In Government we trust

The assets that beat inflation in 2022

Welcome to the 200+ investing enthusiasts who have joined us since last Sunday. Join 29,200+ smart investors and traders by subscribing here. It’s totally free :)

Check out our - Best Articles | Twitter | Reddit | Discord

5,000 bucks is a lot of money, in most places.

But take a look at this picture and it’ll tell you a different story.

The artist in the picture is Edison Infante, and he is selling handmade bags for anything ranging from $7 to $15. Look a little closer and you’ll see that all the bags in the picture are made with currency notes. Edison lives in Venezuela which underwent a currency crisis in 2018. Inflation shot up to as high as 35,000% making the local Bolivar worthless - The denominations of the notes he used to make the bags were as high as 5000 Bolivars! Savings of families were wiped out overnight and Venezuelans emigrated in large numbers. The cash was worthless and thrown into the trash by the bushel, unless enterprising artists like Edison turned it into souvenirs like this which tourists from abroad loved.

This isn’t the first time that a collapsing currency has sent a country into chaos. Zimbabwe printed 100 Trillion dollar notes when their inflation soared above 79.6 Billion percent in a month! People had to carry wheelbarrows full of money to buy a loaf of bread. And there is the story of the Weimar Republic’s collapse which turned up in the news regularly over the last year, drawing parallels to the US economy. But there is no way that we are heading in that direction.

The US is still one of the strongest economies in the world - I brought up these stories because extreme situations highlight certain truths much better than statistics. Inflation eats up your savings over time regardless of how much your earning potential increases or how much you manage to save, unless you invest it - and the last year has been a grim reminder of this fact.

Double whammy

*Quick note - If you have been reading Market Sentiment for a while now, you must have realized that tech and data can be used for maximizing your investment returns and minimizing risk. If we learned anything from 2022, it's that investments don’t always go up. High-flying tech companies, cryptocurrencies, NFTs, and heck, even bonds have taken a beating so far this year.

This is exactly why I partnered up with Opus from Composer*. Opus is quantitative investing done for you in a single, one-click portfolio. Outside of expensive and often exclusive hedge funds, retail investors have had limited access to portfolios that employ systematic investment strategies, portfolio optimization, and rigorous risk management. Opus is here to change that*. The cherry on top is that they have a flat subscription fee and no management fee for the portfolio.

*This is sponsored content

Now, back to it:

Inflation is much harder to ignore than a stock market decline. You don’t have to check your portfolio every day, but, every time you fill up at the pump or buy food, inflation is staring you right in the face. - Nick Maggiuli, Of Dollars and Data

Investor sentiment is a measure of the optimism in the markets and the economy, and if that’s anything to go by, we are at an all-time low. According to the American Association of Individual Investors, bullish sentiment dipped as low as 17% last month before making a recovery. In comparison, the lowest to which bullish sentiment dropped during the 2008-09 crisis was 18.9%. The 2022 bear market is neither the largest drawdown nor the longest bear market in the last few decades (yet?), but its emotional toll is harder. The reason is inflation.

Inflation peaked at 9.1% in June. It hasn’t accelerated since then, but its pinch is being felt. While it’s definitely worrying, the economy is sure to revive in the long term, and in the meantime, it’s important to hedge against inflation so that your savings aren’t worth less down the line due to your present decisions.

Debt instruments

Typically, fixed-income instruments like treasury bonds are the worst affected during periods of inflation - You are paid out in cash, making it tax-inefficient, and inflation makes the yield less valuable even if rates are unchanged. But one type of instrument is a great option to preserve value: Treasury Inflation-Protected Securities (TIPS). TIPS work just like bonds, but the principal amount is adjusted according to inflation. If you invest $100 and inflation is 5%, your principal would be adjusted to $105, and a 3% yield would be $3.15 instead of $3. At the end of the bond’s term, you would receive the adjusted amount. It’s a good option to preserve your capital, especially if you are close to retirement.

Income producing assets

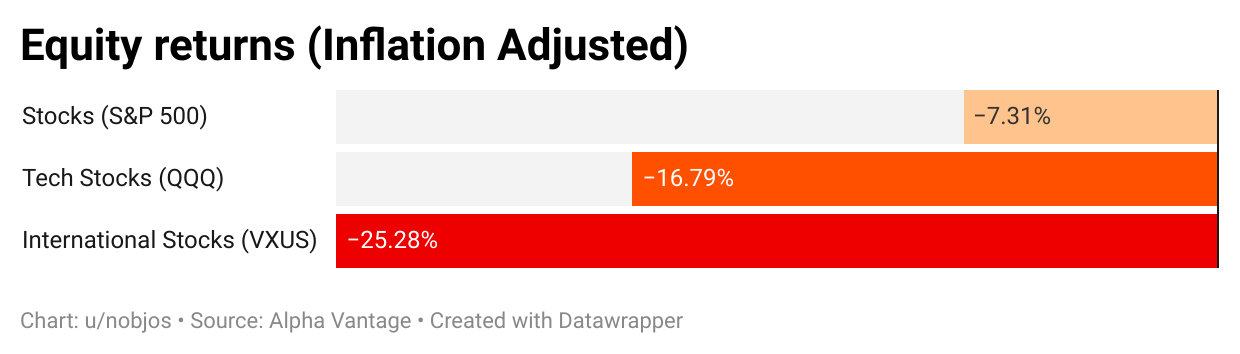

There are mainly two classes of income-producing assets: Equities and Real Estate. For stocks, it has been a bad year across the board1, with the Nasdaq falling almost twice as much as the S&P 500. In my previous article on inflation hedges, I mentioned International Stocks as a possible hedge against inflation - But global stocks have done worse than tech stocks.

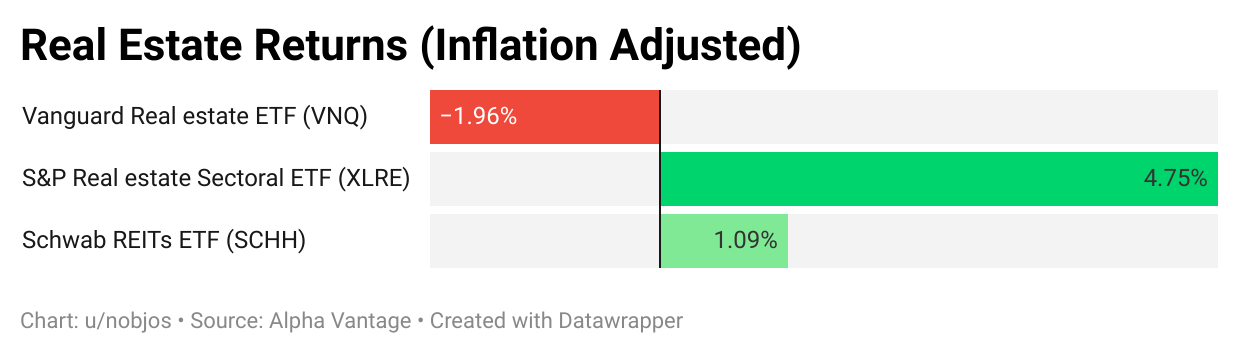

The Fed’s rate hike is definitely a major factor in this: A stronger dollar has caused cascading effects throughout the world, affecting the global economy.2 Higher rates have also affected mortgages. Not all real estate ETFs have been profitable and REITs have barely managed to beat inflation.

Historically though, stocks and real estate have been the best-performing assets in the long term because of the underlying assets and the growth prospects associated with them. If you’re invested in these assets it might be emotionally difficult to stay invested, but for a long-term investor, this high-inflation period might be akin to a bargain sale where you can pick up assets at cheap prices!

Commodities

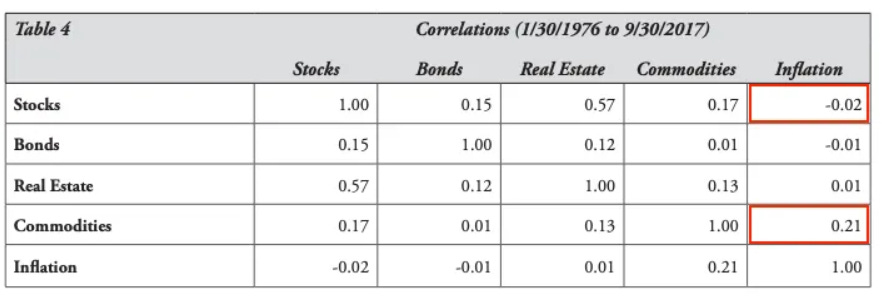

Commodities have historically underperformed the S&P 500 (equities performed almost 5x better compared to commodities over the last 16 years). But during times of high inflation, there seems to be no better hedge. According to this analysis by Washington Trust Bank which looks at the performance of different assets from 1976 to 2022, returns from commodities had the highest correlation with inflation while stock returns had the least.

Over the last 20 months, commodities have been the best-performing asset - The Bloomberg Commodity Index produced an inflation-adjusted return of 31.6% at the same time that the S&P 500 dropped 7.3%. Diversifying a portion of your portfolio into commodities during high-inflation periods is a good strategy (I had covered the benefits of investing in Commodities way back in May!).

“I believe the current trend of high inflation, supply chain constraints, and turbulence in the Oil market due to the Russia-Ukraine conflict are all going to push the commodity index even higher” - Market Sentiment Research (May ‘21 Issue)

Inflation hedges or illusions?

Finally, I wanted to check on the claims made around a category of assets that are completely based on perception. The most common argument for holding gold in your portfolio is that it’s a shield against bad times and it acts as an inflation hedge. This argument was used with abandon in favor of “digital gold” aka Bitcoin. But the evidence speaks otherwise.

One possible explanation for this is that cryptocurrencies are in their infancy, and are still liable to get shaken up by the increase in Fed rates. Without actual use-cases, a lot of the initial innovation in crypto is being funded by VCs who would have a hard time in a high-interest rate environment. But that doesn’t make crypto very reliable as a short-term inflation hedge.

Gold is a more complicated case to analyze - One theory is that inflation hedges are not absolute, and their returns are also influenced by how easily accessible other hedges are. In developed markets, instruments like stocks and TIPS are now within the reach of investors, and they are also more sensitive to metrics like CPI. Nevertheless, a small amount of gold in your portfolio might be beneficial over the long term.

If you look at the back of this dollar bill, it says “In God we trust”. Really, that’s false advertising. It’s actually, In Government we trust. Because God isn’t going to do anything about that dollar bill if the government does the wrong things. Any currency related investment is a bet on how government, now and in the future, will behave.

- Warren Buffett, 2011 Berkshire Hathaway Annual Meeting

While it might seem like a lot of asset classes and investments have severely underperformed over the last 2 years, it’s important to remember that every investment above has a fighting chance in the long run except for the elephant in the room that we haven’t discussed - Cash.

While holding some cash for emergencies is a wise move, it isn’t an investment strategy. Stocks, REITs, real estate, commodities, and bonds have always trended upward in the long term. Even gold has seen periods of gain, but the value of cash has always dropped and will continue to do so.

Investing isn’t just about appreciation of value - It’s also about preserving your assets against decay. Depending on whether you’re young and have spare cash to buy stocks at low prices, or whether you’re happy with saving your retirement funds by investing in TIPS, allocate your portfolio accordingly. But you know the kind of person who holds all of his cash for decades together waiting for the next dip? Don’t be that guy.

This publication remains free due to support from our partners. Do check out Opus from Composer.

If you enjoyed this piece, please do me the huge favor of simply liking and sharing it with one other person who you think would enjoy this article! Thank you.

Disclaimer: I am not a financial advisor. Please do your own research before investing.

Return on investment has been calculated from 1 Mar 2021 to 1 Sep 2022 (it was around March 2021 that inflation was raised as a matter of concern in the news). Inflation Adjusted Return is calculated as (1+Return)/(1+Inflation)-1. (Check this for reference)

We faced a similar combination of high inflation and high Fed rates in the 1970s when Paul Volcker raised the Federal Funds Rate to almost 20% to combat inflation.

thanks

Absolutely loving your content, would you be open to allowing us to share it with our 60k+ audience as well?