Investing in Managed Futures

An easy way to generate crisis-alpha

Market Sentiment delivers data-backed, actionable insights for long-term investors. Join 54,000 other investors to make sure you don’t miss our next briefing.

If you have been investing for a while, you would have invariably heard a day trader friend say that “the trend is your friend”. While we all might roll our eyes and move on, the fact is that there is some science behind it.

Based on a study from AQR, the price trend of a stock unfolds in 3 stages:

Start of the trend: Underreaction to information

A catalyst, such as an earnings surprise or policy change, causes a change in the intrinsic value of an asset. However, the price of the asset doesn’t shift immediately due to:

Anchoring bias: Investors tend to rely heavily on past information and adjust their decisions slowly.

Disposition effect: Investors tend to sell winners and hold onto losers, as booking profits is easier than booking losses.

Non-profit participants: Larger players, such as central banks, may resist price changes as their job is to reduce volatility.

Trend Continuation: Herding and Overreaction

As the price continues to rise, momentum builds up. More investors take notice and start piling in, misconstruing the recent price move as a signal. The key drivers for this phase are:

Herding: When prices have moved up or down for a while, some traders jump on the bandwagon.

Confirmation bias: People tend to look for information that confirms what they already believe, and look at recent price moves as representative to verify that.

Risk Management: Some risk-management schemes involve selling in down markets and buying in up markets, in line with the trend (aka Momentum Investing).

For traders who got in during the first stage, this is the sweet spot to exit. But, this is also the stage that primarily contributes to the prices overshooting their fundamental value as more players pile into the trend.

End of the trend: Reversal to Fundamentals

Naturally, trends cannot persist indefinitely. Eventually, the reality of the imbalance sets in. At this stage:

Fundamentals don’t support continued gains/losses.

Contrarian investors step in.

Newer information starts contradicting the trend.

These lead to a sharp reversal in sentiment, and consequently, the price and range-bound markets remain if no new catalysts emerge.

Now, long-term readers of Market Sentiment will be very worried, wondering whether we are changing our investment strategy to day trading!

Relax! We are not :)

The same trend we just discussed can be observed in all asset classes, ranging from commodities, equities, cryptocurrencies, and currencies.

Managed Futures is a strategy that we can use to systematically capitalize on these trends.

Historically, managed futures have consistently generated long-term absolute returns, independent of the overall market direction. To put it simply, using market data, trend managers can create a systematic, rule-based approach to buy or sell based on the asset’s trend.

Since managers are not predicting what the market should do, but instead focusing on what it is doing, this approach can provide incredible alpha during crises, as you are not betting against the trend.

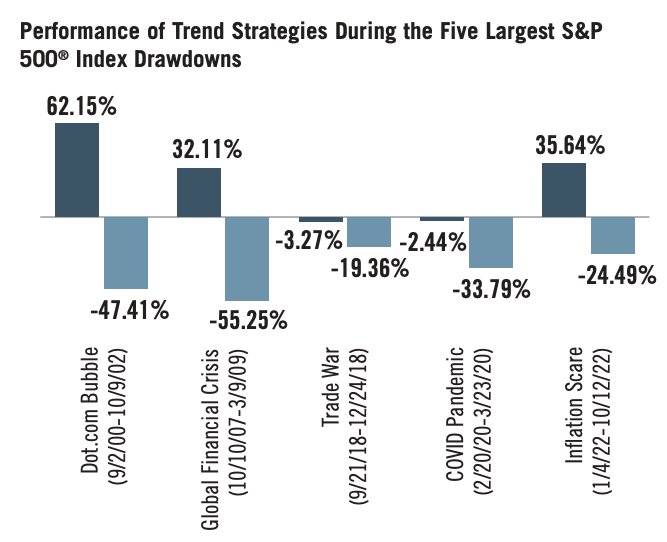

For example, the SG Trend Index1 returned an impressive 62% during the dot-com bubble and 32% during the Global Financial Crisis, while the S&P 500 was down almost 50%.

This sort of diversification, with its benefits and low correlation, makes it an excellent strategy for small portfolio allocation. A 10% allocation to Managed Futures markedly improves the performance of the traditional 60/40 portfolio.

While Managed Futures was only available to institutional investors until a few years back, the benefits have now trickled down to us retail investors in the form of ETFs.

Let’s dig into some of the best Managed Futures ETFs available for retail investors, it’s historical performance, and their limitations.