Accountability check-in

Did you invest this month?

Even if you can invest like Warren Buffett, if you can’t save, you will die poor – William Bernstein

Peter Adeney runs a fascinating personal finance blog called Mr. Money Mustache. Peter used to work in the tech industry but what made him popular was that he managed to retire in his 30s – And no, he did not start a company nor was part of a successful IPO. He started his career in 1997 for a salary of $41K and when he “retired” in 2006, his salary was $100K.

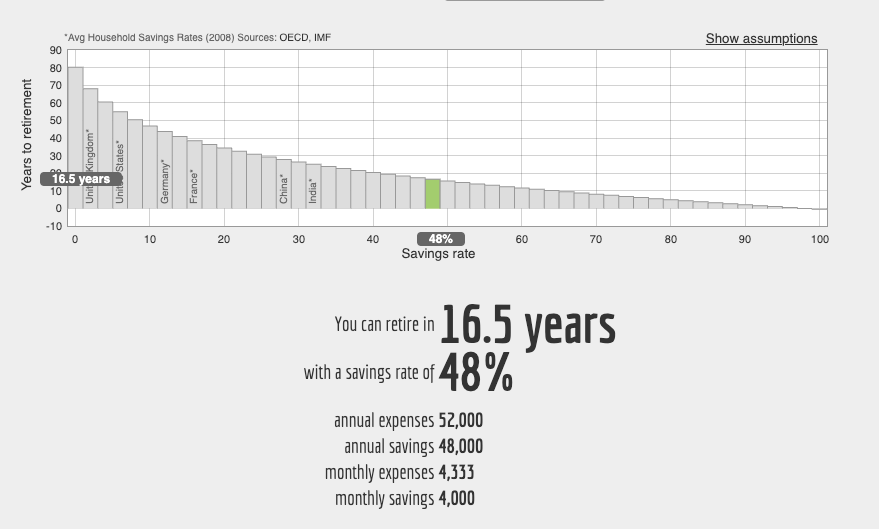

So how did he do it? Turns out, the number of years that you have to work is inversely proportional to your savings rate. Just as we had discussed in the 5 principles of long-term investing, if there is one rule that you should know in investing, it should be this — No matter how much you optimize your investments and maximize your returns, it doesn’t matter if you spend more than what you make.

While we can argue that Peter took things to an extreme level (his savings rate was 70%+), all of us can derive useful insights from the above chart.

If you spend 100% of your income, you will never retire

The average personal savings rate in the U.S. was only 4.6%, implying that the average person will have to work an incredible 66 years to retire.

If you save 10%, you will need to work another 50 years to retire

Bump the savings rate up to 25%, and you only need another 32 years.

The above figures are assuming that you start at 0. But most of us are not starting at zero. If you are curious, you can go to Networthify, plug in your income, savings rate, and current portfolio value, and it will show exactly when you can retire.

So what does Peter recommend you do with all the money you save?

Invest it in index funds. That’s it — Simple, boring, and effective.

The reason we started this series is that investing regularly and sticking to your plan is one of the best possible approaches to building wealth and we wanted to make your life easier and be your accountability partner.

Here is a reminder to you in case you forgot to invest this month.

Tell us about the investments you made so that all of us are exposed to new ideas.

Suggest new analysis ideas/portfolio backtests/interesting books or blogs.

Market Sentiment Recap: May ’23

One of our Twitter posts went viral recently and more than 1,000 of you joined us this week. In case you missed out on any of our previous issues this month, they are:

The Definitive Guide to REITs (paywall): At first glance, REITs take away all the challenges with classic real estate investing — Capital investment is low, assets are liquid, and getting diversification is simple as buying a REIT index. But, are REITs the silver bullet for your portfolio?

Investing in family-owned businesses (paywall): Over the past 16 years, family-owned businesses have generated 112% alpha over non-family-owned businesses. So, if you want to invest your hard-earned money, why wouldn’t you invest it with owners running the company who are in the same boat as you?

5 Principles for Long-Term Investing (free): The average investor only had an annualized return of 2.9% in the last 20 years. Here are 5 simple yet powerful principles for successful long-term investing

Game of Chicken (paywall): Another year, another unnecessary debt-ceiling crisis. We deep-dive into a hypothetical scenario of the U.S. defaulting on its debt.

More Interesting Stuff

We spend hundreds of hours researching every month. Here are some of the best articles/videos we enjoyed this month and hopefully, you can discover new and interesting content!

How America Invests: Vanguard put together this very detailed report (60 pages!) on the personal investing behavior of households with $500K+ assets. They go into detail about asset allocation strategies, trading behavior, and the impact of Covid-19. If you feel lazy, you can just read the report we put together last month on where millionaires (and even billionaires) invest their money.

The 1%

·The irony in finance is that windfalls make great headlines, but such occurrences are rare. The probability of you winning the lottery or signing a multi-million contract is lower than one in four thousand. Contrast this with the latest census, and there is a

The Bogleheads' Guide to Investing: A short book capturing all the investment wisdom from John Bogle.

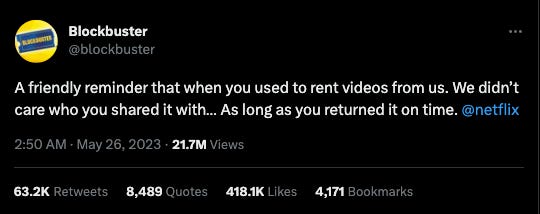

Some Fun Stuff

Bezos just bought a single share of Amazon (That too his first purchase transaction for $AMZN since 2005). Check the timestamp of the trade :)

We have a bonus for those who read till the end – you get to decide on one of our next articles :)

Welcome to the 1,500+ investing enthusiasts who have joined us this month. Market Sentiment is now fully reader supported – Please consider upgrading your subscription to support our work and to get access to all of our analyses. We are offering a 20% discount on our annual subscription. :)

Yes I did! Very boring vanguard all world, all world bonds, gold and some energy etf sprinkled in

I assume this is after tax income, but clarifying this point in future articles would be helpful.