Diving into Dividends

Sharing is caring

Hello friends! Welcome to Market Sentiment. Join 14,209 other smart investors and traders by subscribing here:

You can check out my best articles here and follow me on Twitter too!

Every time I talk about dividends to my friends who are very new to investing, it blows their minds. They can’t imagine a company paying them regularly for owning its stock. An extreme example I use is Warren Buffett’s Berkshire Hathaway which collects close to $800M in dividends just from Apple every year.

For those who are new to the world of dividends, a dividend is a distribution of some of the earnings of the company to its shareholders and the dividend yield is just a simple percentage of how much a company pays out in dividends each year relative to its stock price. If the stock price of a company is $100 and the company issued $5 in dividends, then the dividend yield is 5%.1

Consider the example of the following companies which have some of the highest dividend yields in the S&P500:

If you had $100K invested equally across these companies, you would have received on average around $7k last year just as dividends - this is not including any gains you would have made holding on to the stock. And herein lies the allure for dividend investing.

If you have a significant allocation of capital to these high-yielding dividend stocks, you would get a steady cash flow in the form of dividends while simultaneously enjoying the benefits of capital appreciation. This is considered the holy grail of investing as you don’t have to sell off your asset (and incur capital gain tax) but at the same time you enjoy a steady stream of passive income in the form of dividends. There are hundreds of thousands of people who swear by dividend investing and even big shots like Kevin O’Leary have said that he will never invest in a non-dividend paying company2!

But, as with everything else in investing, my motto has always been

If it sounds too good to be true, it probably is!

So before we go all-in on a dividend portfolio, let’s analyze if the importance of dividends is overblown, whether we can achieve the same results by investing in non-dividend paying stocks, and finally what the ideal portfolio allocation to dividend stocks should be, if any?

Why do some companies pay a dividend while others don’t?

First, we have to understand this difference.

Generally, companies that pay a dividend are mature organizations that are growing relatively slowly and do not see any better investment opportunities where they can deploy their capital3. Adding to this, a steady and consistent dividend over the years shows investors that the company is financially strong and the management is responsible - both of which make it an attractive investment. Some of the biggest companies that pay a dividend include Apple, Microsoft, Exxon Mobil, etc.

On the other end of the spectrum, companies that are expanding quickly typically won’t make dividend payments. The management believes that it’s better to re-invest the profits back into expansion and operations strategies rather than to give it back to their investors. The idea here is that if investors want a payout, they can sell the stock. The returns would be generated by capital appreciation (aka stock price going up) rather than as a direct payout to its investors. Famous companies that don’t pay a dividend include Google, Facebook, Amazon, Tesla, etc.

Which one performs better over the long run?

Given that there are amazing companies in both buckets, the question becomes which type of companies perform better over the long run. This is where it gets interesting. Hartford Research conducted an analysis where they divided stocks into two categories - Dividend payers and dividend non-payers based on their dividend payout behaviors during the previous 12 months. Even among dividend payers, they differentiated between the companies that increased or reduced their dividends.

The companies that paid dividends gave almost 2x the return of an equal weight S&P 500 index and the companies that did not give out a dividend massively underperformed both the index as well as the market! Among the companies that paid a dividend, companies that increased their dividend year on year contributed to the maximum amount of return.

The cherry on top is this: not only did the companies that paid a dividend outperform both the market and the non-payers, but they also did it with much lower volatility.

And it’s not just the U.S market that exhibits this trend. A similar study conducted on a global portfolio4 from 1990 to 2013 gave the following results.

Dividend paying stocks outperform their non-paying counterparts by a dramatic amount. From 1991 through 2015, non-dividend paying stocks earned just +4.18% return per year while dividend paying stocks significantly outperformed with a +9.7% average annual return - Factset

Explaining the outperformance!

I was as stumped as you are right now when I saw these results. I explored multiple research articles to find a reason for this outperformance. While this can be a standalone analysis on its own, the most convincing reason I could find was that because dividend companies are usually mature enterprises, their growth prospects are not going to be high.

This usually allows investors to purchase these stocks at a discount when compared to growth stocks. (P/E ratio of Tesla is 209 compared to Coca-Cola trading at 27). The chances of all these high-growth companies living up to their valuation are much lower than decently valued companies just chugging along and paying dividends.

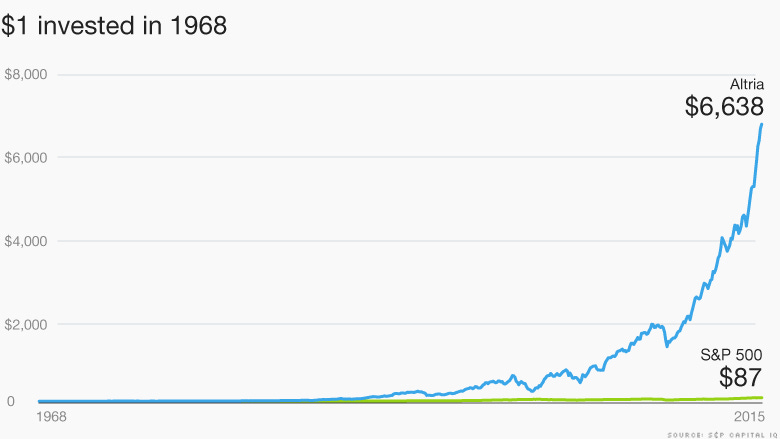

If you are still not convinced, here’s a bit of trivia - Guess the best performing U.S stock from 1968 to 2015? It’s almost 5 decades during which we landed on the moon, experienced iPhone, and made unimaginable progress in Computing and Telecommunications. So this company must have created something revolutionary and must have changed the world - right?

The company that a lot of investors shunned (for good reason) in a declining industry produced the highest return because it was just a boring old Cigarette company paying consistent dividends over 5 decades! As they say, boring is good in investing.

Importance of Reinvesting Dividends

Given that we now have conclusive evidence that dividend-paying stocks outperform their counterparts, it’s extremely important to understand how investing your dividends helps snowball the growth of your portfolio.

Reinvestment is the process of putting the dividend we receive back into the stock. For example, say we have $100K worth of AT&T stock. With the current dividend yield, you would get $2.2K every quarter. Instead of spending this, we buy back AT&T stock for the dividend they issue - and rinse and repeat it throughout the investment time period.

The final difference in your portfolio value would be massive. $10k invested into the S&P500 in 1960 would be worth $795k in 2021 - A cool 7,858% return. This would pale in comparison to the total value of $4.94MM if you had reinvested the dividends - a staggering 49,496% return!

Word of Caution

It wouldn’t be a Market Sentiment post without covering the limitations of this approach.

Dividends aren't guaranteed - Even though dividend-paying companies are not as volatile as growth stocks, you shouldn’t solely rely on dividend income as it can fluctuate based on market conditions. In the aftermath of the 2008 financial crisis, 14% across the world eliminated their dividends and 41% of the firms reduced their dividends.

Chasing a high dividend yield is a bad idea - Just evaluating your investment based on how much dividend the company is paying is bound to end up hurting your portfolio. You should always look into the company fundamentals before making your investment. To quote Raymond Dev,

More money has been lost reaching for yield than at the point of a gun

Taxes - Dividends are famous as a passive income strategy. You should definitely optimize based on your tax bracket as sometimes capital gain tax (by selling stocks) would be lesser than taxes on dividends.

Conclusion

Investing in dividend stocks does seem to produce out-sized returns. Do note that if you are currently investing in S&P500, more than 80% of the companies on the list are dividend payers. So you are automatically allocating a large chunk of your portfolio to dividend stocks. Just make sure the fund you are on is reinvesting the dividends instead of issuing it as a payout.

For those who are all-in on growth stocks, if your investment horizon is long, do consider moving some part of it to well-established dividend stocks as history shows us that companies growing to their expected valuations are rare!

Until next week…

Footnotes

If you are interested in learning more about dividend yield and its implications, check out this excellent article from Investopedia

You should definitely take this with a pinch of salt as he has an ETF that invests only in dividend-paying stocks

Think about it - If a company is optimistic about its future growth opportunities, it would be pumping more capital into those instead of paying its shareholders through dividends.

North America (50%), Europe (25%), Japan (10%), Emerging Market (10%), and Pacific (5%)

If you enjoyed this piece, please do us the huge favor of simply liking and sharing it with one other person who you think would enjoy this article! Thank you.

The returns from the first study assume the individual reinvested the dividends correct?

Did they do any analysis on how it performs post an average tax rate? Meaning after paying ordinary income tax on dividends this is how returns really look.

Also did they examine potential bias for low performers in the non dividend paying group?

For example, not every company that avoids paying a dividend is a growth stock. It could mean they are in decline. If comparing high growth companies to mature dividend paying companies are the results still the same? Or do all good high growth companies eventually become dividend paying ones in the end leading to survivorship bias?

The Hartford research only looked at whether companies paid dividends over the last year and whether there was an increase or a decrease. That can be a bit tautological because companies that had a good year are likely to pay out a bigger dividend. It's like saying, "the most successful companies were the most successful."

Perhaps a more informative study would examine a real growth index fund vs a real dividend index fund over a long period of time.

I found a Vanguard dividend fund, VYM. On the 'performance' page linked below it is possible to compare its growth to other indexes and funds on a line graph. I put it up against VBK (small cap growth ETF) and the S&P over ten years. S&P came first, the other two about equal second.

https://investor.vanguard.com/etf/profile/performance/vym

I chose those funds at random - perhaps someone can find one that did better.

Like Mulder, I want to believe. Like Scully, I cannot ignore the evidence that the broad index keeps on winning.