Here are some numbers to put things in perspective of how much we are investing in AI (all figures adjusted for inflation):

Every month, we are spending more on AI infrastructure than the total cost of the Manhattan Project.

Every quarter, we now allocate more to AI than the entire 14-year Apollo program.

Just last year (2025), we spent more than what it took to build our entire Interstate highway system over three decades.

While no one can be certain whether AI has the potential to generate returns on this scale of investment, the massive amount of capital being pumped in is pushing companies, industries, and technology to their limit.

The problem we have noticed here is that most media outlets just attribute AI to the Magnificent-7 stocks and do the bare minimum due diligence on other companies. The “research” is so bad that, just a few years ago, the BBC News called ASML “a relatively obscure Dutch company.”

We believe the real impact (and alpha) lies with the second- and third-order companies and industries. A $100B deal now barely moves the needle for Nvidia, but even a $1B deal for a supplier to Nvidia will double its stock price overnight.

Here are a few examples where we captured the alpha by implementing this strategy:

Data centers already consume 5% of total US electricity demand, and that demand is rapidly rising. Energy remains a bottleneck, with hyperscalers scrambling to lock in long-term energy deals to power their data centers. The energy portfolio we have put together has now outperformed the market (as of Jan’26)!

We have already hit the limit on how fast data can be transmitted through traditional Copper cables, and companies are rushing to develop better technologies to overcome this Copper Wall. The portfolio we put together last month now has now 4.3% return compared to -2.8% for QQQ (as of Jan’26).

This is just scratching the surface. There are dozens of other industries and companies at the limit due to this massive capital inflow and demand. Here are a few more that are on our watchlist:

Advanced Packaging

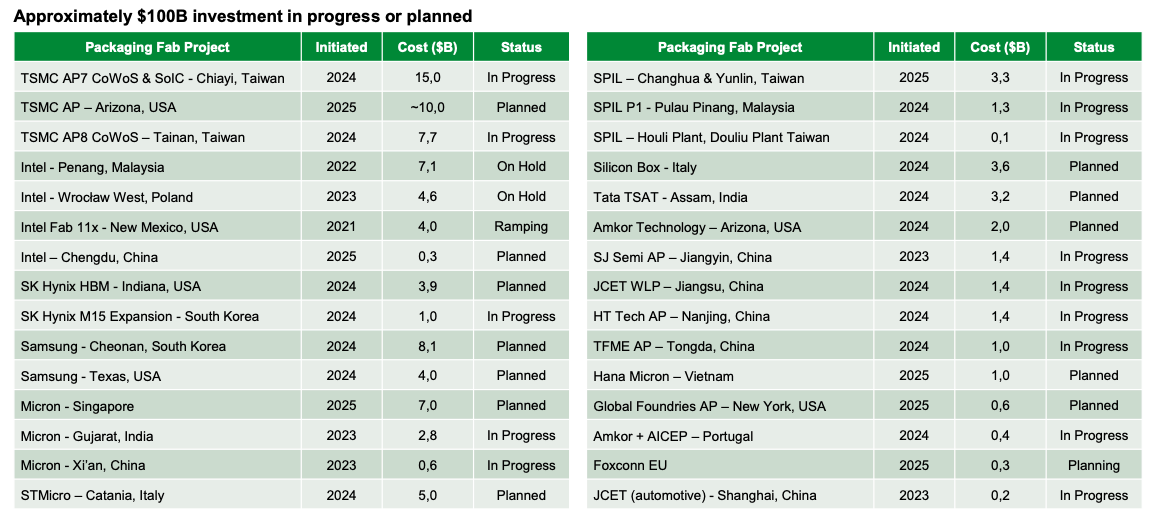

The need for an exponential increase in computational performance for AI means that we have already reached the limits of Moore’s law of adding more transistors to a single chip. The proposed solution is to go beyond single-chip packaging by integrating multiple dies, memory, and functions into a single system using advanced packaging. The demand for a solution is so strong that more than $100B in capital has been allocated to advanced packaging alone.

Copper & Other Commodities

The data center boom (Copper is required everywhere as the primary conductor) and supply disruptions at major mines in Chile, Peru, and Indonesia have driven Copper prices up by ~40% over the last year. Lithium has also doubled in price in the last year.

The U.S. Grid

The U.S. Department of Energy had highlighted the shortcomings of the current grid a year before ChatGPT was released. Most of the transmission lines currently in use were laid in the 20th century and were never designed to carry so much load. With the U.S. home to 45% of the world’s data centers and modular nuclear reactors at least half a decade away, the U.S. grid will need massive improvements to sustain the current pace of progress.

Memory

If you’ve ever saved an AI-generated image, you’ve likely noticed the massive footprint: A simple Gemini-generated image can easily reach 10 MB, nearly ten times the size of a standard screenshot. Now imagine how much storage a Gen AI video would take. We are watching an entirely new market for memory chips being created, and unsurprisingly, storage company stocks are going parabolic!

As anyone who has worked in a manufacturing plant will agree, bottlenecks get all the attention and capital. It’s natural, since that’s the section holding up the entire plant. We have been watching this play out over and over again in the past year. The alpha is in the bottlenecks, not the hype.

We at Market Sentiment focus on finding and investing in these bottlenecks

We also like putting money where our mouth is. So if we are recommending any industries or companies, we will back our recommendations with real capital and share regular portfolio updates with you.

You’re in good company

This is easily the most evidence-backed, not click-bait, not "#1 Stock Now!" investing information I've found. I value supporting that. — Jerome Steckler

A must-read for any investor — Graham Stephan, #1 Finance Creator on YouTube

As a financial advisor, I value your research, insight, and the stories you convey. Thank you! — Michael Bird, CIMA®, AIF®

It’s often said that you get the customers you deserve. If that’s true, we consider the quality of our readers to be the best compliment we could hope for!

Thanks for all the support, and see you on the other side :)

Disclaimer

This publication’s authors are not licensed investment professionals. Nothing produced under the Market Sentiment brand should be construed as investment advice. Do your own research before investing.