To leverage or not to leverage?

Welcome to the 83 investing enthusiasts who have joined us since last Sunday! Join 11,533 smart investors and traders by subscribing here:

This issue of Market Sentiment is brought to you by… TOPDOWN CHARTS

Chart driven macro insights for investors -- NEW entry-level service

We have 3 simple goals in our research:

Deliver a flow of interesting and actionable investment ideas across markets/geographies

Provide risk management input to help sidestep downside risks

Present meaningful macro insights that never leave you guessing as to the “so what?“

To be honest with you, this is our very first paid sponsorship — we chose Market Sentiment for a few reasons, but a key one is that we ourselves pay very close attention to sentiment in our research process.

We’ve got a few options available for you to get hooked into our research insights (both paid and free versions), so come on over and take a look:

Imagine a world,

a world where your returns are doubled,

but so are your losses,

a world where you can beat SPY,

but it can bankrupt you as well.

Welcome to the world of leverage!

While researching for my last article, I came across this interesting survey that highlighted the increasing use of leverage by retail investors. The key part that stood out was

40% of investors said they have taken on debt to invest, including 80% of Gen Zers, 60% of millennials, 28% of Gen Xers.

80% of Gen-Z borrowing money to invest seems to be very high. And it's not like they are taking inconsequential amounts.

Of those who took on debt to invest, nearly half (46%) borrowed $5,000 or more.

While I am not questioning the outcomes from their survey1, I ran a similar survey in my subreddit with drastically different results. As you can see below, only around 13% of the responders have used borrowed funds while investing in the market.2

No matter the variations in the results, the key insight is that a large number of retail investors are using leverage while investing. So in this week’s analysis, let’s do a deep dive into the world of leverage.

Leverage - A double-edged sword!

Having a large amount of leverage is like driving a car with a dagger on the steering wheel pointed at your heart. If you do that, you will be a better driver. There will be fewer accidents but when they happen, they will be fatal - Warren Buffet

For those unfamiliar with the concept, investing with leverage is very simple.

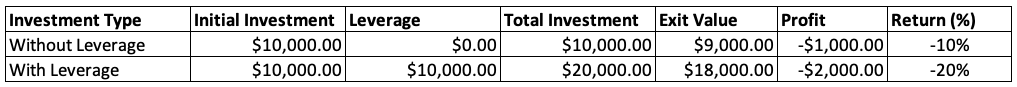

Let’s say that you had $10K in your brokerage account. You have a high conviction stock that you think is going to have a very good return in the next year and want to invest more than $10K in the said equity. You can take another $10K as a loan from your brokerage staking your entire position as collateral.

Assume the stock went up 10% over the next month and you exit the position.

This is the magic of leverage. You used a 2:1 leverage on your investment and doubled your return. (It won’t exactly be double as you have to pay some amount as interest for the money lent to you. I have ignored it for ease of understanding)

Why leverage is known as a double-edged sword is because of what happens when the stock price tanks. Let’s assume that the stock went down 10% and you had to exit the position.

The 2:1 leverage would literally double your losses3 since your exposure to the stock was double that of your initial available capital.

Now that we know what the benefits and risks associated with using leverage are, let’s look at the current trends in the market.

Rise of leverage in retail trading

Trading on margin is just one way of using leverage while investing. While there are more exciting ways to lose money using leverage (Options, Futures trading, etc.), in this article we would be focusing only on leveraging using borrowed money.

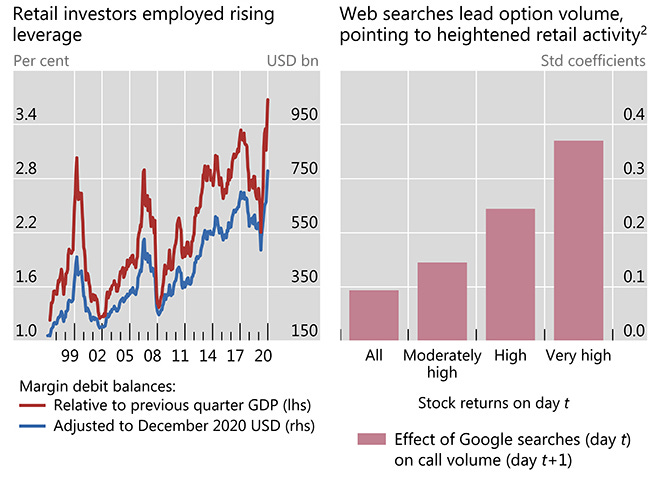

The below study from BIS shows an ever-increasing demand for leverage from retail investors since 2019. By Dec’20 the total amount of debt stood at $750 Billion, the highest level on record since 1997 (Inflation adjusted). Adding to this, retail investors are using options now more than ever before. A study by Goldman Sachs showed that retail brokers alone are now trading more options than the entire market used to do in 2019.

The pandemic has only accelerated this trend as showcased by the Harris Poll. 46% of the responders stated that they have either bought options or bought on margin since the pandemic has started.

It’s not that using leverage is inherently risky. The way many of them are obtaining leverage is a cause for concern. The below chart shows the source of funds used by investors for using leverage.

While borrowing from friends and family can be considered interest-free (it does come with its own set of issues), on average, personal loans charge 9% to 13% APR and credit card debt on average charges a whopping 15% to 23% in APR.

The issue here is that just to break even on the investment, the stock or the portfolio must go up somewhere between 9% - 23%! Imagine picking the right stock with it going up by 20% only to lose money in the end because you used the wrong leverage.

How to use leverage correctly?

“Give me a lever long enough and a fulcrum on which to place it, and I shall move the world.” - Archimedes

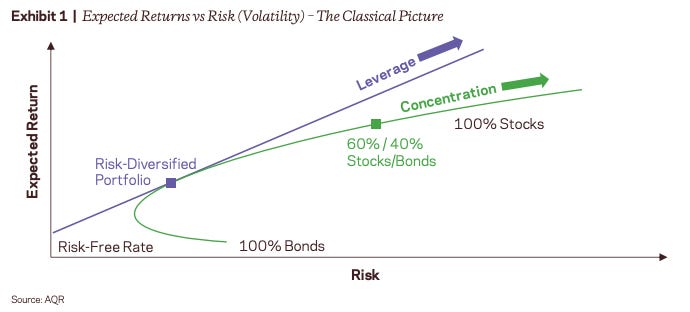

Leverage used correctly can be a powerful tool in growing your portfolio. As per a study published by APR, more investors prefer concentration over leverage while thinking of maximizing their expected return.

What this means in plain English is that most of us will just allocate larger and larger portions of our portfolios to stocks expecting a better return, whereas ideally, you would have got a better risk-adjusted return if you had a well-diversified portfolio and then leveraged that4.

Ian Ayres and Barry Nalebuff (both professors at Yale) argued in a 2008 paper that it’s responsible for young investors to use leverage. The argument made is that when we are young we need to maintain a lot of exposure to stocks but we would be cash poor. The solution is to use margin to invest in equity and gradually decrease the percentage of leverage as you become older. This in the end would end up providing a much better-expected return.5

But using traditional leverage while investing comes with its own risk

Limited access to cheap debt: Not everyone might be eligible for getting a loan that’s cheap enough to make sense for leverage investing. Depending on your current assets/credit score, the loan you get might be sustainably more or less expensive than the next guy!

Margin call: If you are using a margin account from your brokerage and are unable to maintain the margin requirements set by your broker (i.e, value of the margin account falls below the required amount), unless you have enough case to cover the position, the brokers will liquidate your position themselves and cover their loan.

Risk of loss greater than initial investment amount: In our first example, we only considered what happens when there is a 10% loss. Imagine a scenario where the company you invested in files for bankruptcy. Then you would lose the 10K investment you made and still owe another 10K to your broker making it a 200% loss on your investment.

Given all these complexities, how would a normal retail investor realistically use leverage?

Leveraged ETFs

Leveraged ETFs take care of all the complicated stuff for you. It’s like investing in any other ETF (albeit, with a slightly higher expense ratio) where they use debt and derivatives to amplify the return of the underlying index.

A classic example is ProShares Ultra S&P500 (SPXU), where it tries to 2x the return of its underlying benchmark (in this case S&P 500) everyday.

As you can see from the below chart, the returns are magnified when compared to the normal S&P-500. Another example is TQQQ which (3x leverage of Nasdaq) has generated 57.86% CAGR over the last 10 years compared to the 22.67% CAGR of QQQ.

While leveraged ETFs present a rosy picture in returns, they do come with significant risks. The single most important issue with leveraged ETF is that it breaks the number one rule of Warren Buffet - Never lose money.

Leveraged ETFs work amazingly well when it’s a bull market. But imagine a hypothetical scenario where the market drops 20% in one day. The 3x leveraged ETF (since it has to close its position every day) suffers a 60% drop. Now the market has to only go up 25% for the regular investor to break even on their index fund. But for someone who had invested in a 3x leveraged ETF, the market has to go up 50% for their fund to even break even. In an outlier scenario where the market drops more than 33%, you will suffer a 100% loss6 in which case it’s game over.

Conclusion

Leverage is that magical thing that works until it doesn’t. When it doesn’t, it does not look pretty. Ask Bill Hwang if you don’t believe me! He had an amazing run where he converted 200MM into $20 Billion in 10 years (which is phenomenal considering the scale he was working with), then lost all of it in just two days due to an extremely over-leveraged position.

Granted, the optimal use of leverage while investing would end up giving you outsized returns, but the extremely complicated nature by which you have to rebalance and carefully adjust your portfolio is far beyond the skill-set of most investors. You don’t have to take it from me, take it from two of the most successful investors of our time.

“If you’re smart you don’t need leverage; if you’re dumb, it will ruin you.” - Warren Buffet

“There are only three ways a smart person can go broke: liquor, ladies and leverage” - Charlie Munger

Until next week…

If you would like to partner/sponsor us, you can reach us at marketsentiment.live@gmail.com

The survey was conducted by Qualtrics. it was an online survey of 2,046 U.S. consumers — of which 994 were investors — from March 30 to April 6, 2021. The survey was administered using a non-probability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

Either the sample from which they did the analysis was biased or the Reddit crowd is extremely risk-averse, both of which seem to be not realistic. Let me know what you think about why the results are so vastly different!

Same as with the gain calculations, in reality, your losses would be even higher as you would have to pay back the interest as well on the borrowed amount.

This has more to do with the perception of risk. While concentrating all your portfolio into equity when you are young does not feel that risky (due to a longer timeframe), ideally, your risk would have been lower if you had borrowed money to invest in a well-diversified portfolio. But this intuitively feels riskier (borrowing money) for a large segment of investors even though mathematically it would give a better return over the long run.

The argument made in the paper supporting leverage is that even if we end up blowing the account due to leverage, the capital loss would be lower as we would be young and we would have enough time to build up another account. This excellent video from Ben Felix explains the concepts in detail.

Leveraged ETFs are so complex that they can be an analysis topic of their own. This video from Plain Bagel does a great job of explaining the risks associated with leveraged ETFs.

One final and simple request – if you enjoy the articles I publish, please consider doing me the huge favor of simply clicking the “like” button when you are done reading. When new readers arrive at a Substack homepage and are considering whether to subscribe, one of the strongest indicators of quality they look for is the average number of likes each article generates. Pressing the heart at the end of every piece costs you nothing and means the world to me.

Amazing article as always.

I am not demanding anything here. But I expected to see a chart with hypothetical leveraged Vs non-leveraged S&P500 chart with 30 years data. As you often do.