Thank you for reading Market Sentiment and being one of our most engaged readers.

We just crossed 50,000 subscribers! That makes us one of the biggest financial newsletters on Substack. To everyone who reads this newsletter, has subscribed, or has simply shared a post with a friend or colleague, thank you. Your support has made this possible.

As a token of our appreciation, we're offering you a limited-time 30% discount on our paid subscription. It’s one of our best offers to date and is only valid for one day!

If you find value in our content and want to delve deeper, this might be the perfect opportunity. But no pressure – your readership, paid or not, is always valued. If you are new here and want to know more about us, continue reading :)

We started Market Sentiment at the peak of the 2021 zero-interest hype cycle as a place for investors to rationally evaluate investment ideas. We curate some of the best ideas, test their validity, and distill them into actionable insights. What started as a germ of an idea on Reddit is now read by more than 40,000 investors, financial advisors, and investment analysts.

If you need a flavor of our work, check out these free articles:

Consider a Japanese worker who started working in 1980. Assuming a 30-year career & $1K annual investment into Nikkei 225, by the time he retired in 2010, the $30K invested would have turned into $20K. A -31% return over 30-years.

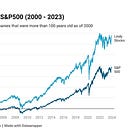

Do investors benefit from the Lindy Effect? To test this, we evaluated the performance of 70 companies that were 100+ years old and benchmarked them against the S&P 500. Here are the results:

The only difference for one of the world’s largest corporations owning 70+ companies and having 50+ stock positions outperforming or underperforming the market finally came down to the one stock pick they made 10 years back.

Transparency is how we do things

How we make money:

Most, if not all, of our revenue is from subscriptions from readers like you. It helps us be objective and maintain an unbiased opinion. We like a simple business model of building something that we think is of considerable value, and you paying us to get that thing, and we are all happy.

Free subscribers get our occasional free article and previews of our deep dives.

Premium tier gets

Access to all our deep dives & complete archive

Vote on our deep-dive topics

The comments section with active participation from our side

Subscriber chat

Here are the four subscriber-only reports we published in May.

You’re in good company

This is easily the most evidence-backed, not click-bait, not "#1 Stock Now!" investing information I've found. I value supporting that. — Jerome Steckler

A must-read for any investor — Graham Stephan, #1 Finance Creator on YouTube

As a financial advisor, I value your research, insight, and the stories you convey. Thank you! — Michael Bird, CIMA®, AIF®

It’s often said that you get the customers you deserve. If that’s true, we consider the quality of our readers to be the best compliment we could hope for!

Thanks for all the support, and see you on the other side :)

Disclaimer

This publication’s authors are not licensed investment professionals. Nothing produced under the Market Sentiment brand should be construed as investment advice. Do your own research before investing.