Riding the innovation wave

Investing in disruptive companies

Welcome to the 430+ investing enthusiasts who have joined us since last Sunday. Join 26,285 smart investors and traders by subscribing here. It’s totally free :)

Check out our - Best Articles | Twitter | Reddit | Discord

Stories are actually much more effective at selling businesses than numbers are. It’s been true for as long as human beings have been on the earth. But if you tell a story, what I want you to have is enough numbers to discipline yourself, because if you don’t, it’s very easy to veer away into fantasy land. - Aswath Damodaran

The power of stories to capture the imagination of people is indisputable. What draws people to investing is usually some version of this story: Your money is going to decay if it’s just sitting around, but you can grow its value by investing it. The numbers that support this story pop up as an afterthought; what captures your attention is the story.

I’m not denigrating the role of stories here. I’m fascinated by them. But over the last two decades, I have been increasingly seeing tweets and financial snippets like this:

The last 25 years have seen the ascent of giants like Amazon, Google, Meta, Apple, and Tesla. These might even be the only companies whose growth some beginner investors have personally seen, and the examples are overwhelmingly in favor of innovation and disruption. This has given rise to a powerful story - That innovation is the only way forward, and that you cannot get rich investing in value or index funds anymore.1

I wanted to explore whether this is true. What is the possibility of actually making money following waves of innovation, and how can you make better decisions when you are inevitably swept up by the next trend?

The impossible stock pick

Before we jump in,

As you know, I am a big fan of alternative investments. Percent is a platform that gives accredited investors exclusive access to the $7T private credit market*.

What is Private Credit? An asset class involving investments in private loans and debt financing. Investors loan money to companies, receiving interest in return. Percent offers access to these transactions, providing a chance to earn high-yielding interest on products such as corporate loans to startups, discounted receivables, and small business portfolios.

You can get up to 20% APY* with an average investment maturity of 8 months and Private Credit returns are largely uncorrelated to Stocks.

The cherry on top is that Market Sentiment readers get up to $500 on the first investment*.

*This is sponsored content

Now, back to it: The chief risk in historical analysis of investments is that the winning investments seem perfect only in hindsight. When making predictions based on current information, it’s very difficult to pick the right stock. Don’t believe me?

Of the 28,853 companies traded on the U.S. stock market from 1950-2009, 22,469 were gone by 2009. About 78%.

Fewer than 5% of companies remain over rolling 30-year periods.

Among startups, 20% fail within the first year. 9 out of 10 fail within 10 years.

Let’s look again at what it was like to invest in Amazon when it went public in 1997. Its stock which was worth $18 when it was listed is now worth more than $3,000 (adjusted for splits and dividends). But Amazon was not even among the top 10 IPOs of 1997. In the dot-com crash of 2002, Amazon lost more than 90% of its value before it eventually bounced back. 1,039 companies went public in 1997, of which 33% are now delisted, including the top ones like Santa Fe International. When Amazon stock crashed amid such chaos, would you have held on?

Innovative companies usually ride a euphoric trend that emerges because of novel technology. This introduces another risk factor - As higher expectations draw more attention to the technology, the market is flooded with new entrants, some of which are money-grab schemes while many have genuine intentions (even though intentions are not sufficient for a good business).

When there are too many stocks competing for your money, it’s very difficult to separate the signal from the noise. At some point, investors are aware that there is no substance to the mania, but continue to invest for short-term gains. George Soros calls these “rational bubbles.” This is exactly how every bubble in history has played out - From railroads and the industrial bubble, to dot-coms and the housing market bubble.

Despite the impossible math in picking a winning stock, there are ways to invest in innovation. Venture Capital funds have been doing it all along - Making a large number of bets of which a very small percentage pay off. 65% of venture-financed companies lost money from 2004-2013, and the 0.4% that grew by more than 50x accounted for most returns. But this makes sense only if you have a large amount of money and access to expertise to make the right picks.

A better approach for individuals is to construct a barbell portfolio where 80% of your investments are extremely safe and you experiment with 20%. With a disciplined approach and an understanding of the failure rates, you might be able to manage risk in a better manner. The question remains: How do you select your investments?

The rise and fall of technologies

Maybe betting on the most promising startup is not the right model. What if you were diversifying your investments instead by directly following the underlying technologies as they grew from obscurity to success?

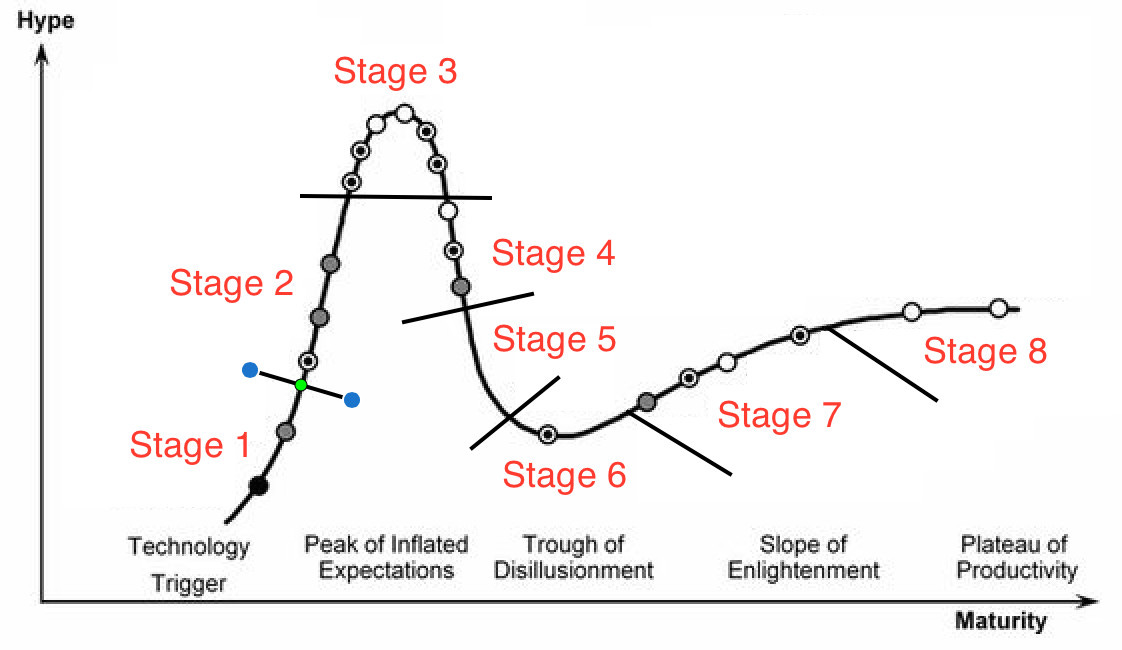

The Gartner cycle tracks the emergence of technologies in the public eye and classifies them every year. The assumption is that technologies will pass through a cycle of hype and disillusionment before maturing and serving an actual use case.2 Michael Mullaney has compiled the yearly data into an excellent spreadsheet where he tracks the stages that different technologies have gone through, as shown below.

In simple terms, stage 2 and stage 3 are when a technology trend has the maximum amount of hype around it, and stage 7 and 8 are when they enter the market in some usable form. Out of the 204 technologies that were tracked by Mullaney:

101 technologies were hyped in the period between 2000 and 2010. Out of these, 32 were successful by 2016, and 20 had a minor impact. About 50% of the hyped technologies just died out.

45 technologies reached the market directly, without any hype. This included Java, Tablet PCs, VPNs, Instant Messaging, QR codes, and text-to-speech.

35 technologies appeared on the cycle more than 5 times. 19 of these either failed or faded away.

Trends and hype around technology are not just poor predictors of success; they can distract you from the real technological developments happening under the radar. Also, a wildly successful technology is no guarantee of an underlying business. Linux runs more than 90% of web servers, but you still can’t invest in it.

At this point, you probably feel that innovation investing is a myth. Not quite…

The innovation premium

There has been a tug-of-war between the narratives of growth and value investing over the last two decades, with the financial crisis and the emergence of Big Tech playing major roles. But over the last couple of years, interest in world-changing technologies like EVs and cryptocurrencies took the innovation investing story to a different level - till it all came crashing down. The downfall of ARK Invest’s Innovation ETF and Softbank’s Vision fund seemed like the meme to end all memes after a wild ride.

But you can’t write off the innovation premium because a couple of funds with innovation in their name are having a bad run. In his excellent paper titled Investing in Innovation, Kai Wu of Sparkline Capital outlines a different strategy - Using the number of patents produced by a company as a metric of innovation. This is done in two steps:

Grouping patents with common words together to identify the broad technology trends of the time (not based on hype).

Identifying the top patent holding companies in each technology trend and creating a portfolio.3

Google, Meta, Uber, Nvidia, IBM, and other legacy companies feature in these portfolios - It’s not necessary that start-ups produce the most innovation. Sometimes established companies have the most money to spend on innovation, as this strategy shows. Backtesting and comparing the returns against the S&P500:

The difference in annual returns is about 2.6% - Over 50 years, this is a cumulative difference of 260%. There is a definite advantage to investing in innovation ETFs. But of course, there are caveats:

Innovation ETFs that are currently being offered in the market have a huge component of style exposure (i.e there are factors other than innovation that come into play while constructing the portfolio). This is one of the reasons for Ark Invest’s high volatility even compared to other innovation ETFs.

The existing ETFs have a much shorter track record than other Factor ETFs. This holds true for Sparkline’s own ETF which is barely a year old.

Investing in innovation is anything but straightforward. But the pull of disruptive technology and potential returns is bound to draw you in at some point, so it’s better to understand how to minimize your chances of failure rather than come up with a formula for success.

Waiting for a few more years is probably the one thing that will save you the most pain. Since 90% of start-ups fail in the first 10 years, you could improve your odds by selecting from a much smaller set.4 You might not even lose out much - Google went public in 2004 when it was 6 years old, and it grew by 4x in the next five years. But even if you had bought it 5 years later, it would have grown another 7x by 2014!

Investing based on the number of patents, successful projects, intellectual properties, and other solid metrics is a much better indicator of success than following hype, trends, and the narrative that startups see the maximum growth. If you plan to invest in an Innovation ETF, ensure their selection process aligns with your criteria.

Ultimately, be honest with yourself about why you are investing in a technology. It’s exciting to feel like you’re part of a generational change. You might passionately believe in the technology’s potential, but in the absence of a sensible business model, it’s activism and not investing. Sometimes it’s best to just be boring.

A lot of you have written to me asking how you can support the newsletter. Thank you, I’m touched. The best way to support me is by growing the newsletter, so please drop a like if you enjoyed the article, share it with your friends, and tell them about Market Sentiment.

One last thing - Market Sentiment remains completely free due to the support from our sponsors - So do checkout Percent.

Disclaimer: I am not a financial advisor. Please do your own research before investing.

Throughout this article, I use innovation and tech startups interchangeably. There is a distinction, but the majority of VC-funded startups are tech-based, and the number is growing every year. The focus of this article is on tech as innovation.

Whether all technologies follow this path is debatable, but in this case, I am only interested in whether the companies in the hype stage eventually make it to maturity.

Some examples of technology trends and a sample portfolio are given in the original link.

Check out my deep-dive on Tech IPOs for more.