Three Questions

And Three Stories

Let’s start with a quick poll:

Recently, we came across an interesting stat — Only 17% of Americans said that they use a financial advisor. While this in itself is not a problem, what was concerning was that less than one-third of U.S. adults could answer all the Big Three financial literacy questions correctly. The questions were based on core investing concepts like inflation, compounding, and diversification.

Here are the questions for those who are curious:

We hope all our readers found these questions trivial and got all three right. You can find the solutions in footnote1 (no peeking :P)

Three Stories

1. Risk

While it’s intuitive that spreading your investments over multiple stocks reduces risk, most people underestimate how much risk they take by investing in one company. SpaceX is now a $200 billion company — Let’s take a look at how close SpaceX came to bankruptcy.

Most people only came to know about SpaceX once they achieved the first landing of their Orbital booster in 2015. What most people don’t know is that Musk started the company in 2002 with his proceeds from the sale of PayPal with no other backing.

The company struggled for the first 7 years with a string of failures and was near bankruptcy. (emphasis by author)

I messed up the first three launches. The first three launches failed.

And fortunately, the fourth launch, which was, that was the last money that we had for Falcon 1. That fourth launch worked. Or it would have been — that would have been it for SpaceX. But fate liked us that day. So, the fourth launch worked — Elon Musk in 2017

Now, consider that one of the Falcon launches failed due to a busted nut that eventually caused a fuel leak during the launch. While it was initially thought to be a human error, the US defense review concluded that

A small aluminum nut designed to hold the fuel pipe fitting in place failed due to subsurface corrosion not visible to the naked eye.

All that stood between bankruptcy and an eventual $200 billion company was yet another busted nut or a screw a technician forgot to tighten. Think about all the early investors and employees in the company — they would have never thought all that stood between a total loss and a 10,000x return on their investment would be a loose nut.

2. Compounding

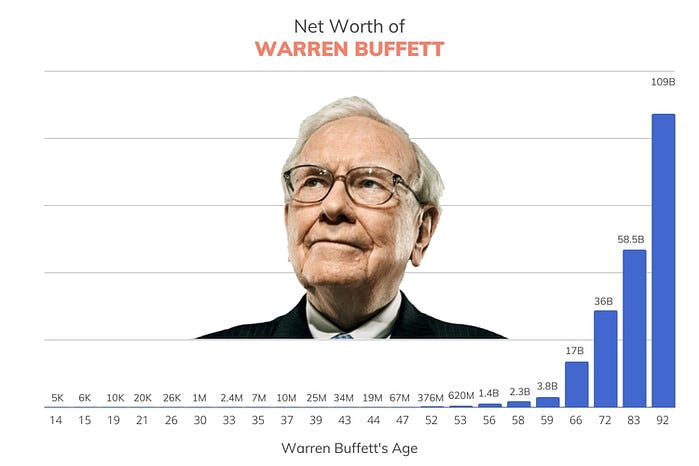

Warren Buffett is one of the best investors of our time. He started investing at 14 and is now worth $145 billion. If you split his 80 years of investing in half, you see something interesting.

At 55, he was barely worth $1 billion. So, 99.7% of Warren Buffett’s wealth came after he turned 55. $128 billion out of the $145 billion (88%) came after Buffett qualified for social security.

Human beings have a hard time understanding exponential growth. Let’s say you can save $100 every day starting on Jan 1st, 2025. If you did it for the entire year, you would have saved $36.5K by the end of the year.

But, in our experiment, you make a slight tweak and increase the savings by 1% every day. So on Jan 2nd, you will add $1 to the $100, making it a total of $101, and on Jan 3rd, add $1.01 (1% of $101) on top of it, making it $102.1, and so on.

With this small change, you would have saved an incredible $367K by the end of the year. This is more than 10x the initial value of 36K we would have saved by just putting the same amount. In the same exercise, if you reduce 1% every day, you will end up with total savings of only $9.7K.

Life is like a snowball. The important thing is finding wet snow and a really long hill. — Buffett

3. Inflation

Americans are getting stronger. Twenty years ago, it took two people to carry ten dollars' worth of groceries. Today, a five-year-old can do it. — Henny Youngman

Over the past century, the purchasing power of the U.S. dollar has been in freefall. A dollar in 1933, capable of buying ten bottles of beer, can barely buy a cup of coffee today.

But, this would only have been an issue for you if you never invested. A single dollar invested in the S&P 500 in 1925 would have grown to over $7,000 by 2017, delivering a compound annual return of 10%. In fact, any investment in gold, real estate, or long-term U.S. bonds all outperformed inflation and allowed you to improve your purchasing power.

If you belong to the 83% of investors who do not use a financial advisor, we hope you got all the answers right and understand the fundamental principles behind each question.

Even if you got all of them right, we believe it’s important to at least consider whether or not you need a financial advisor. Our friend Nick has put together a great guide on “When should you hire a financial advisor?” that should help you get started.

See you next week!

A quick reminder: If you're in investment management and can spare 30 minutes for feedback on our new LLM-powered chatbot, we'll thank you with a $100 gift card or a 1-year MS subscription. Plus, connect us with a potential client and earn 10% of the contract value as a finder's fee!

Disclaimer

This publication’s authors are not licensed investment professionals. Nothing produced under the Market Sentiment brand should be construed as investment advice. Do your own research before investing.

Question 1: More than $102 (due to the accumulation of interest over time. Even though the interest rate is 2% annually, the money would grow slightly more than $102 because of compound interest, where interest earned in earlier years itself earns interest in later years.)

Question 2: Less than today (the inflation rate (2%) is higher than the interest rate (1%). This means that the purchasing power of your money would decrease over time. Even though the amount in the account would grow by 1%, inflation would reduce the value of that money, making it able to buy less than it could today.)

Question 3: False (investing in a single stock is riskier than investing in a diversified stock mutual fund. A mutual fund spreads the investment across many companies, reducing the impact if one company underperforms.)