Betting on Betting

Winning with sin investing

Market Sentiment delivers data-backed, actionable insights for long-term investors. Join 55,000 other investors to make sure you don’t miss our next briefing.

A quick note — 98% of you voted yes for building more thematic equity baskets based on our GLP-1 deep dive. Here’s our research on building a betting portfolio.

If you are like us, you must have at least wondered once why everyone’s betting on everything. While traditional sports betting and casinos have existed for a few decades, betting seems to be out of control now:

People are betting on the color of the dildo that will be thrown at a WNBA game.

Here is a wallstreetbet “investor” losing $500K of his grandparents’ money in 30 seconds on Trump’s stock.

More than $3 billion was bet on the outcome of the Presidential election.

Oregonians are wagering millions of dollars on obscure table tennis matches played in Eastern Europe.

And the craziest — there is almost $1M betting volume on whether Jesus Christ will return in 2025 (2% chance as of now).

Gambling ads are everywhere, and with the legalization of event contracts and the overall lax enforcement, the market is only expected to grow.

Sin investing is a controversial investment strategy of investing in companies profiting from “sinful” services or products like tobacco, alcohol, and gambling. People almost always underestimate the amount of money these companies generate. For example, OnlyFans brings more revenue per employee than Nvidia, Apple, Google, and OpenAI combined!

The idea behind sin investing is simple — since these companies are screened out of most funds (as no one wants to be associated with them), it creates a pricing imbalance that active investors can exploit. Data supports this — Based on a 2022 paper, investing in these companies outperformed the benchmark index by a whopping 4% per year.

So, setting aside our moral qualms about gambling, we wanted to build a portfolio that benefits from the meteoric rise of the betting industry.

But before we do that, it’s important to understand

Why everyone’s betting on everything:

The best explanation is from Travis Kling, Founder and Chief Investment Officer of Ikigai Asset Management, who made a guest post on Market Sentiment on Financial Nihilism (I highly recommend you read the whole thing)

Here’s a TL;DR version (excerpts from the above report):

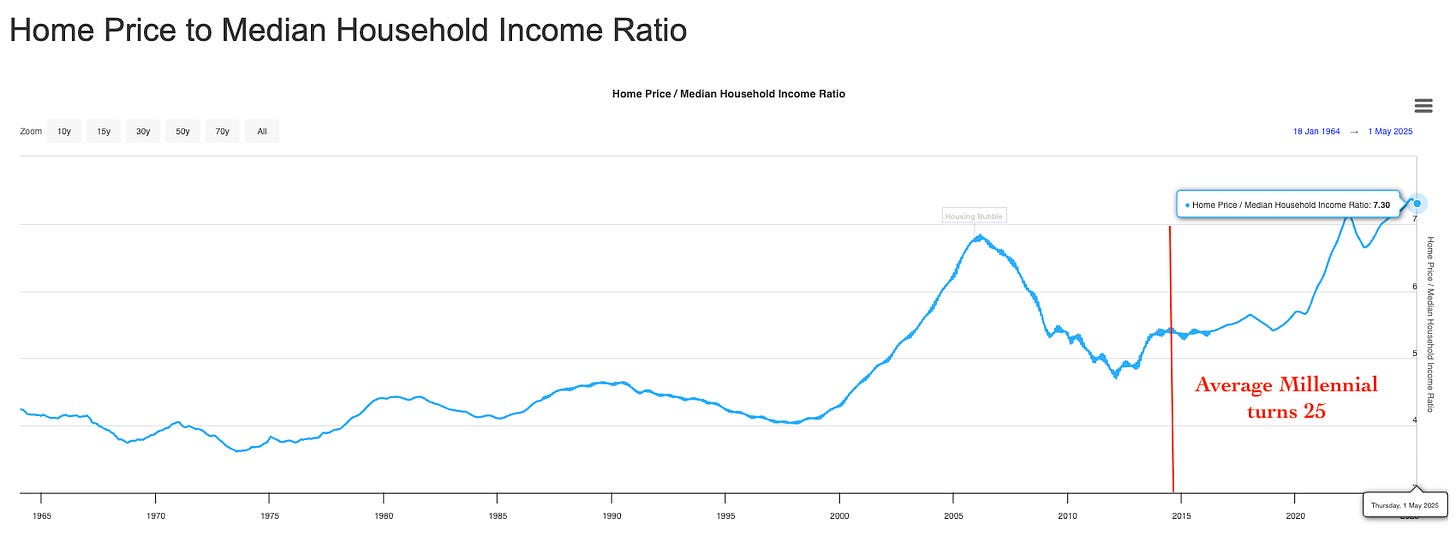

“Financial Nihilism” is the idea that the cost of living is strangling most Americans; that upward mobility opportunity is out of reach for an increasing number of people; that the American Dream is mostly a thing of the past; and that median home prices divided by median income is at a completely untenable level.

Housing

You can see that Boomers (and GenX) bought all the houses at about 4.5x their annual income. Then, subprime lending fueled the housing bubble, and the bubble collapsed. Not long thereafter, Millennials entered the workforce and got to the point where they could start buying houses at ~5.5x annual income. Then Covid happened, the Fed printed $6 trillion, and now houses are 7.5x annual income, much higher than even the peak of the housing bubble.

Simply out of reach for many millions of Americans under 40. The numbers just don’t add up.

Household Wealth

From 1989 to 2023, total US household wealth increased from $20tn to $143tn, a 7x increase.

Drilling down into these numbers, the rise of Financial Nihilism among young people is hardly surprising. In 2020, the youngest Millennials turned 25, and Millennials had a paltry 5% of total household wealth. Compare that to GenX – in 2005 the youngest Gen X’er turned 25, and their generation had already amassed 8% of all household wealth. Then compare that further to Baby Boomers – in 1989, the youngest Boomer turned 25, and by that point, the Boomer generation had gathered 20% of total household wealth.

Stock Market

Below is the ratio of Median Household Income to the S&P 500. Think of it as, “how many shares of the SPX can I buy with a year’s worth of median income?”

Back in the early ‘60s, you could get 94 shares of the SPX with the median household income. That peaked in the crash of 1982 at 219 shares and then structurally collapsed. The stock market is getting less and less affordable for the average American.

That’s the setup. The Boomers have all the money. The rich have been getting richer while the poor are getting poorer. The American Dream of upward mobility has been slipping out of reach for increasingly more people. Why do you think Oliver Anthony exploded out of nowhere into such popularity? That is Financial Nihilism. So if you’re like the large majority of Americans and you’re on the wrong end of this, what do you do about it?

You take bigger risks. You feel driven to take bigger risks to try and leapfrog from your current financial position (mostly paycheck to paycheck; buying a home feels nearly impossible; saddled with student loans; salary increases not keeping up with expense increases) to something more tenable. More comfortable. More baller.

So you gamble. You. F**king. Gamble. You look anywhere for anything that can give you a 5:1, 10:1, or 50:1 type of payout.

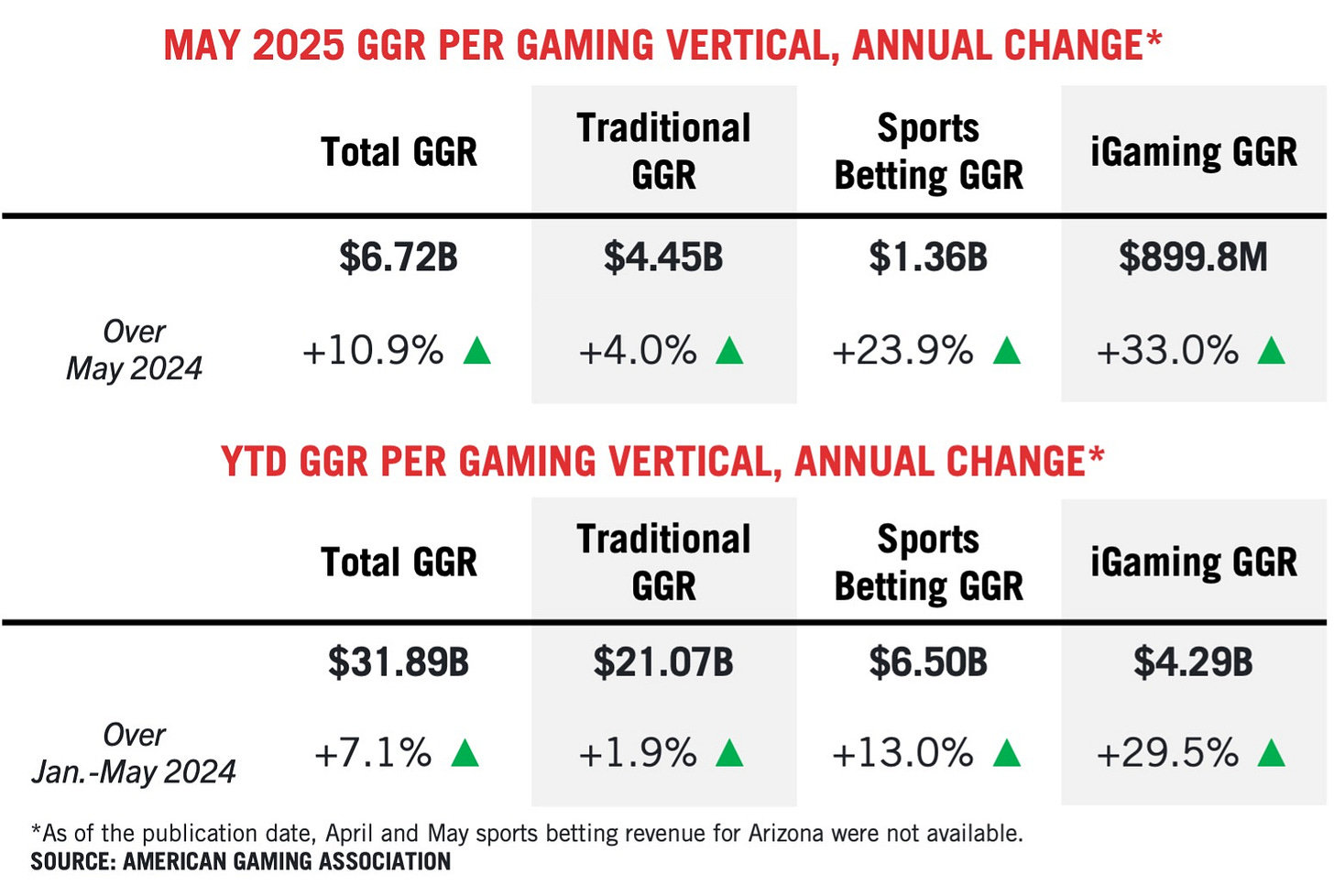

How does this work out for gambling companies? They are making record profits:

May commercial gaming industry revenue from traditional casino games, sports betting, and iGaming reached $6.72 billion, 10.9 percent higher than the previous year and the best May performance on record.

Of the 37 commercial gaming jurisdictions that were operational a year ago and had published complete May data, 35 reported an increase in combined revenue from traditional casino games, sports betting, and iGaming compared to the previous year.

Online gaming revenue – encompassing online sports betting and iGaming – expanded 28.8 percent, reaching $2.21 billion in May. Individually, iGaming revenue grew 33 percent, while online sports betting revenue grew 23.5 percent.

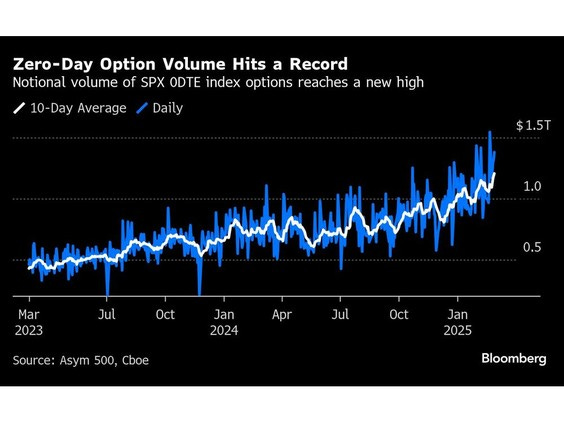

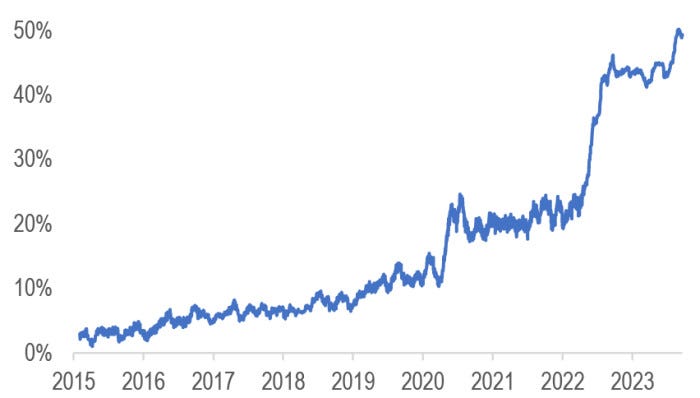

The trend is not limited to sports and gambling. You can see the same playing out in the stock market. In Feb 2025, contracts that expire within 24 hours made up a record 56% of the S&P 500’s total options volume — and it just keeps going up.

The above chart starts in 2023. Go back 10 years, and the growth in zero-day-to-expiry options (often just called 0DTE) is explosive.

When the numbers don’t add up, might as well swing for the fences even when you’re more likely to strike out.

Building a betting portfolio:

We can split our portfolio across four segments, all of which have seen explosive growth:

Online gambling: Sports betting, casino games, poker, lotteries, etc. had a 5-year revenue growth of 14x.

iGaming: Slighly narrower and includes only casino-style digital games such as online slots, blackjack, poker, and roulette. Currently, it’s legal only in a few states, but growth is staggering at ~30% CAGR.

Stocks/Crypto Brokerages: Platforms facilitating options/stock/crypto trades — After a pullback in 2022/23, growth has accelerated with a 20% jump in 2025.

Data providers/facilitators: Platforms supplying trading data feeds, event contracts, analytics, and infrastructure.

Betting Portfolio Performance

The portfolio we have put together reflects this staggering growth.

$10K invested into the betting portfolio 3 years back would have now grown to over $44K (63% CAGR) compared to $16K for the S&P 500 (17% CAGR).

Let’s dig into the portfolio holdings and allocation: