Real Estate

The best asset class of all time?

Buy land, they're not making it anymore. – Mark Twain

In 2017, The Federal Reserve Bank of San Francisco released a report titled The Rate of Return on Everything, 1870–2015, which had some stunning implications — In the report, the authors collected data going back to 1870 (~145 years of data) and found that residential real estate had been the best long-run investment over the course of modern history1.

While the returns were slightly higher than equity (with both hovering around 7%), the volatility (std. deviation) of the housing return was substantially lower (10% for housing compared to 22% for equities). The cherry on top is that while global equities have become more correlated with time, housing returns across countries remain uncorrelated.

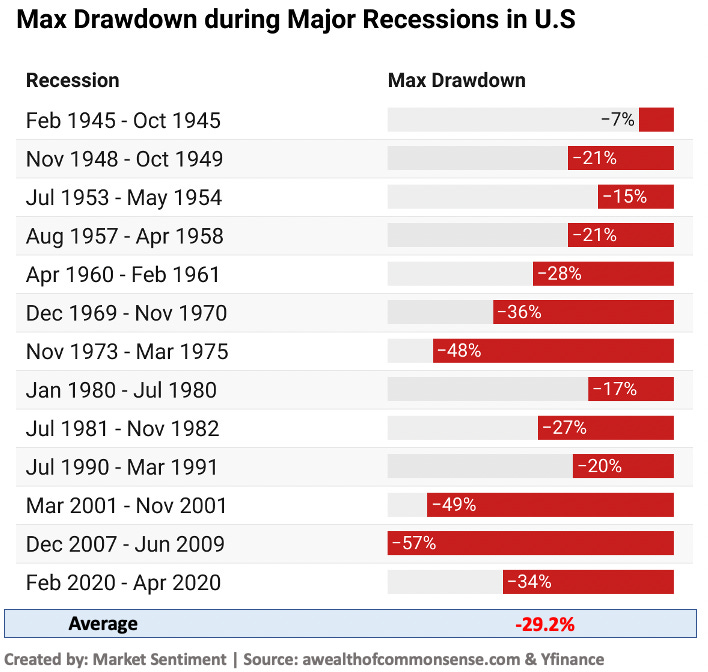

In the last 100 years, there were only 2 occasions where the U.S. housing market dropped more than 20% — the 1929 Great Depression and the 2008 Global Financial Crisis. Compare this to the drawdowns the S&P 500 went through, and you can see the stark difference in volatility across the two.

Statistically, even though the U.S. stock market had a higher return, it came with a 120% increase in volatility when compared to the housing market.

The considerably lower volatility leads to an often-overlooked benefit2 of real estate — how easy it is to employ leverage. Using a 4:1 leverage3 is common in real estate but unheard of in equities. With the newly introduced 1% downpayment program, you are approximately taking a 99:1 leverage in your investment.

Finally, the psychological benefit of owning an income-producing tangible asset is incredible. You might panic sell a stock but it’s very unlikely that you panic sell a house from which you are receiving rent.

Given that for an average American, close to 70% of their net worth is tied up in real estate (for Canadians, it’s close to 77%), let’s dig into

How U.S. housing has performed over the past century

Housing market vs. the stock market

Challenges that come with real estate investing

A quick look into Real Estate Investment Trusts (REITs)

Side note: Annual subscriptions are now at a 20% discount. If you are a financial advisor/investment professional, E-mail us for a group subscription or to expense the newsletter.