Slow and Steady

Importance of being consistent & patient with your investments

Welcome to the 400+ investing enthusiasts who have joined us since last Sunday. Join 29,000+ smart investors and traders by subscribing here. It’s totally free :)

Check out our - Best Articles | Twitter | Reddit | Discord

Most people overestimate what they can do in one year and underestimate what they can do in ten years. - Bill Gates

A little-known fact about Warren Buffett and Charlie Munger is that they had another partner back in the ’70s named Rick Guerin. While Rick had his own fund (Pacific Partners) to manage, he worked closely with Buffett and Munger to acquire controlling stakes in companies. Buffett went as far as including Rick in his superinvestors list in 1984.

After all, why wouldn’t he include Rick in the list and work with him? Rick’s fund gave a compounded return of 22,000% from 1969 to 1983 compared to 316% generated by S&P 500 over the same time period. But shortly after this article by Buffett, Rick dropped off the radar, and Buffett and Munger became a two-man show.

It would take more than 30 years before we found out what happened to their partnership with Rick when Buffett revealed the story in an interview:

“Charlie and I always knew that we would become incredibly wealthy. We were not in a hurry to get wealthy; we knew it would happen. Rick was just as smart as us, but he was in a hurry. And so actually what happened — some of this is public — was that in the ’73, ’74 downturn, Rick was levered with margin loans. And the stock market went down almost 70% in those two years, and so he got margin calls out the yin-yang, and he sold his Berkshire stock to me. I bought Rick’s Berkshire stock at under $40 a piece, and so Rick was forced to sell shares at … $40 apiece because he was levered.”

- Warren Buffett on his partnership with Rick

The Berkshire stock Rick sold for $40 apiece to Buffett to pay for his margin loans is now worth more than $450K (~1100x). He could have been up there in the list of legendary investors with Buffett and Munger, but, in this case, his impatience cost him dearly.

While we all agree that high-return investments are generally riskier, what we usually miss out on is understanding the real downside that comes with it. A 50% loss to your investment can only be made back by the underlying investment growing 100% in value. An extreme example of this would be Jack Dorsey’s first tweet as an NFT. It sold for a whopping $2.9MM last year but when the buyer tried to sell it this year, it ended up getting a max bid of $280! (yeah, that’s not a typo). The whole NFT market has collapsed in the past few months with sales dropping 87% from its peak.

It’s exciting to invest in fast-growing companies and in finding the next big trends. But, in most cases, generational wealth is built by investing in a few boring investments that compound over a very long time. Here’s how.

Compounding Growth

Human beings have a hard time understanding exponential growth. Here is a thought experiment. Let’s say you can save $100 every day starting on Jan 1st, 2023. If you do it for the entire year, you would have saved $36.5K by the end of the year.

But, in our experiment, you make a slight tweak and increase the savings that you are adding to the pot by 1% every day. So on Jan 2nd, you will add $1 to the $100 making it a total of $101 and on Jan 3rd add $1.01 (1% of $101) on top of it making it $102.1, and so on.

*But, before we jump into the answer: The Fed injected trillions of dollars into the financial system over the past 2 years and everything that could go wrong has gone so catastrophically - We now have the worst inflation in 40 years, soaring interest rates, the stock market in a tailspin, and a crypto winter threatening to take down the entire system

Yet, there are still some asset classes that the Fed can’t foul up: assets that can’t be easily replicated. Like contemporary art* – part of a $1.7 trillion-dollar asset class that’s outpaced the S&P 500 by more than 2x over the last 26 years. Even Goldman Sachs says a diversified portfolio with real assets like art has outperformed since WWII.

With Masterworks*, you can invest in multi-million dollar art that you see in the most famous museums around the world, for just a fraction of the price of the entire work. So while others are panic selling at double-digit losses, Masterworks has strategically exited six positions for a net return of 21.5%+ each.* With record demand, there’s a waitlist to join. But Market Sentiment readers with our exclusive link can completely

*This is sponsored content, see important Regulation A disclosures.

Now, back to it: With a small tweak of a 1% increase in savings every day, you would have saved an incredible $367K by the end of the year. This is more than 10x the initial value of 36K we would have saved by just putting the same amount. The same exercise if you reduce 1% every day ends up with a total savings of only $9.7K.

The same is applicable to investing. During the initial years of your investing journey, the 10% return you make on your portfolio feels inconsequential - Just like the $1 we added in our thought experiment.

Let’s take a hypothetical investor Alan who starts investing in his 20s. Alan saves 25% of his income (assumed at $80K) at a 10% return. For ease of analysis, let’s assume that Alan’s salary stays fixed at $80K and he invests $20K every year.

During the initial decade, his investment gains are minuscule and he is still making more at his job than from his investments. But, something magical happens from the 15th year. His cumulative investments start generating more returns than what he is saving every year. In year 20, he is still adding only $20K to his portfolio (25% of 80K), but his portfolio now generates an additional $130K - 6.5x his savings amount & 1.5x his salary. By year 30, his portfolio is adding ~300K every year (~4x his salary). This is the magic of compounding growth.

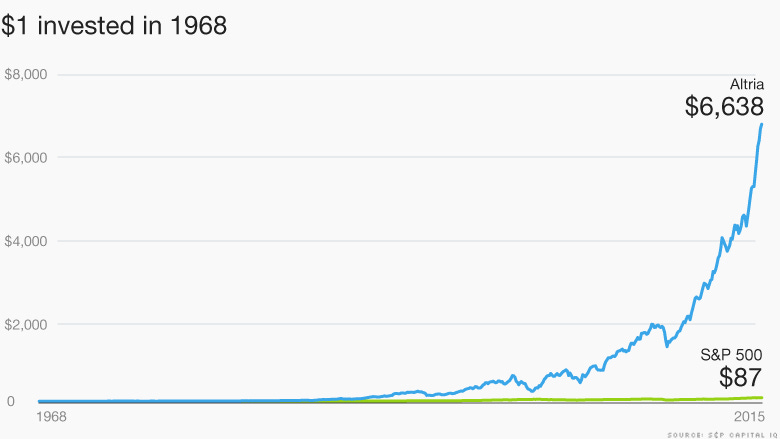

One trivia that I always love to ask everyone is to guess the best-performing stock in the past 6 decades! It’s almost 5 decades during which we landed on the moon, experienced iPhone, and made unimaginable progress in Computing and Telecommunications. So this company must have created something revolutionary and must have changed the world - right?

The company that a lot of investors shunned (for good reason) in a declining industry produced the highest return because it was just a boring old Cigarette company paying consistent dividends over 5 decades!

Problems with high-risk high-reward strategies

One of my biggest pet peeves in investing is when people who own one multi-bagger stock like Tesla won’t shut up when the stock is up 400%. This tells me nothing about their investment skills.

How many stocks did they buy to get a multi-bagger like Tesla?

What happened to the other stocks?

Did the gains from that single multi-bagger offset all the other losses?

In addition to investors overpaying for the small chance of winning big with their investments, more exciting stocks tend to be overvalued since they always dominate the headlines and create more investor interest.

To put the returns of investing in high volatility companies in perspective, if you had invested in the top 50 stocks from the S&P500 based on Beta (and rebalanced it every month), your total return would be -1.3% vs the 337% returned by S&P 500 during 2000 to 2017 period.

In the majority of cases, the market does not price the risk factors properly and the hype associated with the stock tends to end up overvaluing it.

Patience is Key

Atomic Habits author James Clear puts its best with his theory of plateau of Latent potential. It’s the time lag between doing what we need to do and seeing the results we want to see.

The first decade of investment is the toughest. We are in the valley of disappointment where we don’t see much progress. The needle barely moves. The investment gains are low and you are still adding to your portfolio much more than what you are getting in return.

You just have to keep at it for a bit longer and then suddenly, your portfolio is making more than you are putting in. Longevity is one of the key factors that people underestimate in investing. Don’t believe me? - Warren Buffett started investing at the age of 11 but 99.7% of his net worth was made after the age of 52! So, stay in the game.

More Interesting Stuff

The only Crypto story you need - Start this only if you have 2+ hours to read. One of my favorite writers, Matt Levine of Bloomberg, just dropped a 40,000 word article on Crypto explaining where it came from, what it all means, and why it still matters.

Jim Cramer’s stock pick performance - I just realized that close to 20K of you joined after I dropped this banger on 2022 new year’s. Given the launch of the inverse Cramer ETF and crashing markets, it’s a good time to check whether he is actually as bad as we think he is.

This publication remains free due to support from our partners. Do check out Masterworks.

If you enjoyed this piece, please do me the huge favor of simply liking and sharing it with one other person who you think would enjoy this article! Thank you.

Disclaimer: I am not a financial advisor. Please do your own research before investing.

![The Valley of Disappointment | Psychology for Educators [And More] The Valley of Disappointment | Psychology for Educators [And More]](https://substackcdn.com/image/fetch/$s_!Is4d!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2Fffb10dfb-3ca8-467a-946c-55e861bd5ab5_1024x559.jpeg)

Joke theory on cigarettes: it is not "discretionary" but fuel for a productive economy. https://www.psychologytoday.com/us/blog/the-scientific-fundamentalist/201010/why-intelligent-people-smoke-more-cigarettes

But for serious: the "plateau of latent potential" feels like bait for getting people into a "to the moon" scheme "you will see good returns later". Might need some pointers to high reward vs no reward schemes (other than the Pareto Frontier as quant proxy and "just read the fundamentals").