Hi there,

Welcome to the first edition of Market Sentiment Pro. This is aimed at portfolio managers, investment advisors, and serious investors who require and understand in-depth insights into asset allocation.

Our job is simple — to make your job easier. Our team combs through hundreds of academic and institutional reports every week. With MS Pro, we seek to simplify this into clear, concise, and actionable insights. You can spend less time trawling through reports and more time on your main work!

Enjoy our first edition for free :)

Pro seats are available at $499 per year. Upgrade instructions can be found here. If you upgrade your existing subscription, you will only be charged a prorated amount.

A Pro subscription can be extended for free to up to 4 of your team members. Email me at noble@marketsentiment.co to enroll your team. Thank you for your consideration!

Note — We are sunsetting our lifetime membership program. All existing lifetime members will be auto-upgraded to Market Sentiment Pro and will retain their lifetime subscription.

Actionable Insights

Even the best long-term investments suffer deep drawdowns. However, it’s possible to capture outsized returns by identifying strong companies based on their financial strength, unit economics, and management clarity.

In the last three decades, nearly 80% of the U.S. stock market outperformance over other developed markets was driven by U.S. stocks getting more expensive over their EAFE counterparts.

While AI has improved dramatically, it still lags behind on quantitative tasks. ChatGPT tends to be over-optimistic and sycophantic when it comes to financial backtests.

For the U.S. GDP growth, the next decade will hinge on whether AI-driven productivity can offset the drag of rising U.S. debt and aging demographics.

Even god would get fired as an active investor

The toughest aspect of being a long-term investor is that no matter how good you are, drawdowns are inevitable. Charlie Munger, who returned a 20% CAGR for his fund from 1962 to 1975, experienced a 53% drawdown in the two years ending in 1974. Companies are no different — Nvidia had a 65% drawdown just 3 years back, Nike is now down 70% from its top, and Amazon shares dropped 95% during the dot-com bubble.

While drawdowns are inevitable, investing in those companies during these drawdowns can provide exceptional returns. Michael Mauboussin of Morgan Stanley analysed more than 6,500 companies from 1985 to 2024 and found that the larger the percentage drop in the stock, the higher its eventual bounceback.

The funny thing is that even if you had a crystal ball and knew which stocks would perform the best over the next 5 or 10 years, a portfolio built using these would still have massive drawdowns.

An investor who had the perfect foresight to create a portfolio of the stocks with the highest returns in the next five years would still see substantial drawdowns along the way. Indeed, one five-year stretch of the foresight portfolio had a 76 percent drawdown.

This underscores how hard it is for professionals to manage through drawdowns.

Take a look at the drawdowns of the best-performing companies over the past 4 decades. Even a perfect portfolio will test the resolve of those who own it over the long run.

On the other hand, it’s not all roses and sunshine while “buying the dip”. There are always companies that never return to their previous highs.

The data also reveal that the further a stock falls from its peak, the lower its probability of ever again attaining its past apex. Only about one in six stocks that decline 95-100 percent ever get back to their prior peak, while four in five in the 0-50 percent drawdown group do so.

Analysis of the peak recovery from maximum drawdown, expressed as a percent of par, shows that a majority of companies that have drawdowns of 80 percent or more never get back to par.

While no one can buy at the exact bottom, Mauboussin gives us ways to identify potential winners.

Are the fundamental issues with the company cyclical or secular?

Is the unit economics profitable?

How significant is the capital investment risk?

How strong are the company’s financials?

Is the management clear about the challenges?

Source: Drawdowns and Recoveries, Consilient Observer (May’25)

Are we expecting too much from the U.S. Market?

Over the last 35 years, the U.S. market has outperformed other developed global markets by a whopping 4.7% per annum.

But,

Antti Llmanen and Thomas Maloney at AQR Capital did the math. Out of the 4.7% per annum outperformance, EPS growth only gave 1.1% (~23%). The rest was driven by rising valuation.

Since 1990, the vast majority of the US’s outperformance versus the MSCI EAFE Index (currency hedged) of a whopping +4.6% per year, was due to changes in valuations.

The culprit: In 1990, US equity valuations (using Shiller CAPE) were about half that of EAFE; at the end of 2022, they were 1.5 times EAFE. Once you control for this tripling of relative valuations, the 4.6% return advantage falls to a statistically insignificant 1.2%.

In other words, the US victory over EAFE for the last three decades—for most investors’ entire professional careers—came overwhelmingly from the US market simply getting more expensive than EAFE. — AQR Research

This is one of the reasons we are seeing increased volatility in the market. On the day of the tariff announcement, close to $2 trillion was wiped out in one day. While we have bounced back, the relative valuation of the U.S. market is now so high that even a small catalyst can cause significant pain.

Source:

Exceptional Expectations: U.S. vs. Non-U.S. Equities, AQR Research (May’25)

International Diversification: Still Not Crazy after All These Years, AQR Research (May’23)

Is AI now advanced enough to be a quantitative analyst?

The straight answer is no. But the why is fascinating.

Analysts at Quantpedia recently put together their findings on trying to use ChatGPT as a quantitative analyst. While the model appears capable enough to process data and produce a believable backtest at first glance, issues become apparent once you start digging in.

Data corruption — Although the model could not retrieve simple data from the internet, it exacerbated the issues by corrupting the data uploaded into it. The team had to frequently reupload the same datasets and had to constantly check whether ChatGPT was hallucinating any new data points.

Hallucination — ChatGPT claimed the performance of the model it backtested had an annualized return of 8.27%. When the team manually backtested it with the same logic, the actual returns were only 1.74%. The funny thing was that they could not identify why and where ChatGPT made the mistake.

After uploading the data into the model a second time, the results it produced matched our own. How the ChatGPT calculated better ratios in the first time? And why were they different? We have no idea.

Confidently incorrect — The model overpromises on the chat but underdelivers on the actual code. It promises a strategy built using three underlying metrics, but ultimately will only have two in the code.

While the AI models have certainly improved over the past 2 years, generating a reliable and repeatable backtest seems years away.

It’s still a chatbot, not a data analyst, and the chatbot’s primary focus is to make you happy with the “chatting.” What does it mean? It tends to be over-optimistic and sycophantic – it doesn’t “think”, it answers questions and tries to make you willing to continue in the conversation.

A lot of the time, ChatGPT presented its ideas or analysis and made extremely naive mistakes in it; however, it presented results as the best strategy/idea ever in existence.

Source: Can We Finally Use ChatGPT as a Quantitative Analyst?, Quantpedia (May’25)

Everything now hinges on AI

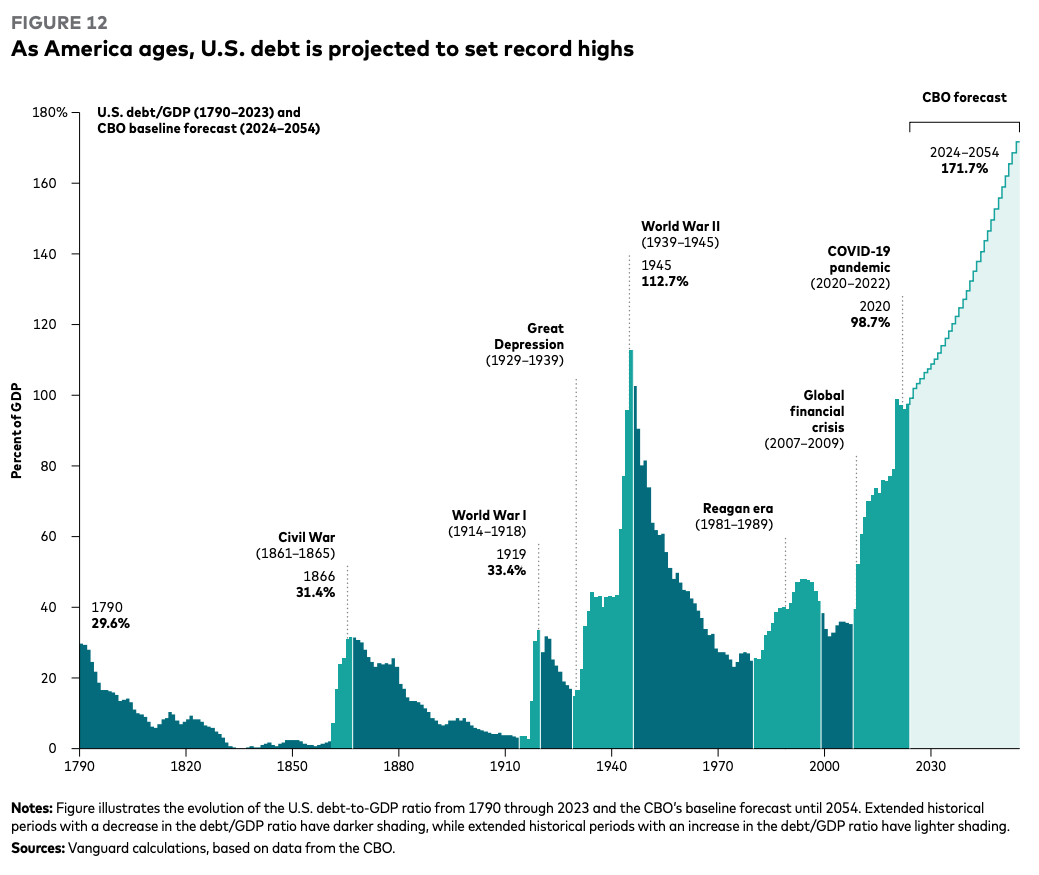

Take a look at the chart below:

The Congressional Budget Office projects that by 2040, the U.S. Debt will balloon to 170% of its GDP. The next decade will be a tug-of-war between AI-driven productivity growth and structural deficits resulting from an aging society.

While AI is still not good enough to be a quantitative analyst, it excels at certain tasks like simple automation, customer support, and translation. If AI is as transformational as investors are expecting it to be, then AI will create significant time savings, and the resulting productivity boost will drive GDP growth.

However, if AI falls short, the discussion will then focus on deficits and rising U.S. debt. The stock market valuation will not only be affected by the low growth but also by the rising interest rates to counter the inevitable inflation.

For what it’s worth, Vanguard projects that the former has a higher chance based on their Megatrends model.

Source: AI, demographics, and the U.S. economy, Vanguard Research | June’24

Thanks for making it till the end. We would love to hear what you think. Just hit reply or comment below.