Since most of our readers are under 40, it’s reasonable to assume the major chunk of your investment experience came after the Global Financial Crisis — a period that heavily skews U.S. returns higher relative to international markets.

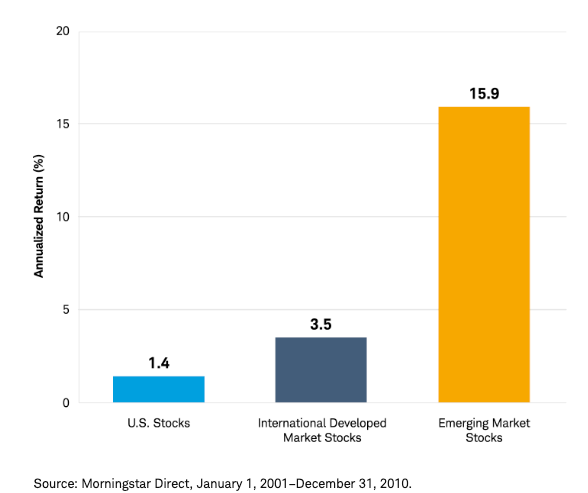

But jump back 10 more years, and you will see a vastly different picture.

The 2000s were pretty much a lost decade for the U.S. market — during the ten-year period from 2000 through 2009, the S&P 500 only generated an annualized return of -0.9%.

It was the decade that saw the dot-com bubble, 9/11, the Iraq and Afghanistan wars, and the Global Financial Crisis. Barring the GFC, every other crisis predominantly affected only the U.S. markets, and it shows in the returns.

This is the exact scenario where diversification protects your portfolio.

Nobel Prize-winning economist Harry Markowitz, the father of Modern Portfolio Theory, famously called diversification “the only ‘free lunch’ in finance.” Diversifying your portfolio would have improved your returns and simultaneously helped to weather both the dot-com bubble and the Great Recession much better.

With both the S&P 500 and Nasdaq-100 briefly touching bear market territories last week, here are five reports that you must read to improve your portfolio diversification!

And if you’ve been meaning to take investing a little more seriously this year — we’ve got something for you. For the next 24 hours, we’re offering 20% off our annual subscription.

Dollars, euros, and yen can be printed at will; gold remains scarce.

Here are some wild stats about gold:

Gold is up 23% in 2025 — its best start since 1974.

Since 1998, owning gold and owning Warren Buffett’s Berkshire Hathaway would have produced similar returns.

In the last 25 years, gold has outperformed both the S&P 500 and Nasdaq-100!

Ray Dalio’s All Weather Portfolio

It took Dalio and his team more than 25 years to perfect the All-Weather portfolio. During the COVID-19 crash, when the S&P 500 was down 20%, the All-Weather portfolio was down only 1%!

Here is the definitive guide to building an All-Weather portfolio.

The best active funds to consider

Active managers tend to perform better during corrections and market stress, while passive strategies excel when business is as usual. We are in anything but a 'business as usual' situation.

The Alpha 20 is a curated database of the 20 highest-performing active fund managers — selected after hundreds of hours of research and analysis.

Top-performing international markets

For a generation of investors, relying solely on the U.S. market has been a winning experience. However, relying entirely on past returns can lead to misguided expectations about the future.

Even Buffett, who has been nudging investors to invest in the S&P 500 since the 1980s, understands the importance of international diversification and has bet big on Japan.

There are also many other countries around the world that have bright futures. About that, we should rejoice: Americans will be both more prosperous and safer if all nations thrive. At Berkshire, we hope to invest significant sums across borders.

Why diversification matters

Effective diversification of your portfolio means that there will always be a part of your portfolio that’s underperforming. Diversification doesn’t feel very good when one part of your portfolio is outperforming. But this is a feature, not a bug.

For less than the cost of a coffee a week, you’ll make decisions that could compound for decades. Join thousands of long-term investors reading Market Sentiment.