Changing Winds

top-down or bottom-up?

Two of the popular approaches to investing are top-down & bottom-up investing. Top-down investing involves looking at the big-picture macroeconomic factors such as interest rates, unemployment rate, GDP growth, etc. to make investment decisions whereas bottom-up investing mainly focuses on company-specific fundamentals like financials, earnings growth, company management, etc.

As you can expect in the investing world, both approaches have fierce supporters that swear by their method! Value investors like Warren Buffett have gone on the record to state that even if he knew the Fed’s exact interest rate moves two years in advance it still wouldn’t make any difference to how he would invest today. On the other extreme, we have investors like Alf who religiously track all macro movements to make investments.

While there is no one size fits all approach to investing, American Hedge Fund investor David Einhorn neatly reconciled the importance of combining both these philosophies in the aftermath of the 2008 crash. (emphasis added)

At the May 2005 Ira Sohn Investment Research Conference in New York, I recommended MDC Holdings, a homebuilder, at $67 per share. Two months later MDC reached $89 a share, a nice quick return if you timed your sale perfectly. Then the stock collapsed with the rest of the sector. Some of my MDC analysis was correct: it was less risky than its peers and would hold up better in a down cycle because it had less leverage and held less land. But this just meant that almost half a decade later, anyone who listened to me would have lost about 40% of his investment, instead of the 70% that the homebuilding sector lost.

The lesson that I have learned is that it isn’t reasonable to be agnostic about the big picture. For years I had believed that I didn’t need to take a view on the market or the economy because I considered myself to be a “bottom-up” investor. Having my eyes open to the big picture doesn’t mean abandoning stock picking, but it does mean managing the long-short exposure ratio more actively, worrying about what may be brewing in certain industries, and when appropriate, buying some just-in-case insurance for foreseeable macro risks even if they are hard to time. - David Einhorn

It was missing a similar trend that brought down Long Term Capital Management (LTCM). The team was built up of Nobel laureates and their state-of-the-art model estimated the risk of each investment individually, but they did not foresee a situation where all the investments would fall together. LTCM was leveraged 250 to 1 and when they posted their first losses in 1998, all their positions started getting margin calls. By the end of 1998, it was worth nothing and the Federal Reserve had to step in to bail out with $3.6 Billion.

While the word unprecedented is thrown around a lot, we are now facing 40-year high inflation, staring down at a possible recession, and Fed is increasingly moving away from the world of zero interest rates. Given this, the best investment strategies would involve taking the best from both the top-down and bottom-up approaches.

The Concerns

Howard Marks, Chairman of Oaktree Capital Management, recently released a memo highlighting key macro conditions changes. If you are a macro enthusiast, the entire memo is worth a read.

It’s near impossible to cover all the factors in a single issue. But in classic Pareto fashion, we are taking a look at arguably the 2 most important factors - Fed rates and inflation.

What’s the Fed doing?

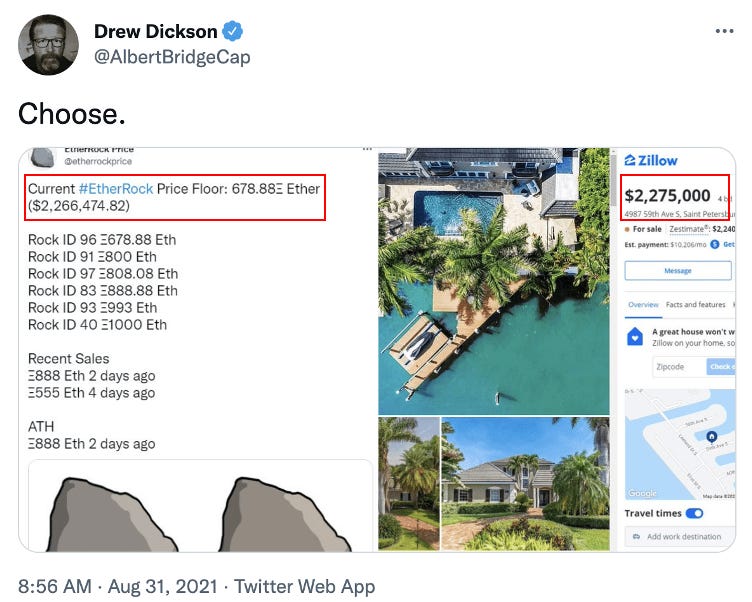

One of the key arguments made for the phenomenal performance of the stock market over the last few decades is that low-interest rates predominantly drove it. After peaking at ~16% in 1980, the rates have only trended one way - down! As our friend Jack Raines so aptly captured, a decade of quantitive easing and near-zero interest rates pushed investors’ risk tolerance sky-high. They were trading images of a rock at the same value as an actual waterfront property in Florida.

Now, after 40 years of decline, the Fed has stepped on the pedal and the interest rate hikes are now the fastest in recent history. With cash deposits now getting ~5% return and I-bonds returning equity-like returns of ~7%, more and more investors would be moving away from the stock market. And with the real interest rate still negative, it’s unlikely that the Fed will reverse its course anytime soon.

So why not keep interest rates low forever?

When interest rates are low, money is cheap and businesses have easy access to credit for expansion, which creates jobs and stimulates economic growth. When interest rates are high, businesses cut back, demand slows down and folks get laid off. So why not keep interest rates low forever? Well, we are living through that answer right now. When the Federal Reserve keeps interest rates low for an extended period, the economy overheats and people spend more, resulting in inflation.

2021-22 saw one of the highest spikes in inflation in recent history as everyone started spending the savings amassed during the pandemic. To add fuel to the fire, the supply side was extremely hampered due to the Covid restrictions.

But we can now almost see the light at the end of the tunnel with inflation steadily declining from its peak of more than 9% in June of 2022, to 6.5% now. That’s still high, but it’s gradually trending downwards. This is reflected in the recent fed hikes as well with the Fed reducing its rate hike to 25 basis points.

"The only function of economic forecasting is to make astrology look respectable" - Kenneth Galbraith

Dylan Grice, former Société Générale strategist did this interesting experiment where he plotted the 3-month changes in dollar exchange rates for both forecast and the real price. What he found out was that the forecast associated with the exchange rate variations always followed a normal distribution. But, the actual variations had wild swings that none of the analysts forecasted.

The problem with economic forecasts is that unless you are Micheal Burry (who is more often wrong than right), most analysts issue only mild forecasts. Rarely do someone want to put themselves out there with a bold prediction and risk their reputation with an out-of-pattern call.

Rise of Fundamentals

If it’s a fool’s errand to predict the macroeconomic conditions, what’s the use of a top-down investing approach? - It makes you focus on the stock fundamentals. At near-zero interest rates, you can project all your earnings to the future and give whatever valuation to the company. Case in point - Rivian had a $100B valuation before ever selling a single car!

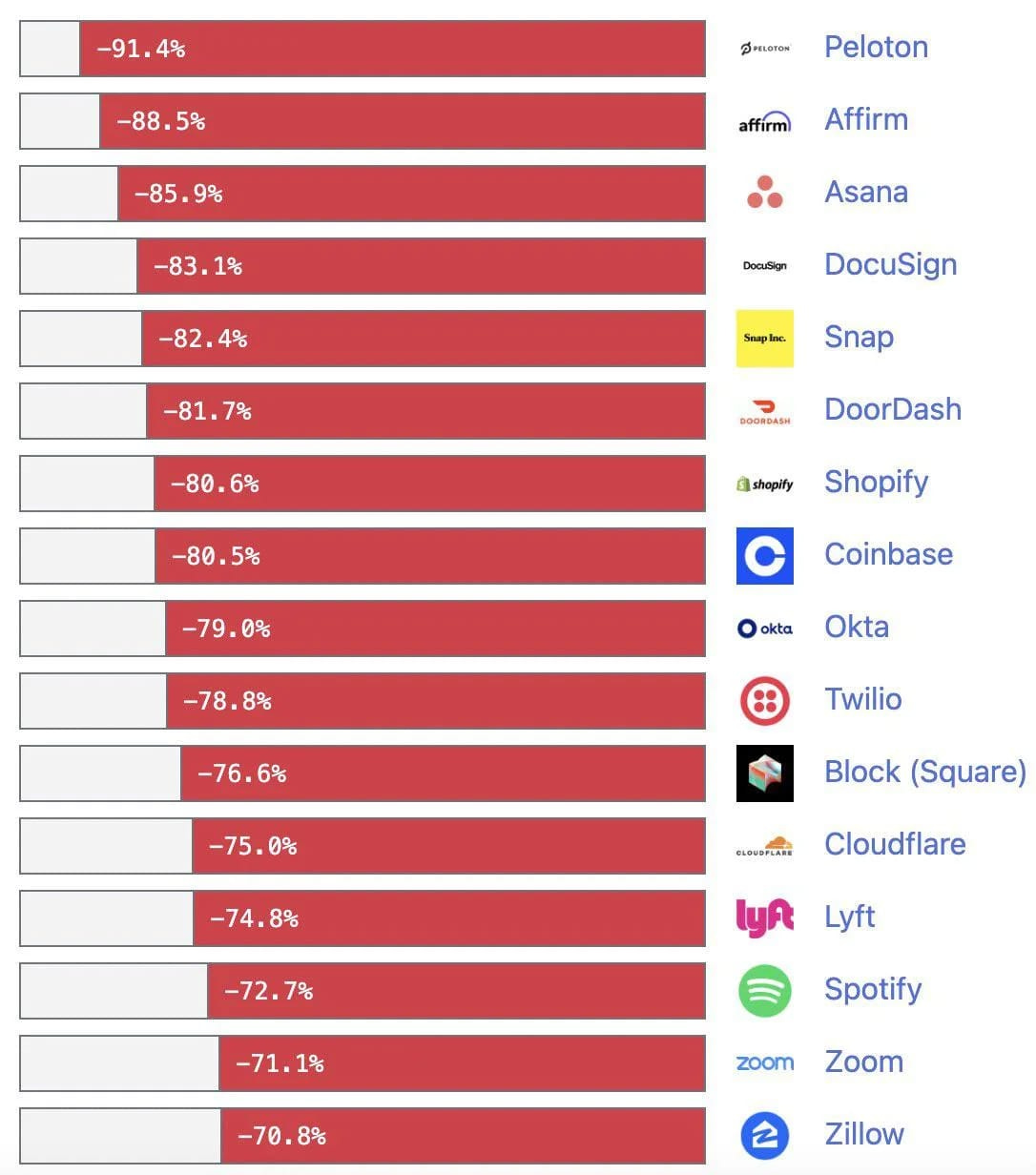

All of this came crashing down once Fed started hiking its interest rates. Investors no longer valued the hypothetical future cash flow from growth stocks when they could get assured 7% return by investing in bonds. And the results were not pretty!

For 2023 and beyond, fundamentals would be far more important in driving stock returns than any changes to the interest rate. Look for investments that have shown strong and consistent earnings growth and only invest in growth stories if you can hold them for a long time.

Now that 10,000 more of you have joined since we last did our favorite thought experiment, here is why you should always focus on the fundamentals:

Assume that you have ownership in a company, and the following are some of the key metrics of the company over the past 10 years.

Personally, we wouldn’t. It definitely looks like a healthy business. The company has consistently increased its revenue and more importantly its Return on Equity (ROE). The margin is stable and the EPS has also gone through a 3x rise in the past decade.

Now let’s look at the same company via the stock price lens. Every year the drawdowns fluctuated somewhere between -5% and -36% (Even if you remove the Covid crash, it’s still had an average max drawdown of -13%).

This is incredible - Even though the business had solid fundamentals and great growth, the market conditions and sentiment caused the stock to fluctuate. Imagine holding the business when it’s down 20% but the market is up 10%. You will start to question your investment decision and make all kinds of rationalizations to get out of the stock.

The company in our thought experiment was UnitedHealth Group. It would have generated over 1,000% return for you over the past decade if you had just held on to the stock disregarding the yearly fluctuations and quarterly reports. The problem is that the current format of reporting heavily focuses on stock prices. You will never see in the news a snapshot of key business metrics - It’s always alarmist-sounding narratives that the stock is down 15% from its ATH or that the company missed some arbitrary earnings estimate.

Even Warren Buffet changes his mind when he sees an opportunity. In 2008, Buffett himself joked that investors would be better off if a “farsighted capitalist had been present at Kitty Hawk [and shot] Orville down.” (he was talking about the airline industry)

However, over the next several years, the airlines underwent a series of mergers. By 2016, the big four airlines had 80% of the domestic market. In response, Buffett took a 10% stake in all four companies (Buffett loves monopolies). So much for not using the top-down approach!

We agree with David that it isn’t reasonable to be agnostic about the big picture. No matter how good your investment is, if the entire sector is going down, it’s really hard to come out on top. The best approach would be a combination of top-down and bottom-up where we first understand the big picture with the top-down approach and then drill down on the fundamentals using the bottom-up approach to pick the best possible investments.

Market Sentiment is now fully reader-supported. If you enjoyed this piece, please hit the like button and consider upgrading your subscription to get access to all issues (the last 3 premium analyses - Motley Fool Performance, Investing in moats, The Cockroach Portfolio).

Disclaimer: We are not financial advisors. Please do your own research before investing.

Great article, enjoyed reading it.