Ideastorm #9

Financial influencer performance, Covered Call ETFs, market timing strategies, and more...

Happy New Year! Close to 1,000 readers joined Market Sentiment just last week. As a thank you for your support, we are publishing this without a paywall. Please share with a friend.

If you are new here, in Ideastorm, we curate some of the best ideas and distill them into actionable insights. Stick with it till the end, and you can vote to choose the topic you think we should do a deep dive into!

Actionable Insights

The majority of financial influencers on Twitter were giving harmful advice, and following it would have yielded a monthly abnormal return of -2.3%.

Investing in Covered Call ETFs to generate income is a suboptimal approach, with the costs always outweighing the returns.

Dimensional backtested 720 different market strategies and found that only 4% reliably outperformed. The strategies that outperformed were also extremely sensitive to input parameters.

Based on AQR estimates, for a repeat of the 2013 to 2023 performance of the U.S. stock market, valuation has to rise higher than the tech bubble peak.

1. Should you trust financial influencers?

Everyone who has even remotely dipped their toes into content creation knows that the easiest way to grow a finance audience is to offer them stock picks. This is why the Motley Fool has over a million paying subscribers, and 7 out of the top-10 finance publications in Substack offer stock picks or trade ideas.

Despite the ever-growing popularity of financial influencers, we know very little about the accuracy and quality of investment advice they provide. But, the latest research from the Swiss Finance Institute gives us interesting insights into the world of Finfluencers.

Based on the backtest of over 29,000 financial influencers on Twitter, researchers found that only 28% provide valuable investment advice (Monthly abnormal return of 2.6%), and 16% provide no value. The stunning yet not-so-surprising finding was that the majority (56%!) of financial influencers were giving harmful advice, and following it would have yielded a monthly abnormal return of -2.3%.

Equally concerning was that the most popular accounts (based on follower count) provided the worst advice, as they created overly optimistic beliefs when the times were good and overly pessimistic beliefs during the tough times. Ironically, a contrarian investment strategy that trades against the advice from these accounts yielded a 1.2% monthly abnormal return.

Finally, the less active financial influencers with fewer followers were among the most skilled. The lower follower count was predominantly due to their contrarian tweets. They don’t ride the momentum (both social media and the market) and make positive tweets after negative returns (or news) and negative tweets after positive returns. On the other hand,

finfluencers with more followers have a higher likelihood to be antiskilled. Antiskilled finfluencers ride return and social sentiment momentum. They make positive tweets after positive returns and negative tweets after negative returns.

Source: Finfluencers (Swiss Finance Institute Research Paper)

2. The problem with Covered Calls

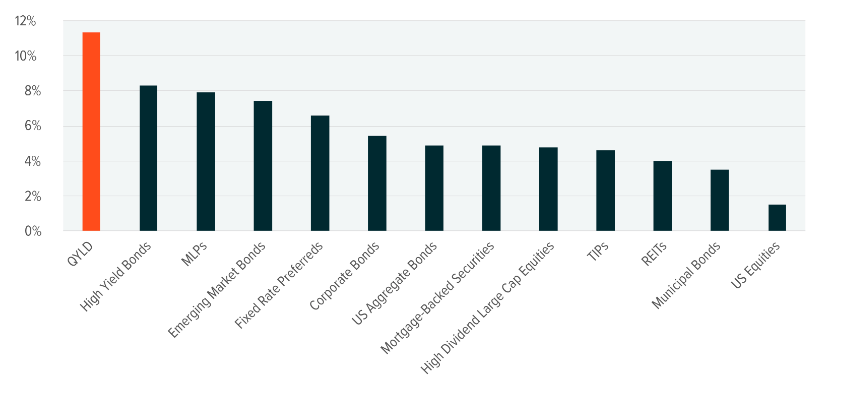

The popularity of dividend stocks shows that many investors are still obsessed with creating a passive income stream using equities. Taking advantage of this, Covered Call ETFs1 promise the best of both worlds — a steady income and lower volatility. For example, the Nasdaq 100 Covered Call ETF($QYLD) generated an incredible yield of 12.51% in the 12 months leading up to Jul ’23.

Instead of relying on the dividends from companies, covered call strategies can be used to control the exact amount of yield. While this might look appealing at first glance, Covered Call strategies have some serious drawbacks that investors often overlook or do not understand.

Consider for example a goal of generating a 6% annualized derivative yield by selling index call options.

Each month, a strike is selected to sell a call option with a targeted price that is 0.50% of the SPX index value. Over the period from 1999 to 2023, these options settled at maturity with a value of 0.54% of the SPX index value versus an average sale price of 0.49% of the SPX index value.

The P&L from selling the call option was a loss of 0.05% per month or an annualized loss of 0.60% —Roni et. al. (NDVR, Inc)

This performance gap can have significant portfolio implications. $10K invested into QQQ (Nasdaq) in 2014 would have grown to over $50K now (CAGR 17.65%, Sharpe Ratio of 0.91). The same amount invested in the QQQ Covered Call ETF would only have grown to $20K (6.9% CAGR and Sharpe ratio of 0.52).

Most investors are attracted to Covered Call ETFs for the wrong reason — i.e., seeking a consistent income source. In reality, they only provide exposure to equity and volatility risk premia.

Covered calls implemented to deliver higher derivative income should be expected to have

(1) lower total returns,

(2) higher tax realizations along the path, and

(3) a more negatively skewed return profile.

Investors who allocate to these strategies for their income alone, without accounting for these other considerations, might have made a devil’s bargain.

Source: A Devil’s Bargain (NDVR, Inc.)

3. Backtesting 720 different market timing strategies

The holy grail of investing is finding a strategy that can consistently time the market. While this quest is exciting and never-ending, investors tend to underestimate how difficult it is to create strategies that work. Dr. Wei Dai, the head of research at Dimensional, recently published a report that backtested 720 different strategies that time the market based on valuation ratio, mean reversion, and momentum.

Of these, only 30 strategies (~4%) could deliver reliable outperformance. The best-performing strategy outperformed the buy-and-hold market portfolio by 5.5% (2001 to 2022). But before you jump in, here is the breakdown of the outperforming strategy:

It uses the valuation ratio to time the market premium in the developed ex-US markets.

At the end of each calendar year, the strategy compares the current price-to-book ratio of the market with its historical distribution over the most recent rolling 10-year period. When the price-to-book ratio exceeds the top 20th percentile of its historical distribution, the strategy gets out of the market and invests in one-month Treasury bills. When the price-to-book ratio drops below the 50th percentile of its historical distribution, the strategy switches back to the market portfolio.

Even if you understood it on the first go (we didn’t), consider the number of parameters that go into the strategy. The funny part is that changing any of these parameters would make the outperformance of this strategy statistically insignificant.

As the saying goes, if you torture the data long enough, it will confess to anything.

Source: We Found 30 Timing Strategies that “Worked”—and 690 that Didn’t

4. What will it take to have a repeat of the past decade of U.S. stock market performance?

The S&P 500 outperformed cash by 11.9% annually from 2013 to 2023 (Q3). This is well above the 90th percentile of the rolling 10-year performance across global developed equity markets (since 1950). This outlier performance was driven predominantly by strong earnings growth and richening valuation (multiple expansion contributed 3.6% compared to the historical 1.8%)

This richening valuation has long-term growth implications. Based on AQR estimates, for a repeat of the 2013 to 2023 performance, the company valuations have to rise higher than the tech bubble peak (Even after assuming a 6% real earnings growth).

Source: Driving with the Rear-View Mirror (AQR)

Thank you for reading and being a continued supporter of Market Sentiment. Hit reply to this e-mail to let us know what you think!

Market Sentiment Founding Member

Since some of you have contacted us asking about the benefits of being a founding member, we thought it would be better to give all of you a sneak peek.

As a founding member, you will have access to our universal repository — It’s an ever-evolving document where we capture our best ideas, high-quality corporate and academic research, data sources, datasets, and various financial tools.

Get your business actionable content

If you appreciate our writing, analysis, and research and would like similar services for your company, we would love to work with you. Just email us, and we’ll get in touch. We have one slot remaining in Q1/Q2’24.

Footnotes

AQR has a great report on Covered Call strategies. Below is a quick primer.

Thank you for this amazing post. This needs greater reach so that fewer people fall for the dark side of the market, especially the misleading finfluencers.

Thanks for sharing this! I believe I now have a new favorite word: antiskilled.