear market are high dividend payers where the company have strong cash flows. Most people are going to put in the work on stocks, nor do they understand industry dynamics enough. Long term investors should keep putting money in but during the beginning of the decline stick to broad general indices and once these enough carnage boost weightings in high growth indices - Nasdaq and Emerging market because the upside will be greatest. Look at industries that have gotten crucified, like biotech,,and chose a fund that is actively managed as a sophisticated investor constantly upgrade the quality of the portfolio and most honestly, they only need one or two big winners to drive the funds performance. Market cap indices can disappoint if the largest components by market cap are unlikely to be the strongest performers in the future. Companies have life cycles and tech investors are going to see the mega tech companies dragging down tech sector performance in the future.

In any bear market, you need some cash to reduce volatility and to have ready in cash opportunities present themselves. Most investor should diversify and keep putting money in but change where money goes based on performance. Quite honestly, bear markets create changes in direction so investors need to forget about what we’re “good” areas and think about the future!