How Congress Traded in 2021 - Part 2

A deep-dive into the stock trades and investment returns generated by the U.S Representatives in 2021

Hey everyone, this is Part 2 of the Congress trading analysis. If you missed Part 1 on Senators, you can find it here.

This issue of Market Sentiment is brought to you by… Titan

Ready to ride shotgun with an award-winning investment team?

Let’s face it—most of us can’t give our long-term wealth our full attention. Wouldn’t it be nice to let the experts do the research for you?

At Titan, our team of in-house experts manages your capital on your behalf—while keeping you updated and educated along the way. You’ll always know what you’re invested in, and why.

Choose from our Flagship, Opportunities, Offshore, and Crypto portfolios—and we do the rest. Our portfolios are managed by a dedicated team of analysts who eat, sleep, and breathe the markets—so you don’t have to.

Our aim is to make you the smartest, wealthiest long-term investor you’ve ever been.

Getting started takes minutes. Join the 35,000 clients who trust Titan with over $750,000,000 of their hard-earned capital.

In the fall of 2020, Pew Research released a report which showcased something that we knew all along, deep down. 2/3rd of Americans believe that most politicians are corrupt. This is in stark contrast to Germany where less than 1/3rd feel the same way.

One of the issues at the forefront of the alleged corruption is the ability of elected representatives to trade stocks. The issue of how to prevent Congress from using insider knowledge to trade has been under discussion for more than a decade now. Even though the Stock Act was passed in 2012, it did very little to combat the issue.

What’s hilarious is that lawmakers who violate the Stock Act only face a standard fine of $200 (which also gets waived by Senate and House officials). Here is a report by Insider that highlighted 54 members of Congress that have violated the Stock act in just 2021.

There is an ever-growing push to ban members of Congress from trading stocks, but, we do not know if it’s going to be successful this time around. While we wait for the results on the Bill, let’s see how the Representatives have performed in trading last year.

Data and Analysis

Since both of these parts were already covered in the last analysis, I won’t be going into details. The data used in this analysis was pulled from Capitol Trades and only the transactions that happened in 2021 were considered as part of the analysis.

We will be focusing mainly on the Buy-side of trades done by Representatives.

Results

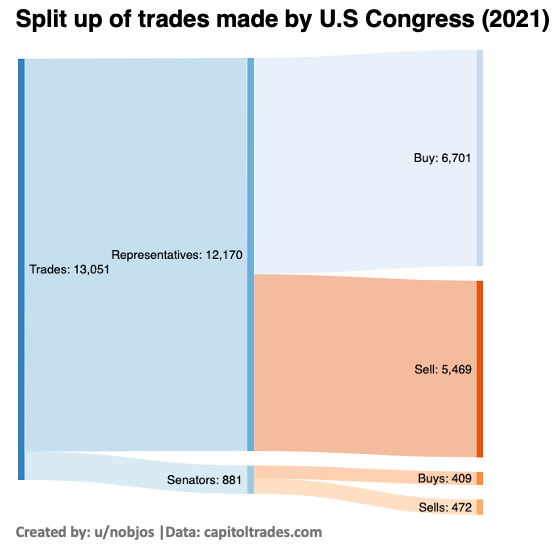

A total of 96 Representatives made a whopping $273MM1 worth of investments last year. In stark contrast to the Senators, whose stock investments only came to 12% of the total, Representatives had 82% of their investments focused on stocks and stock options.

As for the returns, Representatives had slightly lesser returns when compared to Senators making an 8% return on average. This is significantly lesser than what the market would have returned during the same period. Following these trades would also not have generated any alpha as you would have only got a 5% return when compared to the 9.6% return generated by the market during the same period.

But that’s definitely not the full story. Even though on average Representatives lagged the market, there were some outliers that beat the market and then some.

Nancy Pelosi made a 48% return last year investing $970K in NVIDIA in July and $695K in Roblox in March. What’s even more interesting is that these returns are just considering the stocks she bought last year and not including the options returns2.

But on the matter of whether to restrict trading by lawmakers, this was Pelosi’s response

We are a free-market economy. They (Congress) should be able to participate in that. - Nancy Pelosi

Well, I would also be a strong proponent of the ‘free-market economy’ if I was beating the market by more than 30% every year. Other heavy hitters included Suzan Delbene who invested more than $15MM and got a return of 21% and Kim Schrier who invested $1.1MM and made more than 20% in one year3.

Finally, one of the most requested items on the last analysis was the industry distribution of the investments. While Tech got the maximum allocation, what was surprising was the average returns generated. The maximum returns were obtained from Finance and Real estate even though 2021 was very good for tech and growth stocks.

Limitations

Although I had highlighted the limitations of the analysis last time, I felt that it was important to call them out again.

a. Data Quality - I took the data for this analysis from Capitoltrades.com. While I cross verified a sample of their data for accuracy, I cannot be completely sure that they have captured 100% of the trades reported by Congress since it’s a highly manual process4.

b. Time Delay in Reporting - Congress members are expected to report their trades within 30 days. During my last analysis, I noticed that the median delay in reporting was 28 days and the average delay was 52 days. So not all trades that happened in 2021 would be captured in this analysis.

c. Other Investments - We do not know how the other investments such as private equity, hedge funds, and municipal bonds performed. So the performance of their overall portfolio might be drastically different than the one we are observing here.

d. Overall Portfolio - This brings me to one of the biggest limitations of the analysis. We don’t know what the overall portfolio of the Representative looks like. This prevents us from analyzing their trading patterns. For eg., if a Representative reports that he sold apple stock, we don’t have a way to identify whether it was a short-term play or whether he sold it from his existing long-term portfolio for some liquidity.

Even though Congress did not beat the market in 2021, if you look at the past 3 years of data, it shows a very different story. Even setting the starting date of your analysis back by one month to Dec’20 would make for a very different result as showcased by Unusual Whales.

As I highlighted at the beginning of the article, it’s high time that we bar elected representatives from trading stocks. This would be at least a step in the right direction to gain back the trust that the general public has lost in their representatives. Until then, we can try following their trades to find that all-elusive alpha! This article from The Business Times summarized it best for me.

US Congress can trade stocks or keep the public trust. Not both

Until next week…

Data used in the analysis: Here (It’s a live tracker where I will be updating the trades as frequently as I can. Also FYI, you can duplicate this sheet to your own workspace and play around with the trades)

More Interesting Reads

Jack Raines: Jack has a great newsletter where he writes about finance, investing psychology, and his backpacking experience through Europe. The fun thing is you never know what the next article is going to be. Two of my favorites are Rich in Experiences, Sufficient in Finances where he argues that we should be optimizing our lives for experiences instead of money, and House Money where he deep-dives into why we take much more risk with unrealized gains than our capital.

Julian Shapiro: Say you want to learn a skill. Wouldn’t it be great if someone broke down every step of the journey and took you along for the ride? Julian does exactly that - and he gives it away for free! From writing well, to building a startup, to building muscle, Julian picks challenges and acquires expertise in them all while posting his progress and learnings on Twitter. He then distills it into beautiful handbooks on his site - Get started here.

One last thing - Gmail decided to send my ‘Should you invest in sustainable investing article’ to the promotions tab due to which many of you might have missed it. If that’s the case, you can read it here.

Footnotes

This is heavily skewed towards the top with the top 5 Reps making up more than 60% of the total investment amount. Michael Thomas, Rohit Khanna, and Joshua S all made more than $40 MM in investments just last year.

Options returns are not included in the analysis as it’s very difficult to accurately judge when the options were exercised based on the publicly made reports.

To give a sense of scale, all of these folks have a salary of $174K. They have made multiple times their salary just on trading returns.

The average Congressman is 58, which ought to mean lower returns than the market due to holding more bonds, dividend stocks or other low-risk investments for imminent retirement.

On the other hand, American politicians never seem to retire and may be building generational wealth.

A tedious trope in this debate is that Congressmen can always protest that inside information didn't influence them because they were totally going to buy/sell that stock anyway. Forcing them all to hold a blind trust or similar eliminates the nonsense.

I know it's not your point here, but allowing a revolving-door of employment between the SEC and big banks, FDA and big pharma, or military top brass and weapons manufacurers is another example of an obvious problem that could be easily stopped. They don't want to fix it because they know they're doing wrong.

thanks for the followup post!

I'm not necessarily against congress members trading but I do think their transaction should be reported as fast as possible, at most within 3 days. I'm also a fan of not letting them or their immediate family members from trading as well. Cool with both but we all know either ain't happening.