Betting on GLP-1

Buying the haystack

Hi there, this one is a bit different than our usual briefings. Please let us know what you think about this by responding to this email or by voting at the poll at the end.

Thanks to Rebound Capital for allowing us to reproduce the article here. There is no paywall on this report. Enjoy!

Investment Thesis

GLP-1s, also known as glucagon-like peptide-1, is a medication used for weight loss and diabetes management. In just 6 years after launch, more than 2% of Americans are taking this drug. To put the growth in context:

GLP-1 drugs are set to generate nearly double the U.S. revenue of the iPhone’s first 10 years.

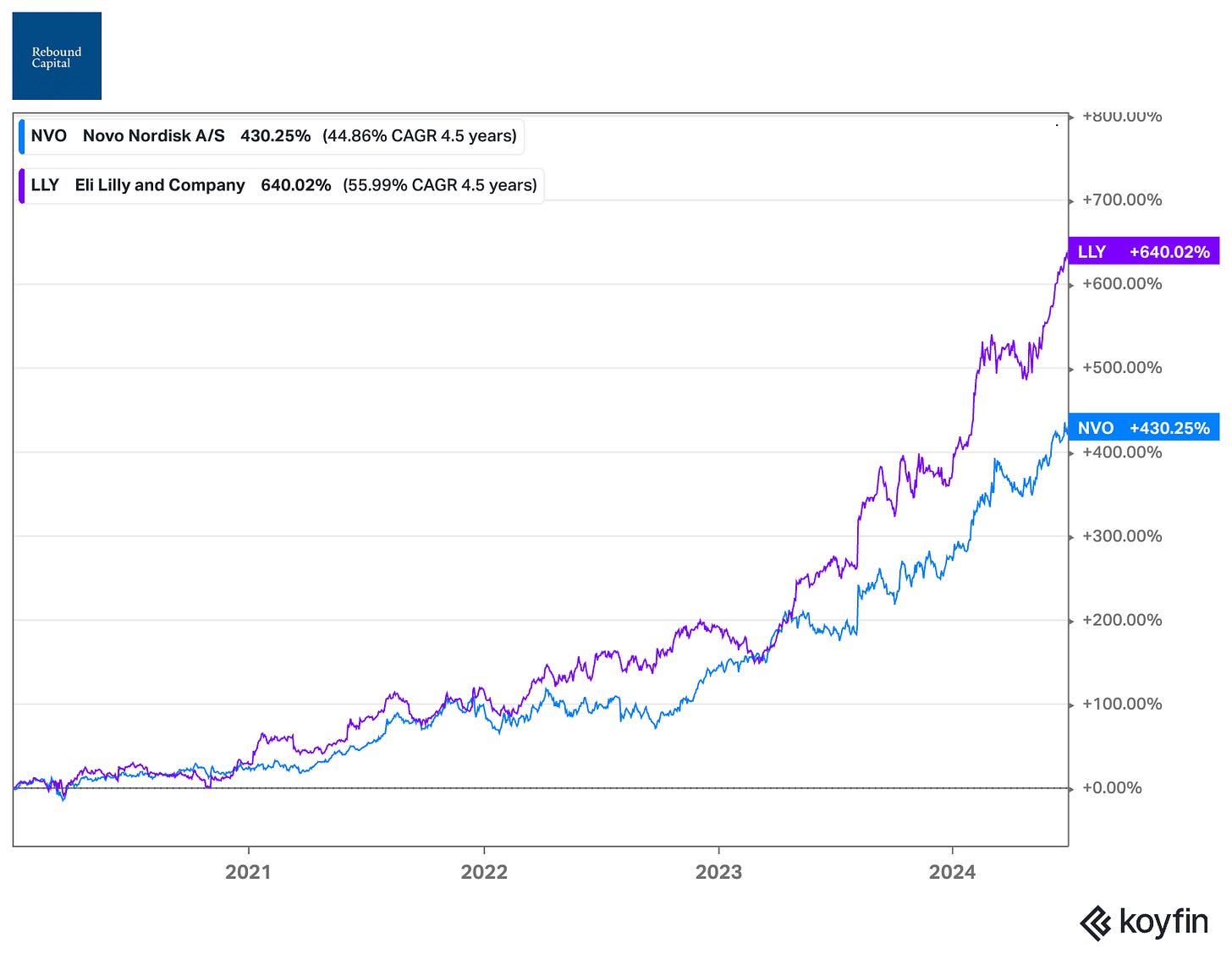

While both companies that have a monopoly on these drugs (Novo Nordisk and Eli Lilly) have enjoyed an incredible run-up from 2020 to 2024, both are now in a drawdown. Novo Nordisk is down 50% due to competition from Eli Lilly, and Eli Lilly is down 15% due to Novo Nordisk & rising price competition.

However, combined, they control over 90% of the GLP-1 market, both globally and in the U.S. The cherry on top is that neither of them can currently produce enough medicine to meet the demand.

With an estimated $130 billion market by 2030, I believe that the market is overreacting to the current short-term issues. Once you dig past the surface-level concerns, GLP-1s might be one of the fastest-growing high-margin products in the next decade.

In our first-ever thematic equity basket, let’s take a look at the GLP-1 market, its players, and how to build an optimal GLP-1 portfolio.

Here is the index to help you navigate:

What are GLP-1 Drugs?

Do they work?

How big is the market?

Who are the players?

Why is the market down now?

How would the next 5 years look?

Building a GLP-1 portfolio

What are GLP-1 Drugs?

GLP stands for Glucagon-like peptide. Simply put, it’s a hormone released by the small intestine in response to food arriving in the gut. Once it enters the bloodstream, it slows the rate at which your stomach empties, allowing you to feel full.

GLP-1 drugs mimic the effects of this hormone. GLP-1 agonists1 help the pancreas release insulin, reduce excess glucagon (a hormone that raises blood sugar), slow down digestion, and signal the brain to increase fullness and reduce hunger. The combined result is improved glucose control and reduced calorie intake, resulting in weight loss.

By making patients feel less hungry and more satisfied, GLP-1 therapies significantly help with weight loss. For example, people on these drugs tend to eat less due to reduced appetite and early satiety.2

Do they work?

Given the snake-oil nature of weight loss claims, the billion-dollar question is whether these drugs work.

The FDA-approved answer is yes3. Data show that both FDA-approved drugs, Wegovy from Novo Nordisk and Zepbound from Eli Lilly, are highly effective. Over 1.5 years, patients who took Zepbound lost ~21% of their body weight, and an incredible 83% of them lost more than 10% of their body weight.

To see its real-world impact, just browse through the Ozempic subreddit, and you will see some incredible transformations.

The obvious next question is whether these drugs are safe, as losing weight by popping a pill4 seems too good to be true.

Fortunately, this is a case where you can have your cake and eat it too (get it!) — Unless you have a phobia of needles. One downside of the current generation of GLP-1 drugs is that they have to be administered using an injector. Both companies are working on a pill version that would be more palatable for patients.

The most common side effects of GLP-1 drugs are gastrointestinal and mild, particularly when starting treatment. Common side effects include: loss of appetite, nausea, vomiting, and diarrhea. In fact, the drug is so effective that patients stop eating so much that protein supplements are recommended to maintain their muscle mass.

How big is the market?

As expected, the market for these drugs is exploding. We went from ~$4bn in sales in 2020 to ~$35 billion last year. In total, GLP-1 drugs have generated a cumulative $71 billion in the U.S. over the past five years. Projections now estimate that the cumulative revenue will surpass a staggering $470 billion by 20305.

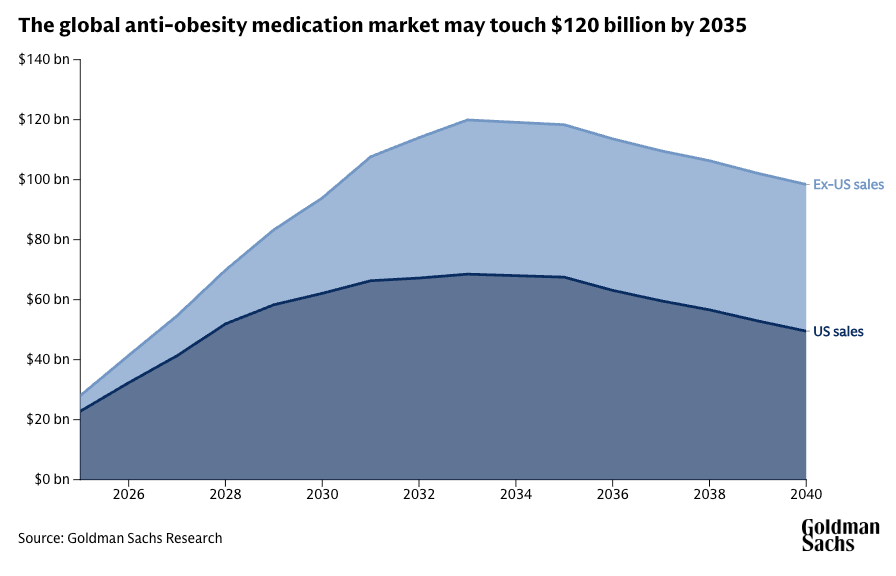

Morgan Stanley estimates that ~9% of the U.S. population will be taking these drugs by 2035, and the market would cross $100 billion by 2030. Even the muted prediction from Goldman Sachs expects the market to reach $95 billion by 2030.

The cherry on top (from an investment perspective) is that GLP-1 drugs are comparable to Thyroid/Diabetes medicine in the fact that once you start, you will be in it for the long haul. Even after reaching the target weight, the patient will still need to be on a maintenance dose to ensure they don’t regain the weight.

Data shows substantial weight gains once they stop using the drugs.

Who are the players?

Novo Nordisk (Denmark) and Eli Lilly & Co. (USA) are currently the only two companies with GLP-1 medications approved for chronic weight management in the U.S.

Novo Nordisk is the market leader:

Ozempic (weekly injection for type 2 diabetes)

Wegovy (higher-dose weekly injection for obesity)

Rybelsus (Oral tablets for diabetes — Oral tablets for weight management is in phase 3 trials)

Eli Lilly is the other major player:

Mounjaro (weekly injection for type 2 diabetes)

Zepbound (higher‑dose weekly injection for obesity)

This duopoly meant that both stocks had an incredible run-up from 2020 to 2024. Eli Lilly was up 640% and Novo Nordisk was up 430%.

Both Eli Lilly & Novo Nordisk are working on their versions of an oral pill for weight management. Other big (aka investable) companies in the GLP 1 race is:

Amgen

Amgen is developing MariTide, a monthly injectable, currently in Phase 3 trials. Amgen’s Phase 2 trial of MariTide showed remarkable efficacy: non-diabetic patients lost ~20% of body weight in 52 weeks (vs just 2.6% for placebo). Notably, weight reduction had not plateaued by 52 weeks, indicating potential for further loss with longer use. It would be the first GLP-1–based obesity therapy requiring only monthly injections. FDA approval is expected by 2027.

All the other companies (Viking Therapeutics, Structure Therapeutics, Altimmune, etc.) have either just completed Phase 2 or are still in Phase 2, which means any results will take years to materialize.

Why are the GLP 1 stocks down over the last year?

As I highlighted at the beginning, both Eli Lilly and Novo Nordisk have been in a drawdown over the past year.

Novo Nordisk

The stock has lost 50% of its value in the last year due to a combination of factors:

In Q1 2025, U.S. Wegovy scripts were essentially flat quarter-to-quarter, even as supply was raised.

Investor concern is that the company is losing market share to its US rival Eli Lilly, which makes the diabetes and obesity drugs Mounjaro and Zepbound.

Finally, late-stage trial results for its new GLP-1 combination drug, cagrisemaglutide (CagriSema), disappointed investors. CagriSema produced ~22.7% weight loss (vs. a 25% target) at 68 weeks, well below expectations.

Eli Lilly

The stock is down 15% over the last year.

CVS dropped Eli Lilly’s obesity drug Zepbound from the list of medicines it covers for reimbursement. Losing this status meant less automatic reimbursement and fiercer price competition with Novo Nordisk’s weight loss drug.

Lilly started selling the two highest Zepbound doses online for $499/month, well below list price, to win self-pay patients and blunt compound-pharmacy copies. This could cause a drop in the average selling prices for the drug.

What will the next five years look like?

While predicting the exact future is a fool’s errand, it’s easy to identify some secular trends that will play out over the next 5 years.

The market — Obesity and type-2 diabetes remain expanding markets. Novo’s own data show its obesity-care sales up 56% and global obesity drug demand up 119%. As we saw earlier, almost all major investment banks expect the obesity drug market to grow past $100 billion by 2030.

Pipeline — Other than Novo Nordisk and Eli Lilly, only Amgen6 and Viking Therapeutics have a weight loss drug that is in phase 3 trials. Even then, the initial results are expected by the end of 2027, and FDA approval and market penetration might take time.

On the other hand, Novo Nordisk has already submitted its oral weight loss pill to the FDA for approval, with results expected by the end of this year. Eli Lilly is also not far behind and is expected to submit its FDA application by the end of this year/early next year.

The compounding pharmacy issues — Because of huge demand and chronic shortages of Wegovy and Mounjaro, compounding pharmacies started making their own versions of semaglutide and tirzepatide. These were often sold for as low as $199/month, compared to $900–$1,300/month for branded drugs like Wegovy or Zepbound. The FDA allowed this under a “shortage exception” clause in Section 503A of the FDCA, which permits compounding if the branded drug is on the FDA’s shortage list.

This meant that patients and doctors switched to cheaper compounded versions. But now that the shortages are almost over, the FDA and State boards have been actively cracking down on compounding pharmacies. As supply improves, these compounded versions are no longer legally allowed, making the loss temporary.

Supply issues — Making the GLP-1 drug is a multi-step process, which is slow and capital-intensive. The unprecedented surge in demand meant that all parts of the supply chain were stretched to the limit, to the point where even auto-injector pens were in short supply. Both companies have heavily invested in improving their supply chains and manufacturing capacity over the past few years. As of today, the FDA confirms that shortages are over for the main weight loss drugs7

This means that, at least for the next few years, secular trends are in favor of Eli Lilly and Novo Nordisk, barring concerns about their current valuations and price competition between them. That brings us to:

Building a GLP-1 portfolio

Core drug developers | 88%

Unsurprisingly, the majority of our investment must be allocated to the core drug developers.

Novo Nordisk — 45%

The company gets a higher allocation purely due to a more palatable valuation. The last time the company traded at a sub-20 P/E was in 2019. To put this in perspective, to justify their current valuation, they only have to grow their topline by ~7% for eight years while the overall obesity care market is expected to grow by ~26% CAGR!

Regarding the risks, there is no patent risk, as the core patent is expected to expire only after 2031. However, even though Novo has the first-mover advantage and market dominance, Eli Lilly’s drugs offer superior weight loss (Eli Lilly: ~20% vs. Novo: ~16%), and Eli Lilly has proven its ability to scale production quickly.

Eli Lilly — 35%

A better product does not always mean that it will become more popular. For example, if I am a patient looking to lose 10% of my body weight, the decision on which medicine to use might finally come down to price and its side effects rather than overall efficacy.

While the company has always traded at a premium valuation given its product mix, right now it’s trading at a P/E of 61. If it has to “grow into” this valuation with an exit P/E of 25x by 2030, it should grow its EPS by 20% CAGR. While it’s a tall order, it’s achievable given the pace at which the market is growing. Purely from a value perspective, we should be even more underallocating here, but I feel that we might be betting on Novo Nordisk a bit too much.

Amgen & Viking Therapeutics — 8%

Given that our portfolio is built for the next 5 years, it makes sense to allocate a small portion to possible new entrants. Amgen and Viking Therapeutics are the closest competitors that might receive FDA approval in the next few years. If one of them does get it quickly, we hedge the risk from the inevitable drop from Novo and Lilly.

Supply Chain and Delivery | 7%

While clearing the supply-chain bottleneck might be a great catalyst, we allocated only 7% as it’s challenging to attribute a 1:1 impact to the GLP tailwind for these companies' stock prices, as they are involved in other businesses as well.

Ypsomed Holding has a long‑term autoinjector supply deal with Novo Nordisk.

Gerresheimer AG provides autoinjector & cartridge deals for Wegovy/Zepbound.

Stevanato Group supplies glass barrels & moulds, and management has cited a mid‑single‑digit share tied to GLP‑1, which is growing fast.

ThermoFisher provides contract sterile fill–finish for Wegovy.

West Pharmaceutical provides elastomer stoppers for pens. Management has stated that GLP‑1 contributes to mid‑single‑digit sales.

Distributors | 5%

The strategy for distributors is to gain lower-beta, volume-driven leverage to the GLP-1 boom without taking direct pipeline or manufacturing risk. McKesson gets the higher weightage as GLP‑1 scripts already account for roughly one‑eighth of its revenue and are the single biggest contributor to its recent profit upgrades. It does not make sense to allocate more, as the upside for the distributors is limited.

GLP-1s sit at the rare intersection of unmet medical need, proven efficacy, and explosive demand — Conditions investors chronically over-estimate or under-estimate based on the past few quarters’ growth trends.

And the past few quarters have been tough for the GLP market with rising price competition and supply chain issues. But none of these issues will dent the simple math that a $35 billion category today will triple before the decade is out — And rising tide lifts all boats.

Footnotes

An agonist is a drug (or other substance) that binds to a specific receptor in the body and “turns it on,” triggering the same biological response the natural molecule would.

Weight Loss and Maintenance Related to the Mechanism of Action of Glucagon-Like Peptide 1 Receptor Agonists — Source

In both trials, after 72 weeks of treatment, patients who received Zepbound at all three dose levels experienced a statistically significant reduction in body weight compared to those who received placebo, and greater proportions of patients who received Zepbound achieved at least 5% weight reduction compared to placebo. — FDA

Not in the pill form right now but lets’s go with it.

The heavy price of GLP-1 Drugs | Source: i-mak.org

I was surprised that you provided a 12 stock suggested portfolio. This is rare. Overall I was quite impressed with this presentation.

Advocates of efficient markets would say that these facts are known and already priced into the market for each stock. There are reasons both to believe that and not to believe it. I don't buy individual stocks - but I do appreciate the insights and quality of the argument that was made. So, not my cup of tea, but very well brewed just the same.