Tech IPOs

Worth the hype?

There’s always excitement in the market when a new company enters the game, and IPOs are marketed as a great way to capitalize on new opportunities. The data reflects this as well - There were 2,849 IPOS from 2012-2021, of which 931 were in 2021 alone! In a previous analysis, we analyzed the performance of IPOs in general over the last 20 years, and some readers had asked - What about Tech IPOs? Do they perform better than the rest?

There is some substance to this curiosity - 5 of the top 10 IPOs of all time have been tech IPOs, with all of them going public in the last decade. Even among the 931 IPOs last year, the top 25 listings were valued at $650 Billion - about 50% of the valuations of all the companies put together! Most of these were tech companies.

Even the marketing for Tech IPOs usually quotes companies like Facebook and Amazon - like the tweet below - but what I was interested in is - How do Tech IPOs perform on the whole?

As a retail investor, the important question is whether Tech IPOs have delivered on their promise. Since some of the most anticipated IPOs in 2022 are Tech IPOs - Discord, Reddit, Instakart, etc. - we need to find out: Were Tech IPOs profitable?

The decade that was

For this analysis, I considered Tech IPOs from the last decade (from 2012) because this has been an incredible bull run for the tech-heavy Nasdaq. QQQ, the ETF that tracks the Nasdaq-100, returned about 386% in this same period. It makes sense to invest in tech IPOs only if we can get a better return than the QQQ benchmark.

On the whole, there were about 144 Tech IPOs of note in the last 10 years (based on market capitalization, and filtering for the ones that went public through SPACs). This spanned a large number of categories, from Saas and Social media and Cloud Computing to Health Tech and Cybersecurity.

Some of the companies had stunning returns, beating the benchmark by 1,000% or more! But on average, their performance was lackluster.

Tech IPOs on average underperformed QQQ by 44%. Not just that, only 32 out of the 144 IPOs had a higher return compared to the benchmark. These were the top 10 gainers:

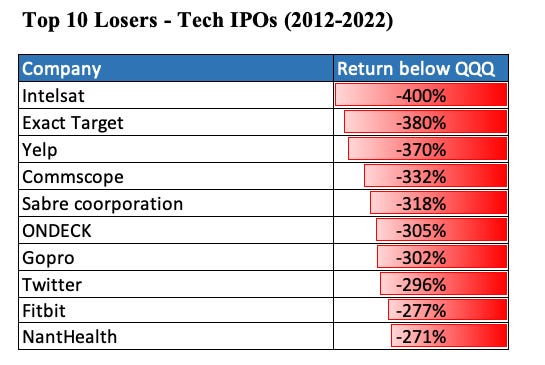

And the top 10 losers:

While it seems like there is no discernible pattern between the Tech companies that performed well and the ones that lost a high-level overview might not give us all the information we need. Let’s take a closer look at some individual categories to see how they performed

Sector-wise analysis

The graph above shows the average returns of different sectors and the QQQ returns over the same time period. Most sectors have individually underperformed the QQQ, while Cloud Computing and Cybersecurity have produced positive returns compared to the benchmark.

Losers

The Hardware IPOs were a disaster - They include GoPro and Fitbit (which were eventually acquired by Google). All of them have negative absolute returns.

Fintech companies were all the rage in the last decade, with 18 companies IPO’ing last year. But of those, only 6 gave positive returns, and only 3 - Square, TransUnion, and First Data - beat the QQQ benchmark. The average returns are not that great either. The lone crypto company that went public, Coinbase, has returned -83% compared to the benchmark!

One of the worst-performing categories was ride-hailing and delivery services - Uber had a terrible IPO, the pandemic might have impacted business, and though one company has positive returns till it was acquired (Grubhub), it did not beat the benchmark. There were zero winners in this category, and it trailed the benchmark by 109%.

Social media is an important category to look out for since Reddit and Discord will be going public in the near future - But unfortunately, the results here are inconsistent. Only Match.com has delivered market-beating returns, but the other four companies that went public bring down the average returns to -76.5% compared to the benchmark.

E-commerce, Healthtech, and social media were all categories that gave positive absolute returns, but the investor would have been better off investing in QQQ and reaping a better return.

Winners

Among all this bloodshed, there are two categories that have exceeded expectations:

Cybersecurity. 6 Cybersecurity companies went public in the last decade, and 4 of them have positive returns WRT the benchmark. On average, they beat the QQQ by 123.6%. While not making it to the news much, this was the single best-performing category.

Cloud computing companies have not performed as consistently, with only 6 out of 16 companies beating the benchmark, but with an average return of 84% above the benchmark, it’s the only other category that beat QQQ.

What about SaaS?

Tech companies that sell software to enterprise or retail users - Software as a Service - are touted to be the perfect business model as they have low overhead costs, zero marginal cost of scaling, and intellectual property that gives them a moat in many cases. But the data isn’t that favorable.

Out of 27 SaaS companies, only 7 beat the benchmark and on average returned 20% less than the benchmark. Though some of the best investments on the list fall into this category, like MongoDB, there is no consistent pattern to figure out which type of software company does the best.

Limitations

While I have tried to make this data set as thorough as possible, it only covers the Tech IPOs with the largest valuations in the years that they went public. There are some caveats to keep in mind:

Categorizing companies into different categories is fluid at times - While it is clear when a company falls into healthcare, whether a company falls into SaaS or Cloud Computing is sometimes less clear.

The assessment of certain categories like Fintech, especially in a bear market, might be harsh, as they are built on the philosophy of blitz scaling - Spending a huge amount of capital upfront to capture market share and reap returns in one fell swoop down the line. But if you plan to invest in Fintech, how it looks in a bear market is a good reality check for your expectations!

In fact, the average returns of all Tech IPOs put together at the end of December 2021 was a little over 8% - Not much, but respectable. Compare that to how they are underperforming the QQQ by 43% now, and it shows the extent of volatility you have to face with newly IPOed companies!

Conclusion

In my previous analysis of IPOs of the last two decades, I arrived at the conclusion that you could make money from IPOs if you had bought and held on for at least a year.

Considering the growth of Tech and the number of unicorns created in the last decade, the assumption was that Tech IPOs would generate an even better return than the average IPO. But a bear market like now is a great time to take a reality check and see how Tech IPOs have performed in reality.

Tech as a whole has performed phenomenally, as the performance of the benchmark shows, but this is largely due to the growth of a few established companies. IPOs of new companies are not as promising as they seem. Outlier returns do seem to exist in certain categories, but unless you have a crystal ball that lets you predict which of these categories is going to continue doing well, you’re better off getting your tech exposure through an ETF.

Until next week…

All the data used in this analysis can be found here.

If you enjoyed this piece, please do us the huge favor of simply liking and sharing it with one other person who you think would enjoy this article! Thank you.

Hey Market Sentiment. Informative, as always!

Love the way you dissect issues / problems using data. If possible, could I suggest a possible deep dive for a future article? The analysis is similar to the one you did for Jim Cramer and also Motley Fool and perhaps to some extent the analysis you did for actively managed funds vs passive funds but with a slight twist.

The aim of the article / analysis would be to answer the following question: how accurate / reliable are Investment Bank Analysts buy, sell, hold recommendations? Which IB Analysts consistently outperform? If we were to follow these recommendations, would we have made money? I believe you can find historical IB analysts recommendations here: https://www.marketbeat.com/ratings/ but i'm sure other sites also exist

I'll have a go at doing my own analysis as well and will try post my results when i finish the analysis.

Thanks