The most important thing

is also the only thing you can control.

Grab a cup of coffee for this one. It’s one of our most in-depth reports.

The late David Swensen, a renowned investment manager, was the chief investment officer for Yale endowment for over 35 years. In a lecture he gave in 2011, he said that your long-term portfolio performance came down to only three things:

Asset allocation — Which asset classes do you own?

Market timing — When do you buy/sell?

Security selection — What type of securities do you own within an asset class?

While all 3 look important, if you dig a little bit deeper, you can immediately see that there is only one factor that you can control:

Security selection aka stock picking

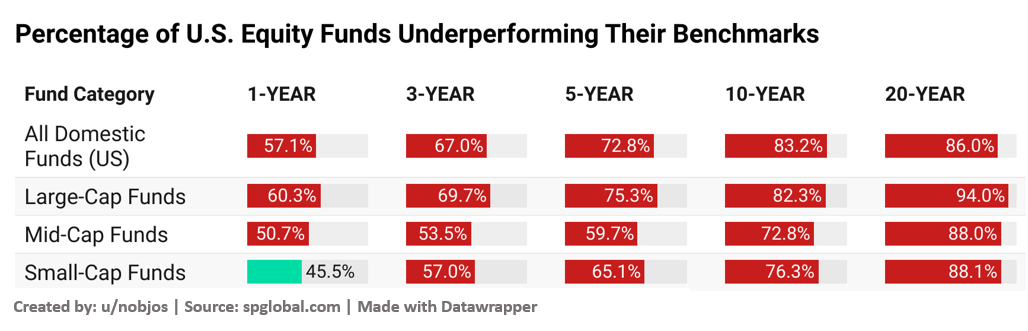

Take a good look at the chart below. It shows the percentage of active U.S. equity funds that underperformed their respective benchmark.

The numbers are staggering!

94% of the large-cap funds underperformed against their benchmarks, and no single category of funds had a decent chance of outperforming over a 10-year investment horizon. The results are no better among bond funds. These funds manage hundreds of billions of dollars and pay their fund managers in the millions with the explicit goal of picking the “right” stocks.

So, if fund managers with dozens of analysts working for them with access to data streams that you and I can only dream of cannot pick the “right” stocks, what chance would an average retail investor have?

Market Timing

The simplest way to show that timing the market does not work reliably is to look at the performance of day traders.

When researchers analyzed the performance of 18,000 regular gamblers in casino games, only 13% won over a two-year period. But, less than 1% of day traders reliably generated a positive return two years running.

So by gambling, you have a 13x better chance of making a profit than when you are day trading.

The case is no different if you try to time the buy and sell decisions of mutual funds or ETFs. Investors, on average, only earned 6% per year over 10 years ending in 2022, compared to the 7.7% return generated by the funds and ETFs they invested in.

This 1.7% shortfall was mainly due to investors trying to time the buy and sell decision.

Mutual funds and ETFs are designed so investors can take a hands-free approach. By trying to time the buy and sell decision, we are taking an active approach, which rarely works out. The average investor by trying to time the market only achieved an annual return of 3.6%, while the S&P 500 returned 9.5% over the past 20 years. A relative underperformance of 62%!

Asset Allocation

So how important is asset allocation? — In a 2000 study, researchers found that asset allocation contributes more than 100% of the total fund return given the negative contribution from security selection and market timing.

Ultimately, it’s also the only factor that you have full control over as an investor. Do you allocate 80% or 40% to stocks? How much gold to own in the portfolio?

You can’t consistently predict the market movements or pick the winning funds. But, you can decide how much of your assets you are allocating to each one.

But there are a dozen different asset classes which all provide varying returns.

The worst thing to do is to put everything into a high-performing asset like equities and then call it a day. So,

How to decide how much to allocate to each asset class?

How to build an “optimal portfolio”?

Why does an optimal portfolio contain 13% gold?

Let’s dig in: