Can past performance predict the future outperformance of Mutual Funds?

Here's what happens if you invest in the top 10% mutual funds based on their past year's performance

Mutual funds that performed the best in a particular year receive the highest investment inflow the following year.

But can past performance predict future outperformance?

Here's what happens if you invest in the top 10% mutual funds based on their past year's performance:

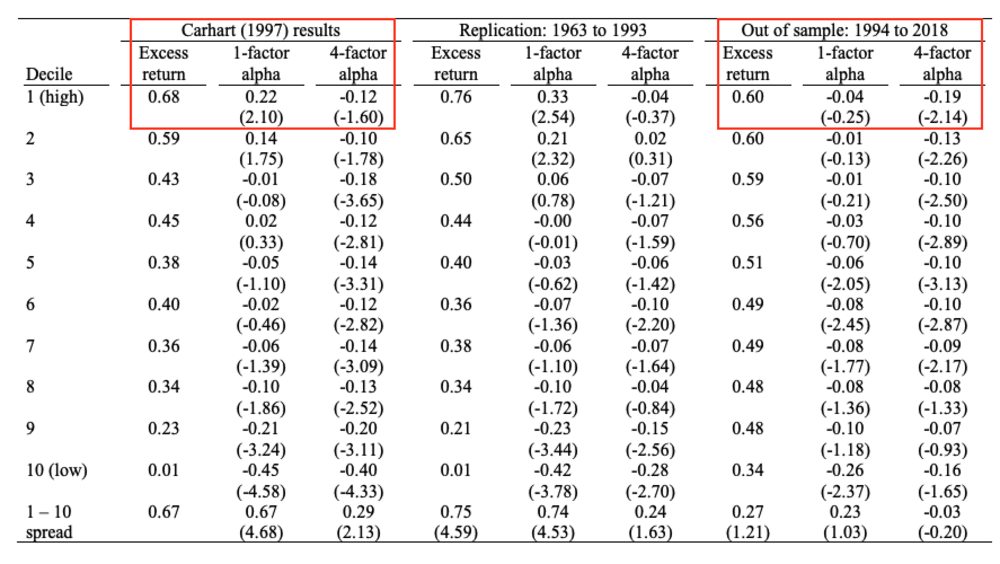

Mark Carhart published his seminal study on this in '971 and found that past-year performance positively predicted the U.S. equity mutual fund's future performance. The top 10% of the funds from the previous year outperformed the bottom 10% by 0.67% per month! (1963 - 1993).

Carhart attributed this alpha predominantly to individual stock momentum. Momentum investing is well-proven, and funds with outperformance tend to hold high-momentum stocks. Fund managers rarely sell their winners, and the momentum effect carries over to the following year.

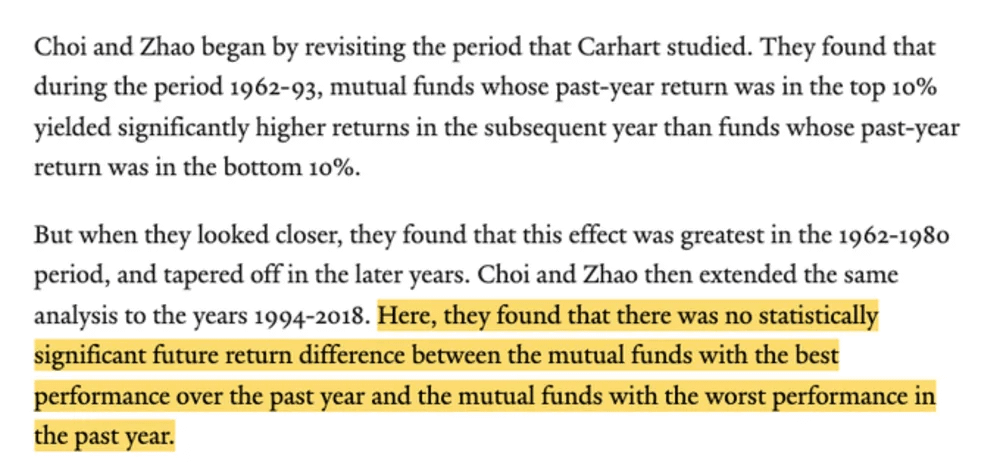

But, as you would have already noticed, this study was done more than 25 years ago. So, does this trend still hold? - unfortunately, no. Recent research from Yale University2 shows that from 1994 to 2018, the best-performing mutual funds did not produce any alpha.

They replicated the research done by Carhart and expanded it till 2018. While the outperformance was present from 1962-93, there was no statistically significant return difference between mutual funds from 1994. You will do worse if you chase past returns.

As for the returns, the difference in the 10-year rolling alpha of the top and bottom 10% mutual funds has declined over time, and after 2012, the bottom decile funds are performing marginally better.

Data, References, and Footnotes

On Persistence in Mutual Fund Performance — Mark M. Carhart (open access)

Did Mutual Fund Return Persistence Persist? — James J. Choi & Kevin Zhao (open access)

Thank you for reading. Market Sentiment is now fully reader-supported. A lot of work goes into these articles, and if you enjoyed this piece, please hit the like button and consider upgrading your subscription to access all issues. (20% off for annual subscription)

Tell us more about momentum investing.